Post incorporation requirements are obligations which LLP are supposed to fulfill subsequent to incorporation. These include filing of annual returns, Financial Statement, change of Partners/Designated Partners, alteration in Contribution, and change of registered office.

All LLPs shall be under obligation to maintain annual accounts reflecting true and fair view of its state of affairs. Even if LLP does not do any business, it has to comply with statutory requirement such as Annual Return, Balance Sheet, Profit and loss Account, Income tax return every year. The statutory fees will depend upon the capital contribution of LLP.

Page Contents

1. Financial Year of LLP:

Every Company has to maintain uniform Financial ending on 31st March of the year. However, in case of LLP is incorporated after the 30th day of September of a year, the financial year may end on 31st March of the year next following that year.

Regular Works of LLP -LLP ACT- 2008:-

2. Annual e-Forms to be filed by LLP

| S. No. | Agenda | Particulars | e-forms | Due Date Form Filling |

| 1. | Statement Of Account & Solvency | A “Statement of Accounts and Solvency” in prescribed form shall be filed by every LLP with the Registrar every year. sub-section (3) of section 34 |

LLP-8 |

30th October |

| 2. | Annual Return | Every LLP would be required to file annual return in Form 11 with ROC within 60 days of closer of financial year. |

LLP-11 |

30th May |

3. More about Form- 8 and Form 11:

What is Form – 8?

It is declaration given by all the designated partners of LLP that whether they are able to pay its debts in full as they become due in the normal course of business or not.

For the purposes of sub-section (3) of section 34, every limited liability partnership shall file the Statement of Account and Solvency in Form 8 with the Registrar, within a period of thirty days from the end of six months of the financial year to which the Statement of Account and Solvency relates.

Content of Form 8

Part A- Statement of Solvency

Part- B- Statement of Account, Statement of Income & Expenditure

Form- 8 is to be signed by two Designated Partners and certified by CS, CA, and CWA (in Whole Time Practice).

What is Form – 11?

Form- LLP-11 is Annual Return containing number of partners, total contribution received by all partners, details of partners, detail of body corporates as partner, summary of partners.

Every LLP would be required to file annual return in Form 11 with ROC within 60 days of closer of financial year.

Due Date of Filling of LLP-11 30th May for each year.

NOTE:

- If LLP fail to file Form- 11 within prescribe time, the designated partners shall be liable to be punishable with fine which shall not be less then Rs. 25000 but which may be extend to Rs. 500,000/-.

- It has been provided that incase LLPs file relevant documents after their due dates with additional fees upto 300 days, no action for prosecution will be taken against them. In case there is delay of 300 days or more, the LLPs will be required to pay normal filing fees, additional fee and shall also be liable to be prosecuted or go for Condonation u/s 460 of Companies Act, 2013.

- The Act also contains provisions for compounding of offences which are punishable with fine only.

- The Act also contains provisions of Condonation u/s 460 of Companies Act, 2013.

REGULAR OTHER REQUIREMENTS:

4. Requirement of Audit of Accountof LLP

Under LLP Act- 2008 (Rule 24) of LLP Rules – 2009.

where the partners of such LLP do not decide for audit of the accounts of the LLP, such LLP shall include in the Statement of Account and Solvency a statement by the partners to the effect that the partners acknowledge their responsibilities for complying with the requirements of the Act and the Rules with respect to preparation of books of account and a certificate in the form specified in Form 8.

Quick Bites:

a) Is audit mandatory for LLP?

Audit of LLP is not mandatory. However, audit of LLP is mandatory if fulfill any of following conditions:

- Its turnover exceed Rs. 40 Lacs; or

- Its contribution exceeds Rs. 25 Lacs.

5. Income Tax Return

Every LLP have to file the Income Tax return with the Income Tax Authorities. Filing of returns is mandatory whether the LLP has started any business or not. Date of Filling of Tax Audit is as given below:

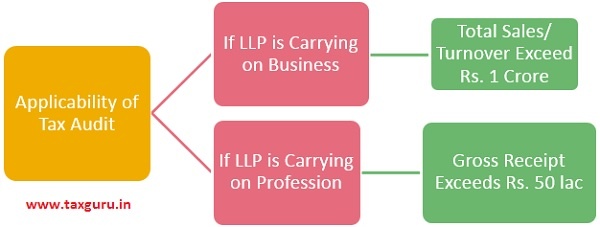

6. Applicability Of Tax Audit On LLP:

[1]As per Section 44AB of Income Tax Act -1961

7. Meaning of Profession

As per Section 44AA and rule 6F following include in Profession:

MEANING OF AUTHORIZED REPRESENTATIVE:

A person who represents any other person, on payment of any fee or remuneration, before any Tribunal or authority constituted or appointed by or under any law for the time being in force, but does not include an employee of the person so represented or a person carrying on legal profession or a person carrying on the profession of Accountancy.

RETURNS AND RECORD REQUIRED BY LLP:

| S. No. | Agenda | Particulars | e-forms |

| 1. | Books of Account | LLP should Maintain proper Books of Account. | N.A. |

| 2. | Minutes Book |

Minute’s book should be maintained to record minutes of meeting of partner and managing/ executive Committee of partners. |

N.A. |

| 3. | Change in Partner | Any change in partner and designated partner (admission, resignation, cessation, death, expulsion) should be filed electronically within 30 days of change. | Form- 4 |

| 4. | Supplementary LLP Agreement | Such admission and cessation will alter mutual right and duties of partner shall change. Hence, supplementary LLP Agreement will be required to file within 30 days of change. | From-3 |

| 5. | Heavy Penalty | Heavy penalty of Rs. 100/- per day late filling of Return | N.A. |

| 6. | Change in Name | Any change in Name of LLP should be filed electronically within 30 days of change. | Form-5 |

| 7. | Change in Registered Office | Any change in place of registered office of LLP should be filed electronically within 30 days of change. | Form- 15 |

(Author – CS Divesh Goyal, GOYAL DIVESH & ASSOCIATES Company Secretary in Practice from Delhi and can be contacted at csdiveshgoyal@gmail.com).

Note:

[1] Turnover limit change from Rs. 1 Crore to 5 Crore for F.y. 20-21 or AY 21-22

Thank you very much sir..very helpful