It is usual practice for all the exporters of goods / services to receive money in foreign currency. Few exporters would have EEFC (Exchange Earners’ Foreign Currency Account) where they can directly deposit the foreign currency in their account which would be maintained in foreign currency in an Indian Bank. Majority of the exporters would receive money in Indian currency after deduction of remittance charges, conversion charges, etc.

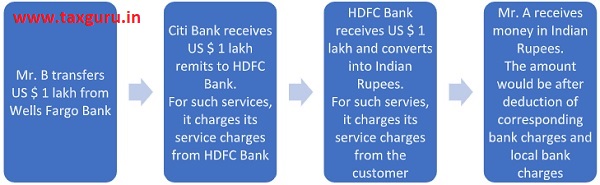

The author in this article tried to explain the transaction flow for such transaction and the impact of GST on each leg of the transaction by the following example:

Mr. A is a customer of HDFC Bank (Indian Bank) exported goods to Mr. B in USA who is a customer of Wells Fargo Bank (Bank of the Mr. B). Mr. A raised an invoice for US $ 1 lakh and asked the HDFC Bank to do necessary arrangement to realise the invoice amount. Mr. B drawn a cheque of Wells Fargo Bank for US $ 1 lakh. Every authorised Indian Bank would maintain an a local account with the Correspondent bank / Intermediary Bank. For suppose, HDFC Bank maintains its account with Citi Bank (Intermediary Bank). Wells Forgo Bank transfer the money to the account held at Citi Bank. Citi bank would remit the amount in foreign currency to the Indian HDFC Bank. For the remittance services provided, Citi Bank would charge its service charges to HDFC Bank. These charges are called as ‘corresponding bank charges / intermediary bank charges’. HDFC bank charges Mr. A for its services of remittance and conversion. For easy understanding the flow of money would be as follows:

In the above said remittance, the following charges were deducted before receipt of remittance:

- Charges by foreign Bank (Citi Bank) – Corresponding Bank charges / Intermediary bank charges.

- Charges by local Bank (HDFC Bank) – This consists for remittance related service charges and conversion charges. It is clear these services are liable to GST under forward charge by the local bank.

With respect to corresponding bank charges (foreign bank charges), first it is charged to HDFC Bank which ultimately recovered from the end customer. In summary, all the above charges would be borne by Mr. A ultimately. The probable issues would be:

> What would be the GST impact on the foreign bank charges.

> Whether such service provided to importer or exporter?

> Whether such bank charges would tantamount to import of service?

> If it is import of service, Whether GST is payable by the Indian exporters or by the Indian bank, through whom the remittance is received?

The following discussion would through some light on that:

GST applicable on all supply of goods or/and services. With respect to import of services, Notification 10/2017 – IGST (Rate) specifies that the recipient is required to discharge GST under reverse charge. Import of service means supply of service where the Supplier of service is located outside India, Recipient of Service is located in India and the place of supply of service is in India.

Under GST, “Recipient” of supply of goods or services or both, mean where a consideration is payable for the supply of goods or services or both, the person who is liable to pay that consideration.

The other important is the terms of contract between the Indian exporter and the Indian Bank which plays a key role in deciding the GST impact. It could be of two ways which are explained as below:

> If the terms of contract between the Indian exporter and the Indian bank is in the nature of Principal and agent relationship. Here Indian bank remitting to exporter the same amount what foreign bank remitting to Indian bank after deducting sender’s charges. It is resembling that exporter’s bank is acting merely as a pure agent for exporter (upon satisfying the conditions of pure agent). There is no privity of contract/agreement between the foreign bank and Exporter/his banker regarding the scope but there will be a contract/agreement between the exporter and his banker. On analysis of above it is clear that recipient of service is the Indian exporter (who ultimately pays the consideration) but not the Indian bank. Therefore, liability to pay GST on reverse charge basis would be on exporter.

> If the Indian exporter and Indian bank has agreed to work on principal to principal basis where Indian bank does not merely get the reimbursement of the foreign bank’s charges but charges a lump-sum to Indian exporter which is over and above the actual charges paid to foreign banks, then the liability could be on the Indian bank as an importer of service under reverse charge mechanism qua the bank charges of foreign banks. For example exporters bank charges $50 to his customer for inward remittance which includes $25 charged by the foreign bank then the recipient of service would be Indian bank. In this case liability to pay GST on reverse charge basis would be on Indian bank. Similar view expressed in the case of “Theme Exports Pvt. Ltd. Vs. Commissioner Of Service Tax, Delhi [2019 (26) G.S.T.L. 104 (Tri. – Del.)] pertaining to Service tax law matter.

The liability can be decided on case to case basis based on the terms of arrangement and the bank’s role in the entire process. However, if the assessee is too conservative and input tax is not accumulated, he can decide of discharging GST under reverse charge and avail input tax credit.

(Article is jointly written by CA Jagadeesh Kumar Balina and CA Rajesh Maddi)

For example, the remitter made a remittance of USD 500 and we have received USD 450 after the deduction of foreign bank charges of USD 50. Afterward, we recover a short receipt of USD 50 in the next remittance, should we still be liable to pay the GST on RCM basis on foreign bank charges deducted?

If Indian Bank is maintaining NOSTRO account wit Intermediary bank outside India to receive remittance and intermediary bank deducts the charges from remittance would it qualify as intermediary service and place of provision outside India. The correspondent bank is acting as itermediator between remiiters bank and receivers bank and is charging commission for its service.

The authors have not considered Section 13 (8) of the IGST Act, which reads as follows,

The place of supply of the following services shall be the location of the supplier of services, namely:––

(a) services supplied by a banking company, or a financial institution, or a non-banking financial company, to account holders;

(b) intermediary services;

(c) services consisting of hiring of means of transport, including yachts but excluding aircrafts and vessels, up to a period of one month.

Explanation.––For the purposes of this sub-section, the expression,––

(a) “account” means an account bearing interest to the depositor, and includes a non-resident external account and a non-resident ordinary account;

(b) “banking company” shall have the same meaning as assigned to it under clause (a) of section 45A of the Reserve Bank of India Act, 1934;

Thus, the services received from a “banking company’, located outside India, by an ‘account holder’ may not become import of service as location of provision of service is not in India.