TAMIL NADU

No. 214] CHENNAI, MONDAY, APRIL 11, 2022

Panguni 28, Pilava, Thiruvalluvar Aandu–2053

Part III—Section 1(a)

General Statutory Rules, Notifications, Orders, Regulations, etc., issued by Secretariat Departments.

NOTIFICATIONS BY GOVERNMENT

LABOUR WELFARE AND SKILL DEVELOPMENT DEPARTMENT

CODE ON WAGES (TAMIL NADU) RULES, 2022.

[G.O. Ms. No. 36, Labour Welfare and Skill Development (H2), 11 Apirl 2022,

uãகுfl 28, d)ovoi, திருoifrளுoiI ஆthrடு-2053.]

No. SRO A-8(a)/2022.

The following draft rules, which the Government of Tamil Nadu proposes to make in exercise of the powers conferred by section 67 of the Code on Wages, 2019 (Central Act 29 of 2019) read with section 24 of the General Clauses Act, 1897 (Central Act X of 1897) and in supersession of the – (i) The Tamil Nadu Payment of Wages Rules, 1937, (ii) The Tamil Nadu Payment of Wages (Unclaimed Amounts) Rules, 1949 and (iii) The Minimum Wages (Tamil Nadu) Rules, 1953, made by the Governor of Tamil Nadu in exercise of the powers conferred by the Payment of Wages Act 1936 (Central Act IV of 1936) and the Minimum Wages Act, 1948 (Central Act XI of 1948), as the case may be, which are repealed by section 69 of the said Code on Wages, 2019, except as respects things done or omitted to be done before such supersession, are hereby notified, as required by sub-section (1) of said section 67, for information of all persons likely to be affected thereby and the notice is hereby given that the said draft rules will be taken into consideration after the expiry of a period of forty-five days from the date on which the copies of the Official Gazette in which this Notification is published are made available to the public.

Objections and suggestions, if any, may be addressed to the Secretary to the Government, Labour Welfare and Skill Development Department, Fort St. George, Chennai – 600009 through the Commissioner of Labour, DMS Campus, Chennai – 600 006 or by e-mail – com.tnlabour@nic.in. The objection or suggestion should be sent in a proforma containing columns, (i) specifying the name and address of the persons and organisations (ii) specifying the rule or sub-rule which is proposed to be modified and (iii) specifying the revised rule or sub-rule proposed to be substituted and the reasons therefor;

The Objections and Suggestions, which may be received from any persons with respect to the said draft rules before expiry of the period specified above will be considered by the Government of Tamil Nadu.

CODE ON WAGES (TAMIL NADU) RULES, 2022.

CHAPTER – I.

PRELIMINARY.

1. Short title, extent and commencement.- (1) These rules may be called the Code on Wages (Tamil Nadu) Rules, 2022.

(2) They extend to the whole of the State of Tamil Nadu.

(3) They shall come into force after the date of their final publication in the Official Gazette, on the date of the commencement of the Code on Wages, 2019 (Central Act 29 of 2019).

2. Definitions.- In these rules, unless the subject or context otherwise requires,—

(a) “authority” means the authority appointed by the State Government under sub-section (1) of section 45;

(b) “appellate authority” means the appellate authority appointed by the Government under sub-section (1) of section 49;

(c) “appeal” means an appeal preferred under sub-section (1) of section 49;

(d) “Board” means the State Advisory Board constituted by the Government under sub-section (4) of section 42;

(e) “Chairperson” means the Chairperson of the Board or a chairperson appointed by the Board to a committee or sub-committee;

(f) “Code” means the Code on Wages, 2019 (Central Act 29 of 2019);

(g) “Committee” means a committee constituted by the Board under sub-section (5) of section 42;

(h) “day” means a period of 24 hours beginning at mid-night;

(i) “Form” means a form appended to these rules;

(j) “Government” means the Government of Tamil Nadu;

(k) “highly skilled occupation” means an occupation which calls in its performance a specific level of perfection and required competence acquired through intensive technical or professional training or practical occupational experience for a considerable period and also requires of an employee to assume full responsibility for his judgement or decision involved in the execution of such occupation;

(l) “Inspector-cum-Facilitator” means a person appointed by the Government, by notification under sub-section (1) of section 51;

(m) “member” means a member of the Board and includes its Chairperson;

(n) “metropolitan area” means an area which is constituted under the Tamil Nadu District Municipalities Act, 1920 (Tamil Nadu Act V of 1920) or the respective City Municipal Corporation Acts and having a population of above 10 lakhs;

(o) “non-metropolitan area” means an area which is constituted under the Tamil Nadu District Municipalities Act, 1920 (Tamil Nadu Act V of 1920) or the respective City Municipal Corporation Acts and having a population of less than 10 lakhs;

(p) “population” means the population as ascertained at the last preceding census of which the relevant figures have been published;

(q) “registered trade union” means a trade union registered under the Trade Unions Act, 1926 (Central Act XVI of 1926) or under the Industrial Relations Code, 2020 (Central Act 35 of 2020);

(r) “rural area” means an area which is not a metropolitan area or non-metropolitan area;

(s) “Schedule” means the Schedule to these rules;

(t) “section” means a section of the Code;

(u) “semi-skilled occupation” means an occupation which in its performance requires the application of skill gained by the experience on job which is capable of being applied under the supervision or guidance of a skilled employee and includes supervision over the unskilled occupation;

(v) “skilled occupation” means an occupation which involves skill and competence in its performance through experience on the job or through training as an apprentice in a technical or vocational institute and the performance of which calls for initiating and judgement;

(w) “sub-committee” means a sub-committee constituted by the Board under sub-section (5) of section 42;

(x) “technical committee” means a committee constituted by the Government for the purpose of advising the Government in respect of skill categorization;

(y) “unskilled occupation” means an occupation which in its performance requires the application of simply the operating experience and involves no further skills;

(z) all other words and expressions used herein in these rules and not defined shall have the meanings respectively assigned to them under the Code.

CHAPTER II.

Minimum Wages.

3. Manner of calculating the minimum rate of wages.– (1) For the purposes of sub-section (5) of section 6, the minimum rate of wages shall be fixed on ‘day’ basis keeping in view the following criteria, namely:-

(i) The standard working class family which includes a spouse and two children apart from the earning worker; an equivalent of three adult consumption units;

(ii) A net intake of 2700 calories per day per consumption unit;

(iii) 66 metres cloth per year per standard working class family;

(iv) Housing rent expenditure to constitute 10 per cent of food and clothing expenditure;

(v) Fuel, electricity and other miscellaneous items of expenditure to constitute 20 percent of the minimum wages; and

(vi) Expenditure for children’s education, medical requirement, recreation and expenditure on contingencies to constitute 25 percent of the minimum wages;

(2) When the rate of wages for a day is fixed, then, such amount shall be divided by eight for fixing the rate of wages for an hour and multiplied by twenty-six for fixing the rate of wages for a month and in such division and multiplication, the factors of one-half and more than one-half shall be rounded as the next figure and the factors less than one-half shall be ignored.

4. Norms for fixation of minimum rate of wages.- (1) While fixing the minimum rate of wages under section 6, the Government shall divide the concerned geographical area into three categories, namely, metropolitan area, non-metropolitan area and the rural area.

(2) The Government shall constitute a technical committee for the purpose of advising the Government in respect of skill categorisation, which shall consist of the following members, namely:-

(i) Commissioner of Labour – Chairperson;

(ii) Additional Commissioner of Labour (Conciliation) – Member;

(iii) Director of Industrial Safety and Health – Member;

(iv) Project Director, Tamil Nadu Skill Development Corporation – Member;

(v) Joint Director, Department of Economics and Statistics – Member; and

(vi) Joint Commissioner of Labour (Minimum Wages) – Member Secretary.

(3) The Government shall, on the advice of the technical committee referred to in sub-rule (2), categorise the occupations of the employees into four categories, namely unskilled, semi-skilled, skilled and highly skilled by modifying, deleting or adding any entry in the categorisation of such occupations specified in Schedule – A.

(4) The Technical committee referred in sub rule (2) shall, while advising the Government under sub-rule (3), take into account, to the possible extent, the national classification of occupation or national skills qualification frame work or other similar frame work for the time being formulated to identify occupations.

(5) The technical committee while advising the Government shall also take into account the arduousness of work like temperature or humidity normally difficult to bear, hazardous occupations or processes or underground work.

5. Time Interval for revision of cost of living allowance.- Endeavour shall be made so that the cost of living allowance and the cash value of the concession in respect of essential commodities at concession rate shall be computed once before 1st April and then before 1st October, every year to revise the dearness allowance payable to the employees on the minimum wages:

Provided that where immediately before the issue of notification under section 8 fixing or revising the minimum rates of wages, cost of living allowance at the rate higher than the rate so fixed or revised where payable under this Code, or under any law or award or agreement for the time being in force, then notwithstanding anything contained in these rules, cost of living allowance at such higher rate, shall be payable to the employees.

6. Number of hours of work which shall constitute a normal working day.- (1) The normal working day under clause (a) of sub-section (1) of section 13 shall be comprised of eight hours of work and one or more intervals of rest which in total shall not exceed one hour.

(2) The working day of an employee shall be so arranged that inclusive of the intervals of rest, if any, it shall not spread over more than twelve hours on any day.

(3) The provisions of sub-rules (1) and (2) shall, in the case of an employee employed in agricultural employment, be subject to such modifications as may, from time to time, be determined by the Government.

(4) Nothing in this rule shall be deemed to affect the provisions of the Occupational Safety, Health and Working Conditions Code, 2020 (Central Act 37 of 2020) or the rules framed under that Code.

7. Weekly day of rest.- (1) Subject to the provisions of this rule, an employee shall be allowed a day of rest every week (hereinafter referred to as “the rest day”) which shall ordinarily be Sunday, but the employer may fix any other day of the week as the rest day for any employee or class of employees:

Provided that an employee shall be entitled for the rest day under this sub-rule if he has worked under the same employer for a continuous period of not less than six days:

Provided further that the employee shall be informed of the day fixed as the rest day and of any subsequent change in the rest day before the change is effected, by display of a notice to that effect in the place of employment at the place specified by the Inspector-cum-Facilitator in this behalf or by publishing in the website of the establishment.

Explanation.- For the purpose of computation of the continuous period of not less than six days specified in the first proviso to this sub-rule, any day on which an employee is required to attend for work but is given only an allowance for attendance and is not provided with work, a day on which an employee is laid off on payment of compensation under the Industrial Relations Code, 2020 (Central Act 35 of 2020) and any leave or holiday, with or without pay, granted by the employer to an employee in the period of six days immediately preceding the rest day, shall be deemed to be days on which the employee has worked.

(2) Any such employee shall not be required or allowed to work on the rest day unless he has or will have a substituted rest day for a whole day on one of the five days immediately before or after the rest day:

Provided that no substitution shall be made which will result in the employee working for more than ten days consecutively without a rest day for a whole day.

(3) Where in accordance with the foregoing provisions of this rule, any employee works on a rest day and has been given a substituted rest day on any one of the five days before or after the rest day, the rest day shall, for the purpose of calculating the weekly hours of work, be included in the week in which the substituted rest day occurs.

(4) An employee shall be granted-

(a) for rest day wages calculated at the rate applicable to the next preceding day; and

(b) where he works on the rest day and has been given a substituted rest day,

then, he shall be paid wages for the rest day on which he worked, at the overtime rate and wages for the substituted rest day at the rate applicable to the next preceding day:

Provided that where-

(i) the minimum rate of wages of the employee as notified under the Code has been worked out by dividing the minimum monthly rate of wages by twenty-six; or

(ii) the actual daily rate of wages of the employee has been worked out by dividing the monthly rate of wages by twenty-six and such actual daily rate of wages is not less than the notified minimum daily rate of wages of the employee then, no wages for the rest day shall be payable; and

(iii) the employee works on the rest day and has been given a substituted rest day, then, he shall be paid, only for the rest day on which he worked, an amount equal to the wages payable to him at the overtime rate; and

(iv) if any dispute arises whether the daily rate of wages has been worked out in accordance with the provisions of this proviso, the Commissioner of Labour or the Joint Commissioner of Labour having territorial jurisdiction may, on application made to him in this behalf, decide the same, after giving an opportunity to the parties concerned to make written representations:

Provided further that in the case of an employee governed by a piece-rate system, the wages for the rest day, or the substituted rest day, as the case may be, shall be such as the Government may, from time to time determine having regard to the minimum rate of wages fixed under the Code, in respect of the employment.

Explanation.- In this sub-rule ‘next preceding day’ means the last day on which the employee has worked, which precedes the rest day or the substituted rest day, as the case may be; and where the substituted rest day falls on a day immediately after the rest day, the next preceding day means the last day on which the employee has worked, which precedes the rest day.

(5) The provisions of this rule shall not operate to the prejudice of more favourable terms, if any, to which an employee may be, entitled under any other law or under the terms of any award, agreement or contract of service, and in such a case, the employee shall be entitled only to more favourable terms aforesaid.

Explanation – For the purposes of this rule, ‘week’ shall mean a period of seven days beginning at midnight on Saturday night.

8. Night shifts.- Where an employee in an employment works on a shift which extends beyond midnight, then, –

(a) a rest day for the whole day for the purposes of rule 7 shall, in this case means a period of twenty-four consecutive hours beginning from the time when his shift ends; and

(b) the following day in such a case shall be deemed to be the period of twenty-four hours beginning from the time when such shift ends, and the hours after midnight during which such employee was engaged in work shall be counted towards the previous day.

9. The extent and conditions for the purposes of sub-section (2) of section 13.- In case of employees-

(a) engaged in any emergency which could not have been foreseen or prevented;

(b) engaged in work of the nature of preparatory or complementary work which must necessarily be carried on outside the limits laid down for the general working in the employment concerned;

(c) whose employment is essentially intermittent;

(d) engaged in any work which for technical reasons has to be completed before the duty is over; and

(e) engaged in a work which could not be carried on except at times dependent on the irregular action of natural forces;

The provisions of rules 6, 7 and 8 shall apply subject to the conditions that –

(i) the spread over of the hours of work of the employee shall not exceed 14 hours in any day; and

(ii) the actual hours of work excluding the intervals of rest and the periods of inaction during which the employee may be on duty but is not called upon to display either physical activity or sustained attendance shall not exceed 9 hours in any day.

10. Longer wage period.- The longer wage-period for the purposes of minimum rate of wages under section 14 shall be by the month.

11. Wages of Employee who works for less than normal working day.- An employee shall not be entitled to receive wages for a full normal working day under section 10, if he is not entitled to receive such wage under any other law for the time being in force.

CHAPTER III.

Payment of Wages.

12. Deduction under sub clause (ii) of clause (f) of sub-section (2) of section 18.- A Loan made from any fund constituted for the welfare of labour, as may be prescribed by the Government, and the interest due in respect of such loan shall be recovered in installments by deduction from wages spread over not more than twenty-four months.

13. Recovery under sub-section (4) of section 18.- Where the total deductions authorised under sub-section (2) of section 18 exceed fifty per cent of the wages of an employee, the excess shall be carried forward and recovered from the wages of succeeding wage period or wage periods, as the case may be, in such installments so that the recovery in any month shall not exceed fifty per cent of the wages of the employee in that month.

14. The authority under sub-section (1) of section 19.- The Joint Commissioner of Labour having jurisdiction over the place of work of the employee shall be the authority for the purpose of sub-section (1) of section 19.

15. The manner of exhibiting the notice under sub-section (2) of section 19.- A notice referred to in sub-section (2) of section 19 shall be displayed in vernacular and English language at conspicuous places in the premises of the work place in which the employment is carried on, so that every concerned employee would be able to easily read the contents of the notice and a copy of the notice shall be sent to the Inspector-cum-Facilitator having jurisdiction. The notice shall also be published in the website of the establishment.

16. The procedure under sub-section (3) of section 19.- The employer shall give an intimation in writing / electronically specifying therein the detailed particulars for obtaining the approval of the imposition of fine to authority referred to in rule 14 who shall, before granting or refusing the approval, give opportunity of being heard to the employee and the employer concerned.

17. Form of register to record fine and realisation under sub-section (8) of section 19.- (1) In any case, when the employer has obtained approval under sub-section (1) of section 19 to a list of acts and omissions in respect of which fines may be imposed, the employer shall maintain in a Register of fines in Form I, electronically or otherwise.

18. Intimation of deduction.- (1) Where an employer makes any deduction in pursuance of the proviso to sub-section (2) of section 20, he shall make intimation electronically or otherwise of such deduction to the Inspector-cum-Facilitator having jurisdiction within 10 days from the date of such deduction explaining therein the reason of such deduction.

(2) The Inspector-cum-Facilitator shall, after receiving intimation under sub-rule (1), examine such intimation and if he finds that the explanation given therein is in contravention of any provision of the Code or the rules made thereunder, he shall initiate appropriate action under the Code against the employer.

19. Procedure for deduction under sub-section (2) of section 21.- Any employer desiring to make deduction for damages or loss under sub-section (1) of section 21 from the wages of an employee shall,-

(i) explain to the employee personally and also in writing the damage or loss of goods expressly entrusted to the employee for custody or for loss of money for which he is required to account and how such damages or loss is directly attributable to the neglect or default of the employee; and

(ii) thereafter, give the employee an opportunity to offer any explanation and deduction for any damages or loss, if made, shall be intimated to the employee within fifteen days from the date of such deduction.

20. Form of register to record all deductions or realisation for damage or loss under sub-section (3) of section 21.- Any employer desiring to make deduction for damage or loss under sub-section (1) of section 21 from the wages of an employee shall, maintain a Register in Form I.

21. Conditions regarding recovery of advance under section 23.- The recovery, as the case may be of,-

(i) advances of money given to an employee after the employment begins under clause (b) of section 23; or

(ii) advances of wages to an employee not already earned under clause (c) of section 23, shall be made by the employer from the wages of the employee concerned in installments determined by the employer, so as any or all installments in a wage period shall not exceed fifty per cent of the wages of the employee in that wage period and the particulars of such recovery shall be recorded in the Register maintained in Form-I.

22. Deduction under section 24.- Deductions for recovery of loans granted for house building or other purposes approved by the Government, and the interest due in respect thereof shall be, subject to any direction made or circular issued by the Government from time to time regulating the extent to which such loans may be granted and the rate of interest shall be payable thereon.

CHAPTER IV.

The State Advisory Board.

23. Constitution of the Board.- (1) The Board, Committee and Sub-committee shall consist of the persons to be nominated by the Government representing employers and employees as specified in clauses (a) and (b) respectively, of sub-section (6) of section 42 and the independent persons as specified in clause (c) of sub-section (6) of section 42.

(2) The persons representing employers as referred to in clause (a) of sub-section (6) of section 42 shall be eight and the persons representing employees referred to in clause (b) of that sub-section shall also be eight.

(4) The independent persons specified in clause (c) of sub-section (6) of section 42 to be nominated by the Government shall consist of the following, namely:-

(i) The Chairperson (ex-officio), Hon’ble Minister for Labour Welfare and Skill Development;

(ii) Two members from Legislative Assembly;

(iii) Two members each of whom shall be from the professionals in the field of wage and labour related issues;

(iv) One member who is or who has been a presiding officer of an Industrial Tribunal constituted by the Government under section 7A of the Industrial Dispute Act, 1947 (Central Act XIV of 1947) or as the case may be, under section 44 of the Industrial Relations Code, 2020 (Central Act 35 of 2020).

24. Meeting of the Board.- The Chairperson may, subject to the provisions of rule 25, call a meeting of the Board, at any time he thinks fit:

Provided that on requisition in writing from not less than one half of the members, the Chairperson shall call a meeting within thirty days from the date of the receipt of such requisition.

25. Notice of meetings.- The Chairperson shall fix the date, time and place of every meeting and a notice in writing containing the aforesaid particulars along with a list of business to be conducted at the meeting shall be sent to each member by registered post and electronically at least fifteen days before the date fixed for such meeting:

Provided that in the case of an emergent meeting, it would suffice to give a notice of seven days.

26. Functions of Chairperson.– The Chairperson shall-

(i) preside at the meetings of the Board:

Provided that in the absence of the Chairperson at any meeting, the members shall elect from amongst themselves by a majority of votes, a member who shall preside at such meeting;

(ii) decide agenda of each meeting of the Board;

(iii) where in the meeting of the Board, if any issue has to be decided by voting, conduct the voting and count or cause to be counted the secret voting in the meeting.

27. Quorum. – No business shall be transacted at any meeting unless at least one-third of the members and at least one representative member each of both the employers and an employee are present:

Provided that, if at any meeting less than one-third of the members are present, the Chairperson may adjourn the meeting to a date not later than seven days from the date of the original meeting and it shall thereupon be lawful to dispose of the business at such adjourned meeting irrespective of the number of members present:

Provided further that the date, time and place of such adjourned meeting shall be intimated to all the members electronically and by registered post.

28. Disposal of business of the Board.- All business of the Board, Committee and Sub-committee shall be decided by a majority of the votes of members present and voting and in the event of an equality of votes, the Chairperson shall have a casting vote:

Provided that the Chairperson may, if he thinks fit, direct that any matter shall be decided by the circulation of necessary papers and by securing written opinion of the members:

Provided further that no decision on any matter under the preceding proviso shall be taken, unless supported by not less than two-thirds majority of the members.

29. Method of voting.- Voting in the Board shall ordinarily be by show of hands, but if any member asks for voting by ballot, or if the Chairperson so decides, the voting shall be by secret ballot and shall be held in such manner as the Chairperson may decide.

30. Proceedings of the meeting.- (1) The proceedings of each meeting of the Board showing inter-alia the names of the members present thereat shall be forwarded to each member and to the Government after the meeting as soon as possible, and in any case, not less than seven days before the next meeting.

(2) The proceedings of each meeting of the Board shall be confirmed with such modification, if any, as may be considered necessary at the next meeting.

31. Summoning of witnesses and production of documents.- (1) The Chairperson may summon any person to appear as a witness if required in the course of the discharge of his duty and require any person to produce any document.

(2) Every person who is summoned and appears as a witness before the Board shall be entitled to an allowance for expenses by him in accordance with the scale for the time being in force for payment of such allowance to witnesses appearing before a civil court.

CHAPTER V.

Terms of office of members of the Board.

32. Term of office of members of the Board.- (1) The independent members of the Board including the Chairperson shall hold office during the pleasure of the Government, as the case may be, under sub-section (6) of section 42.

(2) A non-official member of the Board shall hold office for a period of two years commencing from the date on which his appointment is first notified in the Official Gazette :

Provided that such a member shall, notwithstanding the expiry of the said period of two years, continue to hold office until his successor is nominated.

(3) Notwithstanding anything contained in sub-rule (2) above, all non- official members of the Board shall hold office during the pleasure of the Government.

(4) A non-independent member of the Advisory Board nominated to fill a casual vacancy shall hold office so long only as the member in whose place he is nominated would have held it, if the vacancy has not occurred.

(5) If a member nominated by the Government is unable to attend a meeting of the committee or sub-committee, the Government or the Body which nominated him may, by notice in writing signed on its behalf and by such member and addressed to the chairman of the said committee or sub-committee nominate a substitute in his place to attend that meeting. Such a substitute member shall have all the rights of a member in respect of that meeting and any decision taken at the meeting shall not become invalid on the ground that the said substitute was a party to the decision.

33. Travelling allowance.- The Chairperson and every member of the Board, Committee and sub-committee shall be entitled to draw travelling and halting allowance for any journey performed by him in connection with his duties at the rates and subject to the conditions applicable to the first class committee of the Government.

34. Officers and Staff.- The Government may appoint a Secretary not below the rank of Joint Commissioner of Labour and staff to the Board, as it may think necessary for the functioning of the Board.

35. Eligibility for re-nomination of the members of the Board.- An outgoing member of the Board shall be eligible for re-nomination for the membership of the Board for not more than total two terms.

36. Resignation of the Chairperson and other members of the Board.- (1) A member of the Board, committee or subcommittee may, by giving notice in writing to the Chairperson, resign his membership and the Chairperson of the committee or sub-committee may resign by a letter addressed to the Board.

(2) A resignation shall take effect from the date of communication of its acceptance or on the expiry of 30 days from the date of resignation, whichever is earlier.

(3) When a vacancy occurs or is likely to occur in the membership of the Board, the Chairperson shall submit a report to the Government immediately and the Government shall, then, take steps to fill the vacancy in accordance with the provisions of the Code.

37. Cessation of membership.- (1) If a member of the Board, committee or sub-committee fails to attend three consecutive meetings, without prior intimation to the Chairperson, he shall, cease to be a member thereof.

(2) A person who ceases to be member under sub-rule (1) shall be given intimation of such cessation by a letter sent to him by registered post within a period of fifteen days from the date of such cessation. The letter shall indicate that if he desires restoration of his membership, he may apply therefor within a period of thirty days from the receipt of such letter. The application for restoration of membership, if received within the said period, shall be placed before the committee or the Board, as the case may be, and if a majority of members present at the next meeting is satisfied that the reasons for failure to attend three consecutive meetings are adequate, the member shall be restored to membership immediately after a resolution to that effect is passed.

38. Disqualification.- (1) A person shall be disqualified for being nominated as, and for being a member of the Board, committee or sub-committee –

(i) if he is declared to be of unsound mind by a competent court; or

(ii) if he is an un-discharged insolvent; or

(iii) if before or after the commencement of the Code, he has been convicted of an offence involving moral turpitude.

(2) If any question arises whether a disqualification has been incurred under sub-rule (1), the decision of the Government thereon shall be final.

CHAPTER VI.

Payment of dues, claims.

39. Payment under clause (a) of sub-section (1) of section 44.- Where any amount payable to an employee under the Code is due after his death or on account of his whereabouts not being known, and the amount could not be paid to the nominee of the employee until the expiry of three months from the date the amount had become payable, then, such amount shall be deposited by the employer with the Joint Commissioner of Labour having jurisdiction, who shall disburse the amount to the person nominated by the employee after ascertaining his identity within two months of the date on which the amount was so deposited with him.

40. Deposit of the undisbursed dues under clause (b) of sub-section (1) of section 44.- (1) Where any amount payable to an employee under this Code remains undisbursed because either no nomination has been made by such employee or for any other reason, such amounts could not be paid to the nominee of employee until the expiry of six months from the date the amount had become payable, all such amounts shall be deposited by the employer with the Joint Commissioner of Labour having jurisdiction before the expiry of the fifteenth day after the last day of the said period of six months.

(2) The amount referred to in sub-rule (1) shall be deposited by the employer with the Joint Commissioner of Labour having jurisdiction through bank transfer or through a crossed demand draft obtained from any scheduled bank in India drawn in favour of such Joint Commissioner of Labour.

41. Manner of dealing with the undisbursed dues under clause (b) of sub-section (1) of section 44.- (1) The amount referred to in sub rule (1) of rule 41 (hereinafter in this rule referred to as the amount) deposited with the Joint Commissioner of Labour having jurisdiction shall remain with him and invested in the Government Securities or Deposited as a Fixed Deposit in a Nationalised or Scheduled Bank.

(2) The Joint Commissioner of Labour having jurisdiction will exhibit, as soon as maybe possible, a notice containing such particulars regarding the amount, as the Joint Commissioner of Labour considers sufficient, for information of all concerned, at least for fifteen days on the notice board and also publish such notice in any two local newspapers in the language commonly understood in the area in which undisbursed wages were earned and also upload such notice in the department website.

(3) Subject to the provision of sub-rule (4), the Joint Commissioner of Labour having jurisdiction shall release the amount to the nominee or to that person who has claimed such amount, as the case may be, in whose favour such Joint Commissioner of Labour has decided, after giving an opportunity of being heard, the amount to be paid.

(4) If the undisbursed amount remains unclaimed for a period of seven years, from the date of deposit with the Joint Commissioner of Labour, the same shall be treated as “the amount without claimant” and shall be transferred along with the interest amount accrued thereon to the Tamil Nadu Labour Welfare Fund either through Bank transfer or through a crossed Demand Draft obtained from any Scheduled Bank in the State, drawn in favour of the Secretary, Tamil Nadu Labour Welfare Board and thereafter it is deemed to have been treated as lapsed to the Tamil Nadu Labour Welfare Board.

CHAPTER VII.

Forms, registers and wage slip.

42. The form of a single application.– A single application, may be filed before the authority notified under sub-section (1) of section 45 in Form-II electronically or otherwise along with documents specified in the Form.

43. Appeal.- Any person aggrieved by an order passed by the authority appointed under sub-section (2) of section 45 may prefer an appeal under sub-section (1) of section 49 in Form-III electronically or otherwise along with the relevant documents before the appellate authority notified by the Government.

44. Form of register, etc.- (1) All fines and all realisations thereof referred to in sub-section (8) of section 19 shall be recorded in a register to be kept by the employer in Form–I electronically or otherwise and the authority referred to in said subsection (8) shall be the Regional Joint Commissioner of Labour having jurisdiction.

(2) All deductions and all realisations referred to in sub-section (3) of section 21 shall be recorded in a register to be kept by the employer in Form- I electronically or otherwise.

(3) Every employer of an establishment to which the Code applies shall maintain register under sub-section (1) of section 50 in Form IV, electronically or otherwise.

45. Wage slip.- Every employer shall issue wage slips, electronically or otherwise to the employees in Form V under sub-section (3) of section 50 on or before payment of wages.

46. Appointment of officer for the purpose of holding enquiry and imposing penalty under section 53(1) and for compounding of offence under sub-section (1) of section 56.- (1) The authority of the respective jurisdictions shall be the enquiry officer, under subsection (1) of section 53 and for the purpose of holding enquiry and imposing penalty under clauses (a) and (c) of sub-section (1) and sub-section (2) of section 54 and sub-section (7) of section 56.

(2) An accused person desirous of making compounding of offence under sub-section (1) of section 56, may file an application, either before or after the institution of any prosecution in Form VI electronically or before the officer notified for the purpose under that section.

(3) The officer notified under sub-section (1) of section 56 shall on receipt of application in Form VI, satisfy himself as to whether the offence is compoundable or not under the Code and if the offence is compoundable and the accused person appears for the compounding, compound the offence for a sum of fifty percent of the maximum fine provided for such offence under the Code, to be paid by the accused within the time specified in the order of the composition issued by such officer.

CHAPTER VIII.

Miscellaneous.

47. Timely Payment of Wages.- Where the employees are employed in an establishment through contractor, then, the company or firm or association or any other person who is the proprietor of the establishment shall pay to the contractor the amount payable to him or it, as the case may be, before the date of payment of wages so that payment of wages to the employees shall be made positively in accordance with the provisions of section 17.

Explanation.- For the purpose of this rule, the expression “firm” shall have the meaning as assigned to it in the Indian Partnership Act, 1932 (Central Act IX of 1932).

48. Responsibility for payment of minimum bonus.- Where in an establishment, the employees are employed through contractor and the contractor fails to pay minimum bonus to them under section 26, then, the company or firm or association or other person as referred to in the proviso to section 43 shall, on the written information of such failure, given by the employees or any registered trade union or unions of which the employees are members and on confirming such failure, pay such minimum bonus to the employees.

49. Inspection Scheme.- (1) For the purposes of the Code and these rules, there shall be formulated an Inspection Scheme by the Commissioner of Labour with the approval of the Government.

(2) In the Inspection Scheme referred to in sub-rule (1), apart from other structural facts, a number shall be specified in the Scheme for each Inspector-cum-Facilitator and establishment.

50. Annual Return.- The Annual Return shall be filed electronically by every employer of an establishment who are not covered under the Occupational Safety and Health Code, in Form VII.

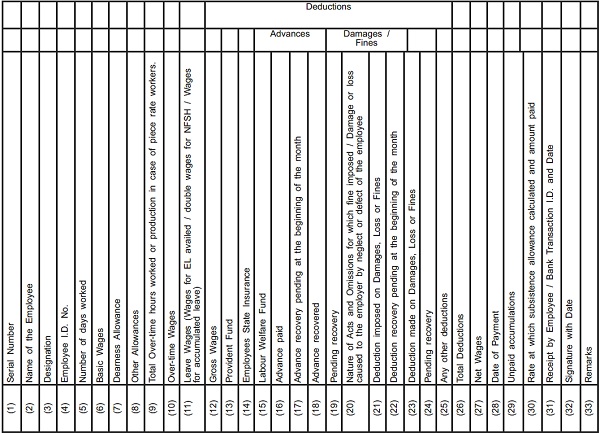

FORM – I.

[(see rule 17, 20, 21 and 44 (1) and (2)]

Register of Wages, Overtime, Fine, and Deduction for damage and Loss

Name and Address of the Establishment:

Name and Address of the Employer:

Total No. of persons employed:

| Men | Women | Young Person – Male | Young Person – Female | Trans- Gender |

Name of the Manager / in charge:

Registration Certificate No. :

Wage Period from ………………….. To……………………..

(Monthly / Fortnightly / Weekly / Daily / Piece Rated)

FORM-II.

[see rule 42]

[SINGLE APPLICATION UNDER SUB-SECTION (5) OF SECTION 45]

BEFORE THE AUTHORITY APPOINTED UNDER SUB SECTION (1) OF SECTION 45 OF THE CODE ON WAGES, 2019 (CENTRAL ACT 29 OF 2019)

FOR…

AREA………..

Application No…………………………………………………………………..of 20……………

Between

………………… (ABC) and (State the number) other Applicants

(Through employees concerned or registered trade union or Inspector- cum- Facilitator)

Address………………………………………………………………..

And

…………………………………………………………………………………………………………….( XYZ)

Address……………………………………

The application states as follows:

(1) The applicant(s) whose name(s) appear in the attached schedule was/were/has/have been employed from to…as…..(category) in…(establishment) Shri/Ms…engaged in … (nature of work) which is/are covered by the Code on Wages, 2019.

(2) The opponent(s) is/are the employer(s) within the meaning of section 2(l) of the Code on Wages, 2019.

(3) (a) The applicant(s) has/have been paid wages at less than the minimum rates of wage fixed for their category (categories) of employment(s) under the code by Rs…per day for the period(s) (categories) of employment(s) under the Code by Rs…Per day for the period(s) from…to……………………………………………..

(b) The applicant(s) has/ have not been paid wages at Rs…Per day for the weekly days of rest from to………………………

(c) The applicant(s) has/ have not been paid wages at overtime rate(s) for the period from to………………………

(d) The applicant(s) has/have not been paid wages for period from…to…………………….

(e) Deductions have been made which are in contravention of the Code, from the wage(s) of the applicant(s) as per details specified in the annexure appended with this application.

(f) The applicant(s) has/have not been paid minimum bonus for the accounting year…………..

(4) The applicant(s) estimate(s) the value of relief sought by him/ them on each amount as under:

(a) Rs…..

(b) Rs…..

(c) Rs…..

Total Rs….

(5) The applicant(s), therefore, pray(s) that a direction may be issued under section 45(2) of the Code on Wages, 2019 (Central Act 29 of 2019) for;

(a) payment of the difference between the wages payable under the Code and the wages actually paid,

(b) payment of remuneration for the days of rest,

(c) payment of wages at the overtime rates,

(d) Compensation amounting to Rs…………………………….

(6) The applicant(s) do hereby solemnly declare(s) that the facts stated in this application are true to the best of his/their knowledge, belief and information.

Dated ………..

Signature or thumb-impression of the

employed person(s) or official of a registered trade union

Duly authorised or Inspector- cum-Facilitator.

Note: The applicant(s), if required, may append annexure containing details, with this application.

FORM III.

(see rule 43)

Appeal under Section 49(1) of the Code on Wages, 2019 (Central Act 29 of 2019)

Before the Appellate Authority under the Code on Wages, 2019 (Central Act 29 of 2019)

A.B.C

Address…………………………………………………………………………………………………………..APPELLANT

Vs.

C.D.E.

Address…………………………………………………………………………………….. RESPONDENT

DETAILS OF APPEAL:

1. Particulars of the order against which the appeal is made:

Number and date:

The authority who has passed the impugned order:

Amount awarded:

Compensation awarded, if any:

2. Facts of the case:

(Give here a concise statement of facts in a chronological order, each paragraph containing as nearly as possible a separate issue or fact).

3. Grounds for appeal:

4. Matters not previously filed or pending with any other Court or any Appellate Authority:

The appellant further declares that he had not previously filed any appeal, writ petition or suit regarding the matter in respect of which this appeal has been made, before any Court or any other Authority or Appellate Authority nor any such appeal, writ petition or suit is pending before any of them.

5. Reliefs sought:

In view of the facts mentioned above the appellant prays for the following relief(s) :—

[Specify below the relief(s) sought]

6. List of enclosures:

(1)

(2)

(3)

(4)

Signature of the appellant.

Date:

Place:

For office use

Date of filing

or

Date of receipt by post

Registration No. :

Authorised Signatory

FORM IV.

[see rule 44(3)]

EMPLOYEE REGISTER.

Name of the Establishment: Name of Employer:

Name of the Owner: PAN/TAN of the Employer:

Labour Identification Number (LIN):

Name of Employer:

PAN/TAN of the Employer:

| Sl.No | Employee Code |

Name | Surname | Gender | Father’s / Spouse Name |

Date of Birth | Nationality | Education Level |

Date of Joining |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

–

| Date on which compl-etion of 480 Days & Service |

Date on which made permanent |

Date of Super- annuation |

Desig-nation | Category (HS/S/ SS/US)* |

Type of Em- ployment |

Mobile No. |

email ID |

UAN | PAN |

| (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) | (19) | (20) |

–

| ESIC IP No. | AADHAAR | Bank A/c Number |

Bank | Branch (IFSC) | Present Address | Permanent Address |

Service Book No. | Date of Exit | Reason for Exit |

| (21) | (22) | (23) | (24) | (25) | (26) | (27) | (28) | (29) | (30) |

–

| Mark of Identification | Photo | Specimen Signature / Thumb Impression |

Remarks |

| (31) | (32) | (33) | (34) |

*(Highly Skilled/Skilled/Semiskilled/Unskilled)

FORM V.

[see rule 45]

WAGE SLIP.

Date of issue:

Name of the Establishment ………………………………………………. Address Period……………………..

1. Name of employee:

2. Father’s / Spouse name:

3. Designation:

4. Adhaar No.

5. UAN:

6. Bank Account No.:

7. Wage period:

8. Rate of wages payable: (a.) Basic (b.) D.A. (c.) other allowances

9. Total attendance/unit of work done:

10. Total hours of overtime :

Overtime wages:

11. Gross wages payable:

12. Total deductions : (a) PF (b) ESI (c) TNLW Fund (d) Others

13. Net wages paid:

Employer / Pay-in-charge signature

FORM VI.

[See rule 46]

APPLICATION UNDER SUB-SECTION (4) OF SECTION 56 FOR COMPOSITION OF OFFENCE

1. Name of applicant :

2. Father’s / Spouse name :

3. Address of the applicant :

4. Particular of the offence: ………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

5. Section of the Code under which the offence is committed : ……………………………………………..

6. Maximum fine provided for the offence under the Code :……………………………………………..

7. Whether prosecution against the applicant is pending or not :……………………………………………..

8. Whether the offence is first offence or the applicant had committed any other offence prior to the offence. If yes, then, full details of the prior offence.

………………………………………………………………………………………………………………………………………….

………………………………………………………………………………………………………………………………………….

………………………………………………………………………………………………………………………………………….

9. Any other information which the applicant desires to provide

………………………………………………………………………………………………………………………………………….

………………………………………………………………………………………………………………………………………….

Dated:

Applicant

(Name and Signature)

FORM VII.

ANNUAL RETURN

(see rule 50)

1. Return for the year ending 31st December.

A. Name of the Establishment and Postal :

Address

B. Name, Aadhaar Number, email ID and

Residential Address of the Owner / Contractor :

C. Name, Aadhaar Number, email ID and

Residential Address of the Managing Agent /

Director / Partner in charge of the Day to day

affairs of the Establishment owned by a

company, body, corporate or association. :

D. Person responsible for payment of wages

(Name, Aadhaar Number, Address, email

ID and Phone Number.) :

2. Hours of work in a Day :

3. No. of shifts worked in a day :

4. Number of days worked during the calendar year :

5. Number of man-days worked during the year :

6. Average daily number of persons employed during the year :

| Type of Skill |

Regular Workers | Contract Workers | Total | ||||||||

| Male | Female | Trans gender |

Adoles- cent – Boy |

Adoles- cent – Girl |

Male | Female | Trans gender |

Ado- lesc-ent– Boy | Adoles- cent – Girl |

||

| Unsk-illed | |||||||||||

| Semiskilled | |||||||||||

| Skilled | |||||||||||

| Highly Skilled | |||||||||||

7. Total Wages paid in details :

(a) Basic Wage :

(b) Dearness Allowance :

(c) Other Allowance :

(d) Gross Wage :

(e) Deduction :

(f) Net Wage paid :

(g) Over Time Wages :

(h) Non-sharing Bonus :

(i) Other Allowance in Cash :

(j) Arrears of Pay in respect of previous year paid during the year :

(k) Total :

8. Deductions :

| No. of cases. | Total amount

Rs. P. |

||

| (a) | Fines | ||

| (b) | Deductions for damage or loss. | ||

| (c) | Deductions for breach of contract. |

9. Disbursement from fines :

| Purpose | D.D. No. | Date | Bank | Amount

Rs. P. |

||

| (a) | 1st Quarter | |||||

| (b) | 2nd Quarter | |||||

| (c) | 3rd Quarter | |||||

| (d) | 4th Quarter |

10. Details of Remittance to the Labour Welfare Fund :

| Sl. No. | D.D. No. | Date | Bank | Amount

Rs. P. |

| (1) | ||||

| (2) | ||||

| (3) |

11. Balance of fine fund in hand at the end of the year

12. Number of Employees eligible for Bonus :

13. Percentage of Bonus declared to be paid :

14. Total amount of Bonus actually paid :

15. Date on which payment paid :

16. Settlement, if any, reached under Section 53(3) or 57(1) of the Industrial Relations Code, 2020 (Central Act 35 of 2020) with date :

Certified that the information furnished above is to the best of my knowledge and belief, correct.

| SCHEDULE – A | |

| [see rule 4(3)] | |

| Sl.No | UNSKILLED |

| 1. | Aquatic weed removal |

| 2. | Attender |

| 3. | Ayahs |

| 4. | Bailors |

| 5. | Bamming Helpers |

| 6. | Basket making workers |

| 7. | Bearders |

| 8. | Beater |

| 9. | Beating of rotted husks |

| 10. | Bee Keeping workers |

| 11. | Beedi- Ring Lablers |

| 12. | Beedi Rollers |

| 13. | Bell Blower |

| 14. | Bicycle Fitter |

| 15. | Bottle cleaner |

| 16. | Bottle Filler /Washer |

| 17. | Box Removers (Mosaic) |

| 18. | Bucket Man |

| 19. | Bundler |

| 20. | Butcher |

| 21. | Button and Khaja Stitcher |

| 22. | Calf boy |

| 23. | Caretaker of goods and Materials |

| 24. | Carrier / Carrier (Water) / Carrier (Stone, Water, husk, Rice, Ball Bag etc.,) |

| 25. | Carrier of Pandal articles and all types |

| 26. | Cartman |

| 27. | Cattleman |

| 28. | Chainman |

| 29. | Charcoal man |

| 30. | Chips Sorenmers (Mosaic) |

| 31. | Clay Feeders / Clay kneaders / Clay mixers |

| 32. | Cleaner / Cleaner (Crane, Truck, Cinder for ash Pit) / Cleaner (Motor shed, Tractor, Cattle,Yard, M.T) and Cleaner of all categories including Floor |

| 33. | Coconut – Leaves Braider / Peeling workers |

| 34. | Coffee – heaping workers |

| 35. | Collecting loose fodder workers |

| 36. | Colour Mixers (Mosaic) |

| 37. | Composter |

| 38. | Concrete Hand Mixer |

| 39. | Condenser Attendant |

| 40. | Cook-helper |

| 41. | Coolie |

| 42. | Cotton Ginning and pressing – Borah Opener |

| 43. | Cotton Ginning and pressing – Borah roller |

| 44. | Cotton Ginning and pressing – Borah filler |

| 45. | Cotton Picking workers |

| 46. | Dairy’s Haystacking workers |

| 47. | Dairyman |

| 48. | Decorticator (Groundnut Carrier, husk Carrier, gunny bag filler, gunny bag stitcher) |

| 49. | Delivery Boy |

| 50. | Despatch Assistant |

| 51. | Developing Assistant |

| 52. | Digger |

| 53. | Dismantling stocks workers |

| 54. | Dispensary Attendant |

| 55. | Domestic worker |

| 56. | Drain Flusher |

| 57. | Drawer and Reacher |

| 58. | Wire Drawer |

| 59. | Dress Washer |

| 60. | Dresser |

| 61. | Driver (Bullock, Camel, Donkey, Mule) |

| 62. | Drum Boys |

| 63. | Drying Yard Carrier |

| 64. | Duster Boy |

| 65. | Dustleaves supplier |

| 66. | Earth Cutter |

| 67. | Electrical Assistant |

| 68. | Emery Wheel Operator |

| 69. | Excavating Labour |

| 70. | Expeller attender |

| 71. | Workers engaged in Fertilising and Pesticiding of trees |

| 72. | Fire wood slitters |

| 73. | Firewood / Timber Head carriers |

| 74. | Fireworks – Chemical mixing, dipping, filling, Moulding, Fuse fixing |

| 75. | Flag Man |

| 76. | Flashers, splitters in Tanneries |

| 77. | Folders |

| 78. | Frame givers |

| 79. | Fuel Carriers |

| 80. | Gangmen |

| 81. | Gardener Assistant |

| 82. | Gate Man |

| 83. | Godown workers |

| 84. | Grass Cutter |

| 85. | Grazler |

| 86. | Gunny Bag Stitcher |

| 87. | Hand folding workers |

| 88. | Hand Ironers / Ironing workers |

| 89. | Hand Setters |

| 90. | Handle Man |

| 91. | Headload workers |

| 92. | Helper – Baker |

| 93. | Helpers in distribution |

| 94. | Helpers in Textile Mills |

| 95. | Helpers in Match and fire works |

| 96. | Helpers in vessel Making |

| 97. | Hole Cutter |

| 98. | House Keeper |

| 99. | Huller Man |

| 100. | Irrigation workers |

| 101. | Jelly Maker |

| 102. | Jumper Man |

| 103. | Kiln repairer / Setters |

| 104. | Labelling and Packing Worker |

| 105. | Labourer (Boiler, Cattle Yard, Cultivation, General Loading and Unloading, Bunding, Carting-Fertilizers, Harvesting, Miscellaneous) |

| 106. | Lampman |

| 107. | Layer(Helper) |

| 108. | Line Operator |

| 109. | Lint Cleaners |

| 110. | Workers engaged in Person employed in Loading and Unloading |

| 111. | Make up Assistant |

| 112. | Mat weaver |

| 113. | Messenger |

| 114. | Mikkals |

| 115. | Mopper, Floor Cleaner, Floor Sweaper |

| 116. | Mould helpers |

| 117. | Mud paster |

| 118. | Number Taker |

| 119. | Office Assistant / Helper |

| 120. | Office Boy |

| 121. | Oiler in power loom Industry |

| 122. | Operator in Petrol Bunks |

| 123. | Other General workers(Cattle feeding, cleaning the cattle, removing cowdung from cowshed, cattle rearing, cowshed cleaning, hay drying, loading of cattle feeds, grass and fertilisers, spade works and such other hand works in fodder fields, sileage pits and cowsheds, etc.,) |

| 124. | Outerbox maker |

| 125. | Outline Workers in Hand Embroidery |

| 126. | Over burden Remover |

| 127. | Paddy Dryers /Millers / Soakers/ Boilers |

| 128. | Pallet Collectors |

| 129. | Pallet Suppliers |

| 130. | Pantry Man |

| 131. | Paper Tracing & Dyeing Helper |

| 132. | Bark Peeling workers |

| 133. | Petrolman |

| 134. | Plantation Worker |

| 135. | Planting, paddy sacking workers |

| 136. | Poultry farming workers |

| 137. | Press Boy |

| 138. | Press Machine Operators |

| 139. | Pressing workers |

| 140. | Processing Assistant |

| 141. | Pumping man |

| 142. | Push cart workers |

| 143. | Rat Catcher / Dog Catcher |

| 144. | Raw Bricks and Tiles Carriers |

| 145. | Raw tiles removers from frame |

| 146. | Replanting of seedling workers |

| 147. | Rhodomine dipping workers |

| 148. | Rice Measurers |

| 149. | Roasting workers |

| 150. | Roll Checking man |

| 151. | Room Boy |

| 152. | Rubber Tapers |

| 153. | Sand and Cement Mixers |

| 154. | Sand Remover |

| 155. | Sand Suppliers |

| 156. | Sanitary Workers |

| 157. | Scudders in Tanneries |

| 158. | Searcher |

| 159. | Seasoners |

| 160. | Security Guards |

| 161. | Seed remover or carrier |

| 162. | Seeding / Sowing / Thatching / Transplanting / Weeding workers |

| 163. | Servant Maid |

| 164. | Setting Machine Operators |

| 165. | Sewage Gauge reader / Water Meter reader |

| 166. | Shaving Learners |

| 167. | Shed Clerk |

| 168. | Sheller man |

| 169. | Shop Assistant |

| 170. | Shunters |

| 171. | Signal man |

| 172. | Slab carriers / Cutter / Placers |

| 173. | Sorters, Counters, Separators and packers of all categories |

| 174. | Sound Assistant |

| 175. | Sprayers |

| 176. | Spreading – coffee curing workers |

| 177. | Stable man |

| 178. | Stackers |

| 179. | Stamping worker |

| 180. | Steam Road |

| 181. | Stitchers (other than bale stitcher) |

| 182. | Store Assistant |

| 183. | Strikers |

| 184. | Stripping workers |

| 185. | Surface loader |

| 186. | Sweeper |

| 187. | Tall Boy |

| 188. | Tappalman |

| 189. | Thatch carrier cum giver |

| 190. | Thatch Remover |

| 191. | Tile Carriers |

| 192. | Tile Plasters (Mosaic) |

| 193. | Timber Carriers |

| 194. | Time Keeper |

| 195. | Tom-Tom Wallah(Village) |

| 196. | Trammer |

| 197. | Trolly man |

| 198. | Trolly Triper |

| 199. | Turbo cleaner |

| 200. | Tying and Carrying loose hay workers |

| 201. | Under Ground Mukar |

| 202. | Unskilled workers in Nurseries |

| 203. | Vaks Controller |

| 204. | Valve Man (Water Supply) |

| 205. | Valveman (Other than water supply) |

| 206. | Varukadalai Worker |

| 207. | Vegetable cutter |

| 208. | Ward Boy |

| 209. | Washerman (Clothes) |

| 210. | Washerman (Utensils) |

| 211. | Waste removing worker |

| 212. | Watchman |

| 213. | Weighman (Bales, pally) |

| 214. | Wheeler in Printing Press |

| 215. | White Washing and Colour Washing Man |

| 216. | Winnower |

| 217. | Wireman helper |

| 218. | Wood Cutter |

| 219. | Wooder Woman / Wooder man |

| 220. | Workers engaged in construction of roads (excluding breaking of rocks) |

| 221. | Workers engaged in drying |

| 222. | Workers engaged in earth works (pit making etc) |

| 223. | Workers engaged in Washing/Setting |

| 224. | Workers in Appalam industry |

| 225. | Workers working in forest, nursery and plantations |

| 226. | Workshop tool keeper |

| 227. | Yard worker |

| 228. | Any other categories by whatever name called which are unskilled in nature |

–

| S.No. | SEMI SKILLED |

| 1. | All Saw Operator Helper |

| 2. | All Trade Certificate holders including Industrial Training Institute (Grade-I) |

| 3. | Aluminium, Iron, Stainless steel etc., vessels maker |

| 4. | Arch Erector |

| 5. | Artificial drying fire attenders in Brick and tile industry |

| 6. | Asbestos / Glass / Lite Roof worker |

| 7. | Assembler |

| 8. | Assembling Operator |

| 9. | Assistant Blacksmith / Helper |

| 10. | Assistant Carpenter |

| 11. | Assistant Cook / Kitchen Assistant / Vegetable Cutter |

| 12. | Assistant Driller |

| 13. | Assistant Electrician |

| 14. | Assistant Engraver |

| 15. | Assistant Fitter |

| 16. | Assistant Machinist |

| 17. | Assistant Painter |

| 18. | Assistant Photo Artist |

| 19. | Assistant Photographer |

| 20. | Assistant Recordist / Room Assistant |

| 21. | Assistant Sales Man |

| 22. | Assistant Tea Maker (in Tea Factory) |

| 23. | Assistant Tinker |

| 24. | Assistant Tyre Man |

| 25. | Assistant Wireman |

| 26. | Assistant-Plumber |

| 27. | Attendance-keeper / Attendant |

| 28. | Bag Weigher |

| 29. | Baker |

| 30. | Bale Stitcher |

| 31. | Bar man |

| 32. | Barber |

| 33. | Bearer |

| 34. | Bender |

| 35. | Binder |

| 36. | Boat Man |

| 37. | Boiler Attender |

| 38. | Boiler operator/Mixture/Chemist |

| 39. | Boundary clearing & fire protection |

| 40. | Box-making (Packing) / Packer |

| 41. | Brander |

| 42. | Bread-Moulder |

| 43. | Breaker (Stone, Rock, Rock Stone, Stone Metal) (using mechanical appliances/manual appliances) |

| 44. | Breakman |

| 45. | Bricks Maker (or) Tile Makers |

| 46. | Buffing Machine Operator |

| 47. | Bullman |

| 48. | Bun Rounder, Bread Moulder in Bakeries |

| 49. | Bunkers operation workers in Mushroom growing |

| 50. | Butler/Cook |

| 51. | Butterman |

| 52. | Camera Assistant |

| 53. | Canvasar in Motor transport |

| 54. | Canweaver |

| 55. | Care taker of Aged or sick or differently abled or child |

| 56. | Workers engaged in Casing / Watering Tamping / flushing in Mushroom growing |

| 57. | Caulker |

| 58. | Cement Tiles Pressers |

| 59. | Chainman(Head) |

| 60. | Charge-man |

| 61. | Checker/ Maistry/ Sorter/Supervisor |

| 62. | Chemical Mixture |

| 63. | Chemical Operator |

| 64. | Chief Watchman/Senior Watchman |

| 65. | Child care – Taking children to school and back |

| 66. | Classman |

| 67. | Clay Slicers and Transplers |

| 68. | Cleaners (machinery inplants etc) |

| 69. | Cleaning /Polishing workers |

| 70. | Coachman |

| 71. | Cobbler |

| 72. | Coir Twisting workers |

| 73. | collecting of bamboo, cane and reeds workers |

| 74. | Colour Setting man |

| 75. | Colourman |

| 76. | Compositor |

| 77. | Compost Maistry |

| 78. | Compounder |

| 79. | Controller |

| 80. | Cooper |

| 81. | Corporal / Seargent /Assistant Security Officer |

| 82. | Cot Weaver |

| 83. | Cracker |

| 84. | Crech Ayah / Ayah / Untrained Crech Attendant |

| 85. | Crowlder Man |

| 86. | Crusher |

| 87. | Cultivator |

| 88. | Cutting – Earth Cutting / Rock Cutting / Stone Cutting workers |

| 89. | Defibering Mechanic |

| 90. | Deliveryman |

| 91. | Depot Maistry |

| 92. | Die Pullers |

| 93. | Disease Control Maistry (Malaria, Dengue etc….) |

| 94. | Dollyman |

| 95. | Dough Maker |

| 96. | Dresser Grade II |

| 97. | Driller |

| 98. | Driver (Helper) |

| 99. | Workers engaged in dying of drag ropes |

| 100. | Electrical Repairer |

| 101. | Electrician |

| 102. | Engraver in Steel and Aluminum Vessels Shops |

| 103. | Excavator |

| 104. | Feeder |

| 105. | Female Nursing orderly and Male Nursing orderly |

| 106. | Ferroman |

| 107. | Filler / Oil Measurer |

| 108. | Filterman |

| 109. | Fireman / Fireman (Brick Kiln, Steam Road Roller) |

| 110. | Firewood / Timber loading and unloading workers |

| 111. | Firewood Cutter in Fire wood shops |

| 112. | Fitter (Assistant Semi-Skilled) |

| 113. | Fitter Helper |

| 114. | Fixing Handles and Other Accessories on Utensils |

| 115. | Workers engaged in Flanging/Rolling/ Drilling/ Rivetting |

| 116. | Flashers |

| 117. | Flower Decorator |

| 118. | Foreman / Supevisor / Boiler Operator / Mechanic / Production Assistant |

| 119. | Forklift Operator |

| 120. | Frash |

| 121. | Fruit Juice and Lassie Maker in shops |

| 122. | Furnance Operator |

| 123. | Gangman |

| 124. | Gardener |

| 125. | Gate Keeper |

| 126. | Generator Operator |

| 127. | Gharami Thatcher |

| 128. | Gin Feeder |

| 129. | Ginning and Pressing man |

| 130. | Glazing Machine Operator |

| 131. | Goat skin knifers |

| 132. | Godown in-charge |

| 133. | Godown Keeper |

| 134. | Graders |

| 135. | Workers engaged in Grading of coconut |

| 136. | Grater |

| 137. | Greaser |

| 138. | Greaser-cum-Fireman |

| 139. | Grinder |

| 140. | Groundsman (Sports Areas) |

| 141. | Hammerman |

| 142. | Handhole Driller |

| 143. | Head Mazdoor |

| 144. | Helper / Helper – Artisan, Blacksmith, loco-Crane Truck, Mason, Carpenter, Sawyer |

| 145. | Helpers in Motion Picture Industry |

| 146. | Helpers in ornaments and related works |

| 147. | Hut Maker |

| 148. | Kalasis or sarang engaged in heavy engineering construction like heavy machinery bridge work etc |

| 149. | Keyman |

| 150. | Kilning of charcoal workers |

| 151. | Labelling workers |

| 152. | Laboratory Assistant |

| 153. | Lamination Workers |

| 154. | Lascar |

| 155. | Lathe Operator |

| 156. | Library Assistant |

| 157. | Lift Operator |

| 158. | Line Man |

| 159. | Log Helper |

| 160. | Lorry Cleaner |

| 161. | Lubricating Assistant |

| 162. | Machine Assistant |

| 163. | Machine Attender |

| 164. | Machine Operator |

| 165. | Mahout |

| 166. | Maramath |

| 167. | Masalchi |

| 168. | Mason – helper |

| 169. | Mat weaver (Power loom / Hand loom) |

| 170. | Mazdoor (Heavy-weight) / Mazdoor (literate) |

| 171. | Mazdoor Mason |

| 172. | Mechanic |

| 173. | Mechanical Technician |

| 174. | Mike Operator |

| 175. | Mike set / Seriel set originator |

| 176. | Mould Operator |

| 177. | Mounting workers |

| 178. | Night-guard |

| 179. | Nurse – ANM /GNM |

| 180. | Oil Passing Workers |

| 181. | Oilers |

| 182. | Oilman/Oiler |

| 183. | Ornamental Adorner |

| 184. | Ornamental Cloth Tier |

| 185. | Oven-keeper |

| 186. | Over Head Tank Operators. |

| 187. | Packer |

| 188. | Packing and weighing workers |

| 189. | Paddy Boilers |

| 190. | Workers engaged in Pavu Pinaithal, Terry / Jacquard ragam in Power Loom Industry |

| 191. | PDC Operator |

| 192. | Peeling Worker |

| 193. | Photo Frame Worker and Cutter |

| 194. | Pile formation workers in Mushroom growing |

| 195. | Pipe line Fitter. |

| 196. | Pit Digger |

| 197. | Planting Co-ordinator |

| 198. | Plate Maker |

| 199. | Ploughman |

| 200. | Plumbers |

| 201. | Pole Erector |

| 202. | Polisher |

| 203. | Workers engaged in Polishing, Drilling, dying in vessels making |

| 204. | Press Man |

| 205. | Press Operator |

| 206. | Pressmen, Spinner and sheet Maker in Vessesls Making |

| 207. | Printing Assistant |

| 208. | Processing Worker |

| 209. | Projection Operator |

| 210. | Proof readera |

| 211. | Publicity Room Incharge |

| 212. | Pulper |

| 213. | Pulper in Paper Industry |

| 214. | Pump Attendant |

| 215. | Pump Operator. |

| 216. | Punch Operator |

| 217. | Purchase Assistant |

| 218. | Workers engaged in Putting coal and fire wood in kiln |

| 219. | Quarry man |

| 220. | Quarry Operator |

| 221. | Raft making workers |

| 222. | Refiners in Paper Industry |

| 223. | Retreading and Tube Vulcanising shop workers |

| 224. | Rimming operator |

| 225. | Roasters |

| 226. | Roasting or frying workers |

| 227. | Roof Thatcher |

| 228. | Ruler |

| 229. | Runner (Post dak) |

| 230. | Sales Assistant |

| 231. | Scraper (semi skilled) |

| 232. | Scudders |

| 233. | Seedlings planters in plantation |

| 234. | Shamiana Erector |

| 235. | Sheet cutter, circle cutter and threading Operation |

| 236. | Slab Placers in Brick and tile industry |

| 237. | Smith |

| 238. | Soldering workers |

| 239. | Solvent Plant Operator |

| 240. | Sorters |

| 241. | Sound Recordist |

| 242. | Workers engaged in Sowing seeds / planting in plantation |

| 243. | Spawn Mixing workers in Mushroom growing |

| 244. | Splitters |

| 245. | Stitching and Packing workers |

| 246. | Stocker |

| 247. | Stoneman |

| 248. | Store Attendant |

| 249. | Supplier |

| 250. | Syce |

| 251. | Table Man |

| 252. | Tailor (Stitching only) |

| 253. | Tannery – Deamers (Back Yard Department) |

| 254. | Tannery – Setters (Back Yard Department) |

| 255. | Technical assistant |

| 256. | Tindals |

| 257. | Trades Man |

| 258. | Trimming Workers |

| 259. | Trollyman (Head Motor) |

| 260. | Turner |

| 261. | Workers engaged in Twisting , drying and Bundling in Bleaching or dyeing Industry |

| 262. | Tyre Grinder in tyre Resoling |

| 263. | Tyre Man |

| 264. | Umbrella fitter |

| 265. | Uncured Coffee / Estate pounded coffee – Workers engaged in unloading and stoking from lorries, Peeling |

| 266. | Valveman / Valveman (Senior) |

| 267. | Vulcanizer and similar workers |

| 268. | Warper |

| 269. | Workers engaged in Warping in silk twisting |

| 270. | Weighman |

| 271. | Workers engaged in Winch Bleaching |

| 272. | Winchman |

| 273. | Winder (Grade – II) |

| 274. | Wire Boy |

| 275. | Wireman fixing tin cables |

| 276. | Woolen weavers |

| 277. | Workers engaged in Match factory and Fire works |

| 278. | workers engaged in Sericulture |

| 279. | X – Ray Photographer |

| 280. | Any other categories by whatever name called which are semi-skilled in nature. |

–

| Sl.No | SKILLED |

| 1. | Aari Worker |

| 2. | Accountant |

| 3. | Agricultural implements maker (including cattle shoe maker) |

| 4. | Workers engaged in Agricultural works of hard nature like digging, loading, bundwork, ridge making, mud fencing, rain pit digging, digging pond for agricultural purposes, Green manure preparation and trimming of trees. |

| 5. | Air Compressor Attendant |

| 6. | Air condition Plant Operator |

| 7. | Air condition Plant Mechanic |

| 8. | Aligner |

| 9. | Ambulance Driver |

| 10. | Analysist |

| 11. | Armature Winder Grade-II and III |

| 12. | Artificer |

| 13. | Artist |

| 14. | Assistant Foreman |

| 15. | Assistant Manager/Supervisor |

| 16. | Assistant Tinkers |

| 17. | Assistant Videographer |

| 18. | Audio and Video Mechanic/Repairer |

| 19. | Automatic Machineman |

| 20. | B.I.M. Modeler |

| 21. | Batching plant Operator |

| 22. | Batterymen |

| 23. | Beautician |

| 24. | Bench Fitter/ Parking Controller (Regulation of parking vehicles supervision, Washing and Lubrication) |

| 25. | Bill Clerk |

| 26. | Bill Collector |

| 27. | Bill Writer |

| 28. | Blaster |

| 29. | Bleacher in Bleaching or Dyeing Industry |

| 30. | Workers engaged in Bleaching and Dyeing of silk |

| 31. | Block Maker |

| 32. | Bobcat Operators |

| 33. | Boiler Foreman Grade II |

| 34. | Boilerman Grade II and III |

| 35. | Book Keeper |

| 36. | Booking Clerk |

| 37. | Boreman |

| 38. | Borer |

| 39. | Brass, Copper vessels making workers |

| 40. | Workers engaged in Breaking of boulders |

| 41. | Bulldozer Driver |

| 42. | Cabinet Maker |

| 43. | Camera Mechanic |

| 44. | Camera Technician |

| 45. | Caneman |

| 46. | Carpenter / Blacksmith / Wood Turner / Grinding (Plywood works) |

| 47. | Cashew Peelers |

| 48. | Workers engaged in Celotex making |

| 49. | Cement tile presser |

| 50. | Chargeman |

| 51. | Checkder (Junior) |

| 52. | Chemist |

| 53. | Chick Maker |

| 54. | Chickman (Junior), Concrete Mixer |

| 55. | Chipper/Chipper-Cum-Grinder |

| 56. | Cinema project Operator |

| 57. | Clamp Shelf Operator |

| 58. | Clerical Assistant |

| 59. | Clerks |

| 60. | Coffee / Tea maker / Roti / Dosa Maker |

| 61. | Workers engaged in Colouring of gold ornaments |

| 62. | Compressor Operator |

| 63. | Computer Opertor |

| 64. | Concrete Mixer Operator |

| 65. | Conductor |

| 66. | Consultant |

| 67. | Workers engaged in Converting gold into pure gold |

| 68. | Workers engaged in Converting pure gold into gold |

| 69. | Cook |

| 70. | Coremaker |

| 71. | Crusher Operator |

| 72. | CTP operator |

| 73. | Curtain maker |

| 74. | Customer Care Executive/Receptionist |

| 75. | Cutter |

| 76. | Cutter cum Marker |

| 77. | Cutter cum Pattern Marker |

| 78. | Cutting Machine Operator |

| 79. | Workers engaged in Cutting of gold |

| 80. | Workers engaged in Cutting the Bark and stacking |

| 81. | Cylinder treadle machineman |

| 82. | Data Entry operator |

| 83. | De-Mineralised water Plant Operator |

| 84. | Depot Starter |

| 85. | Die Makers |

| 86. | Die-Casting Operator |

| 87. | Diesel Engine Operator |

| 88. | Diesel Engine Grade II Machanic |

| 89. | Distemprer |

| 90. | Dorrick Operator |

| 91. | Dozer Operator |

| 92. | Drafts Man |

| 93. | Dragline Drill Dumber Operator |

| 94. | Draughtsman |

| 95. | Dresser Grade-I Mica |

| 96. | Drill Mechanic |

| 97. | Driller / Driller (Well Boring) |

| 98. | Driver (Engine Tractor, M.T.Motor) |

| 99. | Driver in Engine, Static Stone Crusher, Tractor, Bull Dozer, Steam Road Roller, Water Pump, Mechanical Road Roller, Mechanical / Steam Crane,Tractor with Bull Dozer (Mechanical) |

| 100. | Driver (Auto) |

| 101. | Driver (Heavy Vehicle) |

| 102. | Driver (Loco / Truck) |

| 103. | Drivers in Auto Rickshaws (fitted with meters) |

| 104. | Drivers in Taxis (fitted with meters) |

| 105. | Drivers including those employed by Tourist / Operator |

| 106. | Driving Pantooms with Boiler |

| 107. | DTP Operator |

| 108. | Dumper Tractor Operator |

| 109. | Dye House Workers |

| 110. | Dye Maker |

| 111. | Dyeing Master |

| 112. | Workers engaged in Dieing gold jewellery |

| 113. | Electrician (DIPLOMA) |

| 114. | Electro Platter |

| 115. | Engine Driver |

| 116. | Engraver |

| 117. | Excavator Operator |

| 118. | Expeller Driver |

| 119. | Expeller Maistry/Supervisor |

| 120. | Expeller Workers |

| 121. | Extruder Operator in Polythene industry |

| 122. | Ferro Printer cum-chairman |

| 123. | Ferry Driver |

| 124. | Workers engaged in Fibres Bundling |

| 125. | Field Officer |

| 126. | Finisher |

| 127. | Fireman |

| 128. | Fireman in Mines |

| 129. | Fitter |

| 130. | Floor Supervisor |

| 131. | Fork Lift Operator |

| 132. | Frame Fitting and Setting Worker |

| 133. | Fruit Jam and Pulb Manufactures |

| 134. | Garbling Maistry |

| 135. | Generator Operator |

| 136. | Geologist |

| 137. | Godown Keeper |

| 138. | Gold Smith |

| 139. | Grader Operator |

| 140. | Grane Operator |

| 141. | Grinder (Plywood works) |

| 142. | Growers |

| 143. | H.R. Executive |

| 144. | Hair Dresser |

| 145. | Haulage Operator |

| 146. | Head Backer |

| 147. | Hoist Operator |

| 148. | Hole Driller for Blasting |

| 149. | Ice cream Manufactures |

| 150. | IMCE Driver |

| 151. | Imposer |

| 152. | Inspector Grade II |

| 153. | Interior Decorator |

| 154. | Issuer Loco |

| 155. | Jack Hammer Operator |

| 156. | Jaggery Makers |

| 157. | JCB Operator |

| 158. | Jobber in polythene industry |

| 159. | Joiner / Joiner (Cable,Cable Grade II) |

| 160. | Junior Engineer |

| 161. | Lab Technician |

| 162. | Lathe Operator / Latheman (Turner) |

| 163. | Lever Operator |

| 164. | Librarian |

| 165. | Limco Loader Operator |

| 166. | Line Man |

| 167. | Loader Operator |

| 168. | Loco Driver |

| 169. | Lubricating Inspector |

| 170. | M. C. Clerk |

| 171. | Machine Cleaned Fibre Twistings |

| 172. | Machine hand (Class II, III, IV) |

| 173. | Machineman |

| 174. | Machinist |

| 175. | Magazine Clerk |