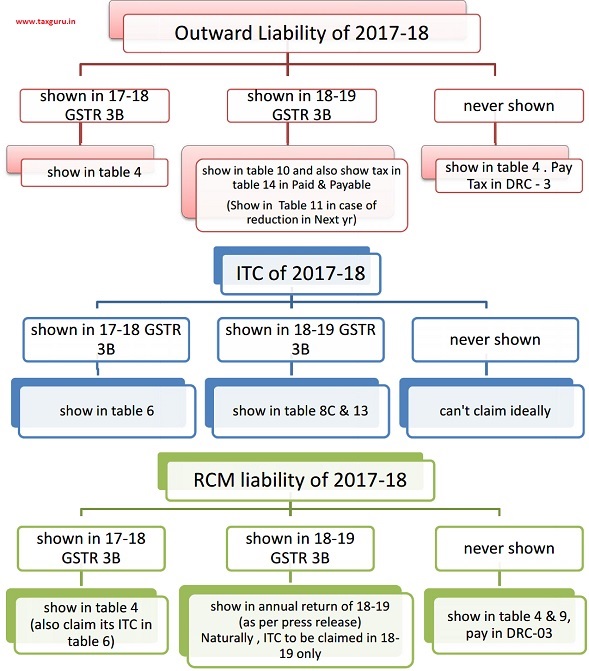

The last date for filing of Annual return in FORM GSTR-9 for the FY 2017-18 is 31st August 2019 and many professionals facing lot of Confusion regarding Presentation purpose in different tables of GSTR 9 specially in case of transactions shown in GSTR 3B of 2018-19 which are pertaining to FY 2017-18. So What will be Treatment of transactions shown in 2017-18 GSTR 3B or you might have shown in 2018-19 or what if You have never shown?? Here it Goes. This chart will guide you for presentation of such transaction in GSTR 9 in different tables. Hope you Find it useful. Also at last , I have given you some check-points which will help you decide which data should ideally match internally in GSTR 9

What will be Treatment of transactions shown in 2017-18 or you might have shown 18-19 or You have never shown?? This chart will guide you for presentation of such transaction in GSTR9.

3 simple Formulas which Serves as CHECK-POINT for TAX PAYABLE AMOUNT , TURNOVER FIGURE , & ITC MATCHING

This flow chart makes it easy. Thanks for your contribution Sir! Sir, do we need to pay penalty on RCM if we are paying it through DRC-03 now?

Well explained in one page

Very well explained

i want amend gstr1 invoice now year 2017 18