Quarterly Return Filing and Monthly Payment of Taxes (QRMP) Scheme under GST:

Quarterly Returns with Monthly Payment (QRMP) Scheme is for eligible taxpayers to file their Form GSTR-1 and Form GSTR-3B returns on quarterly basis, while paying their tax dues on monthly basis through a challan. In this case payment of challan in cash is mandatory.

1. Who can opt for QRMP Scheme :

All taxpayers whose aggregate annual turnover (PAN INDIA BASIS) for FY-2019-20 is up to ₹ 5 Crore in the current financial year and the preceding financial year (if applicable) and have already filed their last due Form GSTR-3B return, are eligible for the QRMP scheme.

If your aggregate turnover (PAN based) for FY 2019-20 and current Financial year is up to ₹ 5 Crore and you have filed your FORM GSTR-3B for the month of October 2020 (let’s say at least) by 30th November 2020, you will be put under QRMP scheme by default, by the GST system.

For example: A taxpayer’s whose Annual aggregate turnover (AATO) was less than/ up to ₹ 5 Crore in preceding FY and has filed Form GSTR-3B for the period June 2021 (let’s say at least) by last day of the first month of the next quarter i.e. by 31st July, 2021.

2. Who can avail and pre requisites:

“The QRMP scheme can be availed only by those taxpayers who are liable to file Form GSTR-1 and Form GSTR-3B returns and can be opted by :

A. Registered taxpayer (Normal taxpayer, SEZ Developer, SEZ unit)

1. Taxpayers who have opted out of composition scheme

2. Persons applying for a fresh registration as Normal taxpayer

3. The Form GSTR-3B return for most recent tax period has to be filed.

4. There Should no data saved on the portal in Form GSTR-1 for the applicable period (i.e. period for which you are opting for QRMP scheme).

3. What is Invoice Furnishing Facility (IFF)?

With the scheme of QRMP Invoice Furnishing there is Facility is also available so that outward B2B supply can be entered to the portal on monthly basis.

Invoice Furnishing Facility for taxpayers who have opted for QRMP scheme to declare outward supplies to a registered person for first two months of any quarter. It is an optional facility. The facility will be similar to Form GSTR-1. It allows filing for only B2B invoices, credit notes, debit notes etc. Last date of filing IFF for a month is the 13th of the next month. This will allow recipient taxpayers to take credit of these invoices in the same month, if reported in IFF, by the supplier taxpayer under QRMP scheme.

If Presently, a Taxpayer filing Form GSTR-1 at quarterly frequency and Form GSTR-3B at monthly frequency, will they be able to opt out of the QRMP scheme?

In the QRMP scheme taxpayer has option to otp this scheme but If you opt out of the scheme you would need to file both Form GSTR-1 and Form GSTR-3B on Monthly frequency or you can opt out QRMP and file both return on Quarterly basis.

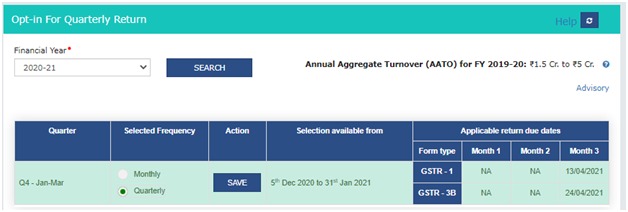

4. From where can I opt in or opt out from the QRMP scheme?

You can opt out from the GST portal GST.GOV.IN > Services > Returns > Opt-in for Quarterly Return option to opt in or opt out of the QRMP scheme.

5. When can a Taxpayer opt out the QRMP Scheme?

Taxpayer can opt in or opt out of the QRMP scheme any time during the year as per the timelines mentioned in the table below:

| S No | Quarter of a particular year | QRMP Scheme can be opted in or opted out during |

| 1. | Q1 (April – May – June) | 1st February’ to 30th April’ |

| 2. | Q2 (July – August – September) | 1st May’ to 31st July’ |

| 3. | Q3 (October – November – December) | 1st August’ to 31st October’ |

| 4. | Q4 (January – February – March) | 1st November’ to 31st January of next year |

6. Can a GST Practitioner opt in/ opt out of the QRMP scheme on behalf of taxpayer:

No, a GST practitioner cannot opt in/ opt out of the QRMP scheme on the behalf of taxpayer. A GST Practitioner can only view details.

7. Migration of Existing taxpayers to QRMP Scheme:

For the Quarter Jan to Mar 2021, all the registered taxpayers whose Annual Aggregate Turnover (AATO) in the FY 2019-20 was up to ₹ 5 Crore and has not exceeded ₹ 5 Crore turnover in current FY i.e. 2020-21 and have furnished there return in Form GSTR-3B for the month of October 2020 by 30th November 2020, will be migrated by default to QRMP scheme by the GST System.

8. Rules based on Annual Aggregate Turnover (AATO) by which the existing taxpayers will be migrated to QRMP Scheme:

The existing taxpayers will be migrated to the QRMP scheme, based on the following criteria of annual aggregate turnover.

Note: In case your return in Form GSTR-3B for the month of Oct. 2020 is not filed by 30th November 2020, GST Portal will migrate your profile to Monthly Return filing option.

9. Points related to changing Profile after opting for QRMP Scheme:

- Taxpayer can’t take action (Change the profile) for two consecutive quarters. The option selected in the current quarter will be set as the default option for the subsequent quarters

- If a taxpayer saved any data in GSTR-1 of the same month then he can’t opt for QRMP scheme, but can opt after deleting the data from the GSTR-1.

- If taxpayer opt for QRMP scheme and not choose any option then both Form GSTR-1 and Form GSTR-3B will be required to be filed at quarterly frequency by default. However, Payment needs to be made every month for tax dues on monthly basis through a challan.

- A newly registered taxpayer can opt for the scheme from initial stage if taken registration during first month of quarter, and can opt from next quarter if registration taken in subsequent month of the Quarter.

- Taxpayer not required to exercise the option every quarter, once the option exercise that will continue to the next periods , Unless they revise the said option or their AATO exceeds ₹ 5 Crore.

10. Impact of opting QRMP Scheme on Taxpayers:

The taxpayer has to deposit tax using form GST PMT-06 by the 25th of the following month, for the first and second months of the quarter. The taxpayers can pay their monthly tax liability either in the Fixed Sum Method or Self Assessment Method.

Fixed Sum Method (FSM):

The taxpayer must pay an amount of tax mentioned in a pre-filled challan in the form GST PMT-06 for an amount equal to 35% of the tax paid in cash.

| S.No. | Type of Taxpayer | Tax to be paid |

| 1. | Who furnished GSTR-3B quarterly for the last quarter | 35% of tax paid in cash in the preceding quarter |

| 2. | Who furnished GSTR-3B monthly during the last quarter | 100% of tax paid in cash in the last month of the immediately preceding quarter |

Self Assessment Method (SAM):

This is the existing method where a taxpayer can pay the tax liability by considering the tax liability on inward and outward supplies and the input tax credit available. The taxpayer has to manually arrive at the tax liability for the month and has to pay the same in form GST PMT-06. For ascertaining the amount of ITC available for the month the taxpayer can use form GSTR-2B.

There are certain instances where no amount may be required to be deposited, such as –

- For the first month of the quarter – where the balance in the electronic cash/credit ledger is adequate for the tax liability of the said month OR where the tax liability is nil.

- For the second month of the quarter – where the balance in the electronic cash/credit ledger is adequate for the cumulative tax liability for the first and second months of the quarter OR where the tax liability is nil.

11.Due Date of GSTR-3B under QRMP Scheme:

(a) Due Dates for Monthly return filing (Said date will vary on state wise).

(b) Due Dates for Quarterly return filing (Said date will vary on state wise)

| S No | States and Union Territories | Due Date |

| 1. | Chhattisgarh, Madhya Pradesh, Gujarat, Dadra and Nagar Haveli, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman and Nicobar Islands, Daman and Diu, Telangana and Andhra Pradesh | 22nd of the month succeeding such quarter |

| 2. | Jammu and Kashmir, Ladakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Mizoram, Manipur, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha | 24th of the month succeeding such quarter |

For More detail you can directly reach me out on Gstex.akb@gmail.com

Is mandatory for me to file GSTR-1/IFF of January 2021 if no Transaction done (means NIL Return)

I opted for GSTR-1 Quarterly basis and GSTR-3B on Monthly Basis. In

January I have NIL return means no sales and purchase on January. Should I file QRMP.

i have a tax liability for month of Feb 2021 but i have only B2C sale .so how to payment tax under QRMP.

sir

I have B2C sales only. Tax liability is around 13k for Jan 21. More than 2.5 lacs ITC is available. is it required to pay tax under self Asessment Tax. if not paid any interest ?

I have filed GSTR1 with B2B, but i have credit ledger balance 19000 but in Jan i have tax liability 19800, under QRMP i did n’t create challan for M1 as i have shortage of 800 only.

A) Is this correct ??

B) I have to create challan for 800 PMT-06

C) I can adjust this shortage amt 800 in M2 challan

D) none of these corret

pls clarify

will there be any interest if we didnt pay in GST PMT-06 within 25th for January month?

I have B2B invoices but didnt furnish within due dt…..Will there be any penality?

if there is no b2b for m1 and m2 then what i should file did i need to file nill for 2b2 for m1 and m2 ? is that necessary ?

I have only B2c Sales Only how to filing and furnishing in qrmp scheme

We are providing Export Service only and our GST portal autometically migratated to QRMP. Now while trying to fill and save Form 6A, one error is approching as Table 6A of Form GSTR-1 has been disabled and not allowing further to save the data. How to solve this problem?

Sir Agar B2C Sale ho toh usko GSTR1 Main kaise input kre. Coloum No. 7 Remove kr diya . toh GSTR1 Nill File Krna Padega Kya ?

We have only b2c Sales in Quarterly return. What should i do.I need to file GSTR1 b2b as nill return or no need to file?

How to create nil challan & if not compulsory so i paid any penulty.

IF NO TAX IN THE MONTH, SO NIL RETRUN IS REQUIRE OR NOT ? , IF SO REQUIRD HOW TO FILE !

Gst System should be like One nation One tax, i.e. Same rules for every tax payers to aviod chaos in monthly compliances of ITC rule. Rule shall be amended such that all tax payers should file their Return Monthly only so that ITC be availed by all types of Tax payers.

in qrmp scheme if my turnover above 1.5 cr but below then 5 cr then what can i used for uploading sales data…? gstr-01or iff…?

What if nothing is paid in cash in the previous return to quarter (whether monthly or quarterly). Then how the Fixed sum method will be available??

Say in Dec 20, a person has filed Nil Return Now in January he has transactions, then payment will be made on which basis if he want to opt for fixed sum method..?

Under monthly payment system, the people have accustomed to comply the GST return regularly.If buyer and seller are regular with GST return, the could avail ITC then and there. Now there will be confusion in monthly payment if GST1 and Gst2 are filed quarterly, There may be chance to miss the return.Moreover the full ITC could be claimed if gst-1 is filled at both side.The present amendment shall be welcomed if ITC is claimed irrespective of the seller filed GS1or not. CBIC is regular in complicating GST portal since it’s implementation.

Nice article..keep updating us