There has been a lot of confusion on taxability of various activities undertaken by projects works contractor. In this article a detailed analysis of various activities is discussed. Generally, Project works contractor engages in various kinds of construction of Dams, Canals, Bridges, Roads, Railways. Construction of dams, canals, bridges etc., is crucial for the infrastructural development of an economy and hence construction of the same shall be undertaken by central government/state government/local authority, which in turn engages contractors for executing such projects. Various chains of contractors and subcontractors will be involved in the execution such contracts.

Taxability on various projects contracts.

In terms of Section 2(119) of the CGST Act, 2017 “works contract” means a contract for building, construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration or commissioning of any immovable property wherein transfer of property in goods (whether as goods or in some other form) is involved in the execution of such contract.”

Project works contracts will fall under the definition of works contract in GST for the following reasons:

- Construction/building activity is involved’

- Such construction services result in an immovable property

- Transfer of property in goods is involved

In terms of Para 6(a) of Schedule II to the CGST Act, 2017, works contracts shall be treated as a supply of services.

Hence, we can conclude that project works will be treated as works contract which in turn is supply of service.

In terms of Section 2(33) of the CGST Act, 2017 Continuous supply of services means a supply of services which is provided, or agreed to be provided, continuously or on recurrent basis, under a contract, for a period exceeding three months with periodic payment obligations……….;

Project works will be treated as continuous supply of services due to the following reasons:

- The contracts take huge time for completion (Above 3 months)

- Contracts involve periodic payment linked to completion of events/provision of agreed services.

- Services are provided under a contract entered with either government/contract/sub-contractor.

Time of supply of works contract

Time of supply shall be earlier of the following dates

- Earlier of date of invoice or date of receipt of payment if invoice is issued with 30 days

- Earlier of date of provision of service or date of receipt of payment is invoice is not issued within 30 days

Due date within which invoice needs to be raised

Invoice shall be raised at following dates

| Particulars | Due date |

| Due date of payment is ascertainable from the contract | Invoice shall be issued on or before the due date of payment |

| Payment is linked to completion of event | Invoice shall be issued on or before the completion of event |

| Due date of payment is not ascertainable from the contract | Invoice shall be issued on or before the date of receipt of payment |

lace of supply

| Location of Supplier and Recipient | Location of Immovable Property | Place of Supply |

| Both are located in India | In India | Location of Immovable Property |

| Both are located in India | Outside India | Location of Recipient |

| Either anyone located at outside India | India or Outside India | Location of Immovable property |

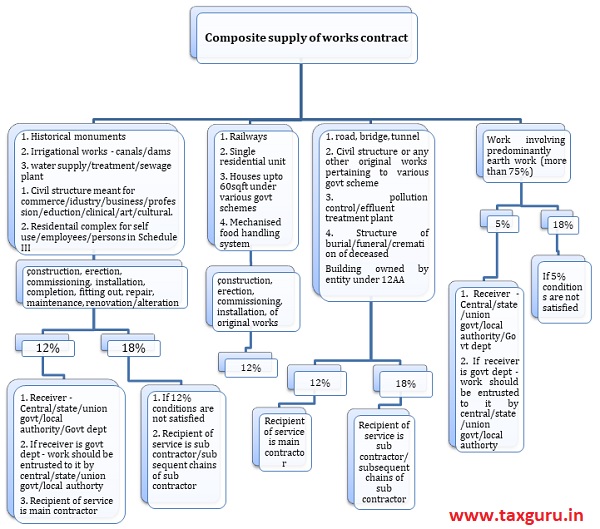

Tax rates for various project works

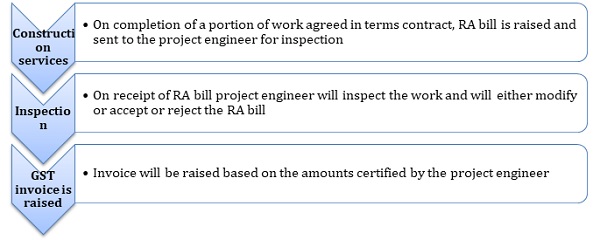

Output process flow

Taxability of special transactions

1. GST applicability on various amounts paid to government

In terms of Entry No. 5 of Notification No. 13/2017 – Central Tax (Rate) GST is liable to be paid under RCM on services provided by the central government, state government, union territory or local authority (herein after referred to as Government).

| Particulars | Taxability |

| Seigniorage Charges/Royalty | Seigniorage charges are paid to government for removal or consumption of minerals.

It amounts to supply as it is collected for providing license for consumption of minerals. GST needs to be paid under RCM if above charges are paid to Government. |

| DMF/SMET | DMF/SMET Contributions are made to District mineral fund (DMF) for the interest and benefit of persons and areas affected by mining related operations.

DMF is a body corporate and a non-profit making trust and shall not be treated as government/local authority. Hence contributions made to DMF are not liable under RCM. |

| Labour cess and NAC | Labour cess & NAC are the statutory payments to be made by an entity in specified industries, wherein no supply is received. Hence, the same is not liable under RCM. |

| Inspection charges | Generally, in government projects, the goods which shall be used for the construction will be inspected by a government department established specifically for the purpose of inspecting.

Inspection charges paid will be covered under the purview of supply as the amounts are paid towards the inspection of goods. Liability under RCM is as follows:

|

Further, as per Section 9 of the Mines and Minerals (Development & Regulation) Act 1957, royalty/seigniorage has to be paid by any individual who has received a mining lease from the authority. Accordingly, the challans will be in the name of the person who has obtained license.

Hence, on constructive reading of above section, an important factor which should be considered while discharging GST on royalty is that RCM will be applicable only if the person is liable to pay seigniorage/royalty i.e., challan should be in the name of person. This also implies that GST will not be leviable under RCM, if royalties are merely reimbursed to main contractor/sub-contractor/customer.

2. Sale of capital goods (Other than Motor vehicles)

In terms of Section 7 of CGST Act, 2017, GST shall be paid on all supply of goods or services or both if such supply is made for a consideration. Hence, GST shall be paid only if the capital goods are supplied for a consideration.

Further, in terms of entry 1 of Schedule I to CGST Act, 2017, GST shall be paid on transfer for business assets on which ITC is availed even if supplied without consideration.

The above is summarized as follows:

| Consideration | ITC availment | Taxability |

| Supplied for consideration | ITC not availed/ITC availed/ ITC not availed but CENVAT credit is availed | GST is leviable in terms of Section 7 of CGST Act, 2017 |

| Supplied at Free of cost | ITC is not availed | GST not leviable in terms of Schedule I to CGST Act, 2017 |

| Supplied at Free of cost | ITC is availed | GST leviable in terms of Schedule I to CGST Act, 2017 |

| Supplied at Free of cost | ITC is not availed but CENVAT credit is availed | GST not leviable in terms of Schedule I to CGST Act, 2017 as Input tax definition under Section 2(62) of CGST Act,2017 only includes Credit of tax payable under GST Act. |

3. Transfer of goods/Capital goods from one site to another

A project works contractor transfers goods from one site to another because of excess stock in one site/urgent requirement in another site…etc., there are two scenarios in which goods are transferred:

- Title in goods/capital goods is transferred – to be treated as supply of goods as per entry 1(a) of Schedule II to CGST Act, 2017

- Only the right to use the capital goods is transferred without transferring the tittle – To be treated as supply of service as per entry1(b) of Schedule II to CGST Act, 2017

In terms of entry 2 to schedule I of CGST Act, 2017 GST is leviable on all Supply of goods or services or both between related persons or between distinct persons (Persons registered in GST under a single PAN) when made in the course or furtherance of business.

Hence from above section supply of goods between sites even without consideration will come under the purview of supply.

4. Sale of Old motor vehicles

In terms of Notification No. 8/2018 Central Tax (Rate) dated 25.01.2018, GST on sale of Old and used motor vehicles shall be paid on Margin value i.e., the difference between Sale value and depreciated value as on the date of sale and where the margin of such supply is negative, it shall be ignored.

Further income tax Act, 1947 requires computation of depreciation on block of assets, but for the purpose of computation of margin as above, the depreciated value should be determined for the specific vehicle which is being sold.

It is pertinent to note that Margin Scheme will not apply for earth moving vehicles, as in terms of Sec 2(28) of Motor Vehicles Act, 1988 motor vehicles definition excludes vehicle of a special type adapted for use only in a factory or in any other enclosed premises, hence motor vehicles do not include earth moving vehicles as they are adopted for use in specified premises.

From Combined reading of above two references, GST shall be paid on sale value in case of sale of earth moving vehicles like JCB, Excavators, Bulldozers. Etc., this is further clarified in the FAQ no: 21 issued by CBIC on Mining.

5. GST on receipt of mobilization advance

Normally Government provides Mobilization advance to Works Contractors for timely completion of works and to support the contractor in case of any financial difficulties. GST shall be paid on mobilization advance/ any other advance received from the principal in terms of Section 13 of CGST Act, 2017 which specifies that Time of Supply shall be earlier of Date of invoice or date of receipt or Date of completion of service.

GST payment on advance will result in accumulation of ITC in all the cases where GST registration is obtained only for a single project which in turn hinders the main objective of GST which is seamless flow of Input tax credit.

One more stand which can be taken w.r.t mobilization advance is that it is in the nature of loan which is a capital receipt and therefore, not taxable under GST.

6. GST on free issue of material

There is possibility that the contractee/customer may supply cement, steel, bricks at free of cost to the contractor and the contractor uses such material received in the execution of the work. Taxability of free issue of material has always been a contradictory issue, at the juncture it is pertinent to analyse the applicability of GST on free issue of material.

The value of supply, in terms of Section 15(2)(b) of CGST Act, 2017, shall include any amount that the supplier is liable to pay in relation to such supply but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods or services or both.

On constructive reading of above section free issue of material shall be included in the valuation if the following conditions are satisfied:

1. Supplier is liable to pay – liability of supplier towards such material should be agreed in terms of contract, that means the contract shall include the clause that the liability to supply such goods is on the supplier.

2. Incurred by the recipient – It is the liability of the supplier to supply those material, however recipient has supplied such goods due to various reasons.

3. The cost of such free issue material is not charged from the customer.

Hence from above GST should be paid on free issue of material only if the liability to supply such material is on supplier which should be further proved in terms of agreement.

Consequently, various contractors specify in agreements that the scope of the contractor is merely restricted to the servicing or installation of such free issue material and accordingly price quoted only includes service fee on the Free issue material.

The liability on free issue material is summarised

| Liability to supply | GST leviability |

| Is on contractor | Leviable to tax |

| Is on contractee | Not leviable (However GST is required to be paid on service fee) |

7. Nature of supply where contract involves construction of an immovable property located outside India

Basically, a country undertakes construction of a project in other country due to various reasons like enabling convenient transport of goods, to boost trade ties/diplomatic ties etc., for example India has constructed Chabahar port in Iran to enable trading of goods to Afghanistan. There could be 2 ways through which contracts for construction in other countries can be obtained

- Contracts received from Indian Government/PSU

- Contracts received directly from foreign party

As contract involves construction of immovable property outside India let us analyse whether such services provided would be treated as an export of service, for any service to be treated as export of service the following conditions should be satisfied as per section 2(6) of IGST Act, 2017:

- Supplier is located in India

- Recipient is located outside India

- Place of supply is outside India

- Amount is received in convertible foreign exchange (except when permitted by RBI)

- Supplier and receiver are not distinct persons

Contracts received from Indian Government/PSU

The POS (as discussed in previous pages) for construction of immovable property shall be the location of recipient (for immovable property located outside India).

Wherever contracts are received from Indian government/PSU it will not be treated as export of service due to the following reasons:

- Recipient of services is not located outside India.

- Amount will be received in Indian Rs./- and not in convertible foreign exchange.

As it is not treated as an export it should be treated as an interstate supply and accordingly IGST needs to be discharged as Sec 7(5)(c) of IGST Act, 2017 specifies that Supply of goods or services or both when the supplier is located in India and the place of supply is outside India shall be treated as Interstate Supply.

Contracts received from foreign party

In all cases where contracts are received from foreign parties it will come under the purview of export of services as it satisfies all the following requirements:

- Supplier is located in India

- Recipient is outside India

- Place of supply is outside India (location of immovable property)

Amount is received in convertible foreign exchange. As, export of service is a zero-rated supply two options are available for the supplier:

- Supply under LUT without payment of tax and claim refund of unutilized credit.

- Export with payment of tax and claim refund of the taxes paid.

Good GST notes on Project Contractor.