How to File GSTR – 3B if Sales Return exceed Outward Supply?

A very Good day to all the readers. We have successfully completed 3 quarters of GST compliance and return filing (July’17 – Mar’18) and we must have experienced some or the other practical problems while doing so.

One of the practical issues among them is How to fill GSTR 3-B Form if the Sales return (Credit Notes issued) for any month is more than the actual Outward Supply for that month? Also what if, the ITC claimed for that month is less than the ITC to be reversed (on account of Purchase Returns i.e Debit Notes issued being more than actual Purchases (eligible for ITC) for that month? These issues are most likely to occur in the month of March (i.e. year end) or April (i.e. year beginning).

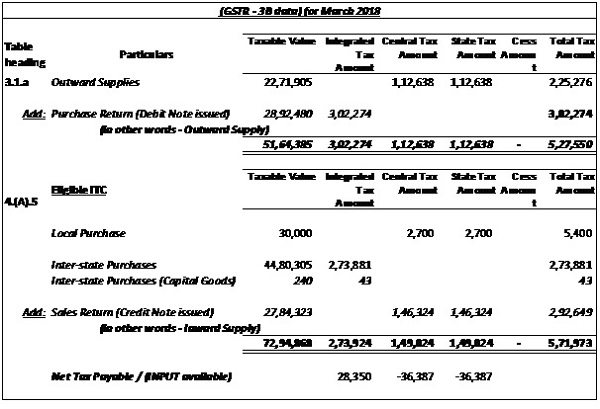

While the GST Department and CBEC has not yet come out with clarification to these problems since the GSTR 3-B Form does not accept figures in the negative. Also the accounting software or ERPs like Tally, Busy, etc show the GSTR 3-B report in the normal general format i.e. Sales – Sales Return and ITC availed – ITC reversed. A screenshot of the same is as below to grasp a clear understanding of the issue. (see attachment – Tally data GSTR 3-B view)

To get the compliances and returns all right and on time, we first need to understand the purpose of Filing that GST Return. GSTR 3-B is a summary form for making adjustments and payments of GST liability and Input Tax Credit for the month. So we need to be extra – cautious in filling the GSTR 3-B Form so that the required Output Liability and the available Input Tax Credit is correctly reflected in the Electronic Credit Ledger.

This brings us to the doorway for solving the above referred problem (in italics & underlined above). While we understand that Sales is an outward supply and Sales Return is an inward supply. Similarly, Purchases are inward supply while Purchase Return is an outward supply. So to get the things right and GSTR 3-B correctly filled and filed, we will have to use this concept of inward and outward supplies.

We shall process the above sample data in the manner as per this table:

1. Outward Supplies

i. Sales – resulting in increase in Output Liability

ii. Purchase Return – resulting in increase in Output Liability (i.e. reduction in Input Tax Credit availed earlier)

2. Input Tax Credit

i. Purchases – resulting in increase in ITC

ii. Sales Return – resulting in increase in ITC (i.e. reduction in Output Liability)

The above screenshot of Tally data of GSTR 3-B can be put as per the above format, as shown below (in the attachment)

While this may seem out of the way, but the purpose of GSTR 3-B is correctly and aptly served while making no errors till the time CBEC or GST Department comes out with proper clarification or guidance note on the above issue. This shall result in overall correct treatment of GST Output Liability and Input Tax Credit availed. Also, there would be no deferment i.e. postponing of Credit and Debit Notes just to avoid negative figures.

After all, the experts have to make a way to deal with such business scenarios even if no guideline from the Government is available. That’s why they are called “Experts” and given the respect they deserve.

Sir If We consider Credit notes in ITC, Then our taxable Output with GSTR1 will not match with GSTR3B output.

will it be ok to move ahead

Dear expert, Please clarify me the following, How to show advance Refund in GSTR3B & GSTR1 respectively? and if advance refund of current months are greater than sales of current month, how to show negative sales in GSTR3B & GSTR1 respectively? and if purchase ITC are made, under which column of GSTR3B & GSTR1, ITC should be reversed? I’ve asked above queries, in many GST meetings,but didnt received a convincing reply, i am expecting from you an expert opinion with detailed reply please?

when we setoff our ITC with Purchase ,,,,..

so how we will setoff our Credit side

How to file GSTR 1 if Sales Return is more than Sales and Purchase Return is more than Purchase Whether we need to file Purchase Return in Debit note .

BATA DE BHAI

From the starting of GST, I used to do the same thing which is quite a simple and common understanding that add Pur ret in sales and sales return in ITC.

But i think you have not seen annual return form or comparison sheet of GST portal which is showing mismatch due to this concept. Also what 2a is showing that much only we are allowed credit in annual return, i think you know this so there also another issue.

I have the same problem in GSTR-3B due to credit notes of sales return to unregistered persons and Composition dealers which is resulting in negative figures which are not possible to show as Minus figure. How should I pass entries. I am using tally ERP-9 software. I can not show this as Inward supply as the basic ledger accounts of parties under sales are in Trade Debtors. Entries are passed under sales account which is outward supply. Also there is issue for Credit notes(unregistered) for sales return which are not showing me in Part 9B of GSTR-1 in Tally ERP-9

Can You please Solve the issue.

D.H.SHAH

(M) +91 9513132779

My problem is , I sell goods1000 Pcs @ 10/- plus 18% igst, Purchaser has returned the goods. he has return 950 Pcs and balance has been waste in testing. pls tell me what entry to be passed. How can adjustment it in gstr-3B form.

Hello Expert,

My problem is , I sell through online site , in aug month i sold an item to an unreg. per to up state and that item i received in sept month then where i show that value (sale return) in 3b because column 3.2 is not accepting negative figure.

plz help me out.

Thanks & Regards

Rahul Sahi

But what about the reconciliation that the department does with 2A?

if i show my sales return in ITC claimed, then it will not match with 2A. what is the solution for that?

if you have excess purchase return then you can show it in 4B itc reversed (2) others.(Any other ITC which has been reversed in the books by you.) hope this will work. try it.

Hello Sir,

My Total Purchase May’18 40,00,000 @ 18 %. My Total Sales 39,00,000 @ 18 %. My supplier Given credit note 3,00,000 @ 18 %. this credit note for incentive & scheme discount for customer. And this discount releted to invoice & date. so Please how to file GSTR-3B. Please Explain me

In case, agr 3b m jo sale, pur show ki h , agr vo

Hmare actual sale s jyada chali jaye then

In there any solution…….

but the problem is that what turnover we have to mentioned in Tax audit report

Nice Article and really a practical Problem.

Another problem is… Exempted Turnovers. In this Case… One Month Companies(with Exempted Turnovers) have only sales.. next month Only Sales Returns. How to file 3B and 1 Returns…. There is no solution

In case of online dealer (on amazon & flipkart) all sales are Interstate & B2C hence need to fill table 3.2 in GSTR3B. But in one state (say GOA) sales return is more than sales which reduce aggregate net sales to be shown in table 3.1 (a). Now issue is how to show GOA in table 3.1 in negative figure?

However what will happen if the credit note is towards wrong tax charging. In one of our case. tax was wrongly charged @ 28% instead of 18%. The credit note issued towards tax only but the tax credit note is more than that months tax liability. i don’t think there is any way out.

Well i believe, by considering Sales returns as Inward supply in 3B will face reconciliation issues while filing GSTR-1. Considering sales returns as inward supply is not correct in my view at the cost absence of clarification or updation from Government.

1st article of Rajat is nice start. keep it up.

Please inform remedy for correction of following inter-state purchase:

The party sends trading material under provisional GSTIN No. in the beginning of the month of April. However, there is some change in the final GSTIN No. What course of action is now available to the purchaser so that ITC can be available against new GSTIN No.

Nice article sir. So for now, GST = confusion.

Nice article it is really felpful. Thank you GST Expert. ?

Very nice article. Thank you GST EXPERT. ?

good suggestion til clarifications

GSTR3B NEEDED TO BE CORRECTED TO ACCEPT FIGURES IN NEGATIVE AND SAME LIABILITY CAN BE OFFSET BY BALANCE IN ELECTRONIC CREDIT LEDGER. NEED TO DO IT URGENT WITH PROVISION TO REVISE EARLIER GSTR3B TOO.

Dear Rajat,

It felt very nice to read the above article, the subject which you took is a major problem nowadays.

However, the attachment in above article is missing and my question to you is how to deal with the situation, suppose outward supplies(Taxable Value) is more than the credit note(Taxable value) but the tax amount in Credit Note (CGST & SGST) is more than the total tax amount (CGST & SGST) in outward Supplies.

For More clarity:

Total Outward Supplies for the month:1000( Taxable value) 36 (IGST) 63 (CGST) 63 (SGST)

Credit Note in the same month: 800(Taxable Value) 0 (IGST) 72 (CGST) 72 (SGST)

I think the above example will help you to ascertain my question ( HOW TO SHOW THE ABOVE DETAILS WHILE FILING GSTR-3B)

What about matching of turnover with the income tax return filed. Means turnover as per GST returns filed should match with the income return tobe filed. In the explanation given it is difficult to match both.

dear expert, i want to know that there is any type of certificate that can be used instead of issuing debit/credit note?

What you said is right we asked this question and also raised query number of times but no response i think it will be adjusted in GSTR-3. 3B also have following issue:-

If we have to reverse Trans Credit of CGST the reversal amount in “other reversal” row also gets auto populated in SGST forcing to reverse SGST although no SGST credit taken

Hello Sir,

I have filed GSTR-3B for March.

After matching Sale as per books & Sale as per Returns, I have found that my tax liability and have promptly paid it off.

The amount paid is showing in my Electronic Ledger.

The payment of difference amount of tax paid is lying there.

My question is how to transfer the amount to GSTIN.

Please suggest a remedy.

Excellent advice. Really Expert Advice