Gain a comprehensive understanding of Related Party Transactions (RPT) with this complete overview. Explore definitions, approval mechanisms, disclosure requirements, and exemption criteria under SEBI LODR and Companies Act, 2013.

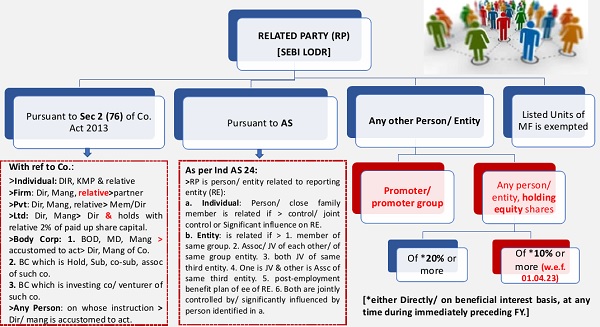

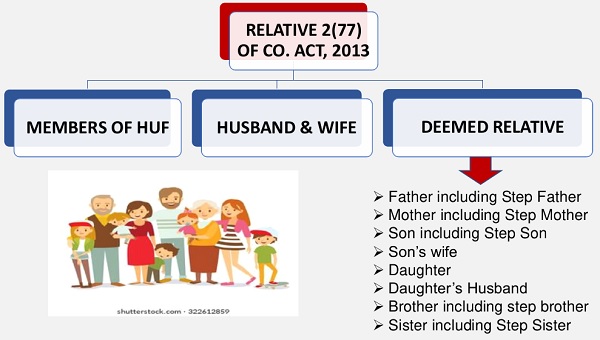

DEFINITIONS:

–

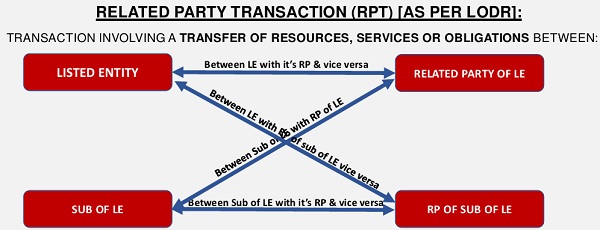

RELATED PARTY TRANSACTION (RPT) [AS PER LODR]:

TRANSACTION INVOLVING A TRANSFER OF RESOURCES, SERVICES OR OBLIGATIONS BETWEEN:

- w.e.f. 01/04/2023: Any above party if enters transition with any unrelated party, the purpose and effect of which is to benefit a related party of the LE or its sub, the same shall deemed to be RPT.

- All aforesaid shall deemed to be RPT regardless whether price is charged or not.

- RPT shall consist of all single/ group of transaction under contract

- Exemption to RPT: 1. Issue of Securities on Pref issue basis pursuant to ICDR Reg. 2. Corporate Action uniformly applicable/ offered to all shareholders such as: Dividend, sub-division/ consolidation of sec., right/bonus issue, buyback.

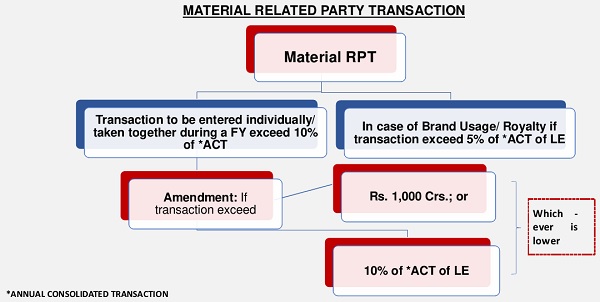

Reg 23(01):

- LE to formulate Policy on Materiality of RPT and on dealing with RPT.

- Policy to have clear threshold limit duly approved by Board.

- Policy be reviewed by Board once in every 3yr.

- Transaction be considered Material if crosses threshold given on Pg. 5.

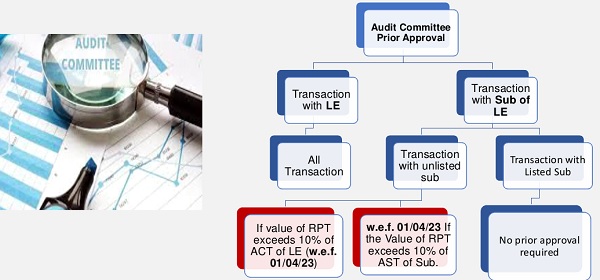

Reg 23(02): PRIOR APPROVAL OF AUDIT COMMITTEE:

> All RPT & subsequent material modification thereon shall require prior approval of AC;

> Only ID members of AC shall approve above;

> AC to define Material Modification disclose in Materiality policy;

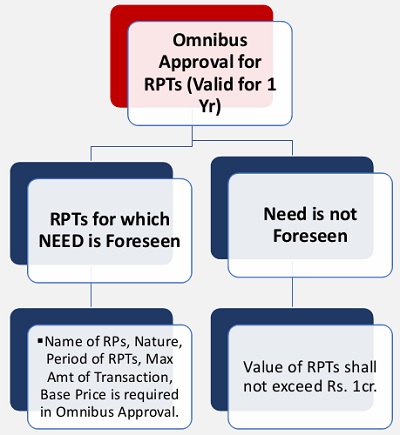

Reg 23(03): OMNIBUS APPROVAL:

AC may grant Omnibus Approval (OA) subject to below conditions:

> AC to lay down criterial for OA;

> AC shall satisfy itself that NEED is Foreseen for such RPT;

> OA shall specify: Name of RP, Nature, period, max amt of RPT, indicative base price, such other terms

> If Need of OA is not foreseen max amt of RPT not to exceed 1cr.

> AC to review RPT on Quarterly basis for which OA is granted;

> OA be valid only for 1 Yr.

Reg 23(04): PRIOR APPROVAL OF MEMBERS:

> All Material RPT & Subsequent Material Modification thereon, shall require Prior Approval of Shareholders through resolution;

> No related party shall vote to approve such material RPT;

> No approval of members for RPTs in which Listed Subsidiary is party but LE is not a party;

> Prior approval of members is not required in respect of a resolution plan approved under section 31 of the Insolvency Code, sub to event being disclosed to SE within 1 day of approval of such resolution plan;

Reg 23(05): EXEMPTION:

Sub Reg 2,3 & 4 of Reg 23 shall not be applicable in transaction between:

> Two Govt Companies;

> Holding & its WOS → a/c are consolidated with holding Co → placed before GM of holding co for members approval;

> Two WOS of the Listed Holding Co → a/c are consolidated with Listed Holding Co → placed before GM of holding co for members approval.

Note : “Government Company(ies)” means Govt co as defined in sub-section (45) of section 2 of the Companies Act, 2013

APPROVAL MECHANISM PURSUANT TO SEBI LODR:

| SR. NO. | PARTY AT ONE HAND | WHETHER

MATERIAL |

PARTY AT OTHER HAND | APPROVAL REQUIRED | ||

| AUDIT

COMMITTEE |

BOARD | MEMBERS

|

||||

| 1 | Listed Entity | Not Material | Related Party of | Prior | Not Required | Not Required |

| 2 | Listed Entity | Material | Listed Entity | Prior | Required | Required |

| 3 | Subsidiaries | Not Material | RP of LE/

Subsidiaries |

Prior | Not Required | Not Required |

| 4 | Subsidiaries | Material | RP of LE/ Subsidiaries | Prior | Required | Required |

| 5 | Transaction which are repetative in nature | Omnibus | Not Required | Not Required | ||

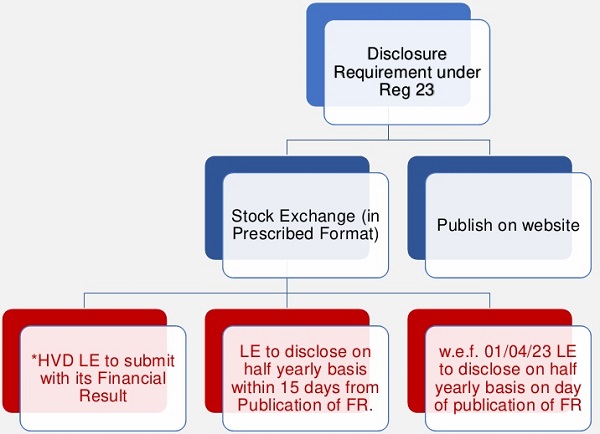

23(9) FILING OF PERIODIC RETURNS:

*HVD LE: High Value Debt Listed Entity

Transaction covered under Section 188:

SECTION 188 OF COMPANIES ACT, 2013):

| 188 (1) | Transactions | Audit Committee | Board Approval | Member’s Approval By Ordinary Resolution |

| a) | sale, purchase or supply of any goods or materials; | Required | Required | If exceed 10% of Turnover |

| b) | selling or otherwise disposing of, or buying, property of any kind; | Required | Required | If exceed 10% of Turnover |

| c) | leasing of property of any kind; | Required | Required | If exceed 10% of Turnover |

| d) | availing or rendering of any services; | Required | Required | If exceed 10% of Turnover |

| e) | appointment of any agent for purchase or sale of goods, materials, services or property; | Required | Required | |

| f) | such related party’s appointment to any office or place of profit in the company, its subsidiary company or associate company; and | Required | Required | |

| g) | underwriting the subscription of any securities or derivatives thereof, of the company: | Required | Required |

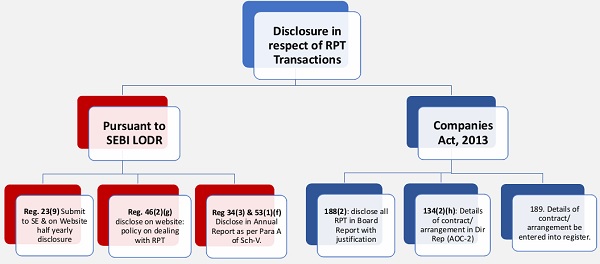

DISCLOSURE REQUIREMENTS FOR RPT:

OTHER PROVISIONS OF SECTION 188:

BOARD’s APPROVAL:

> No approval in case transaction is in Ordinary course of business & at arm’s length basis.

> Approval of Board is required for RPT only at the meeting of Board. The agenda of such BM should contain below:

(a) the name of the RP and nature of relationship;

(b) the nature, duration of the contract and particulars of the contract or arrangement;

(c) the material terms of the contract or arrangement including the value, if any;

(d) any advance paid or received for the contract or arrangement, if any;

(e) the manner of determining the pricing and other commercial terms, both included as part of contract and not considered as part of the contract;

(f) whether all factors relevant to the contract have been considered, if not, the details of factors not considered with the rationale for not considering those factors; and

(g) any other information relevant or important for the Board to take a decision on the proposed transaction.

> If director is interested → not be present at meeting during discussions on the subject matter of the resolution relating to such contract or arrangement.

MEMBER’s APPROVAL:

√ If member is RP shall vote on such resolution.

√ No, approval if 90% or more members, in number, are relatives of promoters or are related parties.

√ No approval in case transaction is in Ordinary course of business & at arm’s length basis.

OTHER TERMS OF PROVISION:

√ Disclose in Board’s report (AOC-2) to the shareholders along with the justification for entering into such contract or arrangement.

√ Any RPT not approved by Board/ Members within 3 months, such contract or arrangement shall be voidable at the option of the Board or shareholders

√ if the contract or arrangement is with a related party to any director, or is authorised by any other director, the directors concerned shall indemnify the company against any loss incurred by it

√ Co may proceed ahead for recovery of any losses from such Director or Employees

EXEMPTION FROM APPROVAL OF MEMBERS/ BOARD:

√ If the Transaction is in Ordinary Course and at Arms length;

√ If 90% or more members, in number, are relatives of promoters or are related parties;

√ In case WOS, the resolution passed by the holding company shall be sufficient for the purpose of entering into the transaction between the wholly owned subsidiary and the holding company.