GST in India has provided a special procedure for removal of products from the principal manufacturer to job worker and return work from job worker to principal manufacturer subject to some terms, conditions, and limitations. Presently, excise duty is levied on the activity of ‘manufacture of goods’, whereas the VAT or central sales tax is levied on the sale of goods. The GST bill proposes to combine these various taxation aspects contained into one broader ambit ‘all inclusive concept’ called as ‘supply’. The law has kept the special transaction of Job Work into consideration while drafting and thus it provides for special procedure for removal and receipt of goods sent on job work.

Meaning of Job Work

It’s a processing or working on goods supplied by the other (principal). The work may be the initial process, intermediate process, assembly, packing or any other completion process. The goods sent for job work maybe raw material, component parts, and semi-finished goods and even finished goods. Examples of common job works are slitting, machining, welding, painting, electroplating, assembly, powder coating etc.

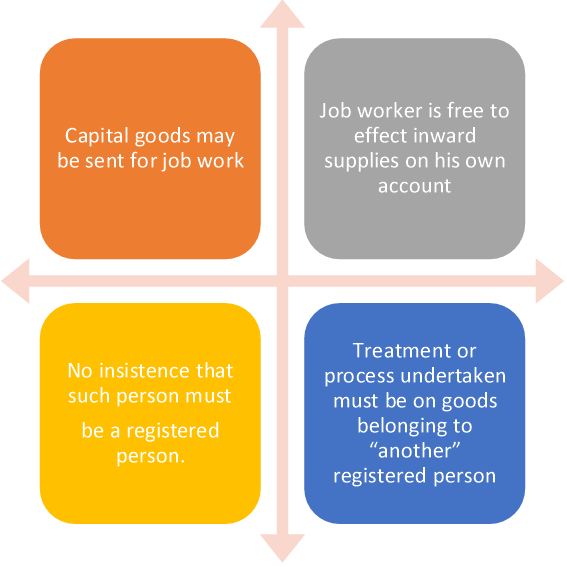

Definition of Job Work

As per Section 2(68) of CGST Act, 2017, Job work means any treatment or process undertaken by a person on goods belonging to another registered person.

The definition is much wider than as given in the existing law. It includes any process whether it amounts to manufacture or service.

Job Worker: The person who is treating or processing the goods belonging to other person is called ‘job worker’.

Principal: The person to whom the goods belongs is called ‘principal’.

Aspects to be noted

Applicability of Job Work Provisions

The provisions relating to job work are applicable only when registered taxable person intends to send taxable goods.

In other words, these provisions are not applicable to exempted or non-taxable goods or when the sender is a person other than registered taxable person.

Option to Principal

The principal would have 2 options:-

First: Principal to send the inputs or capital goods after payment of GST without following the special procedure related to job work. In such a case, the job worker would take the input tax credit and supply back the processed goods (after completion of job-work) on payment of GST.

Second: Principal to send the inputs or capital goods without the payment of GST by following the special provisions contained related to job work. In such case, job worker would not take any credit and would supply back the processed goods without payment of GST.

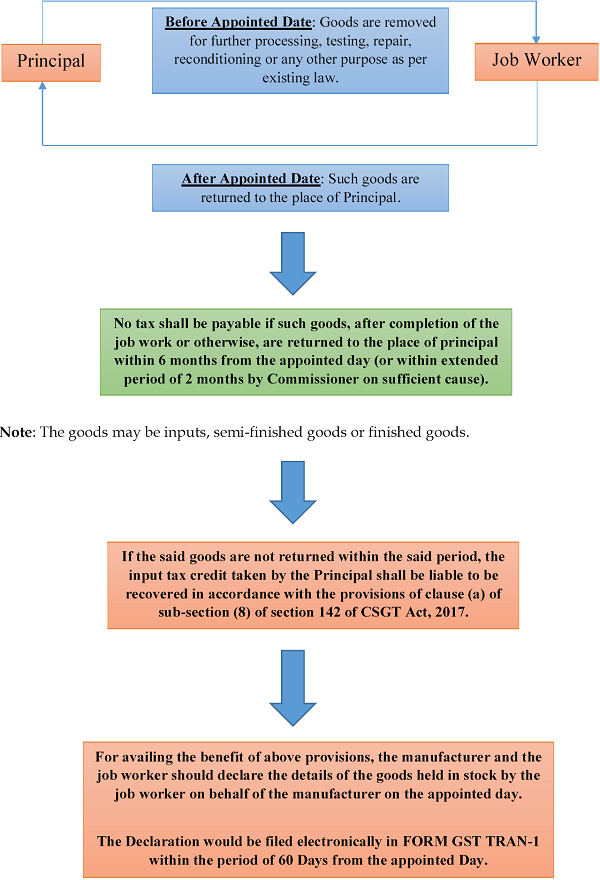

Transitional Provisions in relation to Job Work

Reverse Charge (RCM) under Job Work

As per Section 9(4) of CGST Act, 2017, GST in respect of supply of goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

In other words, if job worker is not a registered person, then on the amount charged by him towards job work charges, principal needs to pay tax to the govt. under reverse charge mechanism. In example given above, Principal shall pay tax on Rs. 2,10,000 from his pocket if job worker is not registered under GST and he can claim the benefit of the same in his subsequent month return only.

So, it is expected that now after GST, many Job Workers would get themselves registered since Principal would surely don’t want to pay tax under RCM and also wanted to take the benefit of direct selling the goods from the premises of Job Worker as envisaged Proviso to Clause (b) in Section 143(1) and Section 143(5) of CGST Act, 2017.

Registration for Job Worker

If job worker is making Intra-State Taxable Supply, then he is required to take registration if his aggregate turnover exceeds the prescribed threshold (Rs. 20 Lakhs for State or Union territory, other than special category States and Rs. 10 Lakhs for special category States).

If Job Worker is making Inter-State Taxable Supply, then job worker is always required to register whether his aggregate turnover exceeds threshold limit or not.

Further, Job work is always deemed as Supply of Service as per Schedule II (3).

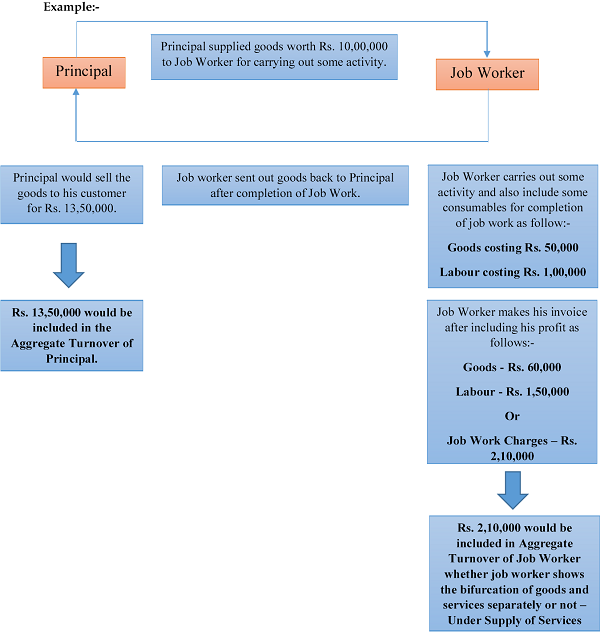

Aggregate Turnover of the Job Worker includes:-

1. Amount charged by the job worker for his services such as commission or labour charges or any other amount by whatever name.

2. It also includes the amount charged towards the value of goods used by the job worker from his side. (It will also be considered as supply of services as the job work is deemed to be supply of services as per Schedule II (3) whether job worker charged towards goods or services in relation to job work).

Aggregate Turnover of the Job Worker does not include:-

1. Value of goods supplied back to job worker after completion of job work.

2. Value of goods sold from the premises of job worker to any person on behalf of Principal.

3. Value of goods transferred from the premised of job worker to the premises of another job worker on instruction of the Principal.

(As per Explanation (ii) to Section 22 of CGST Act, 2017)

Example:-

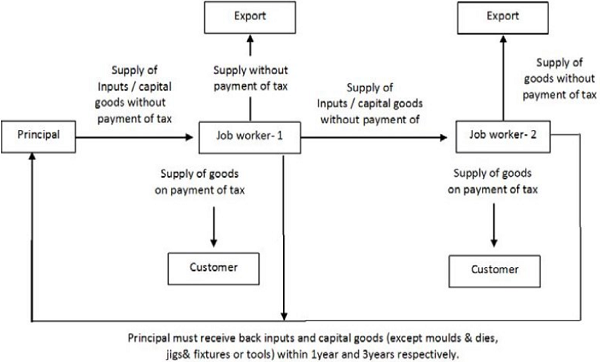

Job Work Procedure (Section 143 of CGST Act, 2017)

Job Work Procedure (Section 143 of CGST Act, 2017)

1. Principal can send the goods (input or capital goods) to job worker without payment of tax only after intimation to department and subject to such conditions as may be prescribed.

2. Principal has to bring back the goods to his place of business after completion of job work or he can also supply the goods from the place of job worker directly to any person on payment of tax within India, or with or without payment of tax for export, as the case may be. [In this case, the said principal has to declare the place of business of the job worker as his additional place of business except where the job worker is a registered person or goods are notified by the Commissioner].

3. Time for bring back the goods or supply the goods directly from job worker premises:-

♦ Inputs: Within 1 Year of their being sent out

♦ Capital Goods: Within 3 Years of their being sent out (Except Moulds and Dies, Jigs and Fixtures, or Tools since they are non-usable after their use and normally sold as scrap).

4. If above time limit are not met, then it will be deemed that such goods (input or capital goods) had been supplied by the principal to the job worker on the day when the said inputs were sent out (or on the date of receipt by the job worker where the inputs or capital goods were sent directly to the place of business of job worker).

5. Any waste and scrap generated during the job work can be supplied by the job worker directly from his place of business, on payment of tax, if he is registered. If he is not registered, the same would be supplied by the principal on payment of tax.

6. The responsibility for keeping proper accounts for the inputs or capital goods shall lie with the principal.

Input Tax Credit by Principal for Goods sent to Job Worker

As per Section 19 of CGST Act, 2017, Principal shall be allowed input tax credit on inputs or capital goods sent out to job worker whether the goods are sent out by Principal after bringing the goods to his place of business or goods are directly sent out to job worker without being first brought to his place of business subject to the prescribed conditions and restrictions as follows:-

1. The inputs or capital goods shall be sent to the job worker under the cover of a challan issued by the principal, including where such goods are sent directly to a job-worker.

2. The challan issued by the principal to the job worker shall contain the details specified in rule Invoice 10.

3. The details of challans in respect of goods dispatched to a job worker or received from a job worker during a tax period shall be included in FORM GSTR-1 furnished for that period.

4. Where the inputs or capital goods are not returned to the principal within the time stipulated in section 143, the challan issued under sub-rule (1) shall be deemed to be an invoice for the purposes of the Act.

Author: CA Gaurav Garg is the Author of this article and is Chartered Accountant by profession. The Author can be reached at gauravgarg9268@gmail.com.

Disclaimer: The entire contents of this article is solely for information purpose and have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. It doesn’t constitute professional advice or a formal recommendation. The author has undertook utmost care to disseminate the true and correct view and doesn’t accept liability for any errors or omissions. You are kindly requested to verify & confirm the updates from the genuine sources before acting on any of the information’s provided herein above.

Very handful article.