PURPOSE:

-The purpose of communicating Key Audit Matters (KAM) is to enhance the communicative value of the auditor’s report by providing greater transparency about the audit that was performed.

-KAM provides additional information to intended users of the Financial Statement to assist them in understanding those matters that, in the auditor’s judgement were of most significance in the audit of financial statement of current period.

NOT A SUBSTITUTE:

Communicating KAM in the auditor’s report is not a substitute for:

1. Disclosure in the financial statement which management is required to make.

2. Auditor expressing a modified opinion when required as per SA 705.

3. Reporting in accordance with SA 570.

4. Separate opinion on individual matters.

DETERMINING KAM:

In determining KAM, the auditor shall take into account the following:

1. Areas of higher assessed Risk of Material Misstatement or significant risks identified in accordance with SA 315.

2. Areas where significant management judgement is involved including accounting estimates that have been identified as high estimation uncertainty.

3. Effect on the audit of significant events or transactions that occurred during the period.

COMMUNICATING KAM:

♣ Auditor shall describe KAM using an appropriate sub-heading. In a separate section of the auditor’s report under subheading KAM. The introductory language in this section of the auditor’s report shall state that:

1. KAM are those matters that in the auditor’s professional judgment were of most significance in the audit of FS.

2. KAM should be addressed in the context of financial statement as a whole and in forming auditor’s opinion thereon; the auditor does not provide separate opinion on these matters.

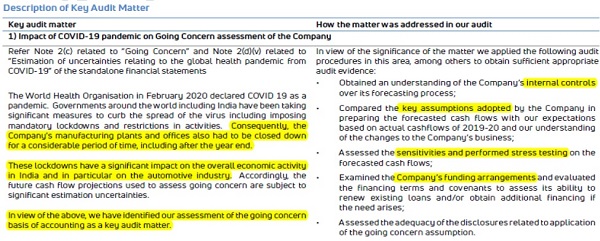

♣ For your better understanding, I am attaching some KAM from the audit report of some companies.

♣ Through this you can easily understand that why entity considered Going Concern as KAM and audit procedures auditor applied in determining KAM.

Key Audit Matter as per SA 701

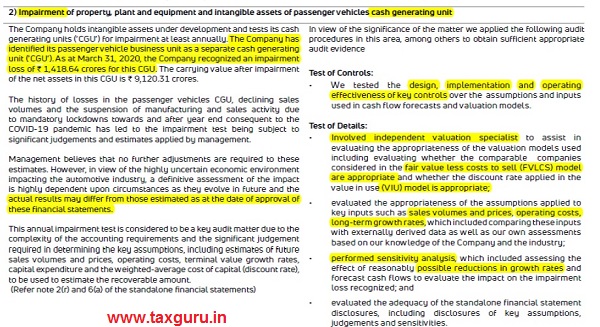

For your better understanding first you must be aware of IND AS 36 “Impairment of Assets”.

This reporting is of the company engaged in Retail business. Here auditor identified Revenue recognition policy as KAM

DOCUMENTATION:

The auditor shall include in the documentation:

1. Matters that require significant auditor’s attention.

2. Rationale for the auditor’s determination as to whether or not each of these matters is a KAM.

3. Where applicable, the rationale for the auditors that there are no KAM to communicate in the auditor’s report.