Sagar Gupta

Consistent with its January 2015 announcement, the Ministry of Corporate Affairs (MCA) has moved quite swiftly and notified its phase-wise roadmap for adoption of the Indian Accounting Standards (Ind AS) – India’s accounting standards converged with the IFRS. After lingering skepticism regarding Ind AS getting notified, this positive development positions India well at the center of high quality financial reporting. The MCA has issued a notification dated 16 February 2015 announcing the Companies (Indian Accounting Standards) Rules, 2015 for applicability of Ind AS.

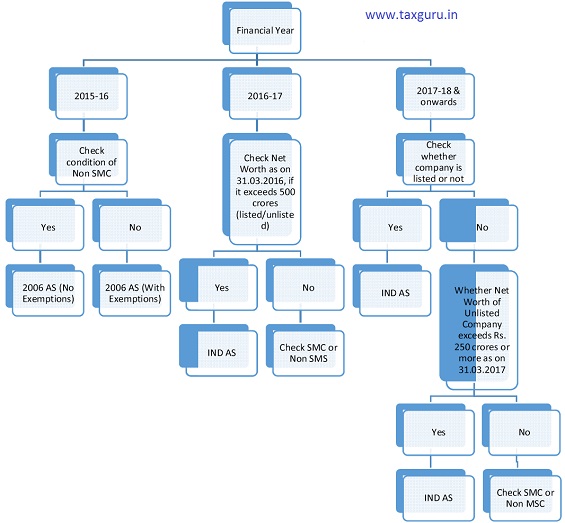

The application of Ind AS is based on the listing status and net worth of a company. Ind AS will first apply to companies with a net worth equal to or exceeding 500 crore INR beginning 1 April 2016. This will also require comparative Ind AS information for the period of 1 April 2015 to 31 March 2016. Listed companies as well as others having a net worth equal to or exceeding 250 crore INR will follow 1 April 2017 onwards. From April 2015 (which is less than six weeks away) companies impacted in the first phase will have to take a closer look at the details of the 39 new Ind ASs currently notified. Ind AS will also apply to subsidiaries, joint ventures, associates as well as holding companies of the entities covered by the roadmap.

Let us understand applicability of Standards

Companies:

♣ Specific Companies – On which IND AS is applicable

1. Any Company which voluntary opts for Ind AS ( from 01.04.2015)

2. Any

a. listed company or company in process of listing having net worth of 500 crores or more, or

b. unlisted companies having net worth of 500 crores or more, or

c. holding, subsidiary of any of the above company.

On these companies, IND AS is mandatorily applicable from 01.04.2016

3. Any

a. listed company or company in process of listing, or

b. unlisted company having net worth of 250 crores or more but upto 500 crores, or

c. holding, subsidiary of any of the above company.

On these companies, IND AS is mandatorily applicable from 01.04.2017

Specific company excludes Banking Company & Insurance Companies.

Net worth is calculated every year and if the limit crosses, it becomes Specific Company from the next day.

But once a company becomes a Specific Company, then it will always remain a Specific Company.

♣ Non SMC – Non Small & Medium Companies (Big Companies)

If any company (other than specific company) qualifies any of the following points, then it will be a Non SMC.

- any company which is listed or in process of listing,

- banking company & insurance company,

- company whose turnover in previous year was more than Rs. 50 crores,

- company whose borrowings at any time in previous year was more than Rs. 10 crores, or

- holding, subsidiary of the above companies.

♣ SMC Companies

All the remaining companies.

Classification of Non Companies:

Classification of Non Companies:

AS of ICAI are applicable on Financial Statements of Non Company.

- 100% Charitable Entities: No AS Applicable.

- For other levels:

Level I:

- Listed Organizations or in process of Listing – Mutual Funds,

- Turnover in Previous Years Rs. 50 crores or more,

- Borrowings at any time in Previous Years Rs. 10 crores or more,

- Banks (Co-operative Banks) & Insurance Organisations (Insurance Trusts)

Level II:

- Turnover in Previous Year exceeds Rs 1 crores but is less than Rs. 50 crores.

- Borrowings in Previous Year exceeds Rs. 1 crores but is less than Rs. 10 crores.

Level III:

- Balance Organisations

Exemptions & Relaxations

| Particulars | Exemptions |

| Specific Companies | Nil |

| Non SMC | Nil |

| SMC | Full Exemptions: AS 3 & AS 17

Partial Exemptions: AS 15, 19, 20, 28, 29 Not Applicable: AS 30, 31, 32 (Recommendatory) |

| Level I | Nil

AS 30, 31, 32 (Recommendatory) |

| Level II | Full Exemptions: AS 3 & AS 17

Partial Exemptions: AS 15, 19, 20, 28, 29 Not Applicable: AS 30, 31, 32 (Recommendatory) |

| Level III | Full Exemptions: AS 3, 17, 18, 24

Partial Exemptions: AS 15, 19, 20, 28, 29 Not Applicable: AS 30, 31, 32 (Recommendatory) |

Re-Classification of Entities:

For Companies:

♣ From SMC to NON SMC:

- Previous years figure for information on which exemption was claimed in Previous Years are not required for Comparative Statements,

- No other relaxations or exemptions.

♣ From NON SMC to SMC

- Exemption will not be allowed for two consecutive years,

- Previous Years figure to be given.

For Other than Companies:

♣ From Level II or III to Level I:

- Previous years figure for information on which exemption was claimed in Previous Years are not required for Comparative Statements,

- No other relaxations or exemptions.

♣ From NON SMC to SMC

- Exemption will not be allowed for two consecutive years,

- Previous Years figure to be given.

Author:

The author, Sagar Gupta is a well renowned Tax & Accounting advisor with several years of experience and can be reached at advisors@ifrsadvisors.com

Nice & informative

Excellent writeup. Keep it up

Dear Sir ,

please suggest on AS (cash flow statement ) and consolidated financial statement for the financial statement for the year 2014-15.

the Companies act refers that financial statement (defination) all the companies except OPC , Small Co. and dormant co shall have cash flow statement ??

pls suggest and also sugggest Consolidated financial applicability concept for year 2014-15 (smc /non smc as stated above)