Factoring works mainly on the principle of seller selling the receivables of a debtor to a specialized financial intermediary called a factor. The sale of the receivables takes place at a discount and the ownership of the receivables is transferred to the factor who shall on purchase of receivables, collect the dues from the debtor instead of the seller, enabling the seller to receive upfront funds from the factor. This allows companies to receive immediate cash on their sales without having to wait for payments to come in from customers in due course. With the purchase of the receivables the factor enters the shoes of the seller and dawns the liability under the contract.

The business of factoring in India is regulated by the Factoring Regulation Act, 2011 (‘Act’)[1]. The Act defines the terms ‘factoring business’ and ‘factor’.

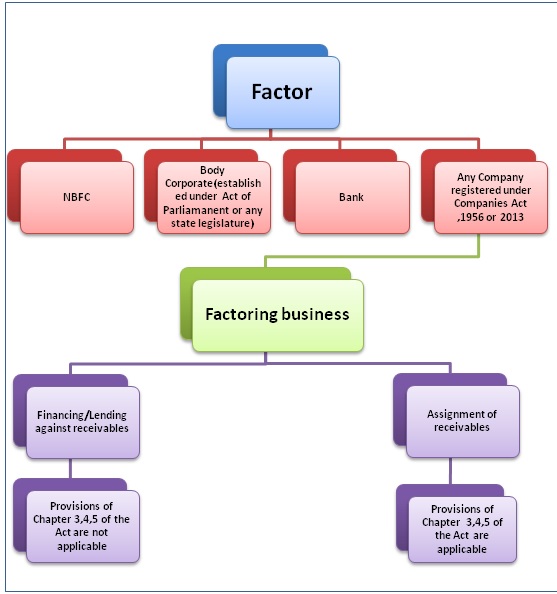

Section 2(i) of the Factoring Regulation Act, 2011defines factor to mean:

“a non-banking financial company as defined in clause (f) of section 45-I of the Reserve Bank of India Act, 1934 (2 of 1934) which has been granted a certificate of registration under sub-section (1) of section 3 or any body corporate established under an Act of Parliament or any State Legislature or any Bank or any company registered under the Companies Act, 1956 (1 of 1956) engaged in the factoring business;”(Emphasis Supplied);

Further, Section 2(j) of the Act defines factoring business which states that:

“factoring business means the business of acquisition of receivables of assignor by accepting assignment of such receivables or financing, whether by way of making loans or advances or otherwise against the security interest over any receivables but does not include— (i) credit facilities provided by a bank in its ordinary course of business against security of receivables; (ii) any activity as commission agent or otherwise for sale of agricultural produce or goods of any kind whatsoever or any activity relating to the production, storage, supply, distribution, acquisition or control of such produce or goods or provision of any services” (Emphasis Supplied)

Further Explanation under the Section 3(2) of theAct defines the principal business criteria for an NBFC-Factor. It states that:

For the removal of doubts it is hereby clarified that a non-banking financial company engaged in factoring business shall be treated as engaged in factoring business as its “principal business” if it fulfils the following conditions, namely:—

(a) if its financial assets in the factoring business are more than fifty per cent. of its total assets or such per cent. as may be stipulated by the Reserve Bank; and

(b) if its income from factoring business is more than fifty per cent. of the gross income or such per cent. as may be stipulated by the Reserve Bank.

Given the above pretext, it is clear that an NBFC principally engaged in the factoring business will be referred to as a Factor under the Factoring Regulation Act, 2011.

For the purpose of definition of factoring business, it can be construed basis that the business has two limbs first being assignment of receivables and second being financing / lending against receivables. However, if one was to read the Preamble of the Act, the focus of the Act was to facilitate assignment of receivables. Therefore the larger construct and substantive clauses in the factoring Act deals with assignment of receivables as also is evident from the reading of Chapter III onwards of the Factoring Act.

Following chart is a graphical representation understanding of factoring business by entities as specified in the Act and the kind of business they may undertake to qualify to be a factor:

With a bit of reflection on the Factoring Act, it seems that there are several advantages in undertaking assignment of receivables vis-à-vislending against receivables as the Act has a greater inclination towards substantively dealing with the assignment of receivables. Below we have enumerated some of the advantages of undertaking assignment of receivables:

With a bit of reflection on the Factoring Act, it seems that there are several advantages in undertaking assignment of receivables vis-à-vislending against receivables as the Act has a greater inclination towards substantively dealing with the assignment of receivables. Below we have enumerated some of the advantages of undertaking assignment of receivables:

Advantages of Assignment of Receivables over Lending against Receivables

1. Registration of assignment/satisfaction of receivables

Section 19 of Act requires every factor in capacity of an assignee to register the particulars of every transaction of assignment and satisfaction of receivables in its favour with the central registry set up under SARFAESI Act, which aims to curb double financing of debtors and safeguards the interests of the factors. The same has been done with the motive of enhancing transparency

2. Exclusive right over the receivable

Section 7(2) of the Act empowers a factoring company to have an absolute right of recovering the receivables and to exercise all rights and remedies of the assignor whether by way of damages or otherwise for recovering the receivables. Such exclusive right is available only to factor who undertakes assignment of receivables.

3. Unaffected by bankruptcy of debtor

Section 7(2) of the Act empowers the factoring company to have an absolute right of recovering the receivables. Further, Section 26 of the Factoring Regulation Act, 2011 states that

“The provisions of this Act shall have effect, notwithstanding anything inconsistent therewith contained in any other law for the time being in force or any instrument having effect by virtue of any such law.”

Based on the above text read with Section 7(2) of the Act we can construe that the factor has an absolute right for recovering the receivables and any provisions contained in any other applicable law which is inconsistent with the provisions of the Act shall not apply to a Factor.

4. Exemption from Stamp duty

Pursuant to the enactment of the Act an amendment was made to the Indian Stamp Act 1899due to which all agreements for assignment of receivables were exempted from stamp duty. Hence, huge cost in terms of stamp duty is saved if one undertakes assignment of receivables as opposed to lending against receivables.

5. Off-Balance Sheet Financing

Customer may hope to put receivables off their balance sheets if the transaction satisfies the conditions of off-balance sheet treatment as specified in AS 30/IFRS 9.

Conclusion

While the business of factoring covers both assignment of receivables and lending against receivables the provisions of chapter 3, 4 and 5 of the Act are not applicable to lending against receivables. In view of the advantages of assignment of receivables over lending against receivable, the Companies may strategically decide to undertake transactions that are in the style of assignment of receivables rather than lending against receivables.

[1]http://voiceofca.in/siteadmin/document/FACTORINGREGULATIONACT_2011.pdf

(Article is written by CS Aman Nijhawan and CS Surbhi Jaiswal who can be reached via email at aman@vinodkothari.com and surbhi@vinodkothari.com respectively. Both the Author are associated with Vinod Kothari & Co.)