1. On 1st April 1935 Reserve Bank of India commenced operations with “Sir Osborne Smith” acting as the first Governor of the Bank and in 1940 the silver rupee was replaced by the quaternary alloy rupee. Rupee note was reintroduced which had the status of a rupee coin and represented the introduction of official Fiat money in India. Fiat means “let there be” in Latin and “Fiat Money” means money that becomes valuable when the government decrees that they have worth. It is used as money by government decree or Fiat.

2. Contemporary digital barrage has caused Fiat money to be encroached by cryptocurrencies. Cryptocurrencies are an alternative to Fiat currencies with no central authority controlling the generation of money. These cryptocurrencies are different from conventional Fiat system of currencies where no federal signatory governs the flow of currency.

3. Cryptocurrency is a digital asset that can be used as a form of electronic payment. Many large companies are now adopting cryptocurrencies into their payment systems. Currently, cryptocurrencies are readily available at hundreds of exchanges around the world against Fiat currency.

4. “Bitcoin” is the first decentralized cryptocurrency established in 2008 based on the work of a pseudonymous developer and researcher Satoshi Nakomot.

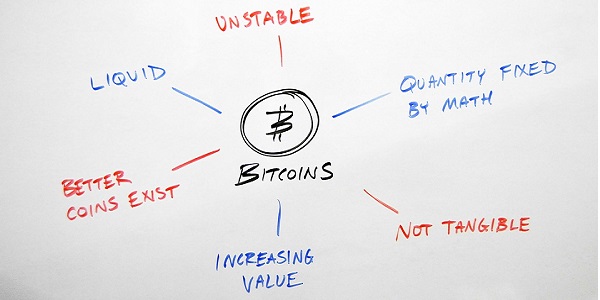

5. Bitcoins are easily accepted by several major brands in different sectors of life. “Blockchain” is a digital ledger in which transactions made in Bitcoin or other cryptocurrencies are recorded chronologically and publicly. Unlike the Fiat currency where the federal banks or governments are responsible for the generation and printing of money, the cryptocurrency is generated by a process called mining. No entity or government can influence the value of the Bitcoin, since it is born within the network, and it stays there. The only thing that affects it is people who are investing in it.

6. In a centralized network system, you need a payment network with an account, balance and a transaction to be able to monetize the cash. The central server keeps track of all transactions and prevents the so-called double-spending that is the same amount of money cannot be spent twice. In a decentralized network, on the other hand, you do not have that server. So you rely on every single entity of the network to record all the transactions and check if the future transactions are valid, without an attempt of double spending.

7. The backbone of cryptocurrency is blockchain which is a technology that was created alongside Bitcoin in 2008. Without internet there cannot be any email similarly without blockchain there cannot be any Bitcoin.

8. Applicability and views of different regulatory bodies and statutes in India on “Cryptocurrencies”:

i. Reserve Bank of India had cautioned the users, holders and traders of Virtual Currencies (VCs), including Bitcoins, about the potential financial, operational, legal, customer protection and security related risks that they are exposing themselves to, vide its press release dated December 24, 2013.The Reserve Bank of India advises that it has not given any license / authorization to any entity /company to operate such schemes or deal with Bitcoin or any virtual currency. As such, any user, holder, investor, trader, etc. dealing with Virtual Currencies will be doing so at their own risk.

ii. ‘Goods’ has been defined under Section 2(52) of CGST Act 2017 as “Goods” means every kind of movable property other than money and securities but includes actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply. Bitcoin doesn’t have any intrinsic value in itself; hence it would be difficult to consider it as “Goods”. However RBI has not declared “Bitcoin” as money, consequently one cannot take the view of completely exempting Bitcoin from GST.

iii. In the case of Tata Consultancy Services V. State of Andhra Pradesh 109, Hon’ble Justice Sinha concurring with the court’s view stated that a commodity is generally understood to mean goods of any kind, something of use or an article of commerce. Since Bitcoin is an intangible asset there is a possibility of it being characterized as a commodity under Indian law.

iv. Bitcoin cannot be categorized as “derivatives” since in case of Bitcoin there is an absence of any underlying security/asset. “Section 2(h) of the SCRA (Securities Contract Regulation Act 1956) defines “securities” to include: shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature in or of any incorporated company or other body corporate…….”. Thus Bitcoins cannot be considered as securities as there is no company or body corporate that is issuing Bitcoins.

v. Section 23 of the Contract Act provides that certain considerations are unlawful and certain contracts may be opposed to public policy. There is nothing in law to suggest that Bitcoins are opposed to public policy or otherwise unlawful. A contract relating to Bitcoin, prima facie, is not such that its enforceability would defeat the provisions of law or is otherwise fraudulent. Therefore, a contract pertaining to Bitcoin, for consideration, cannot be considered as illegal.

vi. For Income Tax purposes, “Bitcoin” may either be a capital asset or stock-in-trade. The purchase of Bitcoins, if it has been made for the purpose of investment, can be treated as a capital asset. Thus, any gains arising on transfer may be characterized as capital gains. If on other hand the transactions in Bitcoins are substantial and frequent, it could be viewed as a transaction of trading in Bitcoins, in which case, income on the sale of Bitcoins could be taxed as business income.

Change is the law of life and those who look only into past or only into future will surely miss upon “Now”. Today technology has invaded our lives to such an extent that now we simply don’t have the choice of ignoring the digital boom. Instead of becoming a silent spectator to celestial wonder that these cryptocurrencies may offer the world, let’s become aware of all our core competencies and enforce needed regulatory framework that could exhort Indian economy to reap the rewards that these cryptocurrencies have to offer.

i HAVE BEEN WONDERING FOR A LONG TIME WHAT IS THIS BIT COIN AND CRYPTO CURRENCY. THIS ARTICLE HAS EXPIANED THE CONCEPT AND OPERATONS IN BITCOIN IN SIMPLE AND CLEAR LANGUAGE. THANKS O THE AUTHOR OF THIS ARTICLE.

The article introduces cryptocurrencies and the accounting system, blockchain, capturing the transactions in that currency. However, an analysis of the value attached to a cryptocurrency derived from a complex algorithmic exercise could have been given atleast broadly. More important that this would been the explanation on the bloackchain that is is different from the double-entry accounting we are all used to!!! But thanks for the brief intro that will be useful for the public wondering what is a cryptocurrency…

Good article that can be understood by a layman and senior citizen like me.

IF ITS IS NOT DERIVATIVE THEN HOW ITS VALUE IS DERIVED? IF INVESTOR WANTS TO INVEST WHETHER HE WILL GET CERTIFICATE OF INVESTMENT?