Report deals with 1. Issues that give rise to frivolous litigation. 2. Issues that impact the quality of representation and effective management of litigation. 3. Systemic issues impacting effective litigation management and how to deal with these issues.

Comprehensive Roadmap to Minimize Litigation and Strengthen Litigation Management

Report of Committee constituted by CBDT

(OM No.279/Misc./M-26/2016-ITJ (Pt.)

dated 5.9.201 6)

CONSTITUTION OF COMMITTEE & TERMS OF REFERENCE

The CBDT vide OM No.279/Misc./M-26/2016-ITJ (Pt.) dated 5.9.2016 constituted a committee comprising of the following officers:-

| Ms. Sunita Bainsla, CIT(OSD) (L&R) | Chairperson of the Committee |

| Mr. Niranjan Kouli, CIT (J), Delhi | Member |

| Ms. Ruchika C. Govil, ADG (L&R)-I | Member |

| Ms. Meeta Sinha, ADG (L&R)-II | Member |

| Mr. Anurag Goyal, CIT (OSD)(NJRS) | Member |

| Ms. Shumana Sen, Addl. DIT (L&R)-I | Member Secretary |

| Mr. D.S. Rathi, DCIT (OSD)(ITJ) | Member |

The mandate of the Committee is to provide a comprehensive roadmap for minimizing litigation by the Department and for strengthening all aspects of litigation management. While framing the roadmap, the Committee has been directed to consider the following material- .

1. Hand book of judicial matters published by CIT (J), Delhi.

2. Note of the Revenue Secretary dated 22.8.2016

a. Review of the functioning of the institution of CIT(J)

b. Review of the NJRS, how successful has it been so far and are there any problems relating to its implementation etc.

c. Consider suggestion of nomination of competent advocates by the HC for engagement as Dept. counsels apart from the normal mode of calling applications

3. Observation given by the Hon’ble Bombay High Court in the case of TCL India Holding Pvt.

4. Observation made by the CVC in their letter dated 10.11.2015

5. All other relevant material made available to the Committee.

The copy of the Office Memorandum issued vide F.No.279/Misc./M-26/2016-ITJ- Part-II dated 5th September, 2016 regarding constitution of the Committee is placed as Annexure-A.

Chapter 1

BACKGROUND

1. Litigation is an inherent component of any modern tax administration as it provides an opportunity to correct procedural, factual, legal errors and also helps in crystallizing the law. Hence, litigation per se is not a cause of concern. What is of concern is the quantum of appeals, quality of issues litigated and the actual conduct of litigation.

2. Increasing economic activity in the country, opening up of the economy to international transactions, rising incomes, complexities in commercial transactions etc. have given rise to complexities in tax administration as well as varied interpretations of the tax law, resulting in increase in litigation. The position of pending litigation as per available data is as follows:

|

Appellate Level |

Taxpayer | Revenue | Total Pending |

Data updated till |

| CIT(A) | 2.58 Lakh | – | 2.58 Lakh | As per the monthly report on disposal of appeals by CIT(A) as on 1st April 16 |

| ITAT | 58492 | 32630 | 91122 | As per report collected from ITAT as on 1st April 2016 |

| High Courts (from data of 10 High Courts listed below)1 | 10179 | 23508 | 32211 | From data compiled in NJRS as per details below |

| · High Court of Bombay | ||||

| o Bombay Bench | 3127 | 7595 | 10722 | 01-Aug-16 |

| o Aurangabad Bench | 91 | 420 | 511 | 25-Jan-16 |

| o Nagpur Bench | 78 | 448 | 526 | 02-Mar-16 |

| · High Court of Gujarat | 1476 | 4180 | 4180 | 02-Nov-15 |

| · High Court of Delhi | 1486 | 3505 | 4991 | 06-Aug-16 |

| · High Court of Karnataka | 294 | 1465 | 1759 | 09-Dec-15 |

| · High Court of Andhra Pradesh | 956 | 1875 | 2831 | 09-Jun-16 |

| · High Court of Kerala | 468 | 449 | 917 | 15-Jun-16 |

| · High Court of Punjab & Haryana | 802 | 1318 | 2120 | 09-Dec-15 |

| · High Court of Madhya Pradesh* | ||||

| o Jabalpur Bench | 485 | 679 | 1164 | 25-Aug-16 |

| o Indore Bench | 284 | 234 | 518 | 25-Aug-16 |

| o Gwalior Bench | 20 | 70 | 90 | 25-Aug-16 |

| · High Court of Chhattisgarh | 38 | 42 | 80 | 04-May-16 |

| · High Court of Orissa | 574 | 1228 | 1802 | 16-Jun-16 |

| Supreme Court | 1600 | 3981 | 5581 | 22-Aug-16 |

3. Over the last few years, and particularly since the year 2014, CBDT has taken several steps to reduce litigation. A few are listed below–

i. Setting up of an Institutional mechanism to resolve Contentious Legal Issues and to formulate Departmental View/Settled View2. A Central Technical Committee (CTC) and Regional Technical Committees (RTCs) have been created at the level of CBDT & Pr.CCIT Charges respectively. Till Date, 14 circulars have been issued on Settled Issues/Departmental View, with directions to withdraw/not press such Departmental appeals. Other clarificatory circulars have also been issued on contentious issues by the Board.

ii. Increase in monetary limits for filing appeals with retrospective applicability, with directions to withdraw appeals covered by the new monetary limits3

iii. Collegium approach to check mechanical filing of appeals to HC 4

iv. Officers working as part of the Dispute Resolution Panel (DRP) have been given DRP work exclusively from January 2015

v. The Finance Act 2016, w.e.f. 1.6.16, provides that no appeal is to be filed to the ITAT by the Department against orders of the DRP

vi. The Dispute Resolution Scheme 2016 has been introduced with the sole aim to reduce litigation & collect taxes.

vii. Increasing number of Advance pricing agreements are being entered into between the international taxpayers and the Department

viii. In order to restrict reopening of cases relating to retrospective amendments w.e.f. 1.4.1962, the matter is to be screened by high level Committees5.

ix. CBDT Instruction No. 9 of 2006 mandated that remedial action be taken, including reopening, 263 etc., even in cases of non-acceptable Audit Objections to safeguard revenue. This Instruction has since been revised to address the issue of litigation naturally arising out of the remedial actions taken6.

x. A committee has been constituted at every Pr. CCIT charge to look into grievances of high pitched assessments and if need be, take appropriate stand before the CIT(A)7.

xi. Extensive workshops by the Directorate of Income Tax (L&R) at various field stations and Training Institutes to sensitise/train officers about improving quality of litigation.

xii. Implementation of the National Judicial Reference System (NJRS) project as a robust tool for effective litigation management. The project achieved Go-Live status on 1.9.15

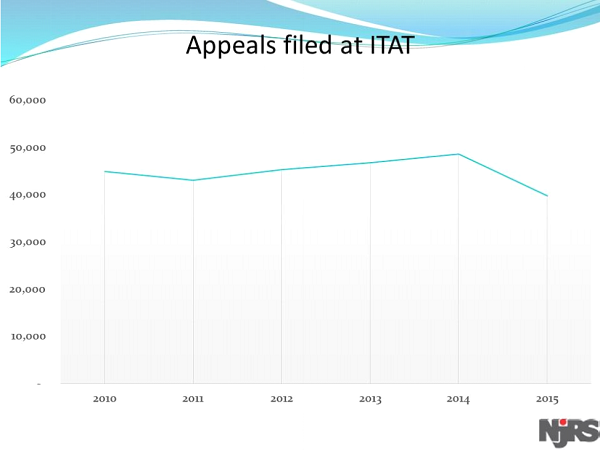

4. The above measures demonstrate that the year 2015-16 was a watershed year with tremendous focus of CBDT on Dispute Resolution. Resultantly, the number of appeals filed annually have started showing a declining trend, as is apparent from the diagram below:

5. However, the absolute numbers are still very high. The proportion of cases escalating to higher appellate levels after each stage is also very high, as depicted by the following diagram (for FY 14-15).

6. Such large number and the high proportion of appeals escalating to higher levels, are a matter of grave concern. This has also been pointed out by several committees8 in the past.

7. The management of litigation by the Department at the various appeal stages has also drawn adverse comments from the authorities9. Time and again the High Courts have made scathing observations about the merit of the appeals filed and the quality of representation by the Department. Other stakeholders have also pointed out the urgent need for the Department to take corrective measures for improving litigation management10. The CVC has also pointed out instances of inexplicable delay in filing appeals.11

8. Therefore, to supplement the various initiatives already taken, a comprehensive roadmap is required to consolidate the efforts, fill remaining gaps, and thereby have a robust and effective system of Litigation Management in the Department.

Chapter 2

METHODOLOGY ADOPTED BY THE COMMITTEE

1. The Committee was of the view that considerable work has been done in identifying the reasons that contribute to large volumes of litigation in tax cases and other problems in litigation management. Accordingly, the Committee decided to examine the earlier reports on the subject. It went on to identify gaps and deliberated upon possible solutions to the issues in their totality (Chapter-3). The issues and solutions were then consolidated using a rational and practical approach from an implement-ability perspective for a comprehensive litigation management roadmap (Chapter-4).

2. Considering the short time available to it, the committee did not have the time to undertake in-depth stakeholder consultations and field visits. However, Ms. Sunita Bainsla, CIT (OSD)(L&R) and Mr. Anurag Goyal, CIT (OSD)(NJRS) interacted with Members of the ITAT, during a training program held for ITAT members in the first week of September 2016 at NADT Nagpur. A report of the interactions is placed at Annexure B. Niranjan Kouli, CIT(J), Delhi interacted with a few Commissioners and other CsIT(J) on some of the issues deliberated in the meetings of the Committee. The Committee also deliberated upon the order of the Bombay HC in the case of TCL India Holdings Pvt. Ltd dated 12.7.2016 and the letter of CVC dated 10.11.2015. The handbook of Judicial matters prepared by the CIT(J) Delhi was also considered.

3. The Committee reviewed the role of CIT(J) and HCC at present and deliberated the measures to strengthen the same. It also looked into the Implementation of NJRS as an effective tool for litigation management

Chapter 3

ANALYSIS AND RECOMMENDATIONS

This Chapter outlines the problem areas and recommendations for a roadmap for effective litigation management. The Committee classified the issues in the following baskets –

1. Issues that give rise to frivolous litigation.

2. Issues that impact the quality of representation and effective management of litigation.

3. Systemic issues impacting effective litigation management

Detailed analysis and recommendation against each of the above is given in the following paragraphs

1. Issues that give rise to frivolous litigation:

1.1 Officers inability to take a decision not to file an appeal –

Primarily two factors contribute to the officers not being in a position to decline filing an appeal.

a) Fear of adverse administrative action –

At present there is no adverse consequence if an appeal is filed without merit. However, there is a possibility of strong adverse administrative consequences even if one case is erroneously left out.

- Therefore, confidence building measures should be adopted to reduce such fears in case of bonafide non filing of appeal in weak/inappropriate/covered cases. Simultaneously, routine frivolous authorizations to file a further appeal which is neither supported by legal precedents, nor based on perversity of facts must be discouraged12.

b) Lack of information/knowledge on judicial precedents –

Appeals are often filed because of non-availability of precedents or the lack of knowledge thereof with officers.

- The use of NJRS should therefore be insisted upon as it provides requisite information.

- Frequent training on judicial matters is required to be conducted.

c) Attempt to defend weak and hasty assessments –

In cases where there is apparent tax evasion but the order is weak in terms of the evidence collection or marshalling of facts, there is a tendency to file an appeal in an attempt to save the assessment. Such a practice simply leads to redundant litigation. An important reason for weaknesses in assessments is overload of assessments to be disposed within the limitation period. Therefore, the workload with an AO is required to be rationalized.

- The workload of assessment should not be allowed to be increased over a predefined number of cases for any AO. Hence, fresh scrutiny assessments for a year should be limited based on the number of already pending cases with an officer. This will allow for more time for evidence gathering and writing of orders.

1.2 Fear of penalty u/s 271(1)(c) is a major cause of first appeal –

Penalty u/s 271(1)(c) is routinely initiated by the AOs. It is important to check indiscriminate initiation of penalty u/s 271(1) (c) as this results in compulsive filing of appeal by the assessee against the assessment order (and also against the subsequent penalty order) thereby escalating litigation. Worryingly, only about 6 % penalty orders are sustained by the ITAT13.

- Therefore, the Act should be amended to provide that the initiation of penalty is to be done with the approval of the Range authority. This will ensure that the penalty u/s 271(1)(c) is initiated only in appropriate cases.

- Training on the amended provisions of section 271(1)(c) needs to be imparted without any delay (and also on a regular basis). Such training should not be confined to RTIs, as only a handful of AOs are able to go to the RTIs. This will help in AOs making legally sound penalty orders and frivolous litigation on the issue will be contained.

1.3 Repetitive appeals to keep the issue alive –

If an issue recurs over several AYs in the case of an assessee, an appeal filed in one AY is required to be repeated in the subsequent AYs, thereby adding to the burgeoning litigation. The Act has already been amended (section 158AA) to contain such litigation at the level of ITAT. There is a need to encourage use of section 158AA to avoid repetitive appeals solely to keep the issue alive.

- In order to ensure that section 158AA is used effectively, a column should be added in the CSR to indicate whether the case is covered by the section.

- Section 158AA is only applicable for appeals to ITAT. Section 158AA could be extended to appeals to the High Courts.

2. Streamlining Litigation Management by Improved Representation

At ITAT

2.1 Availability of information with DRs –

The DRs are constrained in their working because of the non-availability of complete information about judicial precedents on a case. DRs are also constrained by nonavailability/delayed availability of records and information from the field officers.

NJRS is today the largest database of judicial precedents in the country. The appeal folders are also available in the scanned format in NJRS. Thus the information required by a DR is largely available in NJRS. Assessment record can also be requisitioned through NJRS. Hence,

- The use of NJRS by the DRs and Standing Counsels should be encouraged.

2.2 Workload management –

DRs have a High Workload with a large number of cases fixed daily, which effects the quality of representation. Moreover a significant number of cases get adjourned and the time of the officers is thinly spread due to adjourned cases.

- The issue can be addressed by requesting the ITAT to reduce daily number of cases but insisting upon productive hearings by discouraging adjournments

- Once the pendency of cases at CIT(A) level is reduced, the Pr CCIT should be enabled to divert some posts of CIT(A)s to the ITATs.

2.3 Posting of Officers on Rotation basis at ITATs –

The practice of deputing officers on a rotational basis to argue cases before the Tribunal was initiated to tide over immediate requirements. However, this practice has become a norm to the extent that in some places, a regular DR has not been posted at all. The officers posted on rotational duty are not equipped in terms of knowledge of the court craft and procedures, past precedents etc., which impacts their ability to argue cases effectively14.

- The practice of posting officers on a rotational basis for short durations at the ITATs should be done away with and regular officers must be posted.

2.4 Research Support and Infrastructure–

The DRs are constrained by the lack research support. Research support is essential considering the volume of litigation and the diversity of the issues involved. Research support is available to officers doing specialized work in other organizations (e.g. Niti Ayog, NGT, Law Commission, TRAI, NHRC etc.)15. Therefore,

- Research support should be provided to DRs. This will have an added advantage of preparing future regular counsels for the Department who would have had adequate exposure to the working of the Department16

2.5 Incentivize posting at ITAT –

Representing a case at a Tribunal/Court is a specialized skill and not every officer has the capability and interest in the work of a DR. Therefore there is a need to attract willing and capable officers to the ITATs.

- Steps should be taken to incentivize posting and good performance at ITATs, such as rewards on Department’s appeals successfully argued and won, training opportunities, special allowances etc. The awards may be started in this FY itself based on an analysis of the cases already decided.

- An annual event should be organized on an all India basis, preferably in collaboration with the ITAT to recognize the good work done by the officers posted at the ITATs. Commendation letters can be presented as a recognition for the officer’s outstanding The event will also facilitate exchange of ideas amongst DRs as well as with the Members of ITAT.

- Manpower as per the sanctioned posts of officers at the ITAT should necessarily be

- The transfer and posting guidelines relating to posting at a place of choice after a stint at ITAT is should be followed.

- The Department should create a pool of officers specializing in various aspects of taxation. Such officers can be called upon whenever a particularly intricate case/issue comes up before any ITAT bench in the country. For their specialized services such officers should be paid a respectable honorarium.

- In order to prepare future DRs, a practice of sending officers as observers to the ITAT and HCs for a few days every year should be initiated. This will help them in understanding the requirements of the job, learn about common weaknesses in the assessment orders and also about arguments taken at the Court/Tribunal and about court craft.

At High Court –

2.6 Panel Size of standing counsels –

The existing practice of engaging a limited panel of counsels is found to be a handicap as it does not allow for any choice based on expertise neither does it allow for any incentive for good performance. Department is unable to drop ineffective counsels for fear of lack of representation on the hearing dates.

- A larger panel of Counsels is required to improve competition and provide larger The increase should be decided based on the existing size of the panel. Larger panel with varied expertise will allow flexibility in assigning cases based on expertise. The increase in panel size may vary from 100%-200%.

2.7 Engagement of Senior Advocate –

The existing guidelines for engagement of counsels do not specifically provide for inviting Senior Advocates. The approved fee structure indicates that the Department does not expect Senior Advocates to apply. At the Supreme Court level, the Department is represented by the highest law officers of the country. However at the High Court level, the representation is by panel advocates where no Senior Advocate is available. The Bombay HC in TCL Holdings Pvt. Ltd has also expressed anguish that the revenue does not have even a single Senior Advocate on its panel. In fact it has observed that revenue must ensure that it is properly represented. This will be possible when meritorious advocates are appointed to represent Revenue.

- CCITs should be empowered to engage Senior Advocates on need basis without the need to consult the CBDT/Law Ministry as the time available is invariably short.

2.8 Briefing of Counsels –

Instances have come to notice when the counsels were not properly briefed by the officers concerned. In some charges, the counsels are not being consulted in framing the Questions of law (QoL)17. As a result, the counsels find it difficult to defend a pre-formulated question of law and neither do they feel empowered to alter the question of law subsequently.

- There are existing guidelines on the issue. It is part of the duties of the counsel to formulate the QoL while preparing the petition. The field formations may be sensitized about these guidelines18

- There is a need for exhaustive and timely briefing by the AOs/Range officers to the counsels to ensure that the Departments stand is clearly explained. This will also ensure that the counsel has the required files and documents at the time of hearing. Existing guidelines on the issue may be recirculated.

- The daily proceedings should be recorded by the HCC/Counsel in the NJRS for subsequent Standing instructions already exist for the same and are required to be enforced by the Pr CIT/CCIT.

2.9 Expeditious curing of defects in appeal memo at High Court –

Department has lost a number of cases when the defects were not cured on time/after several opportunities were granted by the Court. This has also been taken note of by the CVC. Proper filing of the appeal is the responsibility of the Department. Accordingly, the coordination between the counsels and the Department needs to be improved.

- The CBDT has already approved creation of official email IDs for the counsels. The usage of the same must be insisted upon. This will ensure that an audit trail of the communication with the counsels is available. It will also ensure that responsibility can be fixed in case of any lapse.

- The field officer (all in the hierarchy) must also regularly check NJRS/court websites for the status of the case.

- The payment of fees to the counsels should be compulsorily linked to error free filing of appeals

2.10 Timely payment of bills of the counsels –

This has a direct bearing on the motivation of the counsels. The instruction No 3 of 2012 and the recently revised instruction on the subject were examined and found to have certain anomalies/ambiguities, which may give rise to differences with the counsels on the issue of payment of fee. Detailed note on the same is placed at Annexure B.

- The instructions regarding working of the payment of fee to counsels need to be modified.

3. Systemic Improvements for better litigation management

3.1 Resolving Frequently Litigated Issues –

A widely contested issue should be addressed by CBDT before it results in an epidemic of frivolous litigation. A large volume of litigation is concentrated around a few issues and sections. The volume of such litigation can be reduced by adequately amending the provisions or by clarifying the legal provisions through circulars. Towards this end, work on the Settled/Departmental view circulars has already been initiated in the Directorate of Income Tax (Legal & Research) and the work is being appreciated by the Tribunal and High Courts. A status note on the working of the CTC is available at Annexure D. The working of the CTC needs to be strengthened to make it more proactive. The following measures are suggested:

- Adequate manpower should be provided to the CTC secretariat and participation of the members in the meetings of the committee has to be ensured.

- The regular flow of contentious issues must be ensured –

- The RTCs should meet on a regular basis and to ensure the same, the RTC work should be made part of CAP or some such report.

- The data of most contentious issues at the level of the CIT(A) could also be taken periodically from ITBA by the CTC.

- CTC should also solicit areas of concern from the public at large, market associations, professional bodies and academic institutions etc. Besides making the tax policy more interactive, it will also improve the image of the Department as a responsive tax administration19.

- Publicity and training about identifying, analyzing and proposing contentious issues for consideration by the CTC should be intensified through the RTIs and NADT.

- The Directorate of Income Tax (L&R) and others have flagged a number of issues to TPL to carry out suitable amendments. Early action on the same will go a long way in immediately reducing frivolous litigation.

3.2 Strengthening of Assessments on procedural issues –

Discussion with the Members ITAT20 and the DRs, the experience of the Officers in the Directorate of Income Tax (L&R) and views of the other Committees21 highlight the need to strengthen assessment orders. Often assessment orders suffer from procedural errors (service of notices, opportunity of hearing, reopening etc.) as well as repeated mistakes on some common issues – such as in assessments of cases involving section 68, 147 etc.

- A Handbook of Assessing Officers giving procedural guidelines for framing assessments on frequently litigated issues should be taken out periodically. The work should be done by the Directorate of Income Tax (Legal & Research) through expert committees, where besides Departmental officers, experts from outside should be well represented. This should be followed up with frequent trainings through the RTIs and NADT.

- A small handbook of Standard Operating Procedures (SOPs) on the procedural aspects of assessments should also be prepared for assessing officers.

3.3 Coordination with Courts/Tribunals –

The tax litigation is prone to long time being taken at each Court. One reason is the lack of specialized tax benches at some of the High Courts.

- The Pr. CCITs can request the Chief Justices of the jurisdictional High Courts to constitute temporary tax benches to liquidate the pendency. Similarly, there should be frequent interaction with the ITATs to sort out administrative issues, if any, by way of institutionalized coordination meetings with the Pr. CCIT on a quarterly/half yearly basis.

3.4 Coordination with the Ministry of Law-

The proposals for filing SLPs at the level of the SC are routed through the Ministry of Law. A similar practice is being followed for appeal to the HC at Kolkata. It has been the experience that the Central Agency Section of the Law Ministry sometimes takes inordinately long to file the SLPs even after extensive follow up by the Directorate of Income Tax (L&R). Similar experience is at Kolkata. These issues are already in the notice of CBDT and efforts are being made to address in the issues in consultation with the Ministry of Law. No further recommendation is therefore being made in this regard.

3.5 Periodic Review and withdrawal of pending appeals at ITAT, HC and SC –

An issue may get litigated extensively by the Department for the reason that when the controversy arose in some earlier years/earlier cases, the appeals were filed by the Department in higher forums such as HC/SC. However, legislative changes in the Act or a subsequent Court ruling, makes the old pending appeals on the same issue infructuous.

- A periodical exercise should be undertaken to review the appeals and withdraw all such pending appeals that have been rendered infructuous due to subsequent change in law or court rulings. Such issues should be identified by CTC and should be circulated through NJRS for withdrawal of appeals. However, the secretariat of CTC is required to be properly staffed in order to enable it to discharge this additional responsibility effectively.

3.6 Strengthening of Litigation functions –

a) Role of CIT (J) and HCC –

The Institution of CIT(J) was created with the sole objective of strengthening the Department’s litigation management functions at the High Court level. A detailed note reviewing the working of this institution is placed at Annexure C. The committee observed that there is an immediate need to strengthen this institution. The committee recommends that –

- A team of adequate, and competent manpower should be provided to enable it to discharge its functions more effectively including for identification of cases for bunching of appeals at High Court.

- Special trainings for the officers and staff of the CIT(J) should be carried out periodically to enable them to better utilize NJRS. If the Pr.CIT and the CIT(J) use the NJRS extensively, most of the CIT(J)s functions can be discharged with greater ease and efficiency through the NJRS

- Access to SLP search of NJRS should be provided to CIT(J)/field formations

- Data of SLPs pending, SLPs proposed but not approved by the Board, Departmental views regarding filing of SLP on a particular issue, whether SLP admitted/dismissed is based on merits or not etc., available with the DGIT (L&R) should be made available on the NJRS to be accessible to the CIT(J) and field formations.

- As member secretary of the RTC, the CIT(J) should ensure regular meetings of the RTCs so that contentious legal issues are identified to formulate Departmental view.

b) Educate field formations about Departmental guidelines on judicial processes –

The information relating to judicial matters/processes, counsels, SOPs on filing of appeals etc. is not readily available with all officers. Resultantly, officers commit mistakes, including of delay in judicial matters. The information should be compiled and provided to all Officers.

- The handbook on judicial matters and procedures etc. published by the CIT (J) in Delhi, should be similarly published by all CIT(J)s for their regions. It should be modified to incorporate the local information/guidelines if any pertaining to that area.

3.7 Implementation of NJRS –

The National Judicial reference System (NJRS) project was conceptualized to provide a robust support system for litigation management for the entire Department by using ICT. A review of the implementation is placed at Annexure E. The Committee noted that NJRS is a robust tool for effective litigation management and for reducing litigation, if utilized widely. NJRS has been designed keeping in mind the commonly occurring problems in litigation management like lack of information about judicial precedents, non-availability of records, status tracking, pending issues, frequently occurring issues, bunching, reporting, audit trails etc. If utilized widely, most of the issues identified in the above paras will be taken care of over a period of time.

The beta version of the NJRS went live on 15.3.2015 and it is a full year since the system achieved complete Go-Live status on 1.9.15. The Login footprint indicates that the system is not being used as much as it is required to be used. The administrative authorities are not enforcing the use of the NJRS in day today discharge of responsibilities.

Accordingly, the following steps are recommended for strengthening NJRS and taking best advantage of this excellent initiative:

- The Pr. CITs have to take a lead in ensuring that the officers working below them internalize the culture of regularly referring to NJRS while framing assessments, writing CSRs, working on RTC proposals and for monitoring of appeals. The HCC/SCC/L&R/DRs are the key functionaries in litigation management. Their utilization of NJRS is to be ensured to keep the system robust and effective.

- Training on NJRS for trainers has already been conducted at NADT. The RTIs must now ensure that periodic sessions on NJRS are taken by them as part of their regular training NADT must also include exhaustive training on NJRS to the probationers before they are given field postings.

- The Pr. CCITs should be requested to task their offices for improving coordination with the courts. This will also include scanning of files at the scanning centers or obtaining e-files from the courts.

- NJRS Project office should be strengthened by posting adequate manpower. The project will continue to require constant steering. It will also require coordination with several agencies which cannot be left to the Implementation Agency alone.

- At present, the collection of data for NJRS is a bilateral arrangement between the

Department and each Court individually. Follow up with each court is required to be done

separately. Ministry/DEITY should be requested to institutionalize the provision of data

from the courts for projects like NJRS.

- DEITY should also be requested to standardize the court data (at least the sharable data fields) as part of the Government of India Metadata and Data Standards so as to simplify the collation of data in NJRS and such other project as may come up in future.

- The Pr. CCIT office, DR(Admin) & CIT(J) have to play a proactive role in ensuring coordination with the respective HC for data collection and scanning of appeal records to ensure long term sustainability of the project.

3.8 Strengthening the Institution of CIT (A)-

As suggested by the RSNC22, the institution of CIT (A) needs to be strengthened. Detailed actionable suggestions have already been made by RSNC and are therefore not been repeated.

3.9 Strengthening Alternative Dispute Resolution Mechanisms –

As suggested by the RSNC23, the Alternative Dispute Resolution mechanisms should be adopted, strengthened and encouraged – both at the stage of assessment as well as thereafter. The issue is not being discussed in detail in this report as the same has already been done at length in the RSN Committee Report.

3.10 Public consultations on draft amendments –

The practice of framing tax laws without public consultation on the draft amendments is contrary to what is done for other laws in the country. This practice often results in legislative changes that become highly disputed on account of varied interpretations eg. Section 14A, 2(22)(e), 80(IB)(10) etc.

- Amendments sought to be made to the Act should be widely deliberated in the public domain. Proposed intent and proposed draft legislative amendment should be shared with all stakeholders. Response received is likely to help draft a less dispute prone legislation.

3.11 Instill a culture of according priority to litigation management –

The volume of pending appeals is very similar to the volume of the assessments done every year i.e. around 3.8 Lakh. The time and effort deployed in these two areas is not comparable as the focus is primarily on assessment and collection of taxes. The Central Action Plan24 of the Department does not have any Key Result Area (KRA) related to litigation management. There is only 1 Chapter out of 14 which only lays down the quantitative targets for the CIT (Appeals). There is no mention of litigation management at the level of ITAT, HC and SC. The tenor of the Central Action Plan is highly tilted towards revenue collection. Assessment is seen as a means of high revenue collection rather than as a tool for creating deterrence. Such an approach results in high-pitched assessments and consequential futile litigation.

The field formations appear to be under an erroneous belief that they have no responsibility in appeal matters once the counsel has been briefed. This naturally impacts the effectiveness of litigation management in the Department. Therefore,

- The Central Action Plan must include KRAs related to litigation management.

- CCITs/Pr.CITs have to instill in their subordinates that Litigation Management is an equally important task as compared to assessments and collection of tax.

3.12 Initiate a practice of giving prestigious awards to officers for exemplary work –

At present the outstanding work done by an officer of the Department does not get any recognition while the peers in other services are regularly rewarded. The CBDT must institute rewards similar to the Home Minister’s Medal awarded to the Police personnel for meritorious services.

- The exemplary work done by the Departmental Officers must be recognized by instituting a Finance Minister’s Medal for the most outstanding officer of the year. This is necessary to instill a sense of pride and devotion to duty in the Departmental officers. It is also necessary to nationally acknowledge an outstanding officer.

Chapter- 4

THE ROADMAP

With more than 1.8 Lakh appeals being filed annually and more than 3.8 Lakh appeals pending at various stages at any point of time, the task before the Department of reducing litigation and streamlining litigation management is humungous. The current situation demands serious and concerted efforts by the Department. Accordingly, the following Roadmap is proposed-

Immediate measures to minimize litigation –

1. Central Action Plan must include KRAs related to litigation management.

2. Cap the number of annual scrutiny cases per AO. The cap be kept low to allow reasonable time for enquiries and assessments.

3. Reduce scrutiny assessments significantly for a period of 3 years to give primacy to litigation management during this period.

4. Empower the CTC to discharge a more proactive role as Settled View circulars have proved to be very effective. Provide adequate manpower to the CTC secretariat; Activate RTCs; Release Settled view/Departmental view circulars on contentious issues more frequently.

5. Strengthen and incentivize the DRs at ITAT. Discontinue the practice of posting DRs on rotational duty. Provide Research support to DRs i.e. Research Associates. Work of a DR is tedious, recognize the contribution of DRs through reward schemes/commendation letters Regularly organize an annual all India event in partnership with the ITAT to increase coordination with ITATs and to recognize the good work being done by the DRs.

6. Review and withdraw appeals at ITAT/HC/SC level that have been made infructuous on account of later legislative changes or court rulings.

7. Request HCs to constitute tax benches to liquidate the pendency. The benches can be created temporarily as a short term measure.

8. Initiation of Penalty u/s 271(1)(c) with approval of the Range authority. This will require an Penalties are a major contributor to appeals and the success rate is also low.

9. Extend section 158AA for appeals to the HC.

Continuous improvements for effective litigation management

10. Instill a culture where litigation related work is also a priority. CCITs/Pr. CITs have to instill in their subordinates that Litigation Management is an equally important task as compared to assessments and collection of tax.

11. Alternative Dispute Resolution mechanisms need to be adopted– both at the stage of assessment as well as thereafter.

12. Mandate use of NJRS for day to day work. NJRS is a robust tool available with the Department for litigation management, as well as for strengthening assessments-

a. Its use should be made compulsory for DRs, HC Cells, CIT (J), CIT (Admn.) and DG (L&R) for their judicial work.

b. Access to SLP search of NJRS should be provided to CIT(J)/field formations. Regular Scanning of appeals memos by the Nodal Officers at CCA locations is imperative to keep the data base updated. The Pr. CCIT office, CIT(J) have to play a proactive role in ensuring coordination with the respective HC for data collection to ensure long term sustainability of the project

c. Frequent training on NJRS is required to be conducted throughout the country.

13. Strengthen Assessment Orders.

a. Publish a Handbook for AOs giving guidelines for framing assessments on frequently litigated issues. The Handbook to be revised periodically.

b. Develop SOPs on procedural aspects of assessment and litigation for Assessing Officers.

c. Send AOs as Observers to ITAT and HC to observe proceedings for a fortnight in a year as a training measure.

14. Impart regular trainings on legislative change/frequently litigated issues at RTI, NADT as well as locally through regular discussions/seminars etc.

15. Increase content related to litigation management at the Academy and RTIs.

16. Identify and create pool of specialized officers having mastery in various aspects of taxation. Such officers be called upon whenever a particularly intricate case comes up before any ITAT bench in the country.

17. Strengthen office of the CIT(J). Provide team of adequate and competent manpower to the office of the CIT (J) to discharge its functions more effectively.

18. Empower the Pr. CCITs to engage Senior Advocates on need basis without the need to consult the CBDT/Law Ministry.

19. Improve coordination with counsels. Promote use of official email id provided by the Department to counsels. Provide them access to NJRS. It will help them in accessing the latest judgments as well as allow better monitoring of cases through the daily diary feature of NJRS. Link payment of Fee with filing of error free appeal i.e. compulsory submission of ITA No. of the appeal along with the fee bill.

20. Adopt culture of formal interaction with judicial/appellate authorities. Department has to recognize that the various appellate fora are taking the work of the Department forward. Accordingly Department must interact and support the authorities to dispose the work.

21. Confidence building measures be adopted to reduce fear/promote confidence in case of non-filing of appeal in weak/inappropriate/covered cases. Simultaneously, routine frivolous authorizations to file an appeal which is neither supported by legal precedents, nor based on perversity of facts is to be discouraged.

22. Proposed tax amendment should be widely deliberated in the public domain for more acceptability.

23. Initiate Finance Minister’s Medal for exemplary work by officers.

Annexures A

Copy of OM for constitution of the committee

Annexure B

Issues concerning Instruction No. 3/2012 of CBDT, New Delhi :

1. Substantial number of appeals filed by the Department remain as defective because of failure to cure the defects pointed out by the court registry while filing the appeal by the Departmental counsels. As a result, these appeals are not listed before the Court and they remain as defective years after year. The above problem is mainly due to certain lacuna existing in the guidelines for engagement of Standing Counsels. With minor changes in the guidelines, the lacuna can be removed. Therefore, to ensure that no defective appeal is filed by the Departmental Standing Counsel, the following changes are suggested:

(i) In para 8.2 it should mention ITA number of appeals filed, Diary no. of other petitions/applications filed etc.

(ii) In Annexure II, para 2, 2.1 and 2.2, it should mention ‘For Drafting and Filing’ instead of ‘For drafting’ only.

(iii) In para 12.1.1instead of ‘Bill for drafting’, the nomenclature should be ‘Bill for drafting and filing’. Further, the following should be added: “Bill for drafting and filing of appeal shall be submitted only after removal of all defects with ITA No. of appeal filed.”

(iv) In sl. 5 of Proforma X it should mention “ITA no./WTA no.” and “etc” should be omitted.

(v) In Part A of Proforma X instead of (Bill for drafting), the nomenclature should be (Bill for Drafting and Filing).

2. Settlement of bills of Standing Counsels is an inseparable part of efficient litigation management. On analysis of causes of disputes on several areas of above instruction No. 3/2012, it appears that there are few provisions in the Instruction No. 3 of 2012 which if amended may be able to clear many of the confusion and resolve causes of several disputes relating to fee bills of counsels. These provisions of CBDT’s Instruction No. 3 of 2012 are discussed as under:-

Para 11.3 of Annexure – II says – “No fee will be payable to the Counsel if an advance notice about the adjournment has been circulated or the case has been adjourned at his request due to the reasons personal to him.”

In other words in all other situations, fee should be paid to the counsels. For example, it would mean if there was no advance notice about the adjournment and the case has been adjourned at the request of the appellant or at the instance of the Department, but not due to personal reasons of the counsel the fee should be payable to the counsel.

2. On the other hand, para 1 of Annexure – II says fee for appearance is payable only for “substantial and effective hearing”. Further ‘substantial and effective hearing’ is explained below para 3 as under:

“*A substantial and effective hearing is one in which either one or both the parties involved in a case are heard by the Court. If the case is mentioned and adjourned or only directions are given or only judgment is delivered by the Court, it would not constitute a substantial and effective hearing.”

The above provision of fee payable is contradictory to para 11.3 as because if the case has been adjourned at the request of the appellant or at the instance of the Department, but not due to personal reasons of the counsel the fee should be payable to the counsel even if there is no substantial and effective hearing. Further, if fees for appearance is payable for substantial and effective hearing only, the provisions in para 11.3 is redundant and causes unnecessary disputes.

3. It is seen that in the notification issued by Ministry of Law & Justice (MOLJ) similar provisions are there relating to substantial and effective hearing and adjournment by Court although no inconsistency exists between the two provisions. The relevant provisions of Ministry of Law & Justice as per notification dated 24.09.1999 which was retained in the OM dated 01.10.2015 are as under:-

(a) Effective Hearing: Effective Hearing means a hearing in which either one or both the parties involved in a case are heard by the court on the facts or Law of the case. If the case is mentioned by the other side and adjourned or when only directions are given or only judgement is delivered by the court, the same would not constitute an effective hearing and no fee will be payable to the Senior Counsel.

3. No fee will be payable to the Counsel if the case is not called out or if called out is adjourned by the Court without hearing or adjourned at the request of either of the parties.

The above provision of MOLJ do not make any distinction between adjournments sought by appellant or respondent and reasons for adjournment. Further, there is no contradiction between provisions of adjournment and effective hearing. In view of the above, it suggested that above provisions of MOLJ may be adopted in the CBDT’s Instruction to resolve disputes.

4. Further, provisions relating to connected cases have been defined in CBDT Instruction as under:-

9. Appearance fee in connected/covered cases

9.1 When more than one case involving identical questions/issues are heard together and decided by the High Court, the counsel shall be paid full appearance fee in the main case and Rs. 750 in each of the other connected cases.

Counsels suggests that if assessees are different and issue is identical, then it should not be treated as a connected case as facts of each case are different and court needs assistance on facts of each case even if they are clubbed/tagged together by the court for hearing purposes. Such order/orders should not be treated as connected matter and full fee should be allowed to the counsels provided a certificate is furnished by the counsel in support of their claim. While difference of facts have not been provided in the CBDT instruction, the same have been provided for in the MOLJ notification as under:

(c) Identical Cases: Identical cases means two or more cases in which substantially identical questions of law or facts are involved and where the main difference is in the names, addresses of the parties concerned, amount of money involved, etc. and/or where common or identical judgements are delivered irrespective of the fact that all the cases are heard together or not.

In view of the above, it suggested that above provisions of MOLJ relating to connected case may be adopted in the CBDT’s Instruction to resolve disputes͘

Further, provisions relating to Uncontested matters have been defined in CBDT Instruction as under:-

10. Uncontested matters

A case shall be regarded as uncontested, if the same is withdrawn by the plaintiff/appellant or dismissed in limine or otherwise decided by the court ex parte. In uncontested cases, the fee shall be 1/3rd of the appearance fees as applicable to the stage of the case, otherwise payable, but if such a case is later on restored and decided in contest, the remaining 2/3rd of the fee will be payable.

Counsels suggests that when the appeals are dismissed as withdrawn, the appeals are withdrawn by the assessee due to the efforts of the counsels only where arguments took place at length. In such cases, full fee should be allowed to the counsels on the basis of certificate and clarification furnished by the counsels. The above situation of recognized in the MOLJ notification as under:

(b) Uncontested Cases: All suits and appeals are deemed to be ‘uncontested’, if these are withdrawn by the petitioner/appellant or dismissed in limine at the admission stage or otherwise decided by the Court ex-parte before the final hearing. No Writ Petition/Review Petition (including any interlocutory application connected therewith) will be considered as ‘uncontested’ if it is decided by the Court on preliminary legal objections or is withdrawn by the petitioner/appellant at or during any stage of the final hearing in the presence of the Government Counsel or is withdrawn by the Government at the time of its admission.

In view of the above, it suggested that above provisions of MOLJ relating to uncontested cases may be adopted in the CBDT’s Instruction for more clearly.

6. Further, there is no final dispute resolution authority whose decision shall be final and binding under the CBDT instruction. Under the MOLJ notification to resolve disputes it has been provided as under:

XI. In the event of any doubt or difference regarding the fees, the fees determined by the Secretary, Department of Legal Affairs, Ministry of Law, Justice and Company Affairs, shall be final and binding. He may, by an order in writing, relax any of the aforesaid terms and conditions.

It is, therefore, suggested that above provisions of MOLJ relating to resolution of dispute may be adopted in the CBDT’s Instruction to settle disputes regarding deductions from bills by providing that ‘in the event of any doubt or difference regarding the fees, the fees determined by the Principal Chief Commissioner of Income Tax shall be final and binding’͘

-Sd-

Niranjan Kouli CIT(J), Delhi

ANNEXURE C

Review of the functioning of the institution of CIT (J)

1. CBDT vide its Instruction No. 6/2015 dated 03.07.2015 has defined the work jurisdiction of CIT(J) and created the posts of CIT(J) at Ahmedabad, Bengaluru, Hyderabad and Pune in addition to the existing four posts at Delhi, Mumbai, Chennai and Kolkata. In view of the short time available, to review the functioning of the institution of CIT (J), formal report could not be obtained from the CIT(J)s based at different stations. However, on the basis of telephonic discussion with the CIT(J)s of different stations, an overview on the actual functioning of the institution of CIT (J) vis-a-vis the main functions as provided in the said Instruction is provided as under:-

2.1 Function:- To act as nodal office for all matters relating to the jurisdictional High Court ensuring that the Departmental view regarding the interpretation of the Income Tax Act, 1961 is enforced uniformly within the jurisdiction of the respective Region. Based on NJRS and other available databases, the CIT (J) shall ensure that there is uniformity in the Departmental stand on a particular issue.

2.2.1 Actual functioning: – The CIT (J)s are functioning as nodal office for all matters relating to the jurisdictional High Court. Though the CIT (J) is required to maintain a repository of question of law and departmental view on a litigated subject, in practice, the CIT(J) faces difficulties in discharging this role as the data with CIT(J)’s is incomplete͘ To ascertain the uniformity of Departmental stand on a particular issue, CIT(J)s have to depend on local data available on the basis of appeals filed and questions of law raised at the level of Pr. CCIT region. However there is need for availability of the data to the field formations, issue-wise more scientifically. The reasons for inconsistent stand taken by the Revenue in different appeals on identical issues is mainly because the database is not available scientifically issue-wise.

2.2.2 The NJRS has started compiling data of cases in appeal and data of judgements of ITAT, High court and Supreme Court. However, the officers in the field formation are still unaware of the detailed functioning of NJRS. It is recommended that special train ings for the officers and staff of the CIT(J) should be carried out periodically to enable them to better utilise NJRS.

2.2.3 Further the data on SLPs pending before the Supreme Court and the issues taken in the SLPs is not available to the field officers although such a database is available with DGIT(L&R). It is, therefore, suggested that the above data of the DGIT (L&R) should be made accessible to the CIT(J)/field formations. This will help the CIT(J) to a great extent in identifying the contentious issues pending at regional level, Departmental views on the particular issue taken in the SLP and also help in framing appropriate questions of law.

3.1 Function: Identification of cases for bunching of appeals before the High Court/s based on the available databank.

3.2 Actual functioning: Scanned copy of case records of appeals pending in High court is available only with the Delhi and Mumbai HC. NJRS also has scanned copies of appeals pending in its system. However, the work of identification of cases with the exact same issue has to be done manually. The actual work of identification of cases for bunching of appeals is a very intensive and time consuming exercise as distinguishing factors crop up in most of the cases. It requires proper understanding of law & the issues involved for bunching of the appeals. Further, in the absence of adequate competent manpower, the work is yet to take definite shape. It is suggested that team of adequate competent manpower for identification of cases for bunching of appeals should be provided to the CIT(J).

4.1 Function: Dissemination of settled judicial view based on important decision of jurisdictional High Court and Supreme Court to the field formation in the Pr. CCIT Region on quarterly basis. To co-ordinate with the Pr.DGIT (L&R) to obtain information of cases where Department has accepted a Court’s decision.

4.2 Actual functioning: Settled judicial view circulars prepared by the DGIT(L&R) periodically are circulated through the departmental websites. Further important favorable orders of High Court are also circulated in the Region. However information of cases where Department has accepted a Court’s decision are not received from Pr.DGIT (L&R). System should be put in place where such information is collated by the Directorate of Income Tax (L&R) and made available through NJRS to the field formations.

5.1 Function: Processing of Central Scrutiny Reports (CSRs) received from the respective Pr. CsIT/CsIT. Examine whether the appeal proposed is in accordance with the existing instructions, whether the grounds of appeal are suitably framed and whether they are in conformity with the Departmental position/view on the legal issues.

5.2.1 Actual functioning: The instruction of Central Scrutiny Reports (CSRs) to be processed by CIT (J) is not followed uniformly in all the Pr. CCIT regions. In Chennai, Mumbai and Pune regions appeals are being filed directly without processing by the CIT(J).

5.2 2 Even in the regions where the instruction is followed, several PCIT charges are not sending the CSRs to the CIT (J) for processing.

5.2.3 Many posts of CCITs are lying vacant and held as additional charge by officers posted at different places. Therefore, sending the CSR proposal to panel of CCITs for approval and getting their approval in time creates a problem. Sometimes posts are being held by the same officer and requirement of having a panel of different officers for recommendation, cannot be fulfilled. It is also affecting the timely filing of appeal. In Pune region it is also one of the reason for not sending the CSRs to the CIT (J) for processing.

5.2.4 Further, the appeal memo with QOL is not being sent by many PCIT charges. Only if the CBDT instruction is followed uniformly and Questions of Law in High Court is provided to the CIT(J) immediately after the filing of appeal, a reliable database can be created. Thus in practice, CIT(J)s are not in a position to discharge this mandate of reviewing the CSRs effectively.

5.2.5 NJRS has a feature for uploading the CSRs by the administrative Commissioners (and their ITO Hqrs). The finalised CSR should be uploaded in NJRS by the Pr CITs. The instruction already provides that once these activities are stabilised in NJRS, there will be no need for a separate database to be maintained by the CIT(J).

6.1 Function: Act as a link between the court and the PCIT/CIT and ensure that at least one official is present in the Court at the time of hearing, for taking down instruction.

6.2. Actual functioning: CIT (J) is functioning as a link between the court and the PCIT/CIT. Officials from the High Court Cell functioning under the CIT(J) are present in the Court at the time of hearing for taking down instructions.

7.1 Function: Provide secretarial assistance to the Screening Committee for engagement of Standing Counsels and Prosecution Counsels. Assist the PCIT/CIT in the work of reviewing and evaluating their performance. Ensure uniform work allocation to all Counsels and act as a communication channel to co-ordinate between the Counsels and the Department.

7.2 Actual functioning: CIT (J) has been providing secretarial assistance for engagement of Standing Counsels and Prosecution Counsels and assisting the PCIT/CIT in the work of reviewing and evaluating their performance. CIT (J) has generally been ensuring uniform work allocation to all Counsels and acting as a communication channel to co-ordinate between the Counsels and the Department.

8.1 Function: Information about writ petitions filed by the assessees/ taxpayers to be passed on to the CIT(J) through the PCCIT/CCIT/PCIT/CIT.

8.2 Actual functioning: Writ petitions filed by the assessees/ taxpayers are forwarded by the High Court Cell functioning under the CIT(J) to the PCCIT/CCIT/PCIT/CIT.

9.1 Function: Maintain database of prosecution cases.

9.2 Actual functioning: Database of prosecution cases is maintained as per required format.

10.1 Function: Provide secretarial assistance to the RTCs and ensure that RTC meets regularly and makes references to Central Technical Committee (CTC) on matters as deemed fit.

10.2 Actual functioning: The mechanism to constitute Central Technical Committee (CTC) and Regional Technical Committee (RTC) were initiated by the CBDT as per O.M. 279/M-61/2012-ITJ dated 28.08.2012 with a view to provide clarity on contentious legal issues, promote consistency of approach on a given issue and reduce litigation. There is increasing need to make these mechanisms more pro-active so that contentious legal issues are identified to help the CTC to formulate departmental view for consideration of the Board. However, very few references of contentious legal issues are received from field formations despite reminders. To ensure its success, Pr. CCITs of the respective region should be more actively involved and they should mandate a monthly report from their respective RTCs of meetings held and contentious issues identified. The questions of law raised in maximum number of cases can be another source of contentious legal issues for the CTC/RTCs.

11.1 Function: Ensure that appeal files are provided for scanning at the Regional Scanning Centres expeditiously after filing of the appeals in the Court registry.

11.2 Actual functioning: Appeal files of High Court are not being provided on a regular basis for scanning at the Regional Scanning Centres. In some High Courts, the soft copies are available and these are being provided to NJRS periodically.

12.1 Function: Collation and onward submission of Judicial/appeal/prosecution related reports to authorities concerned.

13.1 Function: In Delhi and Mumbai Region, all the ITAT orders to be centrally received in the office of CIT(J) and to dispatch the orders to the jurisdictional PCIT/CIT preferably within one working day of their receipt.

13.2 Actual functioning: In Delhi region, ITAT orders are received centrally in the office of CIT(J) and distributed to the jurisdictional PCIT/CIT generally within a week since the last more than ten years. However, in Mumbai region the ITAT orders are sent directly to the jurisdictional PCIT/CIT.

14. Keeping in view of the above it is suggested that:

i. Utilisation of NJRS has to be increased. Special trainings for the officers and staff of the CIT(J) should be carried out periodically to enable them to better utilise NJRS.

ii. Access to SLP search of NJRS should be provided CIT(J)/Field Formations

iii. Data of SLPs pending, SLPs proposed but not approved by the Board, Departmental views regarding filing of SLP on a particular issue, whether SLP admitted/dismissed is based on merits or not etc., available with the DGIT (L&R) should be made available on the NJRS to be accessible to the field formations.

iv. Team of adequate competent manpower should be provided to the CIT(J) for identification of cases for bunching of appeals.

v. Regional Technical Committee (RTC) should be made more pro-active so that contentious legal issues are identified to formulate departmental view.

-Sd-

Niranjan Kouli

CIT(J), Delhi

ANNEXURE D – Note on the Working of CTC

DIRECTORATE OF INCOME TAX

(LEGAL & RESEARCH)

15th FLOOR, HINDUSTAN TIMES BUILDING,

KASTURBA GANDHI ROAD NEW DELHI – 110001

Phone: 011-23359234//Fax-011-23354131

Date: 14.09.2016

To,

Shumana Sen

Member Secretary,

Committee to Suggest Roadmap for Reduction of Litigation Hindustan Times Building,

New Delhi-110001

Sub: Strengthening of CTC for effective litigation management.

An Institutional mechanism to provide clarity and consistency on contentious legal issues and to formulate a Departmental view, was initiated by the Board vide OM dated 28.8.2012. The OM put in place, the institution of Central Technical Committee (CTC) at the level of the Board and the Regional Technical Committees (RTC)in every CCA charge which are to identify contentious issues for the consideration of the CTC. The office of DIT (Research), presently CIT (OSD) (L&R) working under the supervision of DGIT (L&R) is to work as the Secretariat of the CTC.

Since 2013, the CTC has received 84 references. So far, it has been able to give the following output:-

| S.No. | ||

| 1 | Circular Issued | 12 + 2 |

| 2 | Amendments | 7 |

| 3 | Issues Referred to TPL& Other Divisions | 18 (other than those which resulted in amendment) |

| 4 | Pending References | 17 |

The clarificatory Circulars issued by the Board giving the Departmental/Settled view have been widely appreciated in the field, especially by the CIT(A) & Pr. CITs. These have been positively noticed by the Members of the ITAT as well as by the tax practitioners. While the Circulars reduce litigation, they also empower the AOs with the knowledge about finality of interpretation of law as accepted by CBDT. They also have the effect of preventing/reducing unnecessary tax demand.

All stakeholders expect that such clarificatory circulars will continue to be issued, with greater swiftness and will cover wider issues.

However, the CTC is struggling to discharge its responsibilities on account of the following issues:

1. Secretarial Manpower Inadequate- The Board has approved the following strength of Officers for the Research unit of DGIT (L&R)25.

| Sl. No. |

Functionary |

Approved Strength |

| 1. | Director of Income-tax(Research) | 1 |

| 2. | Joint/Addl. Director of Income-tax(Research) | 1 |

| 3. | Deputy Director of Income-tax (Research) | 2 |

| 4. | ITO (Admn.) | 1 |

| 5. | Inspectors of Income-tax | 4 |

| 6. | Sr. TA | 2 |

| 7. | Data Entry operators (out sourced) | 5 |

| 8. | Multi task staff | 6 |

However, in practice, the Research Unit as envisaged by the Board has not been created. Since inception and till Sept 2015, the charge of the DIT (Research) was held in addition to NJRS & SLP work by the DIT (Research). As against a team of 5 officers, only a JDIT (Research) has been provided, that too sporadically.

A minimal staff is shared with the NJRS unit. Thus, the manpower provided to the Research Unit is grossly inadequate.

For the CTC to function effectively and to fulfil its mandate, the issue of shortage of Officers is required to be addressed by the Board.

2. Lack of Contribution by RTCs- The RTCs have been set up in all CCA Charges. However, the response from most of the RTCs is not satisfactory. Some of the RTCs have not met even once to deliberate the contentious issues nor have they sent any references so far. In the absence of adequate workforce in the Research unit, it becomes difficult to nudge the RTCs for their contribution.

The RTCs need to be suitably activated by the Pr. CCIT (CCA).

3. Difficulty in participation in CTC Meetings by the CIT (ITA) and JS (TPL)-II. Two Commissioners of CBDT, i.e. JS (TPL)-II and CIT (ITA) are full-fledged members of the Committee. However due to work pressures, their participation in CTC meetings becomes very limited. Thus, at the discussion stage, there is some difficulty in getting an input of the divisions of the Board. In view of the above, the Research Unit/CTC needs to be suitably strengthened for optimum results. Accordingly, the difficulties stated above may be brought to the notice of the Committee setup up to provide a road map to reduce litigation.

-Sd-

(Sunita Bainsla)

CIT (OSD)(L&R)

Member Secretary (CTC)

ANNEXURE E

Review of the implementation of NJRS

An important aspect of every tax administration is the management of tax litigation. There is significant potential for utilizing Information & Communications Technology (ICT) for effective litigation management. The National Judicial reference System (NJRS) project was conceptualized to provide a robust support system for litigation management for the entire Department by using ICT.

1.1 The first requirement for ensuring good litigation management is availability of an authentic and updated record of all appeals filed at various courts and tribunals. There is also a need to identify on a regular basis the frequently litigated issues in taxation, analyze such issues and take corrective administrative action or bring about appropriate changes in the tax law to eliminate the root cause of litigation. The task is difficult considering the wide geographic spread of the Department and multiple appellate levels involved where an appeal originates. As such a reliable database of appeals and judgments was not available in the Department.

1.2 NJRS does this by taking appeal data directly from the computer systems of the ITATs, most High Courts and the Supreme Court of India. Collation of appeal data directly from the source systems ensures that the appeal data is accurate and is updated on a regular basis. The appeals files are also being scanned in NJRS. This ensures ready retrieval of the appeal documents when required. Moreover, these scanned files are being used to pick up appeal metadata which is not available in the data received from the courts. NJRS also incorporates the final orders and judgments in these appeals.

1.3 The appeals and judgments are intelligently connected together in NJRS by the following means:

i. Appeal number formats have been standardized to enable linking of appeals to their judgments and for linking appeals across the three appellate levels

ii. PAN is being used to enable collation of cases by taxpayers

iii. Sections of the Act involved in the dispute are being used allow issue based analysis.

iv. HRMS data is used to provide a jurisdiction based access

v. scanned appeal files and pdf copies of final orders/judgments are also provided

vi. A state of the art search engine is being used for search and analysis

1.4 Besides providing the officers with ready access to comprehensive appeals and judgment databases, the NJRS will also have online workflows for the users to help in efficiently carry out tasks related to litigation management:

For ITATs –

i. NJRS provides a user interface for the DRs posted at the ITATs to enable them to enter day to day proceedings in an online case diary. The case diary entries are also visible to the jurisdictional field officers thereby improving the involvement of field officers in litigation

ii. There is a facility to carry out case related research from the appeal and judgment database and prepare notes.

iii. The system provides a facility to enable communication between the DRs and the jurisdictional officers – the AO, Range head or the CIT. The record of communication is tied to the appeal data so that it is easily available for reference at a later date.

iv. The DRs can recommend good decisions, which will be flashed on the Home Screen for the benefit of all officers of the Department.

v. The system also provides alerts to the DRs and the jurisdictional officers based on information entered in case diary and information fetched from the ITAT system for events such as the next date of hearing, changes in bench, etc.

For High Court Cells (HCC) & Supreme Court Cell (SCC)

i. NJRS allows for distribution of work to counsels. The head of the HCC can assign cases to the Standing Counsels based on the area of their expertise.

ii. The work of counsels can be managed using the Daily Diary feature for entering the daily court proceedings.

iii. The system provides alerts regarding events such as next date of hearing to the concerned officers. A facility for flagging important decisions is also available to the HCC/SCC as in the case of the DRs

For DGIT (L&R):

i. The LRTS system has been found extremely useful in practice to enable close monitoring of proposals and to bring consistency in approach in processing proposals based on information about past decisions contained in LRTS. The NJRS systems has built upon the good features of LRTS and provides further facilities to the users. The NJRS system has a facility for online submission of SLP proposals by the CITs to the Directorate. The proposals received online can be processed in an e-file type of workflow in the Directorate.

1.5 All officers of the Department have access to the search facility of NJRS. The state of the art search engine of NJRS allows for a user friendly search capability for identifying appeals as well as judgments based on parameters of their choice. This will also help the officers to identify if there are any appeals already filed/decided on a particular issue and thereby help in avoiding litigation on settled issues. NJRS has facilities for bunching cases, communicating important decision of the courts to all officers, uploading of articles on legal issues and statistical analysis.

1.6 NJRS also has online service for taxpayers to view a consolidated status of their tax appeals.

1.7 An implementing agency has already been selected to carry out the task of developing the IT hardware and software as well as to manage and operate the system over a period of 5 years͘ The contract was executed in April 2014 and the project achieved the “Go-Live” stage on 1st Sept 2015. The compilation of legacy data is under progress.

1.8 NJRS Project is one of the first e-Governance projects in India to substantially utilize data already created in other IT projects, thereby saving on resources that would otherwise have been spent on recreating data already available with other organizations.

1.9 As on date, the following courts are providing data for the NJRS project periodically – Supreme Court of India; High courts of – Delhi, Bombay, Gujarat, Rajasthan, Punjab & Haryana, Madhya Pradesh, West Bengal, Chhattisgarh, Sikkim, Orissa, AP & Telangana, Tamil Nadu and Kerala; and ITAT for all its 27 locations. Some of the courts have already initiated an automated online mechanism for providing data for NJRS. NJRS now has data of over 5.25 Lakh appeals (both disposed as well as pending), over 1.5 Lakh scanned appeal files and over 1,80,000 judgments/final orders of various courts and tribunals.

1.10 Key benefits of NJRS

- A Comprehensive knowledge base for informed decision making.

- Enable 360-degree analysis of issues involved in litigation based on precedents

- Consistent approach in tax litigation and avoidance of litigation on decided issues.

- Automation in the work-processes of the officers engaged in litigation work.

- Alerts for tracking and monitoring of appeals at various stages.

- Collaboration/coordination between officers for better litigation management.

- Computer assisted legal research and analytical reports for tax policy analysis.

- Storage and ready retrieval of scanned case records.

- Improve success rate in tax appeals

1.11 Issues in implementation:

i. Utilization: The NJRS project achieved the “Go-Live” stage on 1st Sept 2015. The compilation of appeals and judgments prior to 1st September 2015 is in progress. The current data is being uploaded regularly. Even at the time of Go-Live, NJRS was the largest judgment database available in Direct Tax cases. Though the utilization by officers has been steadily improving every month but the utilization is still much below optimal.

ii. Delay in compiling the data prior to go-live date:

The implementation Agency was allowed 6 months’ time to compile the legacy data, however due to the complexity and large volume of data involved (almost twice the volumes reported by the Research wing), the data compilation has been delayed by about 9 months.

iii. Difficulties in obtaining data from the courts:

As mentioned above, the primary source of appeal data for NJRS are the courts. NJRS Project is one of the first e-Governance projects in India to substantially utilize data already created in other IT projects, thereby saving on resources that would otherwise have been spent on recreating data already available with other organizations. The administrative approval of the judiciary has been received from most of the courts. Some of the courts has also started sending data voluntarily on a regular basis or have provided online access to it. However the registries of some of the High Courts have either not provided the data in spite of the administrative approval or it requires intense follow-up to obtain the data.

Moreover, the data formats are not consistent across the courts. It is difficult to identify tax appeals in High Courts and Supreme Court because the classification codes are not being entered correctly by the registry staff. The courts are not yet using a number to identify the parties which could have enabled identification of cases of the Department. As such, there is a possibility that some of the tax appeals may get missed out when the data is fetched from the court systems.

iv. Irregular Scanning:

The scanned files form an important source of data for NJRS. Although Nodal Officers have been appointed at all the scanning centers, in practice it has been observed that all files are not being provided for scanning. An attempt has been made to get over this issue by starting the scanning at the ITAT registries of Mumbai, Delhi, Ahmedabad and Chennai. However, the same cannot be done for HCs and SC

1.12 Recommendations:

i. The Pr CITs have to take a lead in encouraging the officers working below them to institutionalize the culture of regular reference to NJRS while framing assessments, writing CSRs, working on RTC proposals and for monitoring of appeals. Pr CITs have to instill in their subordinates that Litigation Management is an equally important task as compared to assessments and collection of tax.

ii. Data sharing is a mandate under the Open Data Policy of the government. At present, the collection of data for NJRS is a bilateral arrangement between the Department and each Court individually. Law Ministry/DEITY should be requested to institutionalize the provision of data from the courts for projects like NJRS.

iii. DEITY should also be requested to standardize the court data (at least the sharable data fields) as part of the government of India Metadata and Data Standards.

iv. The Pr CCITs should be requested to task their offices for improving coordination with the courts. This will also include scanning of files at the scanning centers or obtaining e-files from the courts.

-Sd-

ANURAG GOYAL

CIT(OSD)(NJ RS)

ANNEXURE – F

A Report on interaction with Members ITAT at NADT on 2/9/2016

On 2.9.2016, Sh. Anurag Goyal, CIT(OSD)(NJRS) and Ms. Sunita Bainsla, CIT(OSD)(L&R) held an interactive session with 40 Members of the ITAT( from across India) who were attending a week long training programme at NADT, Nagpur. The topic for discussion was “Measures taken by the CBDT to reduce litigation and effective litigation management”͘ The Members were informed about the recent initiatives taken by the CBDT to reduce litigation/effective litigation management. A copy of the presentation is placed at (F/A).

As part of the group discussion, the ITAT Members were required to comment upon the existing litigation management practices of the Department at ITAT and also suggest the way forward. In the discussion that followed, the Members expressed their candid views on the quality of orders passed by the AOs, the departmental appeals filed in the ITAT, the representation of the DRs before the ITAT and some other general observations relating to the management of litigation by the department at ITAT. The views expressed are summarized as under: