Whenever one buys any medicine or drugs, one never forgets to check its expiry date. Medicines and drugs have defined life term. They always come with an expiry date. Generally Medicines/Drugs are sold by the manufacturer to the wholesaler, by the wholesaler to the retailer and at last by the retailer to the consumer. The documents issued in these transaction are Tax invoice if goods are taxable else Bill of supply.

But many a times the medicines/drugs (Goods) are not sold and they cross their date of expiry. These expired goods are then returned back to the manufacturer through the supply chain.

In this article we would see the GST procedures for returning these expired goods.

1. How can the expired goods be returned under GST?

- The Retailer or the wholesaler have the following options

2. What are implications if person chooses option 1, treating fresh supply i.e. sale?

- In this there are three scenarios, one where the goods are returned by Registered Person , Two where the goods are being returned by Composition dealer and three where the person returning the goods are unregistered under GST. Let’s see these scenarios-

3. What about the GST implication on the part of Manufacture/ wholesaler for expired goods returned by wholesaler/ retailer and treated as fresh supply?

- When the manufacturer receives the expired goods, he needs to destroy the expired goods.

- As the return of goods is being treated as fresh supply, this return would be purchases for Manufacturer/wholesaler.

- The manufacturer needs to reverse the input tax credit availed on the return of goods u/s 17(5) (h) of the CGST Act. As the goods are destroyed at the end by the manufacturer, so no credit available for the same

- Note -ITC to be reversed would be ITC availed on return supply and not ITC attributable to the manufacturer of such time expired goods.

- Eg. Suppose a manufacturer sold the manufactured medicines at Rs.100/- ,for manufacturing these medicines he made purchases and ITC availed for such purchases was Rs.10/-

- Now the expired medicines are being returned by the retailer/wholesaler to the manufacturer as fresh supply. The retailer/wholesaler charges tax on this fresh supply which amounts to say 15/-

- Then in the above scenario the ITC to be reversed on destruction of expired goods would be Rs.15 and not Rs.10.

- Eg. Suppose a manufacturer sold the manufactured medicines at Rs.100/- ,for manufacturing these medicines he made purchases and ITC availed for such purchases was Rs.10/-

4. What are implications if person chooses option 2, Return of goods by issuing credit note?

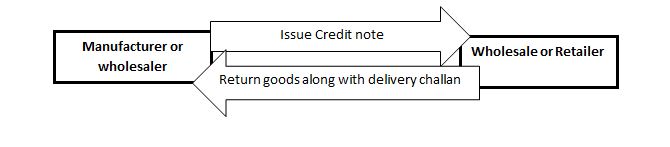

- The manufacturer or the wholesaler, who had supplied the medicines/drugs, has option to issue credit note for the expired goods returned by wholesaler/retailer as the case may be.

- The retailer or the wholesaler who are returning the goods may do so by issuing a delivery challan.

- The manufacture would destroy the expired goods and also reverse the ITC “Attributable” to the manufacture of such goods.

5. Other points to keep in mind, if option 2 mentioned above is selected?

- The points to keep in mind in relation to the issuance of credit note are

Hope this article helps you!! Keep Reading

The procedures mentioned above were clarified by Circular No.72/46/2018-GST dated.26th October 2018.

This article is for guidance only, not intended to be substituted for detailed research or the exercise of professional judgement.

Well Explained, easy to understand.

Nicely explained and elaboratively written. Keep reading & keep writing.

Article is really helpful😊

Information provided by you is really so important and it’s helpful