On Supply of Capital Goods, ITC shall be reversed. The manner of calculation of amount of ITC to be reversed is prescribed in section and rules. But both do not coincide. Let us understand the nuances of section and rules to decide the method to be adopted.

Body of Content

Section 18(6) deals with ITC reversal in case of supply of capital goods. The extract of Section 18(6) is as follows:

In case of supply of capital goods or plant and machinery, on which input tax credit has been taken, the registered person shall pay an amount equal to the input tax credit taken on said capital goods or plant and machinery reduced by such percentage points as may be prescribed or the tax on the transaction value of such capital goods or plant and machinery determined under section 15, whichever is higher.

Provided that where refractory bricks, moulds and dies, jigs and fixtures are supplied as scrap, the taxable person may pay tax on the transaction value of such goods determined under section 15.

When we analyse this section, it says when there is supply of capital goods or plant and machinery on which input tax credit has been taken, the registered person shall pay an amount equal to,

Such percentage points as may be prescribed

Percentage points are discussed under Rule 40(1)(a). The extract of the same is follows:

40. Manner of claiming credit in special circumstances.-

(1) The input tax credit claimed in accordance with the provisions of sub-section (1) of section 18 on the inputs held in stock or inputs contained in semi – finished or finished goods held in stock, or the credit claimed on capital goods in accordance with the provisions of clauses (c) and (d) of the said sub-section, shall be subject to the following conditions, namely,-

(a) the input tax credit on capital goods, in terms of clauses (c) and (d) of sub-section (1) of section 18, shall be claimed after reducing the tax paid on such capital goods by five percentage points per quarter of a year or part thereof from the date of the invoice or such other documents on which the capital goods were received by the taxable person.

From Rule 40(1)(a), we can understand the percentage points to be reduced as five percentage points per quarter of a year or part thereof from the date of the invoice or such other documents.

Now we can rephrase the provision for reversal of ITC in case of Capital goods or Plant and Machinery.

As per section 18(6) read with Rule 40(1)(a), when there is supply of capital goods or plant and machinery on which input tax credit has been taken, the registered person shall pay an amount equal to,

Let us take an example.

Capital goods purchased on 2nd January 2018 for Rs. 5 Crores (Rs. 500 Lakhs). ITC on such capital goods is Rs. 1.8 Crores (Rs. 180 Lakhs).

The same Capital Goods was sold on 1st July 2019 for Rs. 3 Crores (Rs. 300 Lakhs). Tax rate is 18%.

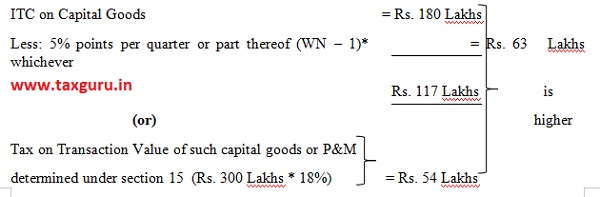

Calculation of ITC to be paid back on Supply of Capital Goods

WN – 1: 5% points per quarter or part thereof

No. of Quarters = 7 (even one day falling in the quarter will be counted as one quarter)

Percentage points for 7 quarters = 35% (7*5%)

ITC to be reduced = Rs. 64 Lakhs (Rs. 180 Lakhs * 35%)

So ITC to be reversed is Rs. 117 Lakhs. We have to pay back Rs. 117 Lakhs.

Now here comes the challenge.

There is controversy between section 18(6) and Rule 44(6).

Extract of section 18(6)

18. Availability of Credit in Special Circumstances

(6) In case of supply of capital goods or plant and machinery, on which input tax credit has been taken, the registered person shall pay an amount equal to the input tax credit taken on said capital goods or plant and machinery reduced by such percentage points as may be prescribed or the tax on the transaction value of such capital goods or plant and machinery determined under section 15, whichever is higher.

Provided that where refractory bricks, moulds and dies, jigs and fixtures are supplied as scrap, the taxable person may pay tax on the transaction value of such goods determined under section 15.

Extract of Rule 44(6)

Rule 44. Manner of reversal of credit under special circumstances.

(6) The amount of input tax credit for the purposes of sub – section (6) of section 18 relating to capital goods shall be determined in the same manner as specified in clause (b) of sub – rule (1) and the same shall be determined separately for input tax credit of IGST and CGST:

Provided that where the amount so determined is more than the tax determined on the transaction value of the capital goods, the amount determined shall form part of the output tax liability and the same shall be furnished in Form GSTR – 1.

Extract of Rule 44(1)(b)

Rule 44: Manner of Reversal of credit under special circumstances

(1) The amount of input tax credit relating to inputs held in stock, inputs contained in semi-finished and finished goods held in stock, and capital goods held in stock shall, for the purposes of sub-section (4) of section 18 or sub-section (5) of section 29, be determined in the following manner, namely,-

(b) For capital goods held in stock, the input tax credit involved in the remaining useful life in months shall be computed on pro-rata basis, taking the useful life as five years

Illustration:

Capital goods have been in use for 4 years, 6 month and 15 days.

The useful remaining life in months = 5 months ignoring a part of the month

Input tax credit taken on such capital goods = C

Input tax credit attributable to remaining useful life = C multiplied by 5/60

When we closely analyse section 18(6) and Rule 44(6), there is controversy between both.

According to Section 18(6) read with Rule 40(1)(a), on supply of capital goods or plant and machinery, on which input tax credit has been taken, the registered person shall pay an amount equal to the input tax credit taken on said capital goods or plant and machinery reduced by five percentage points as may be prescribed or the tax on the transaction value of such capital goods or plant and machinery determined under section 15, whichever is higher.

But whereas, as per rule 44(6), the amount of input tax credit for the purposes of sub – section (6) of section 18 relating to capital goods shall be determined in the same manner as specified in clause (b) of sub – rule (1) and the same shall be determined separately for input tax credit of IGST and CGST:

Provided that where the amount so determined is more than the tax determined on the transaction value of the capital goods, the amount determined shall form part of the output tax liability and the same shall be furnished in Form GSTR – 1.

As per rule 44(1)(b), for capital goods held in stock, the input tax credit involved in the remaining useful life in months shall be computed on pro-rata basis, taking the useful life as five years

Let us take the same example and determine the ITC to be reversed as per Rule 44(6).

Capital goods purchased on 2nd January 2018 for Rs. 5 Crores (Rs. 500 Lakhs). ITC on such capital goods is Rs. 1.8 Crores (Rs. 180 Lakhs).

The same Capital Goods was sold on 1st July 2019 for Rs. 3 Crores (Rs. 300 Lakhs). Tax rate is 18%.

Determination of ITC to be reversed as per Rule 44(1)(b)

Capital goods have been in use for 1 year, 6 months.

The useful remaining life in months = 3 years 6 months (42 months)

Input tax credit taken on such Capital Goods (C) = Rs. 180 Lakhs.

Input tax credit attributable to remaining useful life = Rs. 180 Lakhs * 42/60 = Rs. 126 Lakhs.

ITC to be reversed as per section 18(6) read with Rule 40(1)(a) is Rs. 117 Lakhs.

Whereas as per rule 18(6) it is Rs, 126 Lakhs.

Conclusion

Now there arises a question which one to apply to calculate the amount of ITC to be reversed in case of supply of capital goods? Whether section 18(6) or Rule 44(6)?

Can we take whichever is beneficial for us?

The answer is no.

As Rule cannot override the section, Section 18(6) will supercede Rule 44(6) and ITC reversal in case of supply of Capital Goods shall be based on section 18(6) and not as per Rule 44(6).

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional. Please refer to the complete Terms & Disclaimer here. Terms & Disclaimer

Shouldn’t it be rule 40(2) instead of 40(1)(a)?

Dear mam,

There is some confusion. Rule 40(1)(a) deals with the case specified in Section 18(1), whereas Rule 44(6) deals with the case specified in Section 18(6). Method of calculation is different in both the sub-sections and sub rules.

Those are separate rules and needs to be read accordingly. Henceforth, in case of supply of capital goods one should follow the methods prescribed under rule 44(6) which refers to sub rule (1) which talks of taking the life as 5 years.

If i am wrong in any interpretation, feel free to rectify me.