We often hear the term Board of Advisors/Advisory Board being used with reference to organizations. While it is easy to derive the nature of their role from the name itself, it is important that we understand how to build a board.

The Advisory Board plays a very crucial role in the growth and even sustenance of a business. Their industry experience and business acumen propel businesses towards achieving their goals much faster.

So we thought that putting these thoughts together in an instructional FAQ would help as part of our ‘Practitioners Guide’ series.

What is an Advisory Board? How is it different from the BOD?

There are primarily only 2 ways in which you can get assistance from an advisor in a formal manner apart from as an independent consultant.

Advisory Board (Mentors, Advisors, Evangelists) An Advisory Board is a body of highly qualified and experienced professionals that provide non-binding strategic advice to a company on the basis of goodwill, equity or fees. |

Board of Directors The Board of Directors are representatives of the shareholders and perform specific functions owing to legal authority conferred upon them by law. |

Where do companies go wrong?

Roopa’s Notes:An Advisory Board is more flexible and informal in its structure and management. It can be tailored to suit the organization and is less cumbersome to make additions and deletions.

Nag’s Notes: Advisors act as mentors and guide the company in different areas of decision making. In the course of business, the expectations can change and so can the advisors required.

For the purpose of this document, we will delve a little deeper into the firstone – ADVISORY BOARD, where most mid-sized companies wish to have more clarity.

How do I go about setting up an Advisory Board?

STEP 1: Identify and profile your customer

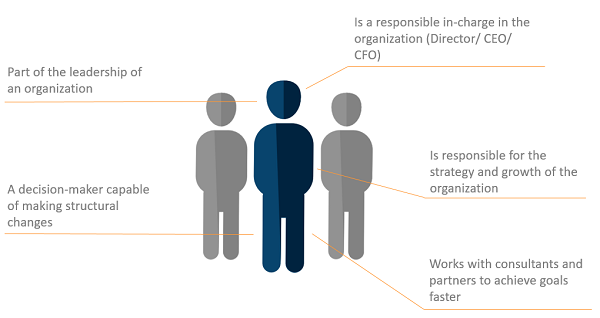

Start with profiling who your ‘real’ customer is. How does he look, where does he work, what are his preferences?

Dilip’s Notes: Not the one who pays for your offerings but the one who is the real beneficiary of the outcome of your business existence.

Nag’s Notes: As yourself: How does your customer look? Where does he/ she reside? How does he/ she buy? When does he/ she need what you offer? How often does he/ she need what you offer?

Let’s take an example to guide you through how we approach it:

Prequate is a management consulting company that works with businesses across industry verticals to help create leaner organizations. Services are providing a CFO Office, Bespoke consulting on specific matters/ transactions and Investment Banking, Mergers & Acquisitions Advisory. Understanding the profile of the target client is imperative for setting up a Board.

The ideal client would like something like this:

STEP 2: Identify the true nature of your business

Analyze the nature of the business (are you B2B/ B2C/ B2B2C/ B2C2B) and the industry that you operate in or cater to.

The nature of the business is B2B for Prequate. Businesses are the end users of our services.

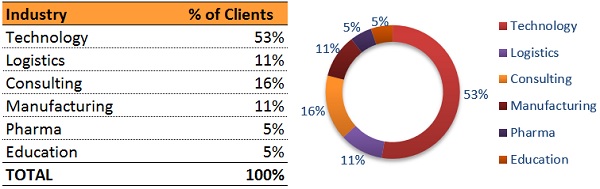

With respect to the industry, a simple analysis of the clientele in the past and clients with who Prequate have ongoing projects reveals the following:

A majority of the clients are from the IT &ITes and the Manufacturing Industry, together constituting close to 64% of the clientele. Based on this broad analysis it is safe to assume that a majority of the Board will need to have prior experience and expertise in one of these two industries primarily (Domain expertise). Apart from specific industry experts Prequate will also need Advisors with consulting experience across industry vertical and cross domain expertise (Operational affinity).

Another important consideration is whether the expert is able to understand the context of the businesses (Operational affinity). Further, the Advisor himself must have lead an organization/ must work with organizations in a professional capacity in the Stage that occupies your largest client sector – Growth (44% of total clients). This will unlock the value of the relationship to business aspects as well (Referral value).

Another important consideration is whether the expert is able to understand the context of the businesses (Operational affinity). Further, the Advisor himself must have lead an organization/ must work with organizations in a professional capacity in the Stage that occupies your largest client sector – Growth (44% of total clients). This will unlock the value of the relationship to business aspects as well (Referral value).

Where do companies go wrong?

Bordia’s Notes:Many organizations approach mentors who have valid experience profile without really understanding how they will suite the core business. Advisors and Founders must see fit first.

STEP 3: Select the number of advisors you need

Once you have a broad framework of what to look for, you need to decide on how many members to have on Board. While 2-3 members is easy to co-ordinate and arrange meetings, most companies feel that it is ideal to have 5-6 members on the Board.

For an organization like Prequate, the advisor team can be a part of the delivery function of the organization as well.

Nag’s Notes: Too large a Board may need more investment in time coordinating, effort managing expectations and higher compensation. Focus on what you need rather than what you want.

Dilip’s Notes: We often use advisors to solve problems specific to a domain. Having a larger board may help here since domain expertise can be borrowed.

STEP 4: Pick your advisor profile

Identify a list of skills and networks/connections that the advisor must have. It is important that they are willing and able to leverage their connections to help the business. The Board plays a strategic role and hence the members that the business needs to look at must have had experience with strategic planning and should also have or be serving on boards of successful companies. They must have Domain Expertise, Business Affinity and Referral Value.

STEP 5: Connect with your target advisor& get them to a F2F

Approach the network that the company, Board of Directors, Top management has built over the years and request for suggestions. There may be some in the network itself who would be interested in playing an Advisory role. Research on Advisory Boards of Fortune 500 companies and make a list of Advisors who could contribute greatly to your company’s vision.

There are channels which you can use to reach out to a specific advisor. Once you have identified a particular channel and found the profile, connect with them.

Nag’s Notes: LinkedIn works like a charm for this approach. The intention is professional. They can view your profile before they connect and you can keep discussions plain text.

Roopa’s Notes: Be clear about your intentions when you connect. Mention why they will add value to your business. Drafting a formal board invitation can help get their attention.

Ref: A draft board invitation can be downloaded from here: http://bit.ly/PrequateWhitepapers

STEP 6: The finer print

The Advisory Board have no fiduciary duty but the company must seek legal advice to still have guidelines and written agreements that would have to be signed off when the Advisors come on board.

- Sign a Non-Disclosure Agreement so that your trade secrets remain your own;

- Ref: A draft NDA can be downloaded from here: http://bit.ly/PrequateWhitepapers

- Prepare a charter of responsibilities;

- Detail the time commitment and expectation; and

- Enumerate the remuneration.

Ref: A draft Advisor agreement, courtesy of Founder Institute: https://fi.co/contents/fast

Where do companies go wrong?

Roopa’s Notes: Build a strong Advisor pitch explaining the business and revenue models. Be honest with the goals and expectations and choose Advisors that are inspirational. Gain and demand trust.

Dilip’s Notes: Many organizations have boards but barely even meet them. Don’t use boards merely to build external trust in your organization. Use boards to build your organization.

Nag’s Notes: An inactive board is a non-existent board. Building a board means more than just adding names to a website. It means letting a guiding light enter.

How do I incentivize a Board?

Typically, Advisors are not in it for money as a primary outcome. Money is a short term incentive and they have probably outgrown this phase. They look at it as an opportunity to mentor, grow their network and help build good businesses with their experiences. Hence, focus on the intangibles first.

The company can offer stock to the Advisors. The advantage is that the Advisors will have vested interest since they also become shareholders but this also leads to some dilution in the holding. The stock compensation must take into consideration many factors focusing on the long term association expectations. The illustrative parameters are experience, skill, level of involvement and degree of interaction. A careful study of their contribution has to be done to arrive at the right compensation.

Nag’s Notes: A stock offer must vest based on milestones and contribution to ensure their interest and involvement remains over a longer period of time. Sometimes a board member may not be very comfortable in working with you. This safeguards both from future uncomfortable situations.

A common practice is to give a small portion of the equity generally between 0.25– 2.0% depending on the value added by the Advisor and the stage that the company is in.

Roopa’s Notes: Growth stage companies can look at giving approximately, 0.10 – 0.20%, while Start-ups would need to give more since the valuation would be considerably lower.

Dilip’s Notes: The same can vest monthly/quarterly over a period of 18 months -2 years with/ without cliff.

Bordia’s Notes: Remember, cover their expenses first. A sitting fees based on attendance in meetings is second. Long term incentive is third. Retainers are the final incentive.

Making the most of your board

Board is a vital asset and the company must plan well to maximize its effectiveness. The Board may meet very few times in a year but the company can always keep them updated by sending them regular snapshots of the business so that it is easy to arrive at a consensus during the interactions. A regular feedback mechanism can also be instated to know the suggestions/recommendations of the Board so that their participation is not limited to only the scheduled meetings.

Roopa’s Notes: Setting a term limit for the Board helps. An internal review of each Advisor can be periodically done and based on their contribution, transitions can be made.

Disclaimer: Please note that these are our views are based on our experience in being advisors and working with advisory boards in various organizations. They are for the limited purpose of educating officers of a company. The rationale and the procedure to be followed can vary significantly based on the specific advisor, exact nature of the business and the stage of the business.