Trusts play a significant role under the Income Tax Act, 1961, with various provisions governing their taxation and exemptions. Business trusts, defined under Section 2(13A), include Infrastructure Investment Trusts and Real Estate Investment Trusts, which are taxed at the maximum marginal rate per Section 115UA. Charitable and religious trusts can avail exemptions under two independent regimes: Section 10(23C) for educational and medical institutions and Section 11 for income derived from property held for charitable purposes. The Finance (No.2) Act, 2024 mandates that, from October 1, 2024, trusts seeking exemptions must apply for registration under Section 11 exclusively. The term “charitable purpose” under Section 2(15) includes relief for the poor, education, medical relief, and environmental preservation but excludes trade or commerce unless incidental and below 20% of total receipts. Accumulated income must be declared and invested as per Section 11(2) to retain exemption benefits. Anonymous donations exceeding certain thresholds are taxed at 30% under Section 115BBC. Trusts are subject to individual slab rates, with exemptions up to ₹2,50,000 and taxation at 5% and 30% for higher incomes. The Finance Bill 2025 introduces amendments to Section 13, revising contribution limits for exemption eligibility. These provisions collectively ensure transparency and compliance in trust taxation. Following are some of the important provisions:-

1. Sec 115 UA

Subject to the provisions of sec 111 A and sec 112, the total income of a business trust shall be charged to tax at the maximum marginal rate.

2. Definition of Business Trusts (Sec 2(13A)

Business trust means a trust registered as-

i. an infrastructure Investment Trust under the securities and Exchange Board of India (Infrastructure Investment Trusts) Regulations,2014 made under the securities and Exchange Board of India Act,1992(15 of 1992)or

ii. a Real Estate Investment Trust under the Securities and Exchange Board of India (Real Estate Investment Trusts) Regulations,2014 made under the Securities and Exchange Board of India Act,1992.

3. Charitable or religious trusts /Institutions can avail income –tax exemption under two different independent regimes.

A. The first regime pertains to the exemption available under section 10(23C),which interalia exempts income received by any person on behalf of university, or other educational institution or any hospital.

B. The second regime pertains to the exemption under section 11 that provides for exemption under section 11 that provides for exemption in respect of income derived from property held under trust wholly for charitable or religious purposes.

Corresponding amendments have been made by the Finance (No.2) Act, 2024 in the provisions under the second regime whereby, with effect from 1 st October 2024 trusts or institutions desirous of availing exemption shall make an application for registration under the second regime only.

4. Charitable or Religious Trusts.

Trust formed for charitable or religious purposes which are not intended to do commercial activities are allowed various benefits under the Income-Tax Act, inter-alia, exemption under section 11.

The term religious purpose is not defined under the Income-Tax Act. However, Section 2(15) of the Act defines “charitable purpose” to include relief of the poor, education, medical relief, preservation of environment (including watersheds, forests and wildlife) and preservation of monuments or places or objects of artistic or historic interest, and the advancement of any other object of general public utility.

Provided that the advancement of any other object of general public utility shall not be a charitable purpose, if it involves the carrying on of any activity in the nature of trade, commerce or business, or any activity of rendering any service in relation to any trade, commerce or business, for a cess or fee or any other consideration, irrespective of the nature of use or application, or retention, of the income from such activity, unless—

(i) such activity is undertaken in the actual course of carrying out of such advancement of any other object of general public utility; and

(ii) the aggregate receipts from such activity or activities during the previous year, do not exceed 20% of the total receipts, of the trust or institution undertaking such activity or activities, of that previous year;

5. Exempted incomes of Charitable or Religious Trusts.

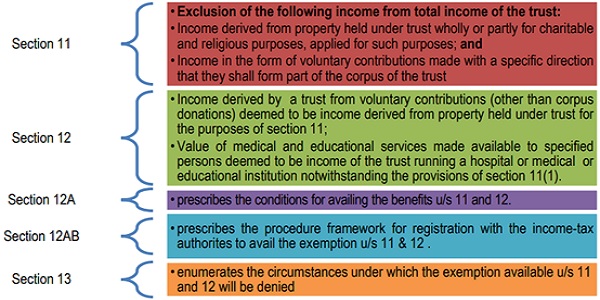

(Source: https://resource.cdn.icai.org/83228bos67301.pdf)

6. Application of Income Under both regimes

Where eighty-five per cent of the income referred to in clause (a) or clause (b) of sub-section (1) read with the Explanation to that sub-section is not applied, or is not deemed to have been applied, to charitable or religious purposes in India during the previous year but is accumulated or set apart, either in whole or in part, for application to such purposes in India, such income so accumulated or set apart shall not be included in the total income of the previous year of the person in receipt of the income, provided the following conditions are complied with, namely:—

(a) such person furnishes a statement in the prescribed form and in the prescribed manner to the Assessing Officer, stating the purpose for which the income is being accumulated or set apart and the period for which the income is to be accumulated or set apart, which shall in no case exceed five years;

(b) the money so accumulated or set apart is invested or deposited in the forms or modes specified in sub-section (5);

(c) the statement referred to in clause (a) is furnished on or before the due date specified under sub-section (1) of section 139 for furnishing the return of income for the previous year:

7. Tax on Anonymous Donations.(Sec 115BBC)

The total income of an assesse includes any income by way of any anonymous donation, the income tax payable shall be the aggregate of :

i. tax @30 % on the aggregate of anonymous donations received in excess of the higher of the following namely:

A. 5% of the total donations received by the assesse, or

B. Rupees one lakh: and

ii. the tax with which the assesse would have been chargeable had his total income been reduced by the aggregate of anonymous donations received in excess of the amount referred to in (A) or (B),as the case may be.

8. Computation of Tax.

A trust is chargeable to tax as per the slab rates which are applicable to an individual (not being a senior citizen or super senior citizen).

Tax Rates

| Total Income | Tax Rate |

| Up to Rs 250,000 | Nil |

| Rs 500,000 to Rs 10,00,000 | 5% |

| Above Rs 10,00,000 | 30% |

9. Finance Bill 2025 (Amendments)

In section 13 of the Income-tax Act, in sub-section (3),__ Amendment of section 13. (i) for clause (b), the following clause shall be substituted, namely:–– “(b) any person whose total contribution to the trust or institution, during the relevant previous year exceeds one lakh rupees, or, in aggregate up to the end of the relevant previous year exceeds ten lakh rupees, as the case may be;”; (ii) in clause (d), the word “person,” shall be omitted; (iii) in clause (e), the brackets and letter “(b),” shall be omitted.

(Republished with amendments)

If trust registered u/s 12A, tax slab of 2.5 Lakhs should be allowed then why it is not available in Income Tax Utility and they counting tax @30% without any basic exemption limit.?