Sec 4 of the Real Estate Regulation and Development Act 2016 mandates every promoter to open and maintain the Project wise bank account in Scheduled Bank

Objective and Intention of the Act is to ensure the money collected from the Allottees for the Specific project shall be utilised for the specific project and to avoid any diversion / diversification of funds by the promoter for better opportunities.

We have seen in many instances that the Promoter has collected money for Project A and sometimes used to acquire the land for the future project by way of investment. Means Project A money is diverted causing delay in completing the Project A and Allottees are deprived of delivery of the project within the time as committed by the Promoter.

In order to protect the Allottees and bring discipline amongst the Promoters in utilization of funds collected from the Allottees , Act mandates that 70 % of money collected from the allottees shall be deposited in a separate bank account viz., designated project bank account (it is not escrow account, however many promoters, professionals do pronounce as escrow) and withdrawal of the such money shall be based on % of completion of the development of the project.

While filing the application for Grant of Registration of project Bank Account details are given to Authority.

On grant of registration of the project, Designated bank account shall be used to deposit the 70 % of the amount collected from the Allottee –

Sec. 4 (2)(l) (D) that seventy percent of the amounts realised for the real estate project from the allottees, from time to time, shall be deposited in a separate account to be maintained in a scheduled bank to cover the cost of construction and the land cost and shall be used only for that purpose

Few of the authorities have printed the designated project bank account details in the RERA Certificates so that the Allottees and housing loan companies shall release the funds to the respective project bank account.

Any deviation from usage of the designate bank account, promoter shall obtain PRIOR approval of the Authority

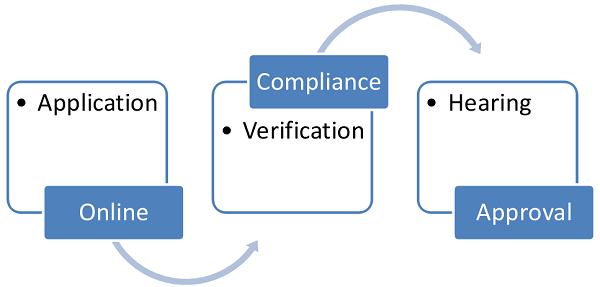

1. Online Application

2. Documents / Certificates

| SL No | Field Name | Description | File Size |

| 1 | New Bank Account Number* | New Bank Account Number | |

| 2 | New IFSC Code* | IFSC Code of new bank | |

| 3 | New Bank Name* | Name of New Bank | |

| 4 | Branch Name* | – | – |

| 5 | State* | – | – |

| 6 | District* | – | – |

| 7 | Reason for Changing Bank

Account Details* |

Reason for Change | – |

| 8 | Board Resolution Copy* | Board Resolution Copy | Up to 1MB |

| 9 | Affidavit* | Affidavit | Up to 1MB |

| 10 | Old Bank Account Statement | Last Statement from Old Bank | Up to 1MB |

| 11 | CA Certificate* | Certificate from Chartered Accountant | Up to 1MB |

| 12 | Bank Pass Book Copy* | Pass Book copy of New Bank | Up to 1MB |

Certificate from Chartered Accountant certifies that promoter has withdrawn money in compliance with Sec 4(2)(l)(d) of the Act

Having received application, Authorities may call for the hearing, verification of documents, compliance and on satisfaction, shall be allowed to use the new bank account for the project.

In many instances lenders or financial institutions insist the promoter to deposit the money collected to the loan escrow bank account, we recommend the promoters to obtain the prior approval by filing necessary application, documents and requirements

Non-compliance of the requirement and provisions of the Act may result in levying of penalty by the Authorities as per sec 61 – which reads as follows

If any promoter contravenes any other provisions of this Act, other than that provided under section 3 or section 4, or the rules or regulations made thereunder, he shall be liable to a penalty which may extend up to five per cent. of the estimated cost of the real estate project as determined by the Authority.

Prepared by –

Vinay Thyagaraj, Practicing Chartered Accountant and Law Graduate from Bangalore, closely associated and rendering services to real estate industry / promoters.

He is associate member of National Real Estate Development Council (NAREDCO), Karnataka Chapter. Travelled across south Indian states to present, deliberate various topics on RERA and Real Estate related laws.

You can write to vinay@vnv.ca for any clarifications