Please note- Regarding migration to GST, part data on provisional IDs of Central Excise registrants has been received from GSTN and made available through ACES website. The remaining provisional IDs of Central Excise registrants and the Service Tax registrants are still awaited from GSTN and would be made available shortly.

Relevant provision of Model GST Law

Sec 166. Migration of existing taxpayers to GST

(1) On the appointed day, every person registered under any of the earlier laws and having a valid PAN shall be issued a certificate of registration on a provisional basis in such form and manner as may be prescribed.

(2) The certificate of registration issued under sub-section (1) shall be valid for a period of six months from the date of its issue:

PROVIDED that the said validity period may be extended for such further period as the Central/State Government may, on the recommendation of the Council, notify.

(3) Every person to whom a certificate of registration has been issued under subsection (1) shall, within the period specified under sub-section (2), furnish such information as may be prescribed.

(4) On furnishing of such information, the certificate of registration issued under subsection (1) shall, subject to the provisions of section 23, be granted on a final basis by the Central/State Government.

(5) The certificate of registration issued to a person under sub-section (1) may be cancelled if such person fails to furnish, within the time specified under subsection (2), the information prescribed under sub-section (3).

(6) The certificate of registration issued to a person under sub-section (1) shall be deemed to have not been issued if the said registration is cancelled in pursuance of an application filed by such person that he was not liable to registration under section 23.

(7) A person to whom a certificate of registration has been issued on a provisional basis and who is eligible to pay tax under section 9, may opt to do so within such time and in such manner as may be prescribed:

PROVIDED that where the said person does not opt to pay tax under section 9 within the time prescribed in this behalf, he shall be liable to pay tax under section 8.

Rule 14. Migration of persons registered under Earlier Law

(1) Every person registered under an earlier law and having a Permanent Account Number issued under the Income Tax Act, 1961 (Act 43 of 1961) shall be granted registration on a provisional basis and a certificate of registration in FORM GST REG- 21, incorporating the Goods and Services Tax Identification Number (GSTIN) therein, shall be made available on the Common Portal.

(2)(a) Every person who has been granted a provisional registration under subrule (1) shall submit an application electronically in FORM GST REG–20, duly signed, along with the information and documents specified in the said application, on the Common Portal either directly or through a Facilitation Centre, notified by the Board or Commissioner.

(b) The information asked for in clause (a) shall be furnished within the period specified in section 142 or within such further period as may be extended by the Board or Commissioner in this behalf.

(c) If the information and the particulars furnished in the application are found, by the proper officer, to be correct and complete, a certificate of registration in FORM GST REG-06 shall be made available to the registered taxable person electronically on the Common Portal.

(3) Where the particulars and/or information specified in sub-rule (2) have either not been furnished or not found to be correct or complete, the proper officer shall cancel the provisional registration granted under sub-rule (1) and issue an order in FORM GST REG- 22:

Provided that no provisional registration shall be cancelled as aforesaid without serving a notice to show cause in FORM GST REG-23 and without affording the person concerned a reasonable opportunity of being heard.

(4) Every person registered under any of the earlier laws, who is not liable to be registered under the Act may, at his option, file electronically an application in FORM GST REG-24 at the Common Portal for cancellation of the registration granted provisionally to him and the proper officer shall, after conducting such enquiry as deemed fit, cancel the said provisional registration.

Page Contents

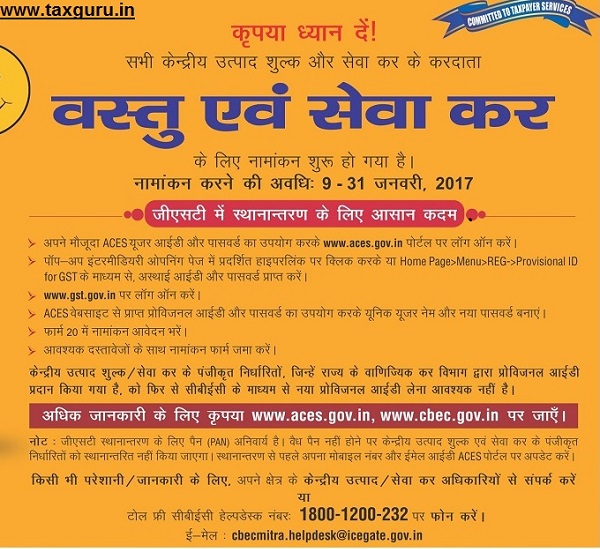

GSTN Enrollment Process

Obtaining credentials

Obtaining credentials

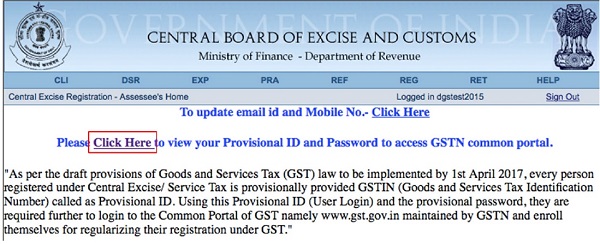

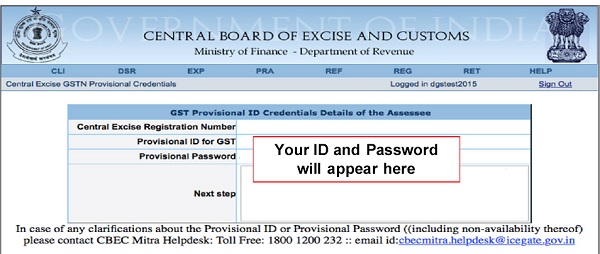

Login to aces.gov.in to view your GSTN Provisional ID and Password

Note on Login Credentials

Note on Login Credentials

1.In some cases, your login credentials may have been shared through State VAT authorities. If you have completed the enrollment process using these credentials, you do not need to repeat the process

2.In some cases, your ID and Password may still be awaited from GSTN.

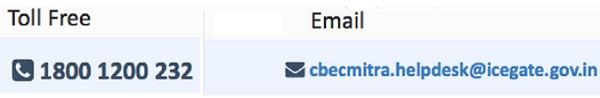

For assistance, contact CBEC MITRA

Data and Documents Required for Enrolment

| BUSINESS DETAIL

|

1.Registration certificate

2.Partnership deed (if applicable) |

PDF/JPEG(1MB) |

| PROMOTERS/PARTNERS | Photograph (for each) | JPEG(100KB) |

| AUTHORISED SIGNATORY | 1.Proof of appointment

2.Photo |

PDF/JPEG(1MB)

JPEG(100KB) |

| PRINCIPAL / ADDITIONAL PLACES OF BUSINESS | Address proof (for each) | PDF/JPEG(1MB) |

| BANK ACCOUNTS | Statement/First page (for each) | PDF/JPEG(1MB) |

GSTN Portal Help

For any assistance with GSTN Common Portal, contact GSTN helpdesk:

- 0124-4688999

- helpdesk@gst.gov.in

- http://tutorial.gst.gov.in

SIR,

WE GOV.OFFICES USED TO FILL EXCISE RETURN (ER-1) FOR PREVIOUS MONTH AND UP TO 10TH OF RUNNING MONTH. WE APPLIED FOR PROVISIONAL USER ID & PASSWORD FOR REGISTRATION TO GS-TN. BUT THE SAME IS NOT RECEIVED SO FAR AND NO CLEAR CUT MESSAGE IS RECEIVED FROM CENTRAL EXCISE DEPT. PLZ GUIDE US FOR THE SAME. – See more at: https://taxguru.in/goods-and-service-tax/gst-migration-under-central-excise-service-tax-provisions-process.html#comment-1957065

Dear Sir, I tried to update my DSC in GST portal, but unable to register the same. Error Shows as “PAN No Verification Failed, Please select the valid certificate to sign”. We are affixing the same DSC for filing of Income tax and ROC. While contacted the DSC renewal person, he forwarded a mail shows that our pan no has been correctly encrypted.

Please share a solution for the same.

Why E signature option is not working, how can we submit form without DSC.

We have both sales Tax no. and service Tax no. and we have already obtain GST provisional ID & Password and temporary registration no. through sales tax dept. so now do we need to take again same thing through Service tax department