For non-financial asset impairment assessment, the recoverable amount of assets or cash generating unit (CGU) should be the greater of (i) fair value less costs to sell (FVLCS) and (ii) its value in use (VIU). (IAS 36.18/Ind AS 36)

Both approaches are defined in the standards as follows (Ind AS 36/IAS 36.6).

(i) Fair value less costs to sell is the amount obtainable from the sale of an asset or cash-generating unit in an arm’s length transaction between knowledgeable, willing parties, less the costs of disposal.

(ii) Value in use is the present value of the future cash flows expected to be derived from an asset or cash-generating unit.

Furthermore, the standards state that determining both an asset’s fair value less costs to sell and its value in use is not always required. If either of these sums exceeds the asset’s carrying amount, the asset is not impaired, and the other amount does not need to be estimated (Ind AS 36/IAS 36.19).

In this article, we look at how to treat specific transactions when calculating recoverable amounts using the value in use technique and how to determine its carrying value.

I. Lessee recognising leases as per Ind AS 116/IFRS 16

Leases recognised as per Ind AS 116/IFRS 16 bring all lease obligations to the financial statements, which was not the case previously when leases were recognised as per Ind AS 17/IAS 17, where leases are classified into two categories, (i) operating lease and (ii) finance lease, the operating lease obligation is recognised on an accrual basis and future contractual obligations are only disclosed in the financial statements, now as per the new standard all future contractually fixed lease payments are discounted and recognised at their present value as lease obligations by corresponding recognition of right to use (ROU) in the financial statement

The lease obligation represents the financing provided by the lessor for the leased asset. As per Ind AS 36/IAS 36, cash outflows from financing activities shall not be included when estimating future cash flows. (Ind AS 36/IAS 36.50) Lease payments are, in essence, the servicing of financing provided by the lessor; therefore, lease payments shall not be included when estimating future cash flows.

However, future lease payments that are not discounted and recognised as lease obligation, such as variable lease payments, lease payment for short term lease etc. are to be included while estimating the future cashflows of CGU.

In general, unless the lease asset is subleased, ROU does not generate independent cashflows; thus, the recoverable amount of ROU is calculated by determining the recoverable amount of the cash-generating unit to which the ROU belongs (Ind AS 36/IAS 36.22). If a lease asset is subleased, then, If it is classified as an operating lease, the lease payment cash inflows can be used as a reference for estimating the future casflow for determining the VIU or to find out FVLCS using DCF model. If the sublease is classified as a finance lease, ROU will be derecognized and net investment in the lease is recognised in the balance sheet, and the impairment testing requirement of the net investment in lease will be covered under Ind AS 109/IFRS 9 (Ind AS 109/IFRS 9.2.1(d)).

Furthermore, as per the requirement of the standard, the carrying amount of CGU shall be determined on a basis consistent with the way the recoverable amount of the CGU is determined (Ind AS 36/IAS 36.75) As a result, because lease payments are not considered when calculating the VIU of a CGU, the carrying value of lease obligations is not considered when calculating the carrying value of a CGU.

However, standard also states that when disposing of an asset or CGU, if buyer must take the liability. In this situation, the asset or CGU’s FVLCS (or the projected cash flow from ultimate disposal) is the estimated selling price for the asset or CGU’s assets and liability combined, less the expenses of disposal. To make a meaningful comparison between the asset or CGU’s carrying amount and its recoverable amount, the carrying amount of the liability is removed when evaluating both the asset or CGU’s value in use and its carrying amount (Ind AS 36/IAS 36.78)

As a result, the carrying value of the lease obligation that the buyer of the asset or CGU must assume on disposal must be deducted from the recoverable amount determined either by the value in use approach or the FVLCS approach (if it is not already reducing while determining the fair value of asset or CGU) and assets or CGU carrying amount.

II. Asset retirement and/or restoration obligation

The asset retirement and/or restoration obligation recognised under Ind AS 37/IAS 37 is the present value of the obligation that must be met at the end of the asset’s useful life.

Standard specify that, to avoid double counting, cash outflows relating to obligations that have been recognised as liabilities should not be included when estimating future cashflows (Ind AS 36/IAS 36.43). As a result, the asset retirement and/or restoration obligation recognised in the financial statement will not be considered when estimating the future cashflow of the asset or CGU.

As stated in point I, when disposing of an asset or CGU, if buyer must take the liability. In this situation, the asset or CGU’s fair value less costs to sell (or the projected cash flow from ultimate disposal) is the estimated selling price for the asset or CGU’s assets and liability combined, less the expenses of disposal. To make a meaningful comparison between the asset or CGU’s carrying amount and its recoverable amount, the carrying amount of the liability is removed when evaluating both the asset or CGU’s value in use and its carrying amount (Ind AS 36/IAS 36.78)

As a result, the carrying value of the asset retirement and/or restoration obligation that the buyer of the asset or CGU must assume on disposal must be deducted from the recoverable amount determined either by the value in use approach or the FVLCS approach (if it is not already reducing while determining the fair value of asset or CGU) and assets or CGU carrying amount.

IASB staff has conducted extensive study and analysis on this topic, and two staff papers1 summarise the reasons for decreasing the asset retirement and/or restoration requirement from the recoverable and carrying value of the asset or CGU.

III. Freehold land

Freehold land is a special case; generally, land value does not depreciate but appreciates, and land used for its own purposes does not generate independently cashflow, that makes impairment testing of freehold land as a standalone basis is difficult and complex; further, when the land is included in CGU, the treatment of land to determine VIU of CGU becomes more complicated.

The general principal as per standard is recoverable amount is determined for an individual asset, unless the asset does not generate cash inflows that are largely independent of those from other assets or groups of assets. If this is the case, recoverable amount is determined for the CGU to which the asset belongs, unless either the asset’s FVLCS is higher than its carrying amount (Ind AS 36/IAS 36.22); based upon that following is a table of scenarios and freehold land recoverable value.

|

Scenarios |

Recoverable Amount |

| Freehold land – Own use | There is no independent cashflow generated; nevertheless, if the FVLCS is greater than the carrying value, there is no need to determine the recoverable amount of CGU to which freehold land belongs. The FVLCS of freehold land is the recoverable amount.

If the FVLCS of freehold land is less than its carrying value, the recoverable amount of CGU to which the freehold land belongs is calculated; if the recoverable amount of CGU is less than the carrying value of CGU, the impairment loss is assigned to all assets of CGU in accordance with the standard requirement. (Ind AS 36/IAS 36.104) |

| Freehold land – Lease out and classified as operating lease | According to Ind AS 40/IAS 40, it will be categorised as investment property.

Freehold land is leased out and the lease is classified as an operating lease for the lessor than land generate the lease payment cash inflow and the same can be used as a reference for estimating the future casflow for determining the VIU or to find out FVLCS using DCF model. |

| Freehold land – Lease out classified as finance lease | Freehold land is leased out and the lease is classified as a finance lease for the lessor than land will be derecognized and net investment in the lease is recognised in the balance sheet, and the impairment testing requirement of the net investment in lease will be covered under Ind AS 109/IFRS 9 (Ind AS 109/IFRS 9.2.1(d)). |

| Freehold land – Held for capital appreciation | According to Ind AS 40/IAS 40, it will be categorised as investment property. There is a difference between Ind AS 40 and IAS 40 in terms of which model to employ to carry the investment property in financial statements; IAS 40 provides for both the cost model and the fair value model, but Ind AS 40 only provides for the cost model. If the cost model is employed to carry the investment property, the recoverable amount is FVLCS as the land held for capital appreciation will not create any independent cashflows that can be used to calculate VIU.

For investment property carried at fair value (as permitted by IAS 40), there is no need for impairment under IAS 36 because the property is already carrying at fair value in the financial statement. |

When ‘Freehold land – own use’ be part of CGU?

There can be two scenarios where ‘freehold land – own use’ included in CGU

(i) When the FVLCS of freehold land is less than its carrying value, it is included to the CGU to which it belongs to determine the recoverable amount.

(ii) ‘Freehold land – own use’ is included in CGU for goodwill allocation and its annual impairment testing.

Treatment of freehold land – own use to determine the VIU of in CGU

The VIU of a CGU is determined by estimating the future cashflows of the CGU during its useful life. The useful life of a CGU is determined by the useful life of assets that generates cashflows, such as a plant that produces the output that generates cashflows. the plant has a finite useful life, but the land over which the plant is built has an infinite useful life, then how should the land be treated at the end of the CGU’s useful life? While estimating future cashflows, the standard requires that net cash flows collected (or paid) for the disposal of the CGU at the end of its useful life be included. (Ind AS 36/IAS 36.39) (c)).

So, according to the requirement, one must calculate the disposal value of land at the end of the useful life of the CGU, but this can be difficult because determining the value of land at the end of the useful life of the CGU can be difficult, especially when the useful life of the CGU is very long.

Property inflation indexes based on land location or past yield curves of property value can be used to determine the disposal value of land at a future date, but it will not be appropriate to include cashflow from land disposal at the end of CGU useful life for two reasons: first, it may not be the intention of management to dispose of land at the end of CGU useful life, and second, management initial investment decisions do not usually include cashflow from land disposal at the end of the project useful life instead management expected to recover initial investment made in land to be recover from the cashflow generated from the output produce by CGU assets. As a result, the disposal value of land should not be estimated at the end of the CGU’s useful life when estimating future cashflow of CGU.

However, while determining the recoverable amount of CGU using the FVLCS approach, land fair value must be included because if CGU is to dispose on the impairment testing date, management is expected to receive the value of land from the transaction.

Delay in goodwill impairment due to value appreciation of ‘freehold land – own use’?

Goodwill must be allocated to CGUs (newly acquired or existing) that are expected to benefit from the business combination’s synergies (Ind AS 36/IAS 36.80). If goodwill is allocated to existing CGU that contain the ‘freehold land -own use,’ it would have been recorded at historical cost and its fair value could be higher than its carrying value, providing a shielding effect for goodwill impairment. The unrecognised appreciation of fair value delays the goodwill impairment by providing additional headroom. If the goodwill is allocated to newly acquired CGUs that include ‘freehold land – own use’, it would have been recorded at fair value on the acquisition date, so the shielding effect for goodwill impairment does not exist as it does in the first case. In both cases of goodwill allocation to newly acquired CGU or existing CGU that contain the ‘freehold land – own use,’ the recoverable amount of CGU determined by FVLCS is later appreciated, providing the further shielding from goodwill impairment.

The underlying idea behind recognising goodwill in a business combination is that the entity will benefit from synergies created by combining its operations. Pre-existing unrecorded fair value appreciation or later appreciation of freehold land’s fair value is primarily driven by external factors and is largely unaffected by combining business operations. IASB has conducted extensive research on the delay in goodwill impairment due to unrecorded internally generated goodwill and fair value appreciation of assets of existing CGU to which goodwill is allocated and is deliberating to develop a new approach namely pre-acquisition headroom approach for goodwill impairment testing. To understand the new approach, refer to staff papers issued till date2, but the new approach is still in the development and research phase and does not provide anything for subsequent appreciation of fair value of asset unrelated to business combination synergies. So, until the standard is amended to address the delay in goodwill impairment using the current two approaches, the excess headroom created by freehold land fair value appreciation will delay goodwill impairment.

IV. Capital expenditures

According to the standard, when estimating future cashflows, inflows and outflows that are expected to arise from improving or enhancing asset performance should not be included (Ind AS 36/IAS 36.44), because future cash flows estimated for the asset in its current condition VIU should not reflect future cash outflows that will improve or enhance asset performance or the related cash inflows that are expected to arise from such outflows (Ind AS 36/IAS 36.45).

Estimates of future cash flows, on the other hand, include future cash outflows required to maintain the level of economic benefits expected from the asset in its existing condition. When predicting the future cash flows associated with a CGU that consists of assets with varying estimated useful lives, all of which are required for the unit’s continued operation, the replacement of assets with shorter lives is assumed to be part of the unit’s day-to-day service. Similarly, when assessing the future cash flows generated by a single asset composed of components with varying estimated useful lives, the replacement of components with shorter lives is considered to be part of the asset’s day-to-day service (Ind AS 36/IAS 36.49).

To avoid double counting, capital expenditure for which a liability has already been recognised will not be considered for projecting future cashflow (Ind AS 36/IAS 36.43).

V. Working capital

It is difficult and/or impossible to estimate future cashflow of an asset or CGU without taking into account the inflow and/or outflow of working capital components such as trade receivables, payables, other financial assets, provisions, and so on, which impairment testing requirement may or may not be covered by Ind AS 36/IAS 36.

The standards require while estimating future cashflows, outflows that are required to create cash inflows fr om continued use of the asset (including cash outflows to prepare the asset for use) and may be directly attributed or assigned to the asset to be considered (Ind AS 36/IAS 36.39). Based on this, any inflow or outflow connected to changes in working capital, without which an asset or CGU cannot operate, must be considered when estimating future cashflows.

Furthermore, the standards provide practical reasons for determining the recoverable value of a CGU after taking into account assets that are not part of the CGU (for example, receivables or other financial assets) or liabilities that have been recognised (for example, payables, pensions and other provisions). The carrying amount of the CGU is increased in such instances by the carrying amount of the assets and decreased by the carrying amount of the liabilities (Ind AS 36/IAS 36.79). As a result, the carrying value of working capital will be adjusted to determined recoverable amount of CGU.

Illustrative Example

H Ltd’s fully owned subsidiary is S Ltd. S Ltd manufactures and sells Product A in the local market from its sole plant; H Ltd has no independent operations; the acquisition is recognised as a business combination under Ind AS 103/IFRS 3 and, as a result, goodwill is recognised in the consolidated financial statement, which must be tested for impairment annually.

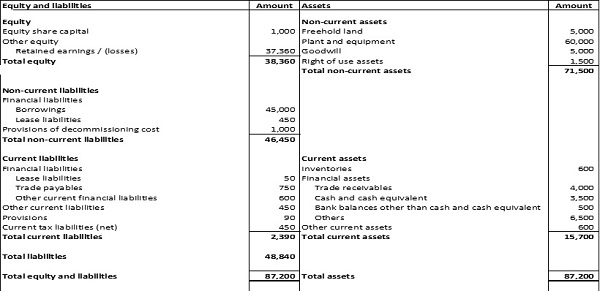

Consolidate Balance sheet of H Ltd. As at 31st March 2022

- Because S Ltd. is a single product manufacturing business, H Ltd. treated S Ltd.’s whole operation as a single CGU, and the goodwill recognised upon acquisition of S Ltd. was assigned to the same CGU.

- The manufacturing plant has a remaining useful life of ten years and a scarp value of INR 500 million at the end of its useful life.

- CGU’s FVLC is INR 90,000 Mn (of which the fair value of freehold land is 40000 Mn) (FVLC is determined after considering the fact that the decommissioning and lease obligation will be assume by buyer)

- S Ltd. Post-tax WACC is 12%

1. https://www.ifrs.org/content/dam/ifrs/meetings/2015/november/ifrs-ic/ias-36-impairment-of-assets/ap14-recoverable-and-carrying-amount.pdf

2. https://www.ifrs.org/content/dam/ifrs/meetings/2017/december/international-accounting-standards-board/ap18c-gi.pdf

Authors- CA Shreyansh Shah and CA RV Rahul Bansal.