This presentation will familiarise you with the end-to-end processes involved in payment made by the Taxpayer using DRC-03 and verification of such payment made using DRC-03 and issuance of acknowledgement of Payment through DRC-04 or Conclusion of Proceeding through DRC-05 as per the Cause of Payment in the CBIC-GST application.

At the end of this module, you should be able to:

- Explain the key concepts of the payment made via DRC-03 by Taxpayer

- Explain the key steps of verification of DRC-03 from the user perspective

- Explain the key steps of issuing DRC-04 or DRC-05 in the DSR module from the user perspective

Overview of Voluntary Payment DRC-03 , DRC-04 & DRC-05

Verification of DRC-03 and issue of SCN in certain cases

FORM GST DRC-03 is a digital intimation of payment made by the taxpayer voluntarily or made against show cause notice (SCN)/ statement. As per Section 73(7) and Sec 74(7), the tax officer is expected to verify the payment received from the taxpayer and if the amount paid falls short of the amount actually payable, they shall proceed to issue the notice in respect of such amount which falls short of the amount actually payable. Accordingly, verification of DRC 03 payment is built in this module.

FORM, DRC-01 is a digital summary of the show cause notice issued to the taxpayer. The taxpayer can make a payment against the DRC 01 on the common portal using DRC 03. Verification of Interest paid in such DRC 03 is built in the system since tax is already quantified in the DRC01.

Overview of DRC-03

Processing of voluntary payments made by the taxpayer through DRC-03 before the issue of any notice

- The DRC-03 is displayed on the dashboard of Jurisdictional Range Officer, who in turn verifies himself or reassigns to the proper officer depending upon monetary limit since the verification of DRC-03 falls in the ambit of adjudication. The Jurisdictional Range Office should carefully check and verify the details available in the documents received with the DRC 03 and re-assign to the proper officer any number of times associated with adjudication, Audit Commissionerate, Anti-Evasion Wing of Commissionerate or DGGI, as applicable. The Officer to whom DRC-03 is re-assigned can either do the verification of the form himself or he can delegate it to his Inspector.

- The verification process of DRC 03 involves answering logical queries in the system leading to either acceptance of payment or issue of SCN. In case, payments are made voluntarily and the validation tests are cleared, the proper officer can issue DRC-04 (Acknowledgement of acceptance of payments made voluntarily). In case, deficiencies if any, are found the tax officer is expected to seek clarification offline, from the taxpayer in this regard. The records of such offline communication have to be uploaded to the system.

- During the process of verification, a series of questions/checklist appears on the screen of the user. The subsequent questions change on the basis of the validations. Further, if it has been established by the officer that there is a fraud/willful misstatement/ suppression from the taxpayer and still, the payment(DRC-03) is received from the taxpayer is in respect of Section 73, then the revised section gets changed to 74 and doesn’t allow issue of DRC-04. Further, the revised liability as calculated by the tax officer is allowed to be captured in the system.

- If the proper officer is of the opinion that the amount paid voluntarily falls short of the amount actually payable, he shall proceed to issue the show cause notice manually and then upload DRC-01 online, in respect of such amount which falls short of the amount actually payable.

- The verification process of DRC 03 made against an SCN, involves verification of interest paid. If validations are cleared, DRC-05 shall be issued for the conclusion of proceedings. For the issue of DRC-05, the entire payment has to be made once within 30 days from the date of issue of show cause notice. Partial payments are not allowed on the common portal.

- Since the verification of DRC-03 falls in the ambit of adjudication, the verification process is to be approved by the proper officer for adjudication depending upon monetary limit enumerated in Circular no. 3/3/2017 dated 05.07.2017 and Circular no. 31/05/2018 dated 09.02.2018.

- Once DRC-05 is issued, the officer will not have the option to issue one more order-in-original or DRC-07. DRC-05 is construed as the closure of proceedings and hence proper officer has to maintain the time limit of three years / five years as per Section 73/74 respectively.

Instructions for taxpayer for filing DRC-03 in Common Portal

- Making Voluntary Payment on GST Portal: A facility is given to taxpayers to make payment on voluntary basis, through Form GST DRC-03 (refer Rule 142(2) or 142(3) of the CGST Rules, 2017). Login into GST Portal and navigate to Services > User Services > My Applications and Select the Intimation of Voluntary Payment – DRC – 03, from the Application Type drop-down list.

- When to make Payment Voluntary Payment: Payment can be voluntarily made by taxpayer for a self-ascertained liability or in response to the show cause notice (SCN) raised by the tax authorities, u/s 73 or 74 of the CGST Act, 2017, within 30 days of issuance of SCN or even before issuance of the SCN.

- Partial Payment not allowed: GST Portal does not allow for making partial payments of the amount stated in the SCN.

- Cause of Payment: Payments through Form GST DRC-03 can be made for any causes like Audit, Investigation, Voluntary Payment, SCN, Annual Return, Reconciliation Statement or Others.

- Saving Draft DRC 03 Application: Draft of Application for intimation of voluntary payment can be saved for a maximum period of 15 days. If the same is not filed within 15 days, the saved draft will be purged. To view the saved application, navigate to Services > User Services > My Saved Applications option.

Continued…

- Using Payment Reference Number: If payment has been made and payment reference number (PRN) has been generated, but application in Form GST DRC-03 has not been filed, then in such cases, application available in ‘My Saved Applications’ need to be selected and using PRN already generated, it may be filed. However, if a period of fifteen days has elapsed, then, details in Form need to be filled up again. PRN generated already can be used for filing the application.

- Filing Form GST DRC 03: Taxpayers are required to file Form GST DRC-03 using DSC or EVC, as the case may be, after making payment. The status will change to “Pending for approval by Tax officer”. However, it may be noted that, no approval of tax officer is needed on earlier application, while making another voluntary payment using FORM GST DRC 03.

- Acknowledgment by Tax Official: Upon filing of Form GST DRC-03, the tax officer will issue an Acknowledgement in Form GST DRC-04(Acknowledgement of Acceptance of voluntary payment). There is no bar on making another payment on voluntary basis by a taxpayer, pending issuance of acknowledgement by the tax officer.

Application walkthrough of receiving DRC-03

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Here DRC-03 (payment before issue of SCN) is transmitted by Range Superintendent to DGGI (from vertical to vertical)- At DGGI, Superintendent delegates the task of verification to Inspector and after verification, DGGI Superintendent issues DRC-04.

Task for Superintendent: DRC-03 Pending for Verification

Step:> Superintendent login with SSOID and select task

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Superintendent: DRC-03 Pending for Verification

Step:> Select CRN link from list

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Superintendent: DRC-03 Pending for Verification

Step:> DRC-03 shall be displayed, verify the details

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Superintendent: DRC-03 Pending for Verification

Step:> Verification options are “Ascertained by Tax Payer” or “Ascertained by tax officer”, System allows “Verify Payment” actions for either options.

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Superintendent: DRC-03 Pending for Verification

Step:> If “Ascertained by your formation” is “No” (this is the case of other formation), then System allows “Re-assign” action.

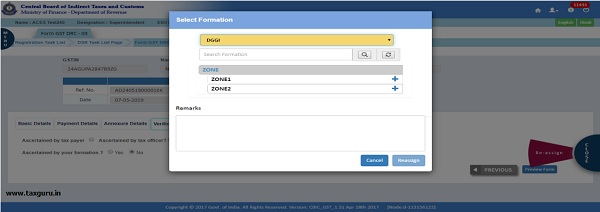

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Superintendent: DRC-03 Pending for Verification

Step:>Superintendent can reassign DRC-03 Record to another vertical (Audit, DGGI, Investigation) by clicking ‘Re-assign’ button. Can select bottom level formation for DGGI vertical

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Superintendent: DRC-03 Pending for Verification

Step:>System displays ‘Success Message’ after Reassign

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Workflow at other formation (DGGI)

Task for Superintendent: DRC-03 Pending for Verification

Step:>Login with SSO ID of DGGI Superintendent. System displays reassigned DRC-03 form under Task list

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Workflow at other formation (DGGI)

Task for Superintendent: DRC-03 Pending for Verification

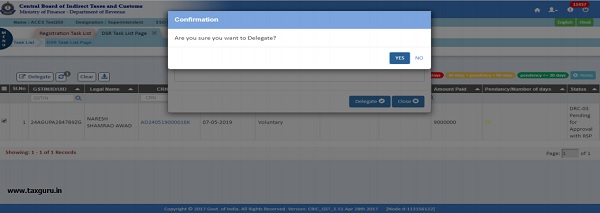

Step:>Select a particular record and click “Delegate” for delegating the task to Inspector

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Workflow at other formation (DGGI)

Task for Superintendent: DRC-03 Pending for Verification

Step:>Confirm the delegation

Intimation of Payment DRC-03 (Voluntary)-Verification of payment-Issue of DRC-04:

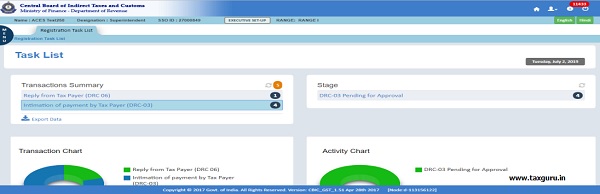

Task for Inspector: DRC-03 Pending for Verification

Step:> Login with SSO ID of DGGI Inspector and Task List displays the delegated task.

Intimation of Payment DRC-03 (Voluntary)-Verification of paymentIssue of DRC-04:

Task for Inspector: DRC-03 Pending for Verification

Step:> Select CRN hyperlink

Intimation of Payment DRC-03 (Voluntary)-Verification of paymentIssue of DRC-04:

Task for Inspector: DRC-03 Pending for Verification

Step:> DRC-03 shall be displayed

Here, the tax payer has declared that the case is a voluntary payment before issue of SCN (Sec.73(5) case).

Intimation of Payment DRC-03 (Voluntary)-Verification of paymentIssue of DRC-04:

Task for Inspector: DRC-03 Pending for Verification

Step:> Select “Verify payment” option from Actions

Intimation of Payment DRC-03 (Voluntary)-Verification of paymentIssue of DRC-04:

Task for Inspector: DRC-03 Pending for Verification

Step:> Confirm by selecting ‘YES’

Intimation of Payment DRC-03 (Voluntary)-Verification of paymentIssue of DRC-04:

Task for Inspector: DRC-03 Pending for Verification

Step:> Answer the verification parameters. Here in this process, tax officer has noticed that case is a suppression and has confirmed this. System automatically validates the case under Section 74(5).

Intimation of Payment DRC-03 (Voluntary)-Verification of paymentIssue of DRC-04:

Task for Inspector: DRC-03 Pending for Verification

Step:> In case payment is under Sec.73(11), System displays ‘Verification details’ as under. Here, validations for parameters are discussed. In case tax period is not correct, the officer can change the period as shown under:

Intimation of Payment DRC-03 (Voluntary)-Verification of paymentIssue of DRC-04:

Task for Inspector: DRC-03 Pending for Verification

Step:> Refer checklist- Sl. No.3, here tax payer has not complied (not paid within 30 days), the system displays ‘Liability Details’ and ‘Revised Liability’. ‘Liability Details’ are details derived from the form. ‘Revised Liability’ displays determinable liability and helps the user to correct the liability details.

If “No” is selected for first question then also System displays “Revised liability” and helps the user in determining liability.

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Inspector: DRC-03 Pending for Verification

Step:> If “No” is selected for second question(documents not uploaded), system enables Upload worksheet option for uploading revised worksheet.

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Inspector: DRC-03 Pending for Verification

Step:> It may be noted that validations are done for penalties. For example: For the cases under Sec.73, the penalty is equal to tax or Rs.10,000.00, whichever is higher. In the following case tax amount is Rs.2000.00, which is less than Rs.10,000.00. When this lesser amount is entered, System validates the penalty to Rs.10,000.00

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Inspector: DRC-03 Pending for Verification

Step:> After all the options are selected, enter Remarks and Click on submit button. System takes the task to Superintendent for approval

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

NOW THE TASK IS RETURNED TO THE SUPERINTENDENT

Task for Superintendent: Returned/Verified DRC-03’

Step:> Login with Superintendent SSOID.

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Superintendent: Returned/Verified DRC-03’

Step:> Select CRN hyperlink

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Superintendent: Returned/Verified DRC-03’

Step:> System displays FORM DRC-03 in editable form

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Superintendent: Returned/Verified DRC-03’

Step:> As per the response to question, DRC-04 button shall be displayed, click the button

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Superintendent: Returned/Verified DRC-03’

Step:> User gets FORM DRC-04 in an editable format

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Superintendent: Returned/Verified DRC-03’

Step:> User can fill the DRC-04 form details and click on submit

Intimation of Payment DRC-03 (Voluntary)-Verification of payment Issue of DRC-04:

Task for Superintendent: Returned/Verified DRC-03’

Step:> On Successful submission, user gets Confirmation message. At the same time, tax payer gets SMS and mail

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

The given case is where the Superintendent himself verifies the payment made against SCN, which is in his monetary limit and issues DRC-05 (conclusion of proceedings)

Task for Superintendent: DRC-03 Pending for Verification

Step:> Superintendent to login with SSO-ID of RSP

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

Task for Superintendent: DRC-03 Pending for Verification

Step:> Select Task List then DSR

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

Task for Superintendent: DRC-03 Pending for Verification

Step:> Select Task List-> Intimation of payment by Tax Payer (DRC-03) DRC-03 Pending for Approval

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

Task for Superintendent: DRC-03 Pending for Verification

Step:> Select CRN of particular DRC-03 Record. Here periodicity of pendency is shown in colour band.

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

Task for Superintendent: DRC-03 Pending for Verification

Step:> View DRC-03 details

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

Task for Superintendent: DRC-03 Pending for Verification

Step:> Click “Verify Payment

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

Task for Superintendent: DRC-03 Pending for Verification

Step:> Click “Yes” to confirm

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

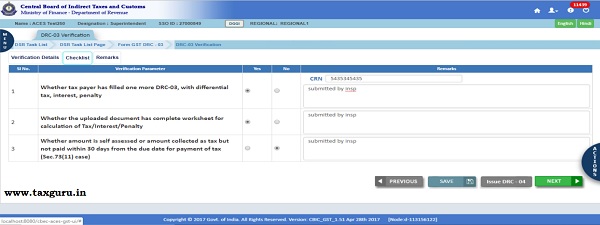

Task for Superintendent: DRC-03 Pending for Verification

Step:> System displays ‘DRC-03 Verification’ in editable mode

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

Task for Superintendent: DRC-03 Pending for Verification

Step:> Answer the verification parameters using options. Make remarks if required

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

Task for Superintendent: DRC-03 Pending for Verification

Step:> If validations satisfy the parameters and the dues are paid, the proceedings can be closed. System displays “Issue DRC-05” button. Click on “Issue DRC-05” button, DRC-05 screen shall be displayed

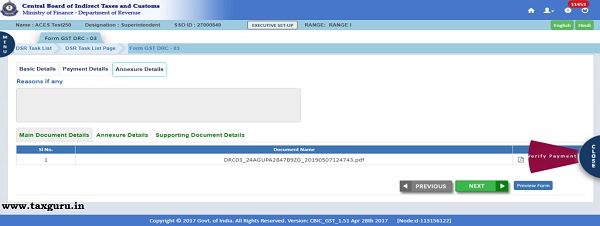

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

Task for Superintendent: DRC-03 Pending for Verification

Step:> Enter the details of “DRC-05” in all the tabs

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

Task for Superintendent: DRC-03 Pending for Verification

Step:> Click “Submit” button and confirm issue of DRC-05. Tax payer gets DRC-05 form. At the same time, he gets SMS/mail also.

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

Task for Superintendent: DRC-03 Pending for Verification

Step:> Officer can view/download the DRC-05

Intimation of Payment DRC-03 (SCN)-Verification of payment-Issue of DRC-05:

In case, amount Payment falls short, then “Issue OIO” button shall be displayed (System restricts issue of DRC-05).

Task for Superintendent: DRC-03 Pending for Verification

Step:> Issue OIO

Informative, very much useful for range supdt. also