Introduction

State GST Department, previously known as Commercial Taxes Department contributes about 75% of the revenue of the state through Kerala Value Added Tax, Kerala General Sales Tax Act, Central Sales Tax Act, Luxury Tax Act, Money lending Act and Agricultural Income Tax Act. The functioning of the department essentially depends on the capability of human resource working in the department. Therefore there is a need to have structured capacity building program inbuilt in the system. Through such continuous capacity building measures the officers in the department will gain knowledge and develop various skills to take up initiatives to achieve the main stated objective of revenue generation.

Therefore, other than efforts of having induction and refresher training programmes for respective officers, it was felt to develop How to do…? series. This series will cover all important themes so that all the officers will understand the importance of the particular subject and they will use the knowledge for improving the performance.

In this series, one of the important areas covered is CAG Reports. There is a general tendency to look at CAG Report as an additional burden but we have to understand that the CAG Report gives lots of insights in the functioning of the department and gives pointers to improve the system. As the department is entrusted with the responsibility of revenue generation, it is important that all officers should take the Audit reports seriously and take follow up actions. This booklet How to do…? CAG Report follow up is published in order to give the information about the whole audit process and how the Reports can be used to the advantage for generating revenue.

CHAPTER I

I. The audit of revenue receipts of the State Government is conducted under Section 16 of the Comptroller and Auditor Generals (Duties, Powers and Conditions of Service) Act 1971.

II. Aim and purpose of the Audit

- To examine whether the provisions in the Act and Rules are adequate to avoid leakage of revenue.

- To see whether the existing organisational structure is adequate for analysis and detection of evasion.

- To see whether corrective measures are taken by the Department to plug the loopholes as and when evasion detected.

- To identify unattended areas of evasion.

- To ascertain whether the internal control mechanism in the Department is adequate and effective to prevent leakage of revenue.

CHAPTER II

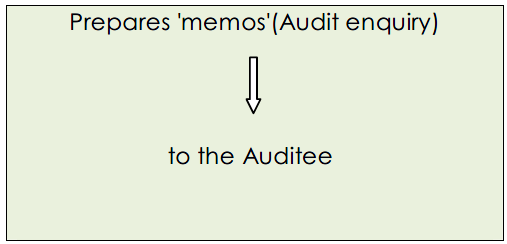

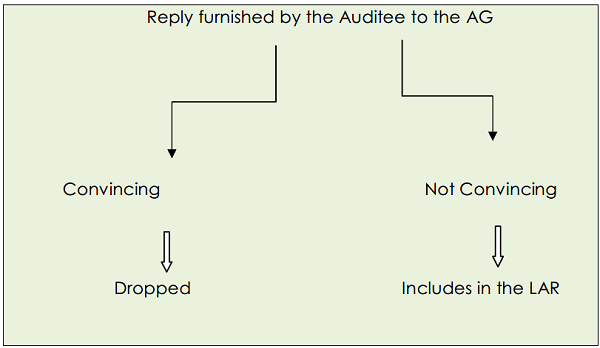

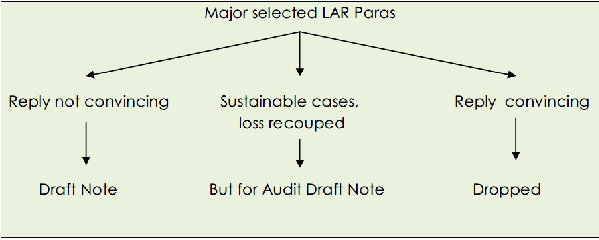

How the audit paras find place in C&AG Report

Inspection Report (IR) or LAR (Local Audit Report)

(a) Criteria for selection of audit by AG

- Revenue position- High/ Medium / Low

- Past trends of audit observations

- Past trends of complaints

- Past trends of non-production of records

- Past trends of media reports

- Past trends of information regarding malpractice

- Past trends of misappropriation.

- Critical issues in Govt. Revenue

- Critical issues in tax administration

- Critical issues in white paper on Finance

- Critical issues recommended by the Finance Commission (State & Central)

- Statistical analysis of the revenue earnings during the last five years

- Factors of the tax administration during the last five years

- Audit coverage and impact during the last five years

Out of 500 or more files with an officer top files are usually selected on the basis of Turnover and Tax effect

(b) Visit of Audit Party of AG to CT Office / Spl.circle/ Intelligence wing/ CTCP

CHAPTER III

Action to be taken by Auditee

1. Provide maximum facility and co-operation to the audit party.

2. Make available all records and files required by the AG.

3. Rectify the irregularities, defects and omissions pointed out by the AG.

Field level officers should discuss with the senior auditors of the AG who are conducting the audit then and there. This will help to clear as many objections as possible on the spot.

Impact

1. Early disposal of inspection reports.

2. Reduce number of paras in the LAR

LAR Files will be sent from SRA(HQ) of AG`s office to

- Auditee office

- Copy to Controlling officer of the Auditee

- Copy to HOD

CHAPTER IV

Common heads of audit findings in the LAR

- Incorrect Exemption

- Incorrect claim of Special Rebate

- Claim of Excess IPT

- Unaccounted Purchases

- Unaccounted Sales

- Non Levy of Interest

- Application of Incorrect rate of tax

- Misclassification of commodities

- Incorrect levy of reverse Tax

- Incorrect computation of Compounded tax

- Non imposition of penalties

- Incorrect reckoning of taxable Turnover in works contract

- Non utilization of information in crime file

- Irregular claim of concessional rate

- Non levy of Surcharge

- Escapement of turnover in AMC, Discount, Other Income etc

CHAPTER V

How to use LAR PARAS at Field Officer’s level:

- Audit objection is to be entered in the register kept in the auditee’s offices.

- Report the action taken in this case to AG through the Controlling Officer.

- Action in the previous files of the concerned assessee

- Action in similar cases.

- Action in all cases in the current year.

- Incorporate entire paras in the action taken report.

- Time limit fixed for first reply to LAR is 4 Weeks.

- Reply shall be furnished only through the controlling officer concerned to the SRA(HQ)

1. Proper examination of the defect with the original para in the LAR, assessment records in the light of provisions of the Act, Rules, Circulars, Notifications, Clarifications and related judgements.

2. After examining the above, furnish the reply to the controlling officer through proper channel with evidences if any.

3. If the audit query is sustainable, assessment should be completed and the demand should be collected at the earliest. If any appellate or court interference is there, take all possible steps (such as urgency can informed to DC (A), Law Officer and DC (Law) for the speedy disposal of the same.

4. If any file is transferred to other circle office the remarks containing the information regarding the audit observation and its stage should also be informed to the transferee assessing officer.

5. If assessments were modified based on the directions of the Appellate authority in a sustainable case, the result may be informed to AG along with documentary evidence such as original assessment order, Appellate authority order, modified order, etc.

6. Reply should be furnished within the time prescribed with evidences.

7. If there is any doubt in adjudication of any matter, clarification can be sought from higher authorities concerned and action can be initiated accordingly.

8. If AG’s query is relating to a particular year, examine the assessment records of other years of the assessee and check the defect is existing in those years and correct the same by completing the assessment.

9. Identify the similar other cases in that section and pass the information of the audit query to other officers for verification. This will minimise the Paras in LAR in the coming years.

Impact

- Creating additional demand.

- Minimize the number of defect to be brought forward to DN/DP Stage.

- Increase the awareness of the defect among officers.

- Avoid recurrence of defects

How to use LAR PARAS at the Controlling Officer’s level

The controlling officers should make entry of the LAR paras in the LAR Register.

Obtain:

- How many defects are sustainable

- How many rectified

- Creation of additional demand

- Collection from additional demand

- Stages of additional demand

- Monitoring the timely response and follow up

- Monitoring recovery and adjudication of the case.

- Share the defects to other officers under the controlling officer.

Impact

- Reduce the recurrence in other offices

- Awareness to officers

- Rectification of particular case.

How to use LAR PARAS at the Head Quarters level

A. Acquire the present position of the LAR Paras included in LAR file from the Auditee Office so as to ascertain –

- Defects pointed out are sustainable or not.

- If sustainable, what action taken

- If assessment completed, the details of assessments

- The stages of recovery of demand created

- The stages of adjudication if any.

B. Issue proper direction and follow up:

- Whether the remarks have been submitted to AG.

- If assessment completed on the basis of the LAR Para, the reason for variation between the quantum of escape pointed out by the AG is less than the additional demand created by the assessing authority.

- If the remarks by the assessing authority or the action taken by the assessing authority were found not suitable enough according to the law and fact of the case, guidance on the basis of verification of records and application of proper provisions of law

- Bunching of defects issuing circulars at CCT level

- Fixing responsibility on the Assessing Authority

- If there is any ambiguity in Rules and Laws, steps should be taken to amend the provisions

- Capacity Building

Impact

- Creation of additional demand

- Clearance of Local Audit Para

- Creation of awareness among the assessing authority all over the State

- Avoidance of recurrence of defects (State wide)

- Proper action against officers responsible for the short levy/irresponsibility

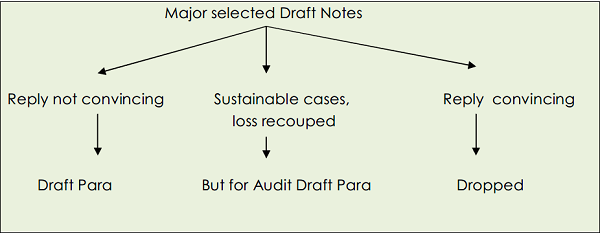

CHAPTER VI

Draft Notes

How to use Draft Notes at the Head Quarters level

- Reply to Draft Note is to be furnished by the Head of Department to the Government

- Time limit prescribed for furnishing the reply is 6 weeks

- The Head of Department have to –

1. Collect all the facts related to Draft Note from the Controlling Officers

2. Verify whether direct or indirect involvement of any officials behind the irregularity committed.

3. Verify whether there is any lack of proper instructions or defects in the organizational setup

4. If there is any loss to the Govt. the responsibility for the same should be fixed

5. Steps should be taken to recover the loss

6. If irregularity committed was due to ambiguity in the Rules, steps should be taken to amend the Rules.

7. In order to prevent recurrences of irregularity, issue proper instructions, circulars.

8. Capacity Building.

How to use Draft Notes at the Controlling Officer’s level

The controlling officers should make entry of the details of Draft Note in the respective Register.

Obtain:

- How many defects are sustainable

- How many rectified

- Creation of additional demand

- Collection from additional demand

- Stages of additional demand

- Monitoring the timely response and follow up

- Monitoring recovery and adjudication of the case.

- Share the defects to other officers under the controlling officer.

Impact

- Reduce the recurrence in other offices

- Awareness to officers

- Rectification of particular case.

How to use Draft Notes at the Field Officer’s level

- Audit objection is to be entered in the register kept in the auditee’s offices.

- Report the action taken in this case through the Controlling Office for onward transmission to HQ.

- Action in the previous files of the concerned assessee

- Action in similar cases.

- Action in all cases in the current year.

- Incorporate entire paras in the action taken report.

- Time limit fixed for first reply to Draft Note is 6 Weeks.

- Reply shall be furnished to the immediate controlling officer.

Impact

- Creating additional demand.

- Increase the awareness of the defect among officers in the office.

- Avoid recurrence of defects

CHAPTER VII

Draft Paras

How to use Draft Paras at the Head Quarters level

- Reply to Draft Para is to be furnished by the Head of Department to the Government

- Time limit prescribed for furnishing the reply is 6 weeks

- The Head of Department have to –

1. Collect all the facts related to Draft Para from the Controlling Officers

2. Verify whether direct or indirect involvement of any officials behind the irregularity committed.

3. Verify whether there is any lack of proper instructions or defects in the organizational setup

4. If there is any loss to the Govt. the responsibility for the same should be fixed

5. Steps should be taken to recover the loss

6. If irregularity committed was due to ambiguity in the Rules, steps should be taken to amend the Rules.

7. In order to prevent recurrences of irregularity, issue proper instructions, Circulars.

8. Capacity Building.

How to use Draft Paras at the Controlling Officer’s level

The controlling officers should make entry of the details of Draft Para in the respective Register.

Obtain:

- How many defects are sustainable

- How many rectified

- Creation of additional demand

- Collection from additional demand

- Stages of additional demand

- Monitoring the timely response and follow up

- Monitoring recovery and adjudication of the case.

- Share the defects to other officers under the controlling officer.

Impact

- Reduce the recurrence in other offices

- Awareness to officers

- Rectification of particular case.

How to use Draft Paras at the Field Officer’s level

- Audit objection is to be entered in the register kept in the auditee’s offices.

- Report the action taken in this case through the Controlling Office for onward transmission to HQ.

- Action in the previous files of the concerned assessee

- Action in similar cases.

- Action in all cases in the current year.

- Incorporate entire paras in the action taken report.

- Time limit fixed for first reply to Draft Note is 6 Weeks.

- Reply shall be furnished to the immediate controlling officer.

Impact

- Creating additional demand.

- Increase the awareness of the defect among officers in the office.

- Avoid recurrence of defects

CHAPTER VIII

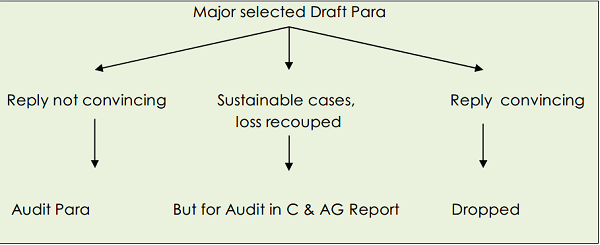

C & AG Report

C&AG Report at a Glance

| Chapter I | Trend of revenue receipt

Analysis of arrears of revenue Arrears in assessments Analysis of collection Cost of collection Analysis of stay granted Response of the Govt/Departments Department committee audit meeting Non production of records of audit for scrutiny Action taken on the recommendations accepted by the Depatments/Government Results of audit |

| Chapter II | Tax Administration

Results of Audit Performance Audit Selected Draft Paras |

| Chapter III | Tax Administration Internal Audit |

| Results of Audit Selected Paras |

|

| Chapter IV | Taxes on Vehicles |

| Chapter V | Land Revenue and Building Tax |

| Chapter VI | State Excise |

| Chapter VII | Other Tax Receipts |

CHAPTER IX

Format for furnishing action taken notes on Comptroller and Auditor General’s Reports

i. (a) Department

(b) Subject/Title of the Review/Paragraph

(c) Paragraph Number

(d) Report Number and Year

II. (a) Date of receipt of the Draft Paragraph/Review in the Department

(b) Date of Department’s Reply

III. Gist of Paragraph/Review

IV. (a) Does the Department agree with the facts and figures included in the Paragraph?

(b) If not, indicate the areas of disagreement and also attach copies of relevent documents in support.

V. (a) Does the Department agree with the Audit conclusions?

(b) If not, indicate specific areas of disagreement with reasons for disagreement and also attach copies of relevant documents, where necessary

VI. Remedial Action Taken

1. Improvement in system and procedures including internal control.

2. Recovery of over payment pointed out by audit

3. Recovery of under assessment, short levy or other dues.

(a) How to utilize C & AG Reports at Head Quarter level

1. Communicate copies of the report to CCT, other major wings of CCT, all district DC’s concerned.

2. Sorting the Paras office wise, assessee wise and year wise.

3. Obtain Factual Report from concerned DC’s.

4. Examine the reply and furnish the reply in cases found satisfactory or seek revised report in unsatisfactory replies with remarks for re verification.

5. Obtain Factual Report relating to all paras and try to furnish the RMT’s within the time prescribed.

6. Verify whether direct or indirect involvement of any officials behind the irregularity committed.

7. Verify whether there is any lack of proper instructions or defects in the organizational setup

8. If there is any loss to the Govt. the responsibility for the same should be fixed

9. Steps should be taken to recover the loss

10. If irregularity committed was due to ambiguity in the Rules, steps should be taken to amend the Rules.

11. In order to prevent recurrences of irregularity, issue proper instructions, circulars.

12. Capacity Building.

13. Preparation for PAC actually starts as and when the date for ‘PAC discussion’ is declared by the Legislature Secretariat. The RMT’s already furnished are re-examined and modifications are done, if any needed. Assessment records are examined for ascertaining the accuracy of the reply, for additional information and for collection of more evidences in random cases if needed.

14. The Audit report so placed will be examined by the Public Accounts Committee. The Government Secretary concerned and the Head of Department will have to appear as witnesses.

15. In similar way SOAT to the paras in PAC Recommendations are also prepared and furnished to the Govt. for vetting.

16. Normally the following questions are being raised by the committee to the witnesses

- After the receipt of the Draft Para whether the irregularities commended upon in the Audit Para have been rectified?

- Whether adequate steps have been taken to see that such irregularities do not occur in future?

- In the case of loss to Govt., what action against the responsibles has been taken?

Action points

- Identify the Audit Reports and paras

- Segregate as per the nature of the audit observations and revenue involved

- Identify similar issues in other similar trade

- Prioritize these dealers scrutiny and complete the assessments

CHAPTER X

Data as on 31st March 2018

Pending LAR Cases as on 31st March 2018

| SI No | ||

| 1. | Number of Paras pending | 24167 |

| 2. | Number of short levy cases | 14455 |

| 3. | Sustainable cases | 9474 |

| 4. | Non sustainable cases | 4981 |

Sustainable cases

| SI No | ||

| 1. | Above 1 crore | 316 |

| 2. | Between 50 lakh crore to 1 | 202 |

| 3. | Below 50 lakh | 8956 |

| Total | 9474 | |

| Total cases assessed | 5560 | |

| Total cases balance | 3914 |

District wise pending cases

| SI No | District | Cases |

| 1. | Thiruvananthapuram | 312 |

| 2. | Kollam | 100 |

| 3. | Pathanamthitta | 152 |

| 4. | Kottayam | 507 |

| 5. | Idukki | 85 |

| 6. | Alappuzha | 280 |

| 7. | Ernakulam | 1049 |

| 8. | Mattancherry | 174 |

| 9. | Thrissur | 587 |

| 10. | Palakkad | 110 |

| 11. | Malapuram | 160 |

| 12. | Kozhikode | 133 |

| 13. | Wayanadu | 65 |

| 14. | Kannur | 103 |

| 15. | Kasaragod | 97 |

Draft Notes

| SI No | ||

| 1. | Number of draft notes pending for want of factual report as on 1st April 2017 | 84 |

| 2. | Received during the year 2017-18 | 24 |

| 3. | Factual Report furnished | 108 |

| 4. | Balance | Nil |

Draft Paras

| SI No | ||

| 1. | Number of draft paras pending for factual report | 5 |

| 2. | Received during 2017-18 | 24 |

| 3. | Factual report furnished | 24 |

| 4. | Balance | Nil |

CAG Reports

| Year | Opening Para | RMT furnished | Balance |

| Reported ended 31st march 2013 | 92 | 92 | Nil |

| Report ended 31st March 2014 | 153 | 153 | Nil |

| Report on KVATIS 2014 | 25089 | 4574 specific cases and report processed 1152 | 3422 |

| Report ended on 31st March 2015 | 502 | 183 | 319 |

| Report ended on 31st March 2016 | 926 | 380 | 546 |

PAC recommendations

| SI No | ||

| 1. | Number of Paras pending | 56 |

| 2. | Received during the year | 42 |

| 3. | SOAT furnished | 98 |

| 4. | Balance | Nil |

Acknowledgements:

C & AG Report is a process which commences from audit enquiry stage and culminates in PAC Recommendations. This Statutory constitutional process should be utilized by the auditee department. This can be achieved by proper actions and follow up by all units of the Department mentioned above. We hope that the booklet will not only guide the officers of State GST Department but also other departments.

After the decision to develop the series How to do…?, the teams were formed to prepare the draft. This draft underwent series of changes from time to time. Shri Muraleedharan Superintendent (Rtd) and the audit section were ably guided by Shri Ziavudeen then Jt Commissioner. Later Shri Raveendran Superintendent and Smt Beejikumari Jt Commissioner Audit and Inquiry and the Audit section followed up all the actions. I appreciate their contribution.

Dr Rajan Khobragade

Prl Secretary & Commissioner