Only few days are left to file the first Return in the era of GST regime i.e. FORM GSTR-3B. It must be filed by every person who are registered under GST. In this write-up, all related aspects of FORM GSTR-3B are being covered.

Introduction

It is a summary return which has to be filed by every GST registrants. This is to be filed for the first two months i.e. July & August. Thereafter FORM GSTR-3 shall be filed.

Who are required file??

Every person registered under GST has to file this monthly return.

| No matter whether you have any transactions during the month of July or not, you have to file this return. It may be NIL return also. |

Who are not required to file??

- Input Service Distributors

- Composition Dealers

- Suppliers of online information and database access or retrieval services (OIDAR), who have to pay tax themselves (as per Section 14 of IGST Act)

- Non- resident taxable person

- E-commerce operators*

*If e-commerce operators supplying own goods & services will require to file FORM GSTR-3B, but in any other cases, they will deduct TCS and file Form GSTR-8 which is yet to be notified.

Timelines of filing Return (revised)

| For the month of | GSTR- 3B | GSTR-1 | GSTR-2 |

| July, 2017 | 20th August, 2017 | 1st – 5th September, 2017 | 6th-10th September, 2017 |

| August, 2017 | 20th September, 2017 | 16th-20th September, 2017 | 21st-25th September, 2017 |

Overview of FORM GSTR-3B

It is a summary declaration of:-

- Taxable value and tax paid on outward supplies and supplies subject to reverse charge,

- Summary values of ITC availed, reversal and ineligible ITC,

- Payment of taxes

Mode of filing

There are two modes of filing Form GSTR-3B:

- Through online entry on portal, &

- Through GST Suvidha Providers (via API connectivity). Please note that in this mode only DSC signing is available.

If a taxpayer wants to file the return through EVC signing, then he has to opt to file via first mode.

How to utilize the ITC

There are following three ITC prioritisation rules:

| Type of credit | First adjusted towards | Second adjusted towards | Third adjusted towards |

| IGST credit | IGST liability | CGST liability | SGST liability |

| CGST credit | CGST liability | IGST liability | – |

| SGST credit | SGST liability | IGST liability | – |

Mode of signing

There are two modes of signing:

- DSC- class II or class III

- EVC (Electronic verification code): An OTP is received on the registered mobile of the authorised signatory with GSTN which has to be inserted.

| If a Company is registered under Companies Act, then it has to be filed using DSC. |

How to Submit return??

Following the steps to be followed to submit the return:

- Go to https://services.gst.gov.in/services/login

- Enter username & Password

- Click on return tab under services

- Click return dashboard

- Select financial year & Return period

- Click to monthly Return GSTR-3B

- Click prepare online

- Click each table and furnish the required information

- Save GSTR-3B

- Verify GSTR-3B

- Submit with DSC or EVC verification

Synopsis of Form GSTR-3B

Details of outward supplies and inward supplies liable to reverse charge

Details of inter-State supplies made to unregistered persons, composition dealer and UIN holders

Details of eligible Input Tax Credit

Details of exempt, nil-rated and non-GST inward supplies*

*Non- GST inward supplies means which out of the ambit of GST i.e. Petroleum, electricity, alcohol.

Payment of Tax

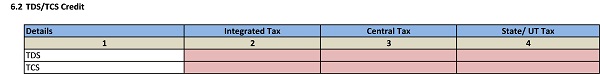

TDS/TCS Credit

| Please Note:

Once you click on submit button, Credit gets auto-populated in ITC ledger and payment get posted in liability ledger & the payment box is enabled to make the tax payment. |

FAQs

Ques.1 Whether Transitional credit can be claimed in FORM GSTR-3B??

Ans. Transactional credit cannot be claimed in FORM GSTR-3B. It is related to the transactions pertaining to the tax period of July & August. It will flow from FORM TRAN-1 in terms of section 140 and Rule 117 and cannot be taken directly in GSTR-3B.

Ques.2 Whether E-commerce operators are required to file FORM GSTR-3B??

Ans. E- commerce operators are not required to file FORM GSTR-3B, but if e-commerce operators supplying own goods & services will require to file FORM GSTR-3B, but in any other cases, they will deduct TCS and file Form GSTR-8 which is yet to be notified.

Ques.3 What if any invoice is missed while filing FORM GSTR-3B, can we update the same and pay additional liability while filing FORM GSTR-3 of July??

Ans. Yes, one can update the same and pay the additional liability while filing FORM GSTR-3, but one also has to pay interest accordingly, while filing FORM GSTR-3.

Ques.4 Can FORM GSTR-3B can be revised??

Ans. GSTR-3B cannot be revised, any revision has to be routed through FORM GSTR-1 & GSTR-2 & GSTR-3 of subsequent tax periods. Till the time you are saving and preparing the return, you can revise the same but once you have clicked the submit button, return cannot be revised.

Hope this information will help you in your Professional endeavors. For further assistance/query, feel free to write to us.

Conclusion

FORM GSTR-3B is the first monthly return post GST implementation. It is a summary return. After the detailed analysis of FORM GSTR-3B, one can opine that if credit cannot be claimed in this return then one has to pay GST for the month of July, 2017 and while filing FORM GSTR-3, transitional credit can be taken and carry forward the balance in next month.

Author: C S Ekta Maheshwari is the Author of this article and is Company Secretary by profession. The Author can be reached at csektamaheshwari14@gmail.com

Disclaimer:

The entire contents of this article is solely for information purpose and have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation.. It doesn’t constitute professional advice or a formal recommendation. The author has undertook utmost care to disseminate the true and correct view and doesn’t accept liability for any errors or omissions. You are kindly requested to verify & confirm the updates from the genuine sources before acting on any of the information’s provided herein above.

How can i enter the sales made to unregistered buyers… Whether I required to enter every invoice or aggregate of all sales made and liabilities accrued

I entered in ITC column all credit in IGST that was wrong, as it consist all IGST, CGST and SGST. But i realised this after submitting the GSTR3B. As there was no option to edit, utilize the credit in the same way, first against IGST, then CGST and then SGST. Actual payable was coming in IGST so challan was paid in IGST, but now after adjustment payable was coming in SGST. It allowed to adjust IGST cash payment in SGST. I got the message of successful of setoff adjustment. But while going to file with DSC, it is showing error message, first clear due and then file return, i then paid SGST, then IGST and then also one challan practically generated for Rs. 2.00, But still facing problem as getting the same error.

I just want to ask the GST department,

1. Why there is no edit option after submitting the data. As payment adjustment is showing only after submitting the data.

2. As GST is new return, why it is online, why not offline, like MVAT form.

3. Why there is no toll free number for GST help line, why STD call number is given?

very good article. thank you. Please tell me, when and how Trans 1 from will be available in Portal

How will one pay the GST ? The modes of payment and the codes have not been declared so far.

Pl clarify.

Nice article. Please clarify about the treatment of invoices for pre GST period ( i.e. Excise & VAT ) but accounted for in July-17 as June-17 VAT Return & payment is already submitted.

Thanks for information

very good article,which help all the registant while filing returns

Very informative and precise ~ Thanks a lot.

Are you sure that additional liability arising on filing GSTR-1 compared to the figures in GSTR-3B will yield interest liability? Wasn’t there an interest exemption for the months of july & august returns even if there is a difference in the individual returns filed as compared to the GSTR-3B?

Nice article, well written, clarification in layman;s language and need of the day.Please also clarify and reply on my email, in case submit button wrongly pressed before editing data filled and without verification of GSTR 3B whether return is filed or otherwise, If it is not filed, how it can be filed. And how filed return can be downloaded. Thanks & regards.

WE ARE REGISTERED UNDER GST AND HAVE GOT PROVISIONAL NUMBERNOW WE WANT TO SURRENDER NUMBER. hOW WE CAN SURRENDER IT ?. WHETHER WE NEED TO FILE NIL RETURN?

Nice efforts Ekta.

Nice efforts Ekta

GOOD

Nice article.well written .clarification in layman;s language. Needy of the day.

Congratulations!

Regards,

J.Janarthanan

Nicely written Ekta. Hope many more like this in future.

Very informative and very well written article. Thank you for sharing

mam

please clarify that id GSTR-3B not produced the 20 august. How many penalty are charges by GST.

Pahala payment karu na. Bad main submit button hoga na GSTR 3B main

Nice article