1. What is Unique Document Identification Number (UDIN)?

Unique Document Identification Number (UDIN) is 18-Digits system generated unique number for every document certified/attested by Practicing Chartered Accountants.

2. What is the objective of UDIN?

It has been noticed that financial documents/ certificates attested by third person misrepresenting themselves as CA Members are misleading the Authorities and Stakeholders. ICAI is also receiving number of complaints of signatures of CAs being forged by non CAs.

To curb such malpractices, the Professional Development Committee of ICAI has come out with an innovative concept of UDIN i.e. Unique Document Identification Number which is being implemented in phased manner. It will secure the certificates attested/certified by practicing CAs. This will also enable the Regulators/Banks/Third parties to check the authenticity of the documents.

3.What is the reference of 18-Digits of UDIN?

The 18- digits UDIN (YY MMMMMM AANNNAANNN) will be like;

19304576AKTSBN1359

Wherein;

First 2 Digits are YY – Last 2 digits of the Current Year (19 in this case)

Next 6 Digits are MMMMMM – ICAI’s Membership No. (304576 in this case)

Next 10 Digits are AANNNAANNN –Alpha-numeric generated randomly by the system (AKTSBN1359).

4. Is there any fee for generation of UDIN?

There is no fee for registration and generation of UDIN.

5. How is UDIN secure?

UDIN is totally secure as it can be viewed only by the Member and/ or the Regulators / other Stakeholders who are having the UDIN. Secondly, it does not contain any information of the client.

6. When to generate UDIN?

UDIN is to be generated at the time of signing the Certificate. However, the same can be generated within 15 days of the signing of the same (i.e within 15 days from the date mentioned at Certificates and not beyond that)

7. For generating UDIN, is any document is required to be uploaded on UDIN Portal?

No document is required to be uploaded for generating UDIN.

B. APPLICABILITY

8. From 1st February 2019 UDIN is mandatory for all the certificates? What is meant by Certificates?

It is mandatory to obtain UDIN for all Certificates* issued where the Financial Information/related contents is certified as True and Fair / True and Correct

Members attention is drawn that AASB (Auditing and Assurance Standard Board) of ICAI has already issued Guidance Note on Reports or Certificates for Special Purposes (Revised 2016) with illustrative formats, to be followed by the Practicing Chartered Accountants.

A drop down illustrative list as below is appearing on the Portal from which the Member can select the certificate they are going to issue. In case their certificates are not matching with the list provided, Members are advised to select others and mention the nomenclature of the certificate in Document Description.

1. Additional Certification by Concurrent Auditors not forming part of concurrent audit assignment

2. Capital Contribution Certificate/net worth certificate

3. Certificate issued by Statutory Auditors of Banks

4. Certificate issued by Statutory Auditors of Insurance Companies

5. Certificate issued for KYC purpose to banks confirming sole proprietorship

6. Certificate issued under RERA

7. Certificate of Liquid Asset U/S 45-IB of RBI Act, 1945

8. Certificate of physical verification of securities issued by Concurrent Auditors of Treasury Department of Banks

9. Certificate of Short Sale of securities issued by Concurrent Auditors of Treasury Department of Banks

10. Certificate Regarding Sources of Income

11. Certificates for Claiming Deductions and Exemptions under various Rules and Regulations

12. Certificates for Funds/ Grants utilisation Charitable Trust/Institution

13. Certificates for Funds/ Grants utilisation for NGO’s

14. Certificates for Funds/ Grants utilisation for Statutory Authority

15. Certificates for Funds/ Grants utilisation under FERA/FEMA/Other Laws

16. Certificates in form 15CB.

17. Certificates in relation to initial Public Issue/compliances under ICDR and LODR.

18. Certificates issued on basis of Statutory Records under Companies Act, 2013 & applicable provisions

19. Certificates issued under LLP Act

20. Certification for claim of refund other Indirect Taxes.

21. Certification for claim of refund under GST

22. Certification of arms length price u/s 92 of the Income Tax Act, 1961.

23. Certification of Fair Values of Shares of Company for Buy Back

24. Certification of Fair Values of Shares of Company for the scope of merger / de-merger

25. Certification of Fair Values of Shares of Company for transfer of shares from resident to non-resident.

26. Certification of Fair Values of Shares of Company for Allotment of further shares

27. Certification under Exchange Control legislation

28. Certification under the Income-Tax Laws for various Deductions etc.

29. Net worth Certificates for Bank finances

30. Net worth Certificates for Bank Guarantee

31. Net worth Certificates for Student Study Loan

32. Net worth Certificates for Visa by Foreign Embassy

33. RBI Statutory Auditor Certificate for NBFCs

34. Turnover Certificate

35. Working Capital Certificate/Net Working Capital Certificate

36. Others

*Certificates includes Reports issued in lieu of a Certificate in terms of Guidance Note on Reports or Certificates for Special Purposes (Revised 2016)

9.What will not be covered under Certificates for UDIN which is being made mandatory w.e.f. 1st February 2019?

Non-applicability of UDIN can be listed out but the list is not exhaustive. Like in the 1st phase, requirement of obtaining UDIN is Not Applicable for :

(i) Auditor’s Opinion/Reports issued by the Practicing Chartered Accountant under any Statute w.r.t. any entity or any person (e.g.: Tax Audit, Transfer Price Audit, VAT Audit, GST Audit, Company Audit, Trust Audit, Society Audit, etc.,

(ii) Valuation Reports,

(iii) Quarterly Review Reports,

(iv) Limited Review Report

(v) Information System Audit,

(vi) Forensic Audit,

(vii) Revenue / Credit / Stock Audit,

(viii) Borrower Monitoring Assignments,

(ix) Concurrent / Internal Audit and the like,

(x) Any report of what so ever nature issued including Transfer Price Study Report, Viability Study Report, Diligence Report, Due Diligence Report, Management Report, etc.

10. Who can register on UDIN Portal?

All Practicing CAs having full-time Certificate of Practice (CoP) can only register on the UDIN portal to generate UDIN.

11.Who has to generate UDIN?

All Practicing CAs having full time CoP has to generate UDIN after registering on UDIN Portal.

12. Is any person other than CA is allowed to register at UDIN portal?

No. Only CAs with full-time Certificate of Practice can register on UDIN portal to generate UDIN.

13. Is UDIN required for Certified True Copies also?

No, UDIN is not required for certified true copies.

14. Can a Partner generate UDIN for the Certificate signed by another Partner?

No, only signing Partner has to generate UDIN.

15.Whether a Firm can register on UDIN Portal?

No, only members of ICAI having full-time Certificate of Practice can register on UDIN Portal.

16. Who will generate UDIN for the assignment carried out by CA firm?

Only the Partners signing the document for such assignment will have to generate UDIN.

17. Whether UDIN will be applicable only for manually signed documents or also for digitally signed certificates being uploaded online such as Form 15 CB?

UDIN will be applicable both for manually as well as digitally signed Certificates / uploaded online. In case of digitally signed / online certificates, UDIN has to be generated and retained for providing the same on being asked by any third party/ authority.

18. Is UDIN required for original Certificate only or for duplicates also?

UDIN is to be generated once only for Original Certificates. In case, duplicate certificate is being issued on the request of the client, same UDIN is to be mentioned.

19. Is UDIN to be generated for the assignments awarded before 1st February, 2019 as UDIN for certificates being made mandatory wef 1st February, 2019?

UDIN is to be generated for all Certificates that are signed on or after 1st Feb., 2019.

20. Is UDIN applicable / useful for Members in Industry?

Only Practicing CAs with full time CoP can register on the UDIN portal and can generate a UDIN.

21. Can Part Time CoP holder generate UDIN?

No. Since part-time COP holders cannot certify the documents. Hence, they have no access to UDIN portal.

22.Whether UDIN is mandatory for each certification done?

Yes, it is mandatory for all Certificates w.e.f. 1st February., 2019.

C. PROCESS:

23. How to Register on UDIN Portal?

To register on UDIN, please follow the below steps:

Step 1: Click “Member Registration” or click at “For first time sign up, click here”

Step 2: Registration window will be opened. After entering Six-digits Membership No., Date of Birth and Year of Enrolment please click “Send OTP”. An OTP will be sent to the registered Mobile and Email of the Member.

Step 3: On confirmation of OTP as received, a Username and Password will be sent to the registered Email and Mobile No.

24. Does a member have to register on UDIN Portal for generating UDIN?

For generating UDIN, a member has to register on UDIN Portal for the first time compulsorily. Thereafter, he can just login and generate UDIN. Members who have already registered on UDIN Portal under recommendatory stage are not required to register again after UDIN being mandatory.

25. How to generate a Unique Document Identification Number (UDIN)?

Step 1: Go to udin.icai.org, login by entering Username and Password.

Step 2: Click “Generate UDIN” from the menu bar.

Please Select Document type from the drop down menu.

Enter Date of Signing Document i.e. the date of signing/ certifying the document.

Then Enter 2 Financial Figures i.e. any Financial Figures from the document such as Turnover/Net Worth etc.

Then Enter the Description of the Figure i.e. Turnover/ Net Worth etc. to be filled in 10 to 50 characters.

Two Financial Figures are mandatory out of 3 (three) given fields. In case, there is no Financial Figure in the Certificate, Zero (0) is to be mentioned in Financial Figure and in its Particulars mention “There is no Financial Figure in Certificate”.

Then please Select Document Description and enter the description/ details about the Certificate in 15 to 50 characters.

Then Click the button “Send OTP”.

After this an OTP will be received on Registered Mobile and Email of the Member.

Then Enter OTP as received and click “Preview”. In Preview details entered for generating the UDIN will be displayed. If there is any change/error in the content, click “Back” button, or else, click “Submit”.

Thereafter, 18 Digit UDIN will be generated and that UDIN can be used for mentioning on the Certificate for which it has been generated either by printing (watermarked) the same or by handwritten or printed. If it is being handwritten or printed, it can be mentioned after Signatures and Membership Number of the Member.

26. Is it advisable to change the password after first login?

The password generated by the system is encrypted to ensure the appropriate safety. However, interested Members may change the password at any time through “Change Password” button.

27. How to change the Password?

1. login.

2. Click “Change Password”.

3. Enter the current Password.

4. Enter new password, then click send OTP. An OTP will be sent on registered mobile and email.

On confirmation of the OTP as received, an Username and Password will be sent to the registered email and Mobile No.

28. What to do in case I forget the password?

Step 1: Go to https://udin.icai.org.

Step 2: Click “Forgot Password”.

Step 2: Click “Forgot Password”.

Step 3: “Forgot Password” form will be opened, enter six-digit Membership No., Date of Birth and Year of Enrolment and click “Send OTP”. An OTP will be sent on registered mobile and email.

Step 4: Enter the OTP as received and click “Continue”.

Step 4: Enter the OTP as received and click “Continue”.

On confirmation OTP as received, a Username and password will be sent to the registered email and Mobile No.

29. What is required to generate UDIN?

For generating UDIN, the Document type is to be selected. Thereafter, date of signing the document is to be mentioned. There are 3 fields for entering the financial figures / values from the document and the description of the figure/ value so entered. Out of these, 2 fields are mandatory. In case, there is no financial figure / value available in the document, 0 (zero) is to be mentioned and in description it should be clarified that no financial figure / value is available.

No details of the Client is to be mentioned anywhere on UDIN Portal.

30. What is meant by “Date of signing Document”?

The date on which the Document is signed/ certified by the member is to be mentioned under this head.

31. What is meant by “Document Description”?

“Document Description” is the details of the document for which the UDIN is being generated and is to be filled between 15 to 50 characters.

32. What are the Financial Figures and Particulars required to be mentioned for generating UDIN?

Any Financial Figure and its particular from the document such as Turnover, Net worth etc. for which UDIN is being generated is to be mentioned under Financial Figures and Particulars. The particular is to be filled between 10 to 50 characters.

Two Financial Figures are mandatory out of three fields. In case, there is no financial figure in the certificate being certified, 0 is to be mentioned in Financial Figure and in its particular please mention “There is no Financial Figure in Certificate”.

33. How UDIN can be edited?

UDIN once generated cannot be edited. A preview option is available after entering all details for generating UDIN for verifying its correctness before Generation.

34. What if the wrong UDIN is generated or if a UDIN needs to be revoked? If yes, is there any time limit for revocation the certificates?

In such case(s), UDIN can be revoked by mentioning the reason. Further, there is no time limit for allowing revocation.

35. How UDIN generated earlier by me can be tracked? Can it be sorted assignment-wise for our records?

Yes, UDIN generated by the members can be tracked through “Search” from your UDIN account

36. How to Revoke UDIN?

The UDIN once generated can be revoked or cancelled with narration. If any user had searched that UDIN before revocation, an alert message will go to him about revocation of the UDIN. After revocation of the UDIN, anybody searches for that UDIN, appropriate narration indicated by Member with the date of revocation will be displayed for that revoked UDIN.

37. What happens if the information is not accepted or the password is not sent?

It will happen only when the credentials do not match with the database as maintained by the Regional Offices of ICAI. In such cases, the query may be lodged at UDIN portal.

38. How to Change/update /verify the mobile no. or email id in ICAI database.

It can be done by contacting to the concerned Regional Office of ICAI to change / update/ verify the email and mobile number.

D. Miscellaneous

39. Sometimes there are multiple reports in one Assignment. Is separate UDIN is to be generated for all such reports?

No. UDIN is to be generated for Assignment wise and same UDIN is to be used in all documents signed under that assignment. Say for Example while signing the various certificates while doing Bank Audit, same UDIN can be used for all certificates to be signed for that particular Bank Audit Assignment.

40. How many UDINs can be generated by a CA? Is there any limit? Or is there any restriction on the number of UDIN to be generated in a Day/ Month/ Year?

There is no limit on generation of UDIN and there is no restriction on the number of UDIN to be generated.

41. Is UDIN required to be mentioned on every page of the Document or it can be mentioned at the last?

UDIN shall be mentioned after every Signature and Membership Number of the Member.

42. Whether fresh registration is required for every financial year?

There is no need for fresh registration for every financial year.

43. Whether one UDIN can be used for multiple certificates generated on same day?

No, separate UDIN is required for each assignment and is to be used for all documents issued under that assignment.

44. Can multiple certificate details be uploaded on UDIN portal in excel or any other format?

There is no provision of such uploading. It has to be generated one by one.

45. Should existing digital signature be revised or changed due to UDIN insertion?

UDIN has no connection with Member’s Digital Signature and therefore no changes are required in Digital Signature.

46. Is it possible to generate UDIN before issuing the certificate?

There is no option to generate UDIN in advance. However there is option given to generate UDIN within 15 days of signing of the certificate.

47. What is the validity of UDIN generated?

Generated UDIN has no expiry unless revoked.

48. What is the consequence of not generating UDIN which are made mandatory by ICAI in respective phases?

UDIN generation is being made mandatory as per the Council Decision hence not generating UDIN for mandatory documents will amount to non-adherence of the Council Decision and may attract disciplinary proceedings as per the Second Schedule Part II of The Chartered Accountants Act, 1949.

E. Authorities/Regulators/Banks/Others

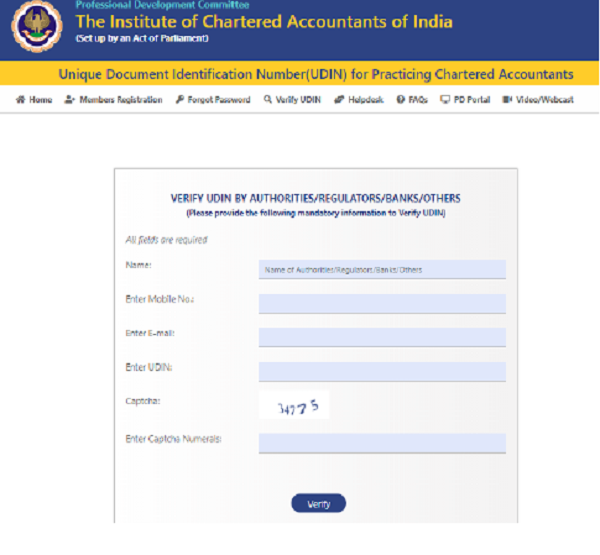

49. How do Authorities/Regulators/Banks/Others can verify UDIN?

The UDIN so indicated on certificate can be verified through the verify option on UDIN Portal by sharing few details such as Name of the Authority, Mobile Number and Email of the person searching the UDIN. However they are not required to register themselves on the UDIN Portal.

The Authorities/Regulators/Banks/others can view the following information

50. For verify UDIN, whether a regulator/third party requires to register on UDIN portal.

50. For verify UDIN, whether a regulator/third party requires to register on UDIN portal.

No Registration is required for regulator/third party to verify the certificate. For verifying the UDIN regulator/third party has to mention UDIN number, Mobile number, email ID and Name of the authorities searching UDIN.

51. Which types of regulators/third parties can ask for UDIN

ICAI has made awareness about mandatory applicability of UDIN to all regulators like RBI, SEBI, CBDT, MCA, IBA and they can very well ask for UDIN.

HELP DESK OF UDIN

Members can submit their query online on the help desk tab on Menu bar available at https://udin.icai.org/complaints or can email at udin@icai.in.

Members can alternatively call at 011-30110411/480. In case of emergency, please speak with Mr. Vishal Agarwal at 9911539260

SIR, I HAVE FILED AUDIT REPORT ON 31.12.2020 BUT UNFORTUNATELY UDIN WAS NOT GENERATED. NOW IT WAS LAPSED. HOW TO GENERATE NOW? IS THERE ANY CONDONATION PROCESS?

SIR, I HAVE FILED AUDIT REPORT ON 5.1.2021 BUT UNFORTUNATELY UDIN WAS NOT GENERATED. NOW IT WAS LAPSED. HOW TO GENERATE NOW? IS THERE ANY CONDONATION PROCESS?

What can be the reason for Revoking UDIN.

While generating UDIN, if we enter same name in document description of 4 certificates then?

sir,

we filed our Tax audit on 31/10/2019 ,but wrongly given audit report date as 30.09.2019.therefore we are unable to generate UDIN. In this case what we will do ?

what is meant by ‘others’ (no.36).