Introduction

Article 366 of the Constitution defines Goods as “Goods includes all materials, commodities and articles” and Services as “Service means anything other than goods. Goods and Service Tax (hereinafter referred as ‘GST’) is a destination based Tax which is based on the destination or consumption of the goods or services. Hence, to levy GST new suitable concept of “supply” of goods/services was devised. GST can be also levied on supply of goods and services related to either movable or immovable property. Hence, it can be safely concluded that unless and until there is a supply, GST is applicable. However, such broad definitions of word ‘supply’ in the Act and meaning of ‘services’ in the Constitution often creates uncertainty and require much debate within the community of the practitioners to find the extent of applicability of GST. One such debate is around the applicability of GST related to immovable property.

In this article, the author will throw light on the application of GST on immovable property, Scope of supply related to immovable property, types of services rendered in real estate sector and levy of taxes, present dilemma and opinion of the author.

Page Contents

Levy of GST on immovable property or Real Estate

The notion that GST is not exigible on immovable properties is false. Although, Schedule III mentioned in Section 7 (2) (a) of CGST, 2017, specifies sale of land and building as one such activity, which is kept outside the scope of GST[1]. But specific inclusion of one means exclusion of others. This clears that the scope of supply according to Section 7 related to immovable property is wide enough to include all the other business services such as renting business, construction services, etc.[2] excluding only sale of land and buildings. Hence, many services related to immovable property are exigible to GST. Such as services included in para 2 of Schedule II:

a) any lease, tenancy, easement, license to occupy land,

b) any lease or letting out of the building partly including a commercial, industrial or residential complex for business or commerce, either wholly or partly and para 5 of Schedule II:

a) Renting of immovable property,

b) Construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly except where required, by the competent authority or after its first occupation, whichever is are considered as a taxable service under GST as per S. 7 (1A) of the CGST Act, 2017[3].

[Explanation-Place of levy of GST in terms of supply of service in relation to immovable property is the place where the property is located.]

- Renting of immovable property and any lease, license, tenancy, easement

According Section 7 (1) expression supply includes all forms of supply including rental services for the furtherance of business. Referring to para 5 of Schedule II of the CGST Act renting of any immovable property as a business is liable to taxed under GST at the rate of specified time to time by the GST Council; currently at 18%.[4] Renting of residential property per se, used for residential dwelling is not taxable and is excluded from the scope of supply[5]. But a residential complex sub-leased for residential purposes were held to be taxable, like a hotel which can by no imagination be termed as a residential dwelling, even if the same is given for residential purposes[6]. Such activity falls under the category of para 2 of the Schedule II. However, the legislation provides few exemptions to certain landlords whose total value of service provided during the financial year is less than 20 years and there are few other exemptions also. Hence, service of renting of immovable property is one of the biggest driving forces in the real sector which should not be left alone from the purview of the taxability Government.

Further, any form of lease whether lease rent in which periodic payment is made or one time premium[7], also falls under the scope of para 2 of Schedule II. Tenancy and license of any immovable property in furtherance of the business is also included in supply.

The scope of supply has been extended to even include sub-tenancy under para 2(any lease, tenancy, easement, license to occupy land) of Schedule II. GST is also applicable on the tenancy premium received, commonly known as Pagadi system. In this system the tenant acquires, tenancy rights in the property against payment of tenancy premium (pagadi).[8]

- Service of construction of real estate projects

Generally the residential apartment system or flat system is prevalent in urban cities. Builders construct the apartment and sell each flat to the buyers. In order to benefit the buyers of flat, GST was introduced in place of old taxes.

According to para 5 of Schedule II, construction services provided for construction a complex or building intended to sell to a buyer will be taxable, except where the entire consideration has been received after issuance of completion certificate, where required, by the competent authority or after its first occupation, whichever is earlier. From this provision it can be said that only under-construction properties are taxable and ready-to-move in flats or completed projects cannot attract GST.[9] GST can only be levied when the buyer is taking the service of construction and once the project is completed service of construction cannot be charged from the buyers.

With effect from 01/04/2019, new GST rates became applicable on the promoters on construction of residential apartments: Two different rates prescribed for two different class of properties: a) Effective rate of GST on construction of affordable residential apartment is 1% without Input Tax Credit (ITC) on total consideration and on other than affordable residential apartments, the rate is 5% without ITC on total consideration.[10] It has also provided liberty to the on-going projects to pay GST at the old rates. (8% and 12% and avail permissible ITC and pass on its benefits to the buyer also. The projects which commences after 01/04/2021 will have to pay GST as per the new rates. [11]

[Explanation of on-going projects is dependent on the Completion certificate which is issued by the competent authority stating that the project is complete as per the sanctioned plan and also on the occupation of the project which is usually done after Occupation Certificate is issued]

Working contracts

In GST, Schedule II of CGST describes works contract as defined under Section 2 (119) as a composite supply which means that it involves two or more supply of goods/supply naturally bundled). Work contracts are contracts for any construction, erection, installation, fitting out, improvement, fabrication, repair, alteration, etc of any immovable property wherein transfer of property in goods is involved in such execution of contract. Basically, works contract is a contract of service related to movable or immovable property. However, works contracts under GST only recognizes contracts related to immovable property. Once the work is completed, the item becomes the part of the immovable property (Triveni Engg. Industries Ltd. v. CCE)[12] and cannot be separate without substantial damage to the structure. In the case of Quality Steel Tubes (P) Ltd. v. C.C.E. UP[13], it was held that erection and maintenance of the lifts forms part of the immovable property. Transmission towers are considered as an immovable property in the advance ruling application filed by Skipper Ltd[14].

Transfer of Development Rights

What is TDR?

For effective planning of the city and/or to construct any public place, widening of road, public garden, civic amenities, etc., State Government acquire the land and provide compensation to the landowner through Land Acquisition Scheme. To overcome complexities in such acquisitions, scheme of issuing Development Right Certificates (DRC) was introduced. It allows a landowner to sell the DRC to any builder or developer or any person in return of some consideration, or jointly develop the building through Joint Development Agreement (JDA). DRC basically contains a right of additional built-up area in return of the area for which the landowner has relinquished his rights. Such Development Rights when transferred to the developer or anyone is known as Transfer of Development Rights (TDR).

Current ruling is such that according to FAQs[15] released on 14th May, 2019 and as per notification[16] dated 25.01.2018, Government notified that TDR is subject to GST in the form of construction services received by the land owner. Subsequent Notifications were also released in relation to TDR to provide some exemptions and clarify that promoters will be liable to pay taxes on reverse charge basis[17]. GST on TDR or FSI is payable at the rate of 18%, under Sl. No. 16, item (iii) of Notification No. 11/2017-Central Tax (Rate) dated 28-06-2017.

These rulings have created havoc in the real estate industry and such notifications enforcing taxability of TDR is challenged before many High courts and Authority of Advance Rulings (AAR).

Authorities have given several different rulings, in which taxability of TDR has not been adjudicated thoroughly and has levied GST on TDR.[18]

In one of the most controversial ruling of Mah-AAR Vilas Chandanmal Gandhi[19] which was further appealed. The appellate authority has upheld the decision of AR. In the context of TDR, the authority carved out exception and ruled that TDR may be immovable property but the question in the present case is whether TDR comes under the definition of land and hence, exempted under para 5 Schedule III of the CGST? The Authority in this case levied 18% tax on the TDR.[20]

Due to contradictory rulings, no defined answer is available to the question “whether TDR comes under the definition of land and exempted under para 5 Schedule III of CGST? Let us examine this issue and try to trace the answer to the question,

Firstly, whether TDR falls under the scope of Supply under Section 7 of CGST, 2017?

To understand this, we need to find whether TDR is a supply of service or goods? Supply as defined in section 2(102) of the CGST means anything other than goods…. Such broad definition would include any service related to either supplying of goods such as vegetable, dairy products, cosmetics, etc. or even supply of services related to immovable property. So as TDR is a right of development related to immovable property which can be transferred, it may presumably fall under services and not under supply of goods. Now, whether TDR can be considered as an immovable property?

What is the immovable property?

Immovable property includes land, things attached to earth and any benefits arising out of land[21]. It has a wide scope to include mostly everything arising out of land. One such benefit arising out of land is TDR, which is considered as immovable property as per the judgments of Bombay High Court.[22] For clarity and after referring to the arguments in AAAR Vilas Gandhi[23], another question arises which needs to be answered is that, whether TDR can also fall under the scope of the meaning of land?

What is land?

As per clause 3 (p) of The Right to fair compensation and transparency in land Acquisition, Rehabilitation and Resettlement, 2013 and Section 2(16) of Maharashtra Land Revenue Code, 1966, land includes benefits to arise out of land, and things attached to the earth or permanently fastened to anything attached to the earth.

Several rulings of the Apex court also include benefits arising out of land under the meaning of land.[24]

Comment on conundrum of taxability of TDR:

The whole complexity has been arisen because of the commonality of clause ‘benefits arising out of land’ in the definition of ‘immovable property’ and ‘land’. The Authority in the case Vilas Chandanmal Gandhi[25] held that TDR is not a land, but a right arising out of land and hence, it is an immovable property. It excluded benefits arising out of land from the meaning of land and further held that the scope of para 5 Schedule III is to exclude only sale of land.

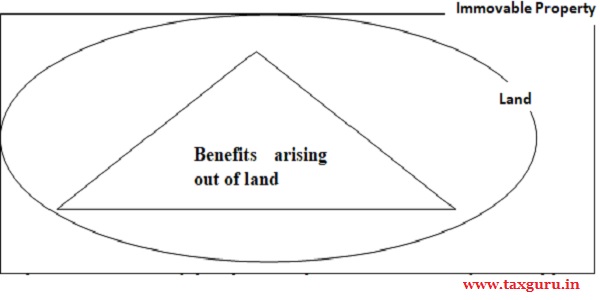

On the contrary, if we closely see the definition of immovable property and land both include benefits arising out of land under its definition. There is no distinction between both the terms per se. In fact, Land is a sub-set of immovable property and ‘benefits arising out of it’ is a sub-set of land. The term immovable property is just wide enough to include land, benefits arising out of it and other benefits such as to right to of ferry, right of way, right to collect rent on immovable property, a right to catch and carry away fish, a factory,[26] building[27], house buildings,[28] rights arising out of building, etc.

In such cases, rules of interpretation can be used to construe the meaning of the clauses. Land and benefits arising out of land are inseparable. No land can be kept alone without the immediate ancillary benefits arising out of it and hence both are immovable property. According to Mischief Rule, when two interpretations are possible then the court should consider the interpretation which advances the remedy and suppresses the mischief as per the intention of the legislature. The construction that achieves the objective should be considered. The meaning of term ‘benefits arising out of land’ under immovable property includes all the benefits, subsuming that arises immediately from land and other benefits included through the judicial pronouncements in the definition.

Pictorial representation of the above explanation meaning of immovable property, land and benefits arising out of land

As per the above explanation and inseparable quality of land, it can be clearly said that all the immediate benefits arising out of it including TDR which can be then exempted from GST as per para 5 of Schedule III under the clause of land and building because ‘land’ will include all the benefits accrued from it.

Currently there are many petitions challenging the taxability of TDR, HCs have admitted the petitions namely, Prahitha Contruction Private Limited (Telangana High Court; WP No 5493 of 2020),Nirman Estate Developers Private Limited (Bombay High Court; WP No 3619 of 2020 – Appellate Side) and Dadar Matunga Residents Welfare Association (Bombay High Court; WP No 3528 of 2018).

Hopefully, the long standing tussle can be resolved after this.

Conclusion

In addition to the services mentioned above, GST is also applicable on flat maintenance charges in the housing society and other services also which has not been discussed in this article. GST has been through several patch works till now and many more are in the pipeline. In the pursuit of making GST capable of subsuming every activity under the sun under tax regime, somewhere the law is left open ended which is creating complexity and confusion amongst the taxpayers. Sound and unanimous rulings of the competent authorities will make GST full water tight legislation by the time.

[1] para 5 Schedule III, CGST, 2017

[2] para 2 and Para 5 of Schedule II, CGST, 2017

[3] Clause 2 and Clause 5 of Schedule II, CGST, 2017

[4] Notification No. 11/2017-Central Tax (Rate) dated 28-06-2017

[5] Serial No- 12 of Notification No- 12 Central Tax Rated dated 28.06.2017

[6] Karnataka by Taghar Vasudeva Amrbish [2020 (4) TMI 692]

[7] Builders Association of Navi Mumbai Vs Union of India (Bombay High Court) https://indiankanoon.org/doc/172963646/

[8] Circular No.44/18/2018-CGST, para 3

[9]https://www.cbic.gov.in/resources//htdocscbec/gst/GST_on_comercial_properties.pdf

[10] F. No. 354/32/2019-TRU

[11] Notification No. 03/2019-Central Tax (Rate)

[12] 2000 (40) RLT 1 (SC)

[13] 1995 SCC (2) 372; Las Palmas Co-Operative Housing Society Limited, GST-ARA-31/2019-20/B-13 dated 22.01.2020

[14] 22/WBAAR/2018-19 dated 26/11/2018

[15] F. No. 354/32/2019-TRU

[16] Notification No. 4/2018 – Central Tax (Rate)

[17] Notification No. 13/2017-CT amended by Notification No. 5/2019-CT and 04/2019- Central Tax (Rate) dated 29.03.2019

[18] Maarq Spaces Pvt. Ltd., KAR ADRG 119/2019 dated 30th September, 2019; Patrick Bernardinz D’sa, 2018-TIOL-292-AAR-GST

[19] GST-ARA-40/2019-20/B-06 Mumbai, dated 15/01/2020

[20] MAH/AAAR/RS-SK/25/2020-21

[21] Section 3(25) of General Clauses Act, 1897; Registration Act, 1908; Section 3 of Transfer of Property Act, 1882

[22] Chheda Housing Development Corporation v. Bibijan Shaikh Farid, 2007 (3) MhLJ 402; Sadoday Builders Pvt Ltd v. Joint Charity Commissioner, Order dated 23.06.2011 in WP No. 4543/2010

[23]supra 23

[24] Safiya Bee vs Mohd. Vajahath Hussain (2011) 2 SCC 94; (2011) 5 SCC 270

[25] supra 23

[26] Section 3, Transfer of Property Act, 1882, page 15

[27] Section 2(6) of Indian Registration Act, 1908

[28] http://www.patnalawcollege.ac.in/econtent/Immovable%20Property.pdf

can we take ITC on immovable property on allotment of residential property