Paperless Customs

One of the pillars of CBIC’s flagship ‘Turant Customs’ programme, the Paperless Customs initiative leverages technology to dematerialize documents/forms as well as provide for electronic registration, wherever required, without the need to submit hard copies of documents in the Customs clearance process. This initiative speeds up the Customs clearance process, enhances the efficiency of the logistics network, reduces interface between the trade and Customs authorities, and is environment friendly. It also increases the bandwidth of both Customs officers and trade to focus on other priority work.

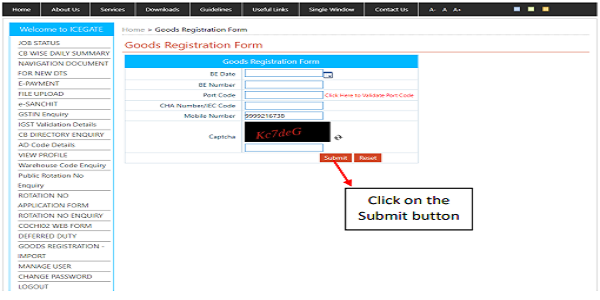

Web based registration of goods:

An importer/Customs Broker can self-initiate the process of electronic registration of goods, examination, documentary verification and issuance of Out Of Charge (OOC) on the Indian Customs and Central Excise Electronic Commerce/Electronic Data Interchange Gateway or ICEGATE. The facility is being availed by majority of importers. This dispensed the need for importer to physically present hard copy of Bill of Entry (BE) along with the supporting documents at a facilitation centre for registration.

Auto Queuing:

Post his physical submission, the goods would be processed for examination and/or OOC. This was changed in ICES 1.5, wherein a BE pending clearance could be electronically registered by the importer after which it is queued before the OOC officer on a First-In First-Out (FIFO) basis. The feature is similar to the queuing of BE for assessment among Appraising Groups.

Customs Compliance Verification (CCV):

The introduction of a CCV has delinked duty payment and allows the importer to self-register the imported goods and paves the way for the Customs officer to conclude necessary compliance verifications and conditionally clear the BE in the system. The importer may thereafter make the duty payment, receive OOC electronically and proceed to take the goods out of Customs control.

Machine based release:

The Indian Customs EDI System (ICES) automatically gives clearance to imported goods when all the compliances are fulfilled/satisfied. This also allows the compliance verification such as examination of goods to be completed even before Customs duties are paid. The facility of machine based release results in substantial reduction in time and cost of Customs clearance.

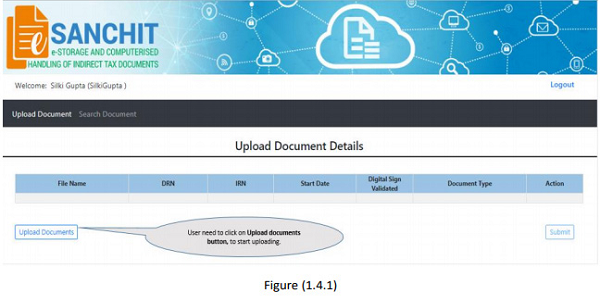

e-Storage and Computerized Handling of Indirect Tax Documents (e-SANCHIT):

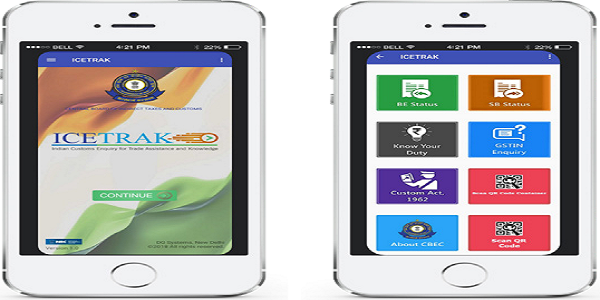

Indian Customs Enquiry for Trade Assistance and Knowledge (ICETRAK):

The free mobile app, ICETRAK, enables stakeholders to live track the BE/SB status, duty calculator, GSTN enquiry and validate the gate pass/BE/SB copies with QR code scanning functionality. QR Scanning facility in ICETRAK assures authenticity of electronic documents to any public by making use of encryption and digital signature technologies.

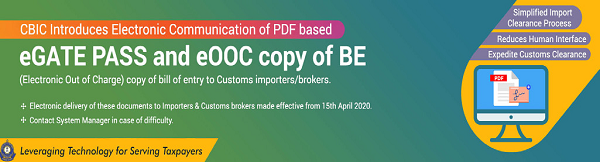

E-OOC BE, e-LEO Shipping Bill:

A secure QR code enabled PDF based final copy of BE/SB is electronically dispatched to the Customs Brokers/importers/exporters in the email address registered on ICEGATE.

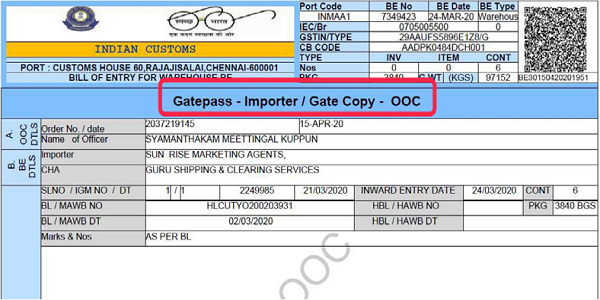

e-Gatepass:

An e-Gatepass is shared with custodians via electronic messaging. This ensures the custodian has advance information to prepare for identification and making available the goods for delivery to importer. The e-Gatepass helps in faster movement of goods out of the port of import. In like manner, an e-Gatepass is sent to shipping lines for advance processing enabling faster movement of export goods.

Indian Customs Tablet (ICETAB):

Smart mobile App installed in ICETABs enables officers working in the Examination section in Customs formations who are on move and require connectivity in the shed area to access the ICES, enter his comments, download e-Sanchit documents and carry out related tasks. These are secure tablets which are exclusively used by officers in examination area.

(Republished with amendments)