Q.1 What is GST ITC-01?

Ans: Registered person who is entitled to claim credit of input tax under section 18 (1) is required to file a declaration in Form ‘GST ITC-01’. The credit may be availed for inputs held in stock, inputs contained in semi-finished or finished goods held in stock or capital goods as mentioned below:

- Filing of Form GST ITC-01 will enable a newly registered taxpayer to take credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date from which he becomes liable to pay tax under GST provisions.

- Filing of Form GST ITC-01 will also benefits the taxpayers who have taken registration on Voluntarily Basis, to take credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date of grant of registration.

- Filing of Form GST ITC-01 will enable the taxpayer who opts out of composition scheme and opts to pay tax as a normal taxpayer, to take credit of input tax in respect of inputs held in stock, inputs contained in semi-finished or finished goods held in stock or on capital goods on the day immediately preceding the date on which he becomes liable to pay tax under Section 9.

- Filing of Form GST ITC-01 will entitle such registered persons whose supply of goods and/or services becomes taxable from exempt, to take credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock relatable to such exempt supply and on capital goods exclusively used for such exempted supply on the day immediately preceding the date from which such supply become taxable.

Q.2 Input Tax Credit can be availed on which goods?

Ans: Input tax credit can be availed on following goods:

- Inputs held in stock

- Inputs contained in semi-finished or finished goods held in stock

- Capital goods (Only in case where composition taxpayer opting out of the composition scheme and opts to pay tax as normal taxpayer or where the supply of exempted goods and/or services become taxable supply). Such persons will ensure that the input tax credit on capital goods shall be claimed after reducing the tax paid on such capital goods by 5 percentage points per quarter of a year or part thereof from the date of the invoice or such other document in which capital goods were received by the taxable persons.

Q.3 When can I claim Input Tax Credit?

Ans: Registered person can claim credit of the inputs tax in respect of eligible stock of goods within 30 days from the date of becoming eligible to avail ITC under sub-section (1) of section 18 or within such further period as may be extended by the Commissioner:

- Claim under clause (a) or clause (b) of sub-section (1) of section 18 can be made only once.

- Claim under clause (c) of sub-section (1) of section 18 can be made once in a financial year.

- Claim under clause (d) of sub-section (1) of section 18 can be made as and when the exempted supply become taxable.

Q.4 By when do I need to claim Input Tax Credit?

Ans: The input tax credit can be claimed for invoices up to one year prior to the date of grant of approval /opting out of composition scheme or exempt supplies becoming taxable and will be counted on or after appointed day. For capital goods the invoices can be dated 5 years prior to the date of grant of approval /opting out of composition scheme or exempt supplies becoming taxable.

Q.5 What are the pre-conditions to claim Input Tax Credit?

Ans: The claim in Form GST ITC-01 should be filed by the registered person within a period of thirty days from the date of becoming eligible to avail the input tax credit in terms of Section 18 of the Act. If the declared amount of ITC is more than Rs. 2 Lakh, then the details given in Form GST ITC-01 should be certified by practicing CA/Cost Accountant.

Q.6 What will happen once the Form GST ITC-01 is filed?

Ans: Once the Form GST ITC-01 is successfully filed, the amount of ITC claimed would be posted to your credit ledger; ARN is generated and SMS and Email are sent to the taxpayer.

——————

How can I declare and file claim of ITC prior to registration/ on withdrawal from composition scheme/ on exempt supply of goods/ services becoming taxable on the GST Portal?

To declare and file claim of ITC prior to registration/ on withdrawal from composition scheme/ on exempt supply of goods/ services becoming taxable on the GST Portal, perform the following steps:

1. Login and Navigate to ITC-01 page

2. Declaration for claim of input tax credit under sub-section (1) of section 18

♣ Claim made under Section 18 (1) (a)

♣ Claim made under Section 18 (1) (d)

3. Submit GST ITC-01 to freeze data

4. Update Certifying Chartered Accountant or Cost Accountant Details

5. File GST ITC-01 with DSC/ EVC

Page Contents

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

3. Click the Services > Returns > ITC Forms command.

4. The GST ITC Forms page is displayed. In the GST ITC-01 tile, click the PREPARE ONLINE button if you want to prepare the return by making entries on the GST Portal.

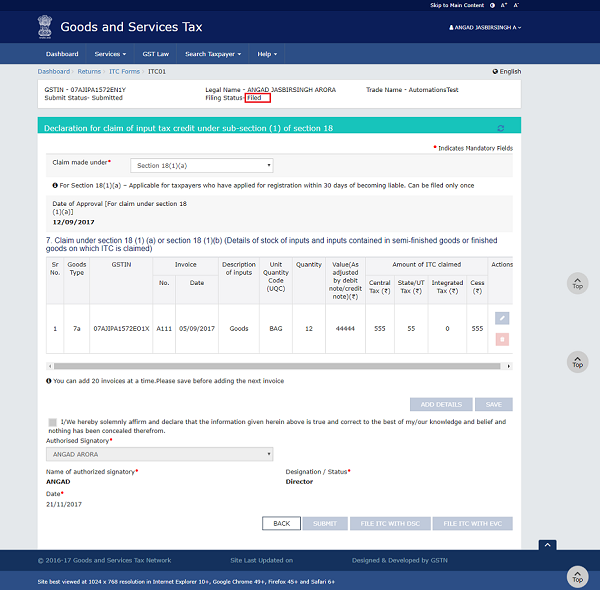

2. Declaration for claim of input tax credit under sub-section (1) of section 18

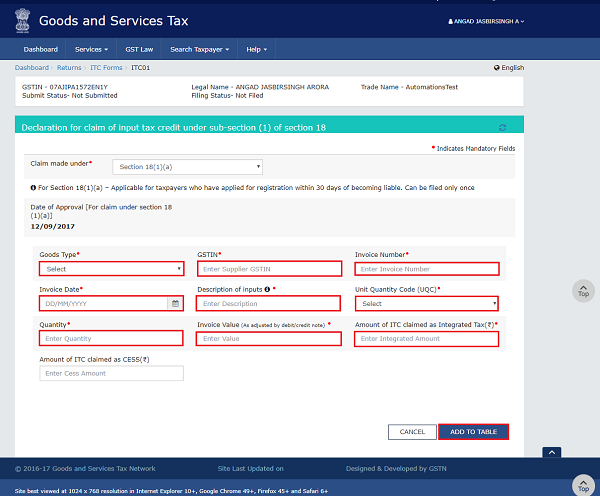

1. Select the appropriate section from the Claim made under drop-down list.

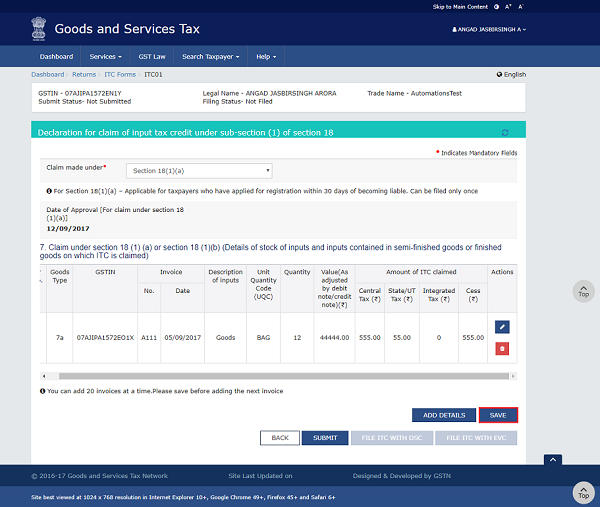

In case of Claim made under Section 18 (1) (a):

Section 18(1)(a) is applicable for taxpayers who have applied for registration within 30 days of becoming liable and can be filed only once.

2. Click the ADD DETAILS button.

3. Select the Goods Type from the drop-down list.

4. In the GSTIN field, enter the GSTIN of the supplier who supplied the goods or services.

5. In the Invoice Number field, enter the invoice number.

6. In the Invoice Date field, select the date on which the invoice was generated using the calendar.

Note: Invoice date should be prior to grant of approval.

7. In the Description of inputs field, enter the description of inputs held in stock, inputs contained in semi-furnished or finished goods held in stock.

8. Select the Unit Quantity Code (UQC) from the drop-down list.

9. In the Quantity field, enter the date quantity of inputs.

10. In the Invoice Value field, enter the invoice value.

11. Enter the amount of ITC claimed as Central Tax, SGST/ UTGST Tax, Integrated tax and Cess as appropriate.

Note: CGST and SGST amount should be same and sum of CGST and SGST should not exceed the invoice value.

In case of Inter-State purchase, IGST amount should not exceed the invoice Value.

12. Click the ADD TO TABLE button.

13. Details are added. Click the SAVE button.

Note: You can add 20 invoices at a time. Please save before adding the next invoice.

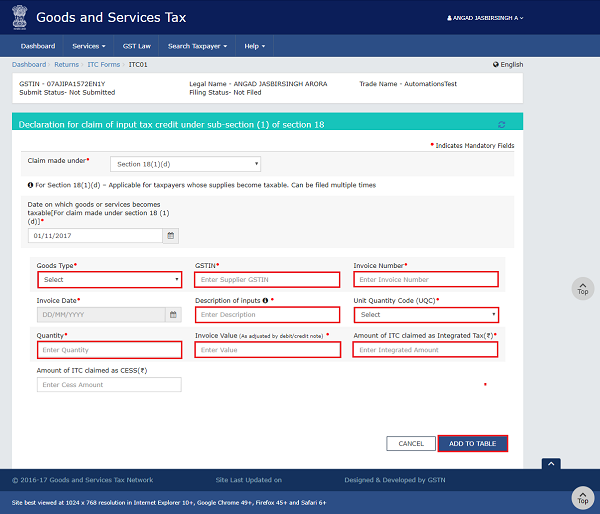

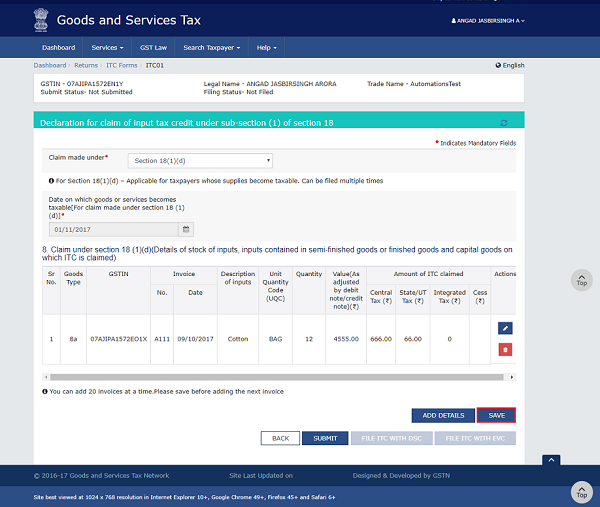

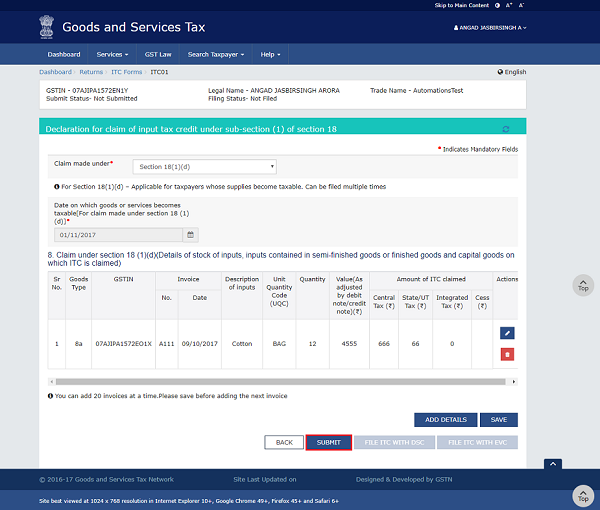

In case of Claim made under Section 18 (1) (d):

Section 18(1)(d) is applicable for taxpayers whose supplies have become taxable and can be filed multiple times.

2. Select the date on which goods or services becomes taxable [For claim made under section 18 (1)(d)] using the calendar.

3. Click the ADD DETAILS button.

4. Select the Goods Type from the drop-down list.

5. In the GSTIN field, enter the GSTIN of the supplier who supplied the goods or services.

6. In the Invoice Number field, enter the invoice number.

7. In the Description of inputs field, enter the description of inputs held in stock, inputs contained in semi-furnished or finished goods held in stock.

8. Select the Unit Quantity Code (UQC) from the drop-down list.

9. In the Quantity field, enter the date quantity of inputs.

10. In the Invoice Value field, enter the invoice value.

11. Enter the amount of ITC claimed as Central Tax, SGST/ UTGST Tax, Integrated tax and Cess as appropriate.

12. Click the ADD TO TABLE button.

13. Details are added. Click the SAVE button.

Note: You can add 20 invoices at a time. Please save before adding the next invoice.

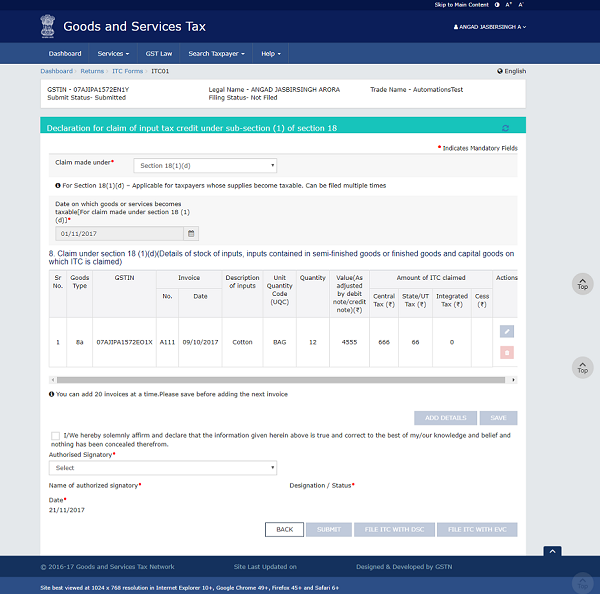

3. Submit GST ITC-01 to freeze data

1. Click the SUBMIT button to submit GST ITC-01.

2. Click the PROCEED button.

3. Once you submit the data, data is frozen and you cannot change any fields. Refresh the page.

4. Refresh the page and the status of GST ITC-01 changes to Submitted after the submission of GST ITC-01.

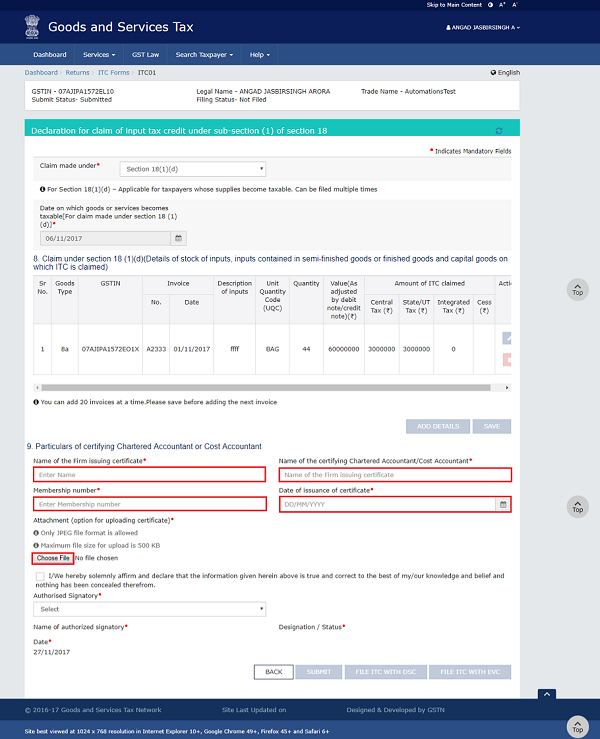

4. Update Certifying Chartered Accountant or Cost Accountant Details

After submitting and before filing ITC-01, if ITC claimed is more than 2 lakhs INR, then you need to update the Chartered Accountant (CA) details. You also need to upload the CA certificate on the GST Portal.

1. In the Name of the Firm issuing certificate field, enter the name of the firm which issued the certificate.

2. In the Name of the certifying Chartered Accountant/Cost Accountant field, enter the name of the Chartered Accountant or Cost Accountant.

3. In the Membership number field, enter the membership number of the Chartered Accountant or Cost Accountant.

4. Select the Date of issuance of certificate using the calendar.

5. Upload the Chartered Accountant or Cost Accountant certificate in JPEG format with maximum size of 500 KB.

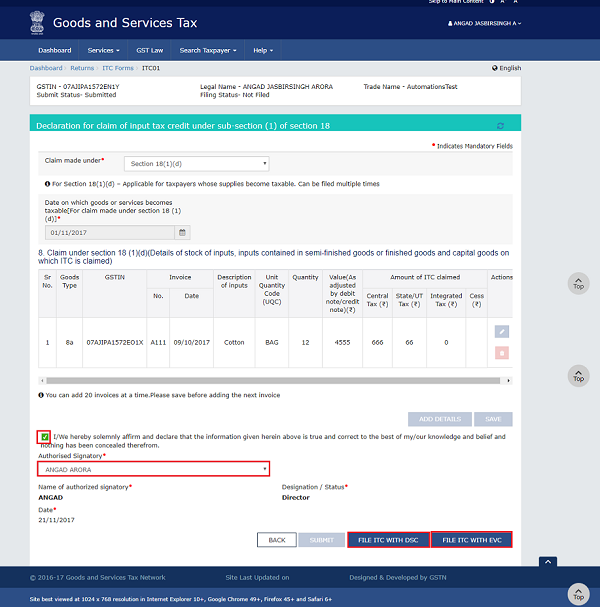

5. File GST ITC-01 with DSC/ EVC

1. Select the checkbox for declaration.

2. In the Authorised Signatory drop-down list, select the authorized signatory. This will enable the two buttons – FILE ITC WITH DSC or FILE ITC WITH EVC.

3. Click the FILE ITC WITH DSC or FILE ITC WITH EVC button to file GST ITC-01.

FILE WITH DSC:

a. Click the PROCEED button.

b. Select the certificate and click the SIGN button.

FILE WITH EVC:

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

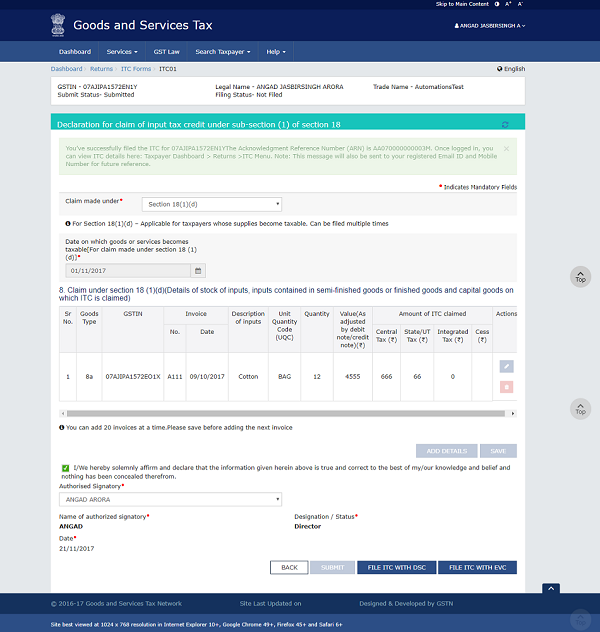

4. The success message is displayed. ARN is generated and SMS and email is sent to the taxpayer. Refresh the page.

The status of GST ITC-01 changes to Filed.

(Republished with amendments)

****

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

I m unable to fill itc01 offline where its to be upload

PLEASE TELL US WHAT CAN WE DO???? IF WE HAVE NOT FILED ITC-001 IN 30 DAYS

I HAVE OPT OUT FROM COMPOSITION AND AVAILABLE ITC IS MORE THAN 2 LAKH, IS THE NECESSARY THAT GET CERTIFICATE FROM CHARTED ACCOUNTANT ???

Dear Sir

what happens if 30 days already passed and Form ITC-01 is missed for filing. is there any remedy?

i opt out composition on 01/10/2018 but failed to file GST ITC-01 with in 30 days, now what can i do how can i proceed further, please suggest me any way..

maine composition se regular me transfer kiya hai . mera claim 2 lakh se zyada hai . mere pass sabhi invoices hai ..kya mujhe ca se certificate lena padega.

thank to update my knowledge.

good understanding

The dealer changed option from composition into Regular on 4/4/2018. He failed to file ITC -1 Return in Time. May I know whether any time limit availble to file it now

would you please tell me where are CA certificate form to apply gst ITC-01

CAN I GET CA CERTIFICATE FOR UPLOADING ITC 01

I changed my scheme composition to regular in feb, 2018 . Can I fill itc -01 form after 3 months.

i have purchased car for above 50 lakhs gst tax same amount cess amount more then 5 lakhs how to rufund cess amount if it is possible

sir,

could you please tel me where could i find the format of such ca certificate or cost accountant certificate to upload my return.

sir,

could you please tell me where is the CA certificate format available to upload in my return

Respected Team members,

We have shifted from composition dealer to Regular dealer and wants to take input tax credit of stock held with us just preceding the date of conversion.

There are certain queries which are need to be resolved regarding the filling of ITC 01

1. Description of goods column- There are different types of goods the firm is dealing IN and the firm purchases goods in a single invoice with multiple rates of GST. so in the description column, what will be the “description of goods” as goods of different rates are purchased in a single invoice .

Similarly some of the goods are sold out of total purchase as per the purchase invoice, so the goods left in stock or goods as per purchase invoice are to be shown in description column.

(Note: There is a limit of fifty words)

2. UQC Column: Similarly what UQC is to be shown if different goods have different UQC Code in the purchase invoice.

3.Quantity column : Total invoice quantity or quantity of each item as per purchase invoice or quantity held in stock. What need to be shown?

4.Value column: Total invoice value inclusive of GST or value of each quantity inclusive of GST or we have to show these without GST.

5. Amount of ITC Claimed Column: CGST or SGST as shown in Purchase invoice or as per the goods held in stock.

6. How we can claim ITC for Stock held with us before 1st July 2017.

7. How the ITC will be transferred to the credit of the firm.

Waiting for your valuable feedback. Please clear the above issues to me as soon as possible.

Thank you

Sir I purchased goods of 15 lakh inr and sale 12 lakh.

Now how can justify rest stock by purchase bill

Bcz rest stock goods dnt have any particular bills.

So which bill I have to submit and which bill I have to ignore..

Plz help me

sir

I have opt-out from composition scheme

just one quary I have purchased 3 nos fry pan out of which I have sale one fry pan before opt out from composition in how can I entered in the itc o1? is it entered the invoice no from which I have purchased 3 now kindly help sir

HOW WE TAKE ITC ..HOWEVER MY GSTR 2A NOT SHOWN ANY ITC

can i get the format of CA Certificate for uploading ITC-01

THIS IS NOT CLEAR WHETHER INVOICE WISE OR ITEM WISE DETAILS ARE TO BE FURNISHED IN GST ITC 01?

IF THIS IS INVOICE WISE THEN WHAT SHOULD BE THE UQC IF THERE ARE MORE THAN ONE UQC AVAILABLE IN A SINGLE INVOICE?

AND WHICH VALUE IS TO BE FURNISHED? ITEM WISE INVOICE VALUE OR THE TAXABLE VALUE OR ONLY THE PART FOR WHICH ITC IS BEING CLAIMED OR THE TOTAL INVOICE VALUE?

dear

ca certificate not uploaded showing a error

” error encountered while uploading the file ”

size and format is valid as per gst site rule

kindly provide any sloution

on priorty

Is the sole proprietor who is doing job work , has to file ITC – 1

The taxpayer has taken voluntary registration. Commencement of Business – 1.7.2017, Date of submission of GST Registration – 2.8.2017, Date of grant of GST Registration – 9.8.2017. The taxpayer had GST paid stock in hand. For claiming ITC on stock he needs to file ITC-01. But the same is not yet showing in his account on GST portal. Please advise on which date stock he will be claiming ITC – 1.8 or 8.8? When ITC-01 be available online?