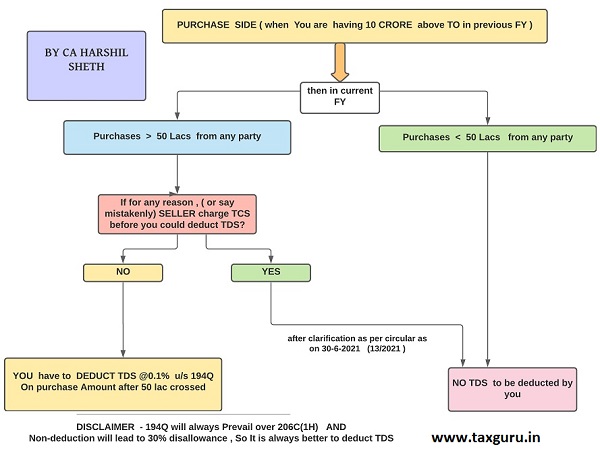

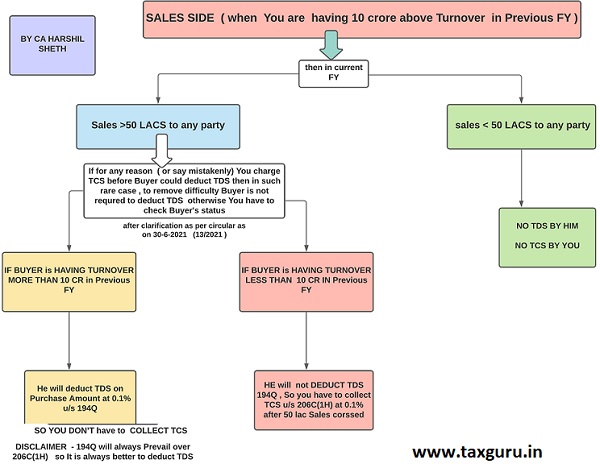

Section 206C(1H) of Incoem Tax Act, 1961 is already applicable from 01-10-2020 and Section 194Q will be applicable from 01-07-2021 Article explains Section 206C(1H) and Section 194Q considering confusions prevailing currently in industry regarding TDS & TCS under both these sections. Article also contains PICTORIAL FLOW CHART OF INTERPLAY BETWEEN Section 194Q VS Section 206C(1H).

First let me tell you my experience with Section 206C(1H) related to TCS on Sale of Goods.

As per Section 206C(1H), A Seller, Having more than Rs. 10 Crores turnover in preceding financial year, is liable to collect TCS from Buyer on Sale of any goods; if amount received from buyer is crossing Rs. 50 lacs.

When TCS on sale of goods introduced u/s 206C (1H) from 1st October 2020, In Industry, There was so much Confusion & Havoc AS if It is completely new taxation introduced. From October -2020, I received calls like hundreds of calls daily just for asking “how to levy TCS? Whether in Invoice or In Debit Note? Whom it is applicable? How to practically implement it?? Trust me still confusion prevails. I am sure all consultants would have felt same. I am still receiving many calls for this.

As per provision, TCS was to be collected on “collection amount received over Rs 50 lacs”. But ALL the big companies started charging TCS on invoices issued from 1st October 2020 only. Even, Proper method would have been “Monthly Debit note” to collect it from Buyer but All Big companies started charging on Invoices. Remember, at year end, Total Amount of Invoices issued and Collection received from buyer will be different.

Even, currently there are numerous confusions amongst all Taxpayers having Turnover more than rupees 10cr

Some are charging on invoice, some are collecting by monthly debit note

Some started collecting from Day 1 (even in FY 21-22)

Some are waiting for collection to be crossing Rs. 50 lacs

Some are waiting Invoices total to be Rs. 50 lacs

Some are not even collecting and waiting for year ending to decide.

This confusion could have been avoided if Provision u/s 206C(1H) would have drafted giving emphasis on INVOICES amount (rather than COLLECTION amount) because all follow mercantile method of accounting and It would have been easy for us to reconcile with 26AS as 26AS would have shown Purchases amount that can be tallied easily with Ledger in books. But unfortunately, really bad drafting without any vision.

NOW, let’s talk about 194Q. From, 1-7-2021, again more confusion will be added in this because 194Q will be applicable.

As per 194Q, section 194Q, ‘buyer’ having turnover exceeding Rs. 10 Crores in the immediately preceding Financial Year require to deduct TDS on liable to deduct TDS at the rate of 0.1% of the purchase value above INR 50 Lakhs at the time of Payment or credit, whichever is earlier.

WHEN 194Q & 206C(1H) will be both simultaneously operational, there will be TOTAL MESS. It will such state that is most confusing for all and endless ping pong between Seller and buyer. It is Going to very messy.

Yes, As per provision, TDS 194Q will have priority over TCS 206C(1H) if on transaction both sections are applicable to buyer & seller respectively. It means that where a buyer is liable to deduct TDS on a purchase transaction under Section 194Q, the seller shall not collect TCS on same transaction on which buyer has already deducted TDS. In other words, the buyer shall have the primary and foremost obligation to deduct the tax.

In theory this is simplistic, But in Practical life, It will be first confusing amongst both to decide whether seller will collect TCS or whether buyer has to deduct TDS. Both need to communicate and convey their side of applicability status

Already TCS Has made mess. I really request Govt. to do away with section 194Q And make only 206C(1H) applicable or vice versa. Otherwise, Each buyer supplier wise, each transaction, you have to decide each time whether which provision will be applicable to whom. Liability will be shifted from one to other on case to case basis. There won’t be any straight way.

TDS on Purchase vs TCS on Sales of Goods

Interplay of 194Q vs 206(1H) on Sales/Purchase of goods apart from those cases when 194Q & 206C(1H) are not applicable

–

what if both the parties are applicable to deduct for tds on purchase or tcs on sale.

Then who is first liable to deduct.

Sir, Tds-Tcs-Gst Pdf Material Available… i Want To buy

Subscriptions sold by Google on behalf of discovery, who will be liable for TCS?

Sir,

My Question is :

If we will purchase the raw material from a supplier and after the manufacturing , we will sell to same supplier than what will TDS rate applicable under 194Q ?

Sir,

If we will purchase the raw material from a supplier and after the manufacturing , we will sell to same supplier than what will TDS rate applicable under 194Q ?

DEAR SIR, OUR COMPANY HAS CROSSED RS.10 CRORES BUT THE SELLER HAS ADDED TCS INSPITE OF INFORMING AND SENDING DECLARATION THAT WE HAVE CROSSED 10 CRORES THEN WHAT TO DO SHOULD WE STILL PAY TDS ON THAT PURCHASE MADE

Dear Sir

Please guide me ……….

our company sale and purchase both transaction in one company

so please tell me we are

sale bill TCS show

Purchase bill TDS deduct

please guide as per new TDS and TCS ruls,,,,,

thanks

9099051762

Haresh

The obligation to deduct or collect tax in a transaction should be fixed either on buyer or on seller. Here both of them may avoid TDS or TCS due to their their own reasons. As a result the purpose TDS or TDS will fail.

Hence the government have to stick on either Sec. 206C(1H) or section 194Q and not both.

The amount ofbtax terrorism this government is carrying out is not less than a direct gun shot to a tradee. How does a trader whos margins are miniscule afford to do business . The gst itself had 1500 changes since inception bc this is becoming a pain to do business in.India

Sir,

All the CA’s should come together and communicate this to CBDT inorder to avoid confusion and complication in accounting and compliance. Can you please ask CBDT to have a simplified rules and also please ask them to have a view from accounting treatment. Thank you

“All the CA’s should come together and communicate this to…”

Should not, from a pragmatic viewpoint, it is the ICAI , besides other professional regulatory bodies- who do not fail seize every given opportunity to claim/proclaim to have ‘ partnered’ with the government in ‘nation building’- make a departure from the routines, venture to rise to the occasion , and do so, in the national perspective, for THE COMMON GOOD !?!

Hope those are listening !

Message (a selective pick) (:

“WHEN 194Q & 206C(1H) will be both simultaneously operational, there will be TOTAL MESS. It will such state that is most confusing for all and ENDLESS PING PONG between Seller and buyer. It is Going to very messy.”

FONT< In essence, THE RULE of the GAME stands OVERRULED; for that matter, as distinct, ' the game ' has its own set of RULES, invariably followed to the end; unlike GST, which has, as commonly and widely grieved about in concerned tax professional and other circles, no set standard RULES but being kept tinkered with, as it suits the TAX Authorities (not barring the ' GST central Council'), on its own whims and fancies,? If incited, suggest to watch the VIDEO on the novel ‘Ping Pong Gun Game’!

Back/ OVER to GST law experts (within and outside the governmental portals) , for FEED , on mixed dilemma both buyers and sellers seem to be equally confronted with !

Whether 194Q is applicable from July ? I think its included in budget but no notification or circular issued on this

True with compliances already complicated & confusion adding to the fiasco!!!

Hello Sir,

My question is more towards seller side.

So here would like to know more from seller perspective do we(seller) have to show TDS amount on the invoices and post that amount to separate GL?

Does TDS impact on eDocument, how TDS should react to eDocument?

Accumulatio period will start from 1st April 2021 or 1st July 2021?

SALES SIDE – What if your Buyer says that yes his Turnover is above 10Cr and at the time of payment he dont deduct TDS. The liability will arise for whom Buyer or Seller ?

So on every transaction you have to ask your Buyer that is your Turnover above Rs. 10 Cr. and then you have to prepare the Invoice and add TCS.. Its really confusing and messy