Introduction

MCA mandates filing of form INC-22A also known as form ACTIVE (Active Company Tagging Identities and Verification) vide its notification dated February 21, 2019 and further introduced the Companies (Incorporation) Amendment Rules, 2019.

It can be also known as KYC of Company.

Requirement of filing:-

Every company incorporated on or before December 31, 2017 shall file the particulars of company and its registered office in e-form ACTIVE on or before April 25, 2019

Pre-requisites to ensure before filing:-

1. Mandatory completion of Annual filing i.e. filing of financial statements and annual return or both till date i.e. upto March 31,2018

2. DIN of the Directors must be in approved status (KYC complaint DIN)

3. Mandatory filing of Statutory auditor’s appointment till March 31,2019 or afterwards

4. Mandatory filing of cost auditor’s appointment till March 31, 2019 or afterwards

Details required in the form

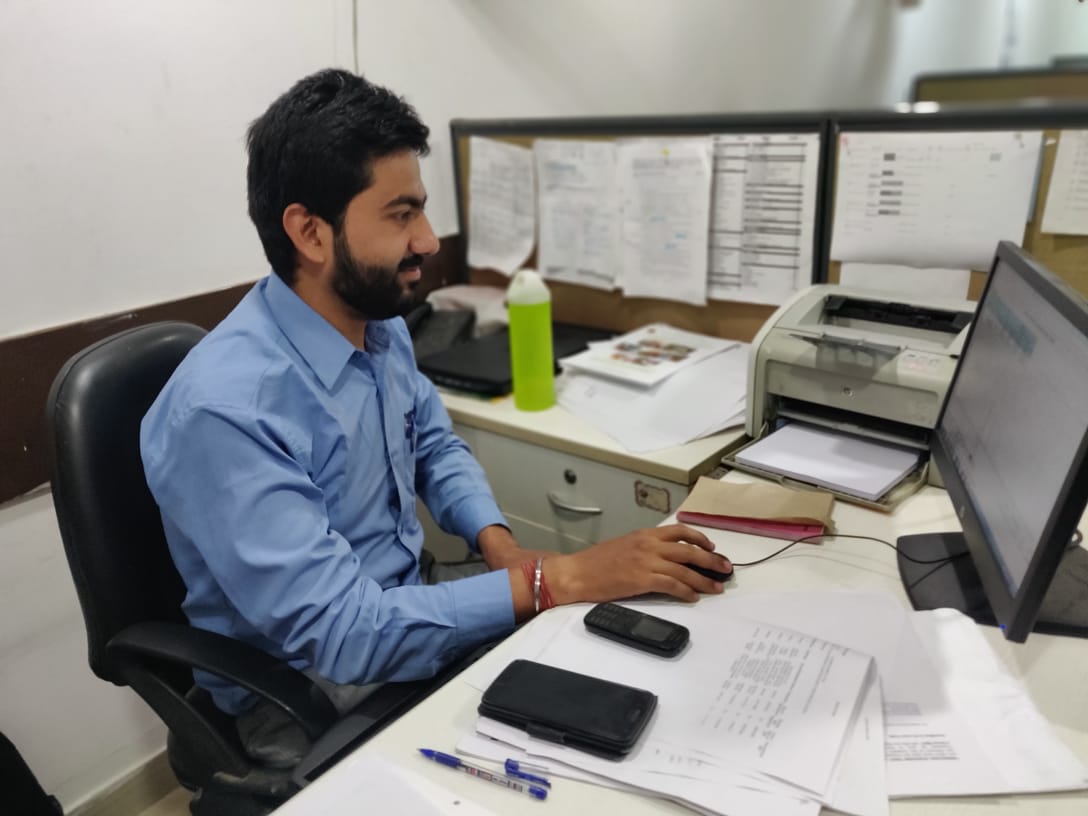

1. Mandatory attachment: Photograph of registered office showing external building and inside office also showing therein at least one director/KMP who will affix DSC in the form

2. Details of latitude and longitude

3. Details like names of all directors along with DIN, Auditors details i.e. of statutory auditor & cost auditor, if any, details like PAN of CEO, CFO, WTD, Company Secretary, if any will be pre-filled

4. SRN of last annual filing forms filed i.e. of financial statements & Annual Return will be pre-filled

OTP Based Verification: – One-time password will be generated against e-mail id of the company and needs to be verified

It is suggested that official email-id of company should be used & manual option of feeding email id is provided in the form

Consequences of Non-Compliance:

Company shall be marked as “ACTIVE non-compliant” on or after April 26,2019 and shall be liable for action under sub-section (9) of Section 12 of the Act.

Company will be debarred from filing the following forms:-

1. SH-07 (Change in Authorised Share capital)

2. PAS-3 (Change in Paid up capital)

3. DIR-12 (changes in Director except cessation)

4. INC-22 (change in Registered office)

5. INC-28 (Amalgamation, de-merger)

6. Late fees for filing the form after April 25, 2019 will be Rs. 10,000/-

Certification

Certification in form INC-22 A will be mandatory by Practicing Professional i.e. CA, CS or CWA

Non-applicability of filing form INC-22 A/Exempted Companies

Following Companies are exempted from the scope of filing form INC-22 A

- Companies which have been struck off;

- Companies under process of striking off;

- Companies under liquidation

- Companies which are amalgamated or dissolved

Practical queries faced while filing the form

Some of the Companies has earlier intimated to MCA regarding the statutory auditor’s appointment as an attachment of form ADT-1 in form GNL-2.

Therefore, MCA will come up with some clarification or explanation on this and concerned persons are requested to wait.

Disclaimer: The Author does not in any way take responsibility & guarantee towards the 100% accuracy of the information provided in this article. The Author has tried to prepare the article based on the relevant information available & is a mere opinion of author. Other views are most welcome for the suggestions or improvements to be done in the article.

The Author is a Company Secretary & for any query/suggestion can be reach at +91-8826108009 or Email at cs.lakshaysethi@gmail.com

Hi Our CA is saying we have to do this compliance even if we want to close our company now . Is it true.

Basically we want to just close the company. We are not doing any business.

Hi,

Kindly guide me through the Geo-tagging requirement in the photos that you mentioned above.

1. Is it mandatory to add Geo-tagging on the photos?

2. Since the form INC-22A requires a PDF file as an attachment, is it possible to recover location from the PDF?

I raised a query regarding the GNL – 2 issue. MCA closed it without any specific reason. The Assessee is always at fault . Ministry is not expected to take any responsibility.