Applicability of GST on ocean freight – Analysis of FOB transaction V/s CIF Import Transaction

The quantum of Ocean freight is one of the important factors in Import / Export Trade. The Ocean Freight is charged by the shipping lines for transporting the Products packed into large containers to the destination country.

Out of many controversial issues under GST, one of the most discussed issues is applicability of GST ocean freight under reverse charge mechanism. In this article, we will be discussing the following: –

I. Examining the provisions of the GST laws which will be applicable on ocean freight.

II. Impact on Indian shipping line business after ruling of Gujarat High court declaring ultra-virus to entry no.10 of Notification 10/2017-IGST.

Page Contents

I. Examining the provisions of the GST laws which will be applicable on ocean freight:

The Ocean freight Expense in respect to Imports of goods is divided into two types based on transaction value namely:

(a) Imports of goods on CIF Value.

(b) Import of goods on FOB Value.

(a) Imports of goods on CIF Value: –

Section 5(3) of the IGST Act, 2017 empowers the Central Government, on the recommendation of the GST Council, to notify the supplies which are liable for payment of GST under Reverse Charge Mechanism (RCM) by the recipient of Goods or Service. The relevant provision is reproduced below for ease of reference:

5(3) The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

On the perusal of the above entry, it is appeared that only recipient of supply can be notified as the person liable for paying the GST under reverse charge. The term ‘Recipient’ is defined under section 2(93) of CGST Act, 2017. The same is reproduced below: –

(93) “recipient” of supply of goods or services or both, means—

(a) where a consideration is payable for the supply of goods or services or both, the person who is liable to pay that consideration;

(b) where no consideration is payable for the supply of goods, the person to whom the goods are delivered or made available, or to whom possession or use of the goods is given or made available; and

(c) where no consideration is payable for the supply of a service, the person to whom the service is rendered,

and any reference to a person to whom a supply is made shall be construed as a

reference to the recipient of the supply and shall include an agent acting as such on behalf of the recipient in relation to the goods or services or both supplied;

By exercising power conferred under section 5(3) supra, Government issued Notification No. 10/2017-Integrated Tax (Rate), dated 28.06.2017 notifying the categories of supplies which are liable for payment of GST under Reverse Charge Mechanism (RCM). The entry number 10 of the said notification provides for payment of GST on ocean freight by the importer. The is reproduced below:

| Sl. No. | Category of Supply of Services | Supplier of service | Recipient of Service |

| 10. | Services supplied by a person located in non- taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India. | A person located in non-taxable territory | Importer, as defined in clause (26) of section 2 of the Customs Act, 1962(52 of 1962), located in the taxable territory. |

The Government has included ‘importer’ in the category recipient of services by way of entry no. 10 of above notification 10/2017-Integrated Tax (Rate).

However, the Government failed to note that in case of CIF transactions, the Importer is not the person liable to pay freight to the shipping line and thus cannot be treated as the recipient of the service of foreign shipping line. Now, the question arises when section has empowered to levy a tax on recipient, can Notification expand the scope of ‘service recipient’?

Several petitions were filled before the Gujarat High Court on the said issue. Entry No. 10 of notification 10/2017-IT (Rate) was challenged on the ground that it is ultra-virus of section 5 of IGST Act. The importer is not the recipient of service as contract for transportation of goods in case of CIF contract is made between the exporter and the shipping line both located outside India.

Finally, a landmark ruling in the case of Mohit Minerals Vs. UOI & Others reported in 2020-TIOL-164-AHMDGST was pronounced. Gujarat High court in the said judgment has held as follows: –

- Entry No 10 of notification 10/2017-IT (Rate) is ultra-virus of section 5(3). The importer is not the recipient of services of transportation of goods. The exporter who is located outside has contracted with the shipping line who is the recipient of service. Hence tax cannot be demanded from the importer. The importer even cannot be considered as indirect recipient of service as ‘recipient of service’ is specifically defined in the statute.

- As per section 14 of Customs Act, assessable value of goods includes freight amount which represent the expenditure on transportation of goods. IGST is already paid on freight element by including it in assessable value. Therefore, payment of IGST separately on the ocean freight will amount to double taxation.

- Value of services cannot be determined by importer under section 15 of GST Act. The value can be determined by the exporter of goods.

- Entry No. 10 of notification 10/2017-IT (Rate) is unconstitutional as tax on ocean freight services and making importer to pay GST is not constitutional as there is no statutory sanction for the same.

In view of the above, it can be concluded that no IGST is payable under reverse charge by Importer in case of CIF transaction.

(b) Import of goods on FOB Value:

There can be another situation where importer paid for goods on FOB basis and hired ocean freight service provider and makes payment for such service. In this case importer is recipient of service as per definition of ‘Recipient’ provided under section 2(93) supra.

The entry number 01 of the Notification No. 10/2017-Integrated Tax (Rate), dated 28.06.2017 provides for payment of GST under RCM on import of service by the recipient of service. The same is reproduced below:

| Sl. No. | Category of Supply of Services | Supplier of service | Recipient of Service |

| 1. | Any service supplied by any person who is located in a non-taxable territory to any person other than non-taxable online recipient. | Any person located in a non-taxable territory | Any person located in the taxable territory other than non-taxable online recipient. |

Accordingly, if ocean shipping line is located in non-taxable territory then GST is payable under RCM by recipient of service.

However, in case of import of goods, customs duties are leviable on assessable value as per determined under section 14 of Custom Act. As per section 14 of Customs Act, assessable value of goods includes freight amount which represent the expenditure on transportation of goods. IGST is payable on freight element by including it in assessable value. Therefore, payment of IGST separately on the ocean freight under RCM will amount to double taxation.

The judicial decisions have been always in favour of an interpretation disallowing double taxation if two interpretations are possible. In the present case there is no interpretation issue in entry no. 1 of Notification 10/2017-IGST and section 14 of Custom Act. Therefore, there is difficulty in sustainability of the argument of double taxation.

In one of the old decisions in the income tax case of Jain Brothers v/s UOI-1970(77) ITR 107 (SC), the Supreme Court said that the Constitution does not contain any prohibition against double taxation. It also held that it is not disputed that there can be double taxation if the legislature has distinctly enacted it. In fact, the Supreme Court has allowed double taxation if the legislative intent is clear. In the case of Premier Tyres Ltd. vs. CCE, Cochin-1987 (28) ELT 58 (SC), relating to Central Excise input tax credit, the Supreme Court held that the language of the notification is so clear that it permits a situation where input credit is not allowed leading to double taxation. Therefore, there is nothing illegal about it. The relevant extract of the said judgment is as follows:

There is no general principle that there can be no ‘double taxation’ in the levy of Excise Duty. The court may lean in favour of a construction which will avoid double taxation but in the present case there does not appear to be any lean question of construction at all.

Further, in the case of Hind Plastics v. C.C. Bombay, 1994 SCC (5) 167 the Supreme Court held that taxing of packing material twice, (once at the rate applicable to the contents and then the rate applicable to the container) which would be the result if the levy on duty to the packing material were not to be exempted would mean double taxation and therefore harsh. But the Court held that even if it is harsh, it is legal. The Supreme Court held specifically in this connection that what should be taxed is a matter not to be decided by the Courts but by the instrumentality of the functionaries. The relevant extract of the said judgement is as follows:

15.After giving anxious consideration to the rival points of view, we are inclined to agree with the view taken by the Division Bench of the Bombay High Court. It may, however, be that taxing of packing material twice, once at the rate applicable to the contents and then at the rate applicable to container, which would be the result if levy of duty on packing material were not to be exempted, may appear harsh, but it cannot be said to be illegal. What should be taxed is a matter not to be decided by the courts, but by appropriate instrumentalities or functionaries.

Therefore, in case of FOB transaction if ocean shipping line is located in non-taxable territory i.e. outside India then GST is payable under RCM by importer of goods being recipient of service under entry-1 of the Notification 10/2017-IGST.

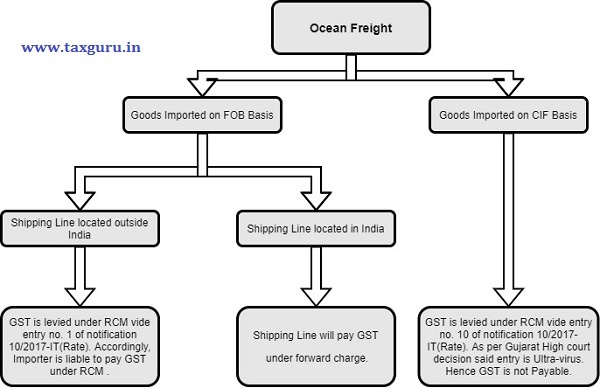

- In nutshell, the scenario emerged from above discussion can be understood by following diagram: –

II. Impact on Indian shipping line business after ruling of Gujarat High court declaring ultra-virus to entry no.10 of Notification 10/2017-IGST: –

It can be seen from above discussion that in case of CIF transaction GST is not payable whereas in case of FOB transaction GST is payable. However, Input Tax Credit (ITC) is available where GST has paid on RCM under FOB transaction. There are many industries wherein huge amount of ITC is accumulated due to inverted duty structure, exports etc. and payment of GST under RCM in FOB transaction as discussed above will lead to unnecessary cash outflow till the same amount is refunded or utilised for payment of GST in case of such industries. Since in case of CIF transaction GST is not payable therefore, if a business entity is facing ITC accumulation, then for them it will be beneficial to enter into CIF transaction instead of FOB transaction.

The above tax scenario will encourage businesses to convert FOB contracts into CIF contracts, and it will be beneficial to appoint foreign shipping lines located into non-taxable territory (i.e. outside India) instead of Indian Shipping lines. It will render Indian shipping industry uncompetitive vis-a-vis foreign shipping lines. It can be seen that the Indian Shipping Industries are not getting level playing field vis-a-vis the foreign shipping lines. Therefore, exemption of RCM on Ocean freight in case of FOB transaction should be granted to provide Indian shipping industry the level playing field vis-a-vis the foreign shipping lines.

Hope the readers will find the above article useful. In case of any query/information, feel free to write back to us. The author can be reached at Sandeep.purohit1@yahoo.com

The opinion is based on my understanding of law and regulation prevailing as on the date. There is no assurance that the Revenue Authorities will agree to the view expressed above. Further, the views, thoughts, and opinions expressed in this article belong solely to the author, and not necessarily represent or reflect the views of the author’s employer, organization, or other group or individual.

Department’s appeal against the decision of the Gujarat High Court in the case of M/s Mohit Minerals has been dismissed.

IGST shall not be leviable on ocean freight under Notification 8/2017 IGST(R) and Entry 10 of Notification 10/2017 IGST(R).

Nice article.

Amazing analysis. Loved reading it.

It mean you willing for double taxation should continue on ocean freight, if custom is assessing value on CIF and collecting custom and IGST on basic value + insurance value + ocean freight value ,

Goods emport duty in woods logs details enquiry ..anbu saw mill tamil nadu

Is there any identification on Bill of Entry : import of goods is on CIF Value or FOB Value or it has to be checked only by Shipping Company Invoice.

Very good analysis…

Keep it up..