E-WAY BILL PROVISION IN RAJASTHAN AS APPLICABLE FROM 20.05.2018

♣ Vide Notification No. F.17 (131) ACCT/GST/2017/3199 DT. 26.03.2018, the Commissioner of State Tax (Rajasthan) has notified that the provisions of rule 138 (E-WAY BILL provisions) for movement goods covered under Schedule I, II, III, IV, V & VI i.e. all goods within the state of Rajasthan shall not apply from 01.04.2018 and thereafter.

♣ Vide Notification No. F.17 (131) ACCT/GST/2017/3544 DT. 16.05.2018, the Commissioner of State Tax (Rajasthan) has rescinded earlier Notification No. F.17 (131) ACCT/GST/2017/3199 DT. 26.03.2018. Post this recession, restriction on applicability of e-way bill on movement of goods within the state of Rajasthan i.e. INTRA STATE is relaxed and the same is made effective from 20.05.2018.

♣ With this notification, now E-WAY BILL is mandatory for movement of goods with consignment value exceeding Rs.50000/- within State i.e. INTRA STATE also in addition to the INTER STATE, which is already in force w.e.f. 01.04.2018.

♣ The E-WAY BILL is mandatory for any movement of goods (having consignment value exceeding Rs.50 K) towards following reasons for transportation (INTRA or INTER STATE):

1. Supply

2. Job Work

3. OWN USE

4. Recipient not known

5. Exhibition

6. Export or Import

7. SKD/CKD

8. Sales Return

9. Others

♣ One has to login @ ewaybillgst.gov.in for preparation of e-way bill.

♣ E-WAY BILL has 2 Parts:

1. PART A

It contains following details:

(a) Transaction Type- OUTWARD or INWARD

(b) Transaction Sub Type i.e. Reason for Transportation ( as listed at Sr. 1 to 9 hereinabove)

(c) Document Type (Tax Invoice or Delivery Challan or Bill of Entry)

(d) Document Number

(e) Document Date (The system will not allow user to enter the future date.)

(f) GSTIN of Consignor (who causes movement of goods) i.e. FROM

(g) Place of Delivery

(h) GSTIN of Recipient i.e. TO

(i) Description of Goods

(j) HSN Code

(k) Taxable Value of Goods

(l) Tax Rate

Notes

- In case the consignor or the recipient is unregistered, URP is to be filled in caption of GSTIN.

- Transaction TYPE- Outward Supply indicates, the user is supplying the goods and inward indicates the user is receiving the goods. Depending upon the type of transaction selected, the system will show the sub-type of transactions. The user needs to select the sub-type accordingly.

2. PART B

Any two of the following needs to be filled:

(i) Vehicle Number or

(ii) Transporter GSTIN alongwith TRANSPORT Document details

♣ The e-Way Bill will not be valid for movement of the goods without the vehicle entry in the e-way bill form. Once the vehicle number is entered, the system will show the validity of the e-way bill. This indicates the user to get the goods moved within that valid date and time. Otherwise the movement of goods becomes illegal. The user should take print out of the e-Way Bill so that the same may be carried alongwith the conveyance.

♣ E-Way Bill is not required in case of movement of exempted goods irrespective of the consignment value.

♣ 50 KMS Provision

1. There is a general belief that e-way bill is not required for movement of goods for a distance of 10Kms (earlier) and now 50Kms even INTRA STATE. However THIS IS NOT THE CASE. The E-WAY BILL is required for movement of goods even for 1 Km i.e. both PART A & PART B is necessarily to be filled by the registered person causing movement of goods.

2. If the goods are transported to the place of transporter within a distance of 50 Kms from the place of business of the consignor for further transportation, in that case, only PART A of the e-way bill is required to be filled. Part B i.e. details of conveyance are not required to be filled.

3. Similarly, if the goods are transported from the place of transporter finally within a distance of 50 Kms to the place of business of the consignee/recipient, in that case, only PART A of the e-way bill is required to be filled. Details of conveyance is not required.

♣ IS PHYSICAL COPY OF E-WAY BILL REQUIRED TO BE CARRIED ALONGWITH CONVEYANCE?

There is general belief that physical print out of the e-way bill is necessarily required to be carried alongwith the conveyances in which goods are transported. Although this is preferable, however, in case physical print out of the same is not possible (say printer is not available), Rule 138A of the CGST rules prescribes that the person in charge of a conveyance shall carry the invoice or bill of supply or delivery challan, as the case may be; and in case of transportation of goods by road, he shall also carry a copy of the e-way bill in physical form or the e-way bill number in electronic form or mapped to a Radio Frequency Identification Device embedded on to the conveyance in such manner as may be notified by the Commissioner. HENCE, EVEN SOFT COPY OF THE E-WAY BILL IN ELECTRONIC FORM IS ALSO ALLOWED.

FEW ILLUSTRATIONS:

1. If the goods are sent for JOB WORK say from Pali to Jodhpur (even within Pali), the PRINCIPAL sending the goods shall prepare E-WAY BILL selecting option under OUTWARD SUPPLY as “JOB WORK” and “DELIVERY CHALLAN” as document. He shall also fill PART A as well as PART B. E-way Bill is not required only in case the value of goods is not more than Rs.50 K.

However, if the goods are sent outside state (INTER STATE) for JOB WORK, then e-way bill is required irrespective of the value of goods i.e. even when value is below/equal to 50K.

However, if the goods are sent outside state (INTER STATE) for JOB WORK, then e-way bill is required irrespective of the value of goods i.e. even when value is below/equal to 50K.

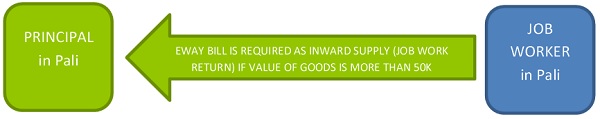

2. If goods are sent back from Job Worker (whether registered or unregistered) to the Principal within Pali, then Principal shall prepare E-WAY BILL selecting Transaction Type as “INWARD SUPPLY” with sub-type- “JOB WORK RETURN”.

Disclaimer: While due care has been taken in preparing this article, the existence of mistakes and omissions herein is not ruled out.. No assurance is given that the revenue authorities/courts will concur with the view expressed herein. Our views are based on provision of GST law and its interpretation, which are subject to change from time to time. We do not assume any responsibility to update the view consequent to such changes.

DEAR SIR,

I HAD SENT THE MATERIAL ABOVE 100000 BY CHALLAN AND BILL MADE A SINGLE FOR 100000 THEN, I DONT GENERATE E WAY BILL , IN THIS CASE HAVE I PANALISE????

I HAVE FORGOTTEN THE PASSWORD FOR E-WAY BILL LOGIN,BUT COMPLETED THE ALL REQUIREMENT COMPLETE & CLICK THE BUTTON FOR SEND OPT. I HAVE FOUND MASSAGE ” NO DATA FOUND WITH RESPECT TO ENTERED INFORMATION.

DEAR SIR,

I HAD SENT THE MATERIAL ABOVE 100000 BY CHALLAN AND BILL MADE A SINGLE FOR 100000 THEN, I DONT GENERATE E WAY BILL , IN THIS CASE HAVE I PANALISE????

WHAT’S THE PROCEDURE TO GOODS SEND ON CHALLAN.

Nice article

Very useful article, thanks

कम्पनी द्वारा शिप्ट 2 पार्टी को माल भेजा जाता हैं।कंपनी डीलर के नाम का बिल बनाती हैं।माल शिप्ट 2पर्टीपर जाता हैं। ऐसे में डीलर को कैसे E WAYBIIL बनाना होगा

Sir- what will be the base documents in case of job worker send back goods to Principal ? can job worker prepare eway bill in this case as he registered in GSTIN ? Please reply

limit of kms in intra state e-way bill

say in a tataace or tempo, the owner takes material of 4 invoice . each invoice is with in 50 k. but in total it is more than 50 k . is any e way bill require? secondly if taxiwala takes material from different dealers & position is same then

DEAR SIR

INTRA STATE E WAY BILL APPLICABLE IN 20.05.2018 MORE THAN RS 50000

REGARDS

VIKRAM SINGH