Introduction to ITR Offline utility Assessment Year 2021-22

ITR-1 and 4*

* Enabled for ITR-1 & 4 as of now

Steps to Download and install Offline Utility and fill the same

Let us understand the execution steps for ITR 1 & ITR 4…….

Step by Step Guide – Download & Install Offline Utility

Step 1

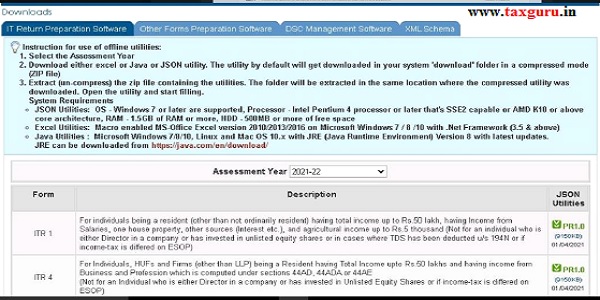

Once you access the e-filing portal . You can download the Utility under:

‘Downloads -> Offline Utilities -> Income Tax Return Preparation Utilities’.

Note: –System Requirements

- OS – Windows 7 or later are supported

- Processor – Intel Pentium 4 processor or later that’s SSE2 capable or AMD K10 or above core architecture

- RAM – 1.5 GB of RAM or more

- HDD – 500 MB or more of free space

Step 2

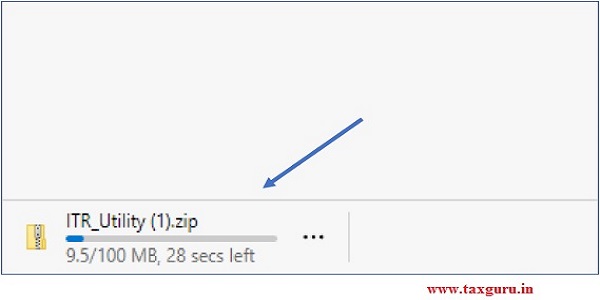

On click of link for the Utility presented against ITR-1 or ITR-4, a ZIP file will start getting downloaded on your system.

Open the Utility from the extracted folder.

Step 3

Step 3

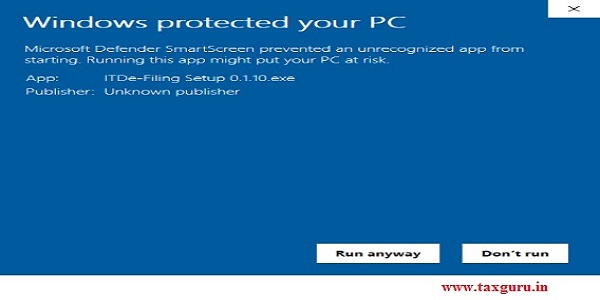

After you Extract the downloaded utility as a ZIP file, open the Utility from the extracted folder. In case, you receive this message, you click “Run Anyway” option in the dialogue box.

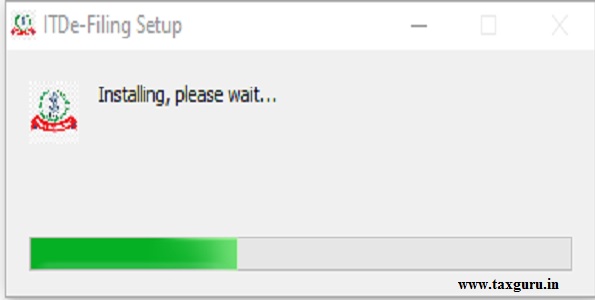

Step 4

Once you click on “Run Anyway”, your utility will start installing, after which you can proceed with filing your ITR.

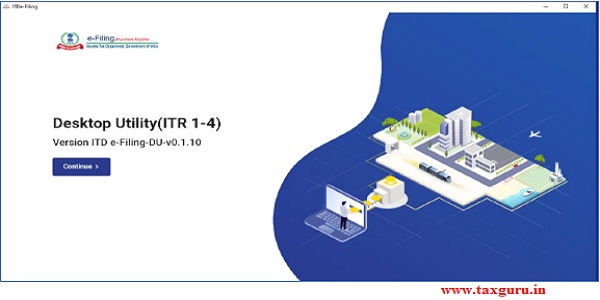

Step 5

As soon as you install the utility, you will be landed to Homepage.

Click on “Continue” to fill your Income-tax Return for AY 2021-22.

Few things to know before you Start using the Utility

- This Offline Utility is enabled only for ITR-1 and ITR-4. Other ITRs will be added in the utility in subsequent releases.

- The Utility is based on new technology “JSON”.

- It is enabled to import and pre-fill the data from e-filing portal. You can fill the balance data. You can also edit the profile data other than PAN data in the utility, however, it is suggested to edit the same in your Profile at e-filing website and regenerate prefill data.

- Facility to upload ITR at the e-filing portal is not enabled. You can fill and save it either within the utility or export output json file to your system.

- Once filing is enabled, you can upload the same at e-filing portal

Below add-ons will be enabled in subsequent releases:

- Pre-fill data related to tax payments.

- Upload of ITR

- Questionnaire based functionality to help you identify which ITR is applicable to you.

- Payment of taxes through this utility

- Facility to verify and upload ITR through the utility itself.

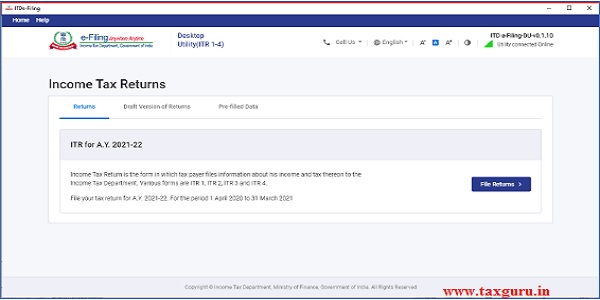

Step 6

You will find 3 tabs: –

- Returns: – If you are filling the return for the first time, click on “File returns” in this tab.

- Draft version of returns: – If you have already started to file your return, you can see the draft version of your returns in this tab and click on “edit”.

- Pre-filled Data: – It will show you all pre-filled ITR data you had earlier imported into the utility.

Step 7

After click on “File returns”, select the radio button to “Import pre-filled data”.

On click of this option, the prefilled data already saved by you on your system in .json format can be imported to prefill the information in the income tax return.

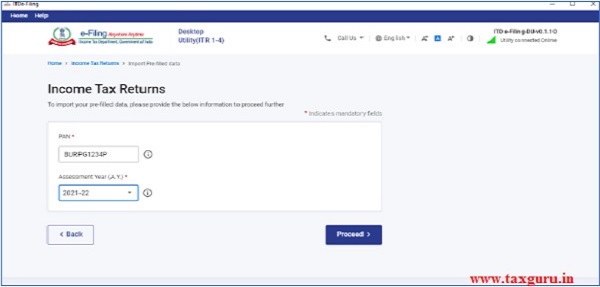

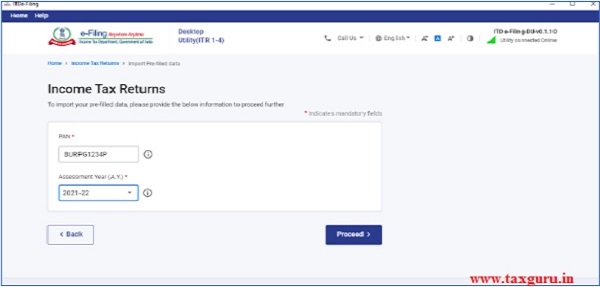

Step 8

Enter the “PAN” for whom you want to fill the return and select the “Assessment year” and click on “Proceed”.

Assessment Year 2021-22 can only be selected.

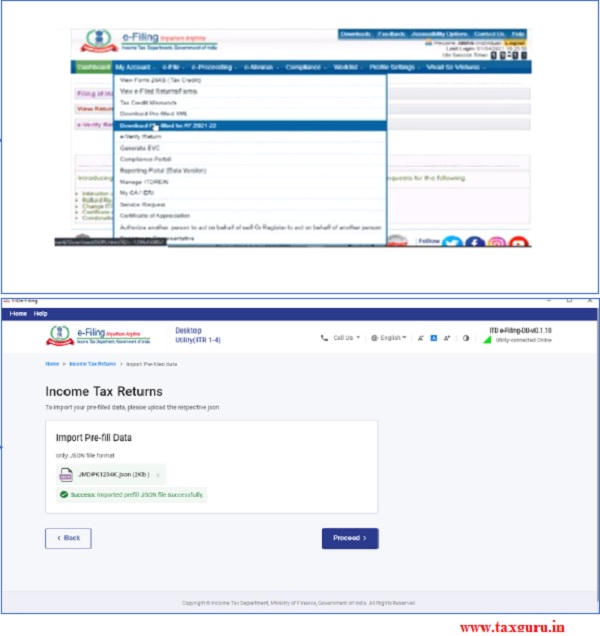

Step 9

Pre-filled json can be downloaded post login to the e-Filing portal from:

‘My Account -> ‘Download Pre-Filled for AY 2021-22’ and can be imported to the utility for prefilling the personal and other available details.

Attach the pre-filled JSON file from your system and click on “proceed”.

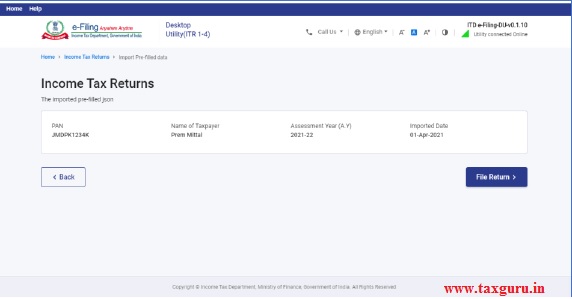

Step 10

On click of Proceed in earlier screen, you will be navigated to “Income Tax Returns” screen, where you can see the Basic pre-filled details from the imported JSON file.

Click on “File Return” to continue.

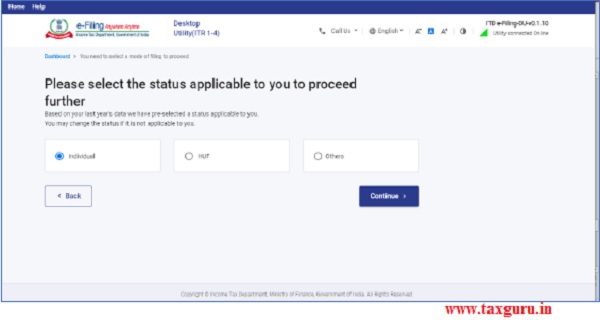

Step 11

Select the Status applicable to you and click on “Continue”.

Status will be pre-filled based on your last year’s data and will be editable.

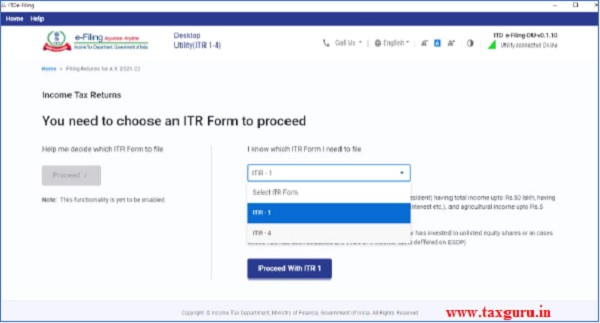

Step 12

Select the ITR type which you want to file from the dropdown and “Proceed”.

A user-friendly questionnaire to identify ITR applicable to you will be available in subsequent release of the offline utility.

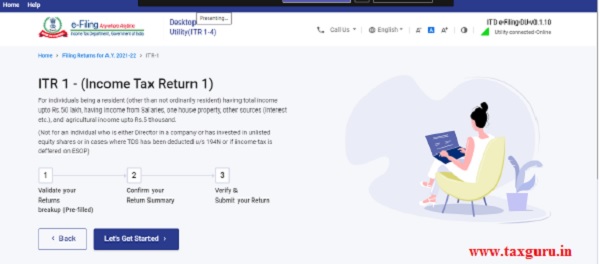

Step 13

Click on “Let’s get started” to start filling your return.

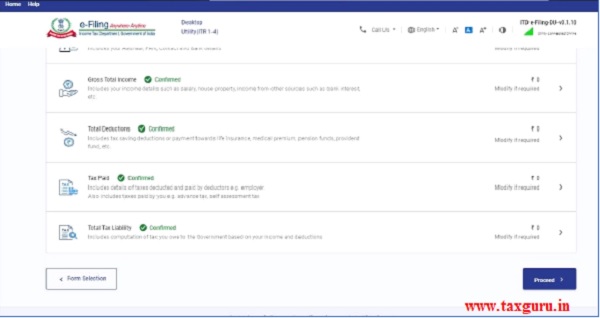

Step 14

Fill the applicable and mandatory fields of the ITR form -> Validate all the tabs of the ITR form and Tax will be calculated.

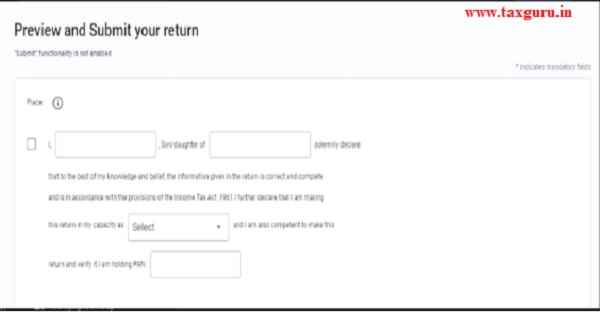

Step 15

After confirming all the schedules, you can Preview and submit your Return.

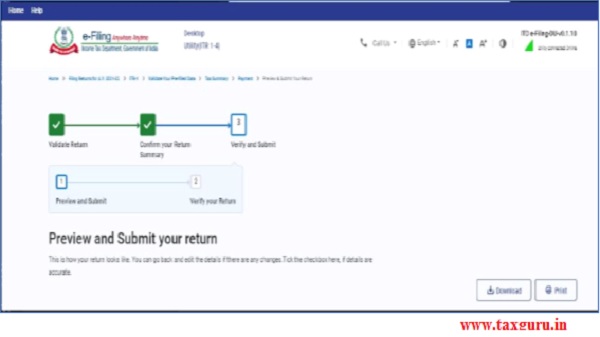

Step 16

You can either “Download” or “Print” the preview by clicking on the respective buttons.

You can download the Preview on your system.

It will be downloaded in pdf format

Step by Step Guide – Fill Income-tax Return

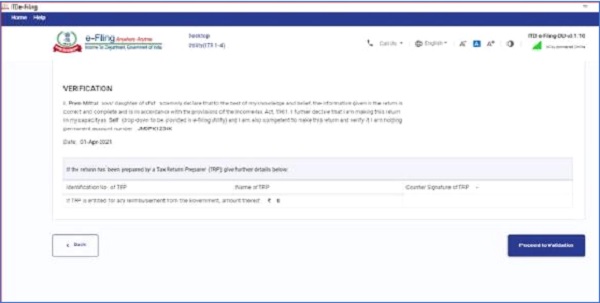

Step 17

Click on “Proceed to validation”, to validate the Return.

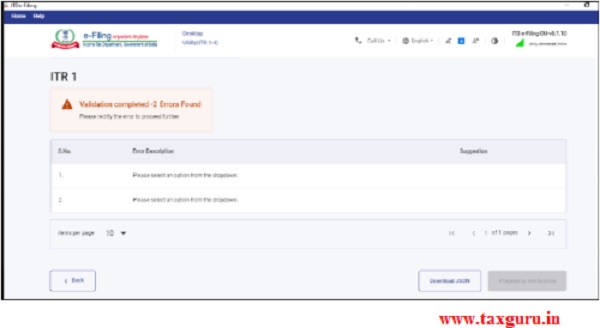

Step 18

All the errors needs to be validated by the user after that he can “Download JSON”.

Just click on the error, you will be navigated to the field related to that error.

Notes

- Data will be refreshed on Real time basis.

- Tax will be calculated on Real time basis.

- Data will be Auto Saved.

- The downloaded JSON file can be generated and saved on the system for uploading it on the e-filing portal (post enablement of the functionality).

NewJSON utility is more complicated and we are struggling to file the return. why cant follow same old excell version?

NewJSON utility is more complicated and confusing compared earlier excel version. Request to provid eexcel option too.

Present system is not fit for general taxpayer.it is only for ca. pl replace with old one.

Wasted more than three hours but offline utility not opening, it always becomes black. New process is useless. In olden version whole process completes in less than one hour.

#Return to old system

I have experienced recurring problems in opening the utility. Job is half done and for the last two days I am unable to open the utility on my laptop. I don’t know how I would be able to file my tax returns.

‘Downloads -> Offline Utilities -> Income Tax Return Preparation Utilities’.

When you open the site and click on downloads further I was looking for Offline Utilities. I could find any Tab like this.

Can anyone help in downloading offline utilities ….

PLEASE CLICK “UTILITY” APPEARING UNDER “COMMON OFFLINE UTILITY (ITR1 TO ITR4”

I am sorry, but what is the solution for this? Any private provider where we can obtain like old Excel or Java utility… This new system is a nightmare…Time is running out…..Somebody here please help….I do not want to go to a CA or anyone to file my bloody paltry IT returns….

IT IS A REALY NIGHTMARE, I AM ALSO A CA (NOT IN PRACTICE) , TODAY 22-8-21 BEING SUNDAY GOT TIME TO FILE THE RETURN, BUT THE SYSTEM IS UNDER MAINTENANCE.

INFOSYS AS WELL AS GOVT.OFFICIALS WHO ARE RESPONSIBLE FOR THIS MESS. BEFORE GOLIVE OF THE NEW SYSTEM, IT SHOULD HAVE BEEN PROPERLY TESTED FROM ALL ANGLES INCLUDING DESTRUCTIVE TESTING

Difficult to download the offline utility. And while start doing filing of return, incorrect data is prefilled. Unable to exclude my disability pension from gross salary head. In the old portal it was very easy. Now data are fetched incorrectly in prefilled return. Any solution?

After downloading and installing the Utility, it is not getting opened at all. It just stands there hanged….Income Tax is already a thorn in the throat…Cannot you at least make the filing process simpler? Please revert to old system asap

now what is the final solution. Can anybody guide how to download blank ITR forms (not PDF) to fill up, validate and generate xml to submit.

Is this new System is really working or not?

There is total mismatch in figures for TDS deducted with respect to 26AS in ITR2. The TAN of deductors are not appearing. Not amenable to edit. Some amount appears in Carry forward column. Needs to be fixed urgently to reflect 26 AS.

how to run this in linux ?

Yes. I had the same query since I only have a Linux environment available. Twice I checked with the Online Tax Assistant on the Income Tax site. The first time they said that the Utility will be ready “shortly”. This is more than a month ago. Today, I checked again but the information provided was of no use. I sent some some emails to the ids provided during the chat (efilingwebmanager@incometax.gov.in, efilingwebmanager@incometax.gov.in, efilinghelpdesk@incometax.gov.in). You also want to try the same.

I unzipped hoping to find a java utility based file, but it appears to be an ,exe file that can only run on windows. If java based utility has been done away with, at this juncture, isnt that terrible?? of course the java version wasnt great, what with the full screen taking away by one or two columns and user had to scroll every time to find the column to enter the number and then scrolling back to reassure if the cell he needs to enter is the same row he wanted to … but this one does make it more welcome

I ran this utility and was over whelmed… too much complexity in the name of simplifying, there isn’t an easy way to view things fully, just in peeks. The prefilled JSON isnt completely ‘believable’ and the utility doesnt say from where it fetched the data that it shows against a row or attribute. For e.g., the TDS data is incomplete, incorrect and confusing. just random numbers without any details on who the deductor is? or what date it refers to. impossible to corelate with the 26AS data or the form16 files. It seems a real nightmare is in store ahead!!

The entire new filing system is confusing and made more complicated….. a lay man would really find it difficult to cope with the new system…. alternate remedy be made available….

While filing online ITR 1 Form for AY 2021-22, I found no column for 80CCF under deduction under chapter VI. Then how should I get the benefit of purchasing Infrastructure Bond u/s 80CCF?

Sir, Excel utility is best one. please updated the excel utilities

how to use this utility on MAC machine

It is really a very complicated to file IT returns particularly form ITR 1 and ITR 4 for AY 2021-22 and after several attempt I failed. It is unnecessarily made complicated. Earlier system was very friendly for all. After all what is use of such puzzled system , when the Department claiming it would every activity relating to IT return filing people friendly.

.

This Json is very much complicated. Excel utility need to uploaded in Income Tax website at the earliest.

Is it possible to file ITR -2 online?

I could fill all datas and got stuck up in verification page, not able to print name.

Dept says, “dont try to file now, wait..many people have reported this issue”

for info and just sharing my exp.

We can not open new file and start. Filling the details. It is definitely a draw back and unlike earlier excel utility, it is humanly impossible to file the return as the new first hand filer. This utility requirements for a prefilled Json file to start with and without the same fist time user will face a big zero. Kindly correct the bug at the earliest to serve all the assessees

When ITR Form will be enable for the A.Y. 2021-22 and prayer for can file as early possible date.

I think this government is under illusion that they iare changing thinks from good to better But in reality it is better to WORST God should Save us !!! Most user unfriendly . It appears they are indirectly suggesting that every one should use the services of tax professional and pay for that

The downloaded prefilljson.json file is of 0kb size (blank file) and without this file I cannot proceed with the filing process……… I tried downloading this file many a times but of no use. So i think the earlier excel system was error free.

Facing some issue. Did you find any resolution to this problem?

It is dam complicated. particularly for senior citizens who have with great difficulty learnt the old systm.

At least for their sake they could have given an option for particular group of people.

This is shameful.

JSon file for prefilled data file cannot be downloaded from the e-filing website. Says being downloaded eterenally! How to overcome the problem? Thanks

Form should be prepaed for windows xp enable system, which will be help to

All the people, who have old pc.

Utility is also for enable to lower version.

The new ITR filing utility is more useless and complicated. The Govt, is bent upon making life of common man worst except grant/subsidy category. The utility does not catch the complete past data. It does not make any sense to discontinue something when existing system is working so smoothly. Till now no body has clarified whether Excel Utility will come or not.

Correct

NewJSON utility is more complicated and confusing compared earlier excel version. Request to provid eexcel option too.

Excel based Utility is the best one.

details related to verification and filing of ITR is not enabled. You can download are output file and save it in your system. Once enabled, you can file it at the portal or verify and file directly through this utility ..

Proceed to verification…The Entry is not broken

WHEN WILL ONLINE ITR FORMS BE AVAILABLE FOR E FILLING????

Details related to verification and filing of ITR is not enabled. You can download the output file and save it in your system. Once enabled, you can file it at the portal or verify and file directly through this utility, Same thing happened with me and now i dont know how to proceed

dear taxguru,

1.itr1 on json format can not be opened in filable form as in previous case of excel and jawa utility but opened only in note pad utility.even opened in filable form kindly show a specimen of it. all other steps are just a formality.

I feel Jason utility is quite easy. I don’t find any problem except there is no provision for providing Aadhaar No. which is not imported. Bank particulars also not imported. Other wise it’s better than Excel utility. It will be nice if Aadhaar number is editable.

agree with all above comments. further my problem -the extracted itr file can not be opened as you suggest. it ask how to open the file with options like pdf, different type of browsers or applications from microsoft applications. this make confusions.

I am unable to log in.

No matter what I write for new incometax portal this notice flashes on screen

Please visit the new e-filing portal http://www.incometax.gov.in

Its a nightmare to visit new portal

After filling section 80G details in new ITR1 Jason utility, the total deduction amount under section 80g is not appearing and hence the data is not getting saved. Rest are all working fine. Can you please me in resolving this?

explanations (steps) not clear. a file prefilljson.json is available folder. if I click I get my derails in a format which looks like notepad (json formatter pro). 2) but no other window (like DESKTOP UTILITY) opens. no other window also opens. your instructions must be more helpful

The new system is more complecated than last years. The old system needs to be reintroduced immediately.

Yes it is correct that every year they make changes and make a simple thing complicated.people make mistakes and govt collect tax.

It’s too damned complicated! Every year a complicated system is introduced and we struggle to learn, and presto!!! Next year again something new! Why does CBDT harass us like this?