CGST Ghaziabad arrested 1 person in follow up of an earlier case which involved GST fraud of Rs. 630 crs. in value and fake ITC of approx 100 crs. by creating 50 bogus firms, using multiple PAN, mobile numbers and bank accounts. 2 persons have been arrested in the case so far.

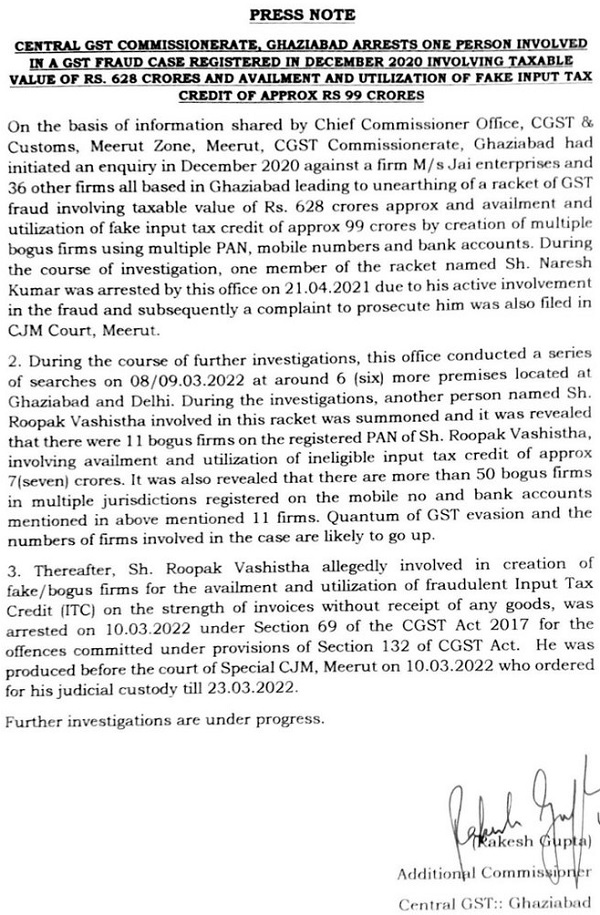

PRESS NOTE

CENTRAL GST COMMISSIONERATE, GHAZIABAD ARRESTS ONE PERSON INVOLVED IN A GST FRAUD CASE REGISTERED IN DECEMBER 2020 INVOLVING TAXABLE VALUE OF RS. 628 CRORES AND AVAILMENT AND UTILIZATION OF FAKE INPUT TAX CREDIT OF APPROX RS 99 CRORES

On the basis of information shared by Chief Commissioner Office, CGST & Customs, Meerut Zone, Meerut, CGST Commissionerate, Ghaziabad had initiated an enquiry in December 2020 against a firm M/s Jai enterprises and 36 other firms all based in Ghaziabad leading to unearthing of a racket of GST fraud involving taxable value of Rs. 628 crores approx and availment and utilization of fake input tax credit of approx 99 crores by creation of multiple bogus firms using multiple PAN, mobile numbers and bank accounts. During the course of investigation, one member of the racket named Sh. Naresh Kumar was arrested by this office on 21.04.2021 due to his active involvement in the fraud and subsequently a complaint to prosecute him was also filed in CJM Court, Meerut.

2. During the course of further investigations, this office conducted a series of searches on 08/09.03.2022 at around 6 (six) more premises located at Ghaziabad and Delhi. During the investigations, another person named Sh. Roopak Vashistha involved in this racket was summoned and it was revealed that there were 11 bogus firms on the registered PAN of Sh. Roopak Vashistha, involving availment and utilization of ineligible input tax credit of approx 7(seven) crores. It was also revealed that there are more than 50 bogus firms in multiple jurisdictions registered on the mobile no and bank accounts mentioned in above mentioned 11 firms. Quantum of GST evasion and the numbers of firms involved in the case are likely to go up.

3. Thereafter, Sh. Roopak Vashistha allegedly involved in creation of fake/bogus firms for the availment and utilization of fraudulent Input Tax Credit (ITC) on the strength of invoices without receipt of any goods, was arrested on 10.03.2022 under Section 69 of the CGST Act, 2017 for the offences committed under provisions of Section 132 of CGST Act. He was produced before the court of Special CJM, Meerut on 10.03.2022 who ordered for his judicial custody till 23.03.2022.

Further investigations are under progress.

(Rakesh Gupta)

Addition Commissioner

Central GST:: Ghaziabad | Dated: 10/03/2022