Can Auditors Afford to Be Non-IT Friendly in India?

Risks, Challenges, and the Imperativeness of Tech-savvy Statutory Audits

CA R RAGHUNATHAN

Technology is expanding rapidly and no field can afford not to use the state of the art tools. Auditors cannot also afford to be non-IT friendly in conducting audits. In this article, the author explains why IT skills are no longer optional, the risks involved in not using the modern audit tools and the repercussions to the organisation for which he is part of, or for which the audit is being conducted.

Introduction

In an era where digital transformation is reshaping every facet of business, statutory auditors in India face a pivotal question: Can they afford to be non-IT friendly? The answer, undoubtedly would be in the negative. With the advent of ERP systems, cloud accounting, and data analytics, auditors must evolve beyond traditional methods. The same is required to remain effective, compliant, and relevant.

Why IT Proficiency Is No Longer Optional

1. Digitalization of Financial Systems

- Most of the organizations now use ERP platforms like SAP, Oracle, or Tally.

- Manual vouching is obsolete; auditors must learn to navigate databases, audit trails, and system logs.

2. Regulatory Push

- ICAI emboldens the use of Computer-Assisted Audit Techniques (CAATs).

- SEBI, RBI, and MCA encourage tech-driven compliance and reporting.

3. Volume and Complexity of Data

- Auditors face terabytes of transactional data.

- Sampling alone is insufficient—data analytics tools are needed for full population testing.

Key Risks of Being Non-IT Friendly

Inability to Access ERP Data

Auditors need direct access to ERP systems to verify transactions. Without access, they rely on summaries or exports shared by clients. This limits their ability to check audit trails and system logs. As a logical corollary, audit evidence may be incomplete or unreliable.

Over-Reliance on Client Reports

Client-prepared reports or the reports prepared by the employees of the client, may hide errors or manipulations. Any report furnished in an editable form (like Excel or Word) must be looked into with suspicion and must be system-validated. Auditors must validate data independently, not just accept it. Blind reliance on such reports increases the chance of missing fraud or bias. It weakens the credibility of the audit findings.

Ignorance of System Controls

ERP systems have built-in controls like approval workflows and user roles. Auditors must understand these to detect bypasses or overrides. If ignored, fraud or control failures may go unnoticed. This can lead to serious audit lapses.

Failure to Detect Cybersecurity Threats

Auditors handle sensitive financial data. They must know basic cybersecurity practices like encryption and secure sharing. If threats go undetected, it can harm the client’s reputation. Legal risks may also arise from data breaches.

Inefficient Audit Procedures

Manual methods take more time and effort. Without tech tools, data analysis becomes slow and limited. This increases audit costs and delays reporting. Efficiency suffers, especially in large or complex audits.

The summary of the risks would be:

| Risk | Major Impact on Audit Quality |

| Inability to access ERP data | Incomplete audit evidence |

| Over-reliance on client reports | Risk of manipulation or bias |

| Ignorance of system controls | Missed fraud or control failures |

| Failure to detect cybersecurity threats | Exposure to reputational and legal risks |

| Inefficient audit procedures | Increased time and cost |

Challenges in Adopting IT for Auditors

1. Skill Gap

- Many auditors lack training in data analytics, SQL, or audit software.

- Resistance to change among senior professionals.

2. Cost of Tools

- CAATs, ACL, IDEA, and other tools require investment.

- Smaller firms struggle with affordability.

3. Client Cooperation

- Some clients restrict access to systems citing confidentiality.

- Auditors must negotiate access without compromising independence.

4. Cybersecurity Concerns

- Handling client data securely is paramount.

- Auditors must understand encryption, VPNs, and secure file sharing.

Visual: Audit Evolution Timeline

| Era | Audit Style | Audit Tools Used | Significant Features |

| Pre-2000s | Traditional Manual Audit | Paper, Ledgers | Physical vouching, manual checks |

| 2000–2010 | Spreadsheet-Based Audit | Excel, Tally | Basic formulas, manual sampling |

| 2010–2020 | ERP-Integrated Audit | SAP, Oracle, Tally | System logs, automated reports |

| 2020–Present | AI & Data Analytics-Driven | IDEA, ACL, Power BI | Full data population testing |

Case Study 1: ERP Audit Failure – A Wake-Up Call for Auditors

Background:

LMN Ltd., is a mid-sized company, having its headquarters in Chennai. It is engaged in manufacturing activities. It had implemented SAP ERP to manage its inventory, procurement, and financial accounting. There are serval warehouses spread across 7 States. The valuation methods are complex and all are linked to the SAP.

Audit Approach:

The statutory auditor is not unfamiliar with SAP’s architecture. He and lacks access credentials. The auditor chose to rely on Excel exports provided by the client’s finance team. These exports included trial balances, inventory summaries, and purchase ledgers. No direct system-level audit was performed. Further, no validation of SAP’s internal controls or audit trails was undertaken.

What Went Wrong:

Months after the audit report was issued, a forensic investigation was conducted. This was triggered due to discrepancies in the company’s quarterly filings. The forensic team, with full SAP access, uncovered that:

- Stock valuation entries had been manually overriddenin SAP by a senior finance manager.

- Audit trails showed multiple backdated entries, which were not visible in the Excel exports.

- System controls for approval workflows had been bypassed, exploiting user role misconfigurations.

These manipulations had inflated inventory values by over ₹ 5 crore; the profits which had been reported to the stakeholders had been over-stated by the like amount.

Consequences:

The following were the consequences of the above:

| Stakeholder | Impact |

| Company | Faced penalties from regulatory bodies Like the MCA; the company also faced loss of investor confidence |

| Auditor | Reputation was damaged; he was questioned by ICAI for lack of system-level diligence and for negligence. |

| Investors | Misled by inflated financials; potential legal action initiated against LMN Ltd., as well as the statutory auditor. |

Lessons Learnt:

- ERP systems must be audited at the source; it must not be merely not through exported summaries given excel sheets which are editable.

- Auditors must understand system controls, user roles, and audit trailsto detect manipulation. This was not done in the present case.

- Reliance on client-s employee-prepared data without validationis a serious audit risk.

Case Study 2: Missed Fraud in Tally – A Lesson in IT Awareness

Background:

A small trading company in Tamil Nadu used Tally ERP for accounting. The auditor relied only on printed trial balances and ledger summaries. No system-level checks or audit trail reviews were done.

What Went Wrong:

A staff member created fake purchase entries in Tally. These entries were later deleted, leaving no trace in printed reports. The audit trail in Tally showed the deletion, but it was never checked. The fraud inflated expenses by ₹22 lakh over two years.

Consequences:

- The company faced a tax notice for false claims.

- The auditor was questioned for negligence.

- The fraud damaged the firm’s reputation with banks and suppliers.

Lessons Learnt:

- Auditors must check system logs and audit trails.

- Printed reports may hide deleted or altered entries.

- Even small firms using Tally need IT-aware audits.

- Basic ERP knowledge can prevent major audit failures.

How Auditors Can Become IT Friendly

| Action | Benefit |

| Enrol in ICAI’s DISA course | Structured IT audit training |

| Use CAATs like IDEA, ACL | Efficient data analysis |

| Learn basic SQL and Excel macros | Navigate databases and automate tasks |

| Collaborate with IT experts | Strengthen audit teams |

| Stay updated on tech trends | Future-proof audit practice |

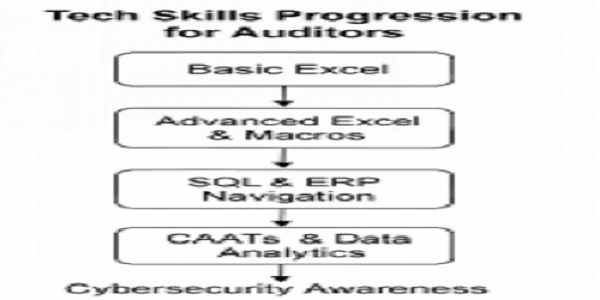

Tech Skills for Auditors

Regulatory Expectations

ICAI Guidelines – Technology in Audits

- ICAI wants auditors to use technology in their work.

- Audits should not rely only on manual checks.

- Tools like CAATs help in analyzing large data sets.

- Planning and execution must include digital methods.

- Auditors should understand system controls and logs.

- ICAI encourages training in IT audit techniques.

- Tech use improves audit quality and reduces risk.

- It also helps meet modern business expectations.

Companies Act 2013: Companies Act 2013 – Reporting on Internal Controls

> The law asks auditors to check internal financial controls.

> Many of these controls are built into ERP systems.

> Auditors must understand how these systems work.

> Manual review is not enough for IT-driven processes.

> They should check workflows, approvals, and user roles.

> Reporting must include system-level observations.

> Weak controls can lead to fraud or errors.

Auditors must be trained to spot such issues.

GST Audits – Matching ERP and GSTR Data

- GST audits need data from ERP systems.

- Auditors must match GSTR filings with actual records.

- This includes sales, purchases, and input tax credit.

- Errors in reconciliation can lead to penalties.

- Manual matching is slow and risky.

- Tech tools help compare large volumes of data.

- Auditors must know how to extract ERP reports.

- Proper matching ensures compliance and accuracy.

MCA – What Auditors Must Know

- MCA oversees company law and audit rules in India.

- It expects auditors to check internal financial controls.

- These controls often depend on IT systems like ERP.

- Auditors must understand how digital workflows operate.

- MCA filings (like AOC-4, MGT-7) rely on system-generated data.

- Errors in digital records can lead to wrong disclosures.

- MCA may question auditors if system-level checks are missing.

- Auditors must use tech tools to verify digital controls and reports.

Conclusion

It is imperative that Auditors must embrace IT, for conducting statutory audits, as a core competency; it is no longer just a tool. The risks of being non-IT friendly are too many, as outlined in the article earlier. Survival of the audit firm itself would be difficult, in the long run. Chartered Accountants must invest in upskilling, adopt audit technologies, and foster a culture of digital fluency to thrive in the evolving landscape. It can lead to audit failures and reputational damage. Over time, it may threaten the survival of the audit firm. Chartered Accountants must upgrade their tech skills. They should adopt audit software and data tools. A culture of digital fluency is key to staying relevant.

This article rightly shows how today’s audits demand real IT understanding, not just traditional checking. As a CA, I truly feel that without tech skills, even experienced auditors risk missing critical red flags that modern systems can easily hide.