Articles explains GST Registration Provisions & related rules in a simple manner covering related definitions, Compulsory Registration in GST, Deemed Registration, Procedure for Registration, GST Migration of person registered under existing law, Unique Identity Number for Specified entities , Display of RC & GSTIN on the name board, Amendment of Registration, Cancellation of registration, Application for cancellation of registration etc.

Sec. 2(107) of CGST Act – “Taxable Person” : means a person who is registered or liable to be registered under section 22 or section 24.

Sec. 22(1) of CGST Act – “Person liable for registration” :

> Every supplier shall be liable to be registered under in the state or UT, other than special category states, from where he makes a taxable supply, if his aggregate turnover in a FY exceeds Rs. 20 lakhs.

> In special category states, the supplier shall be liable to be registered if his aggregate turnover in a FY exceeds Rs.10 lakhs.

> As per sec 2(6), “Aggregate turnover” means aggregate value of all taxable supplies (whether on his own account or behalf of principal), computed on all India basis having same PAN. The aggregate turnover includes/excludes the following:

Definitions

Sec. 2(47) of CGST Act – “ Exempt Supply”: means

A supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax under section 11, or under section 6 of the IGST Act, and includes non-taxable supply.

Sec. 2(78) of CGST Act – “Non Taxable Supply”: means

A supply of goods or services or both which is not leviable to tax under this Act or under the IGST Act.

Sec. 2(108) of CGST Act – “Taxable Supply”: means

A supply of goods or services or both which is leviable to tax under this Act.

Sec. 22(2)- Every person who is already registered under the existing laws immediately preceding the appointed day, is liable to be registered under this Act with effect from the appointed day.

Sec. 22(3)- The transferee or the successor in case of transfer of business as a Going Concern, liable to be registered from the of such transfer or succession.

Sec. 22(4)- The transferee in a case of transfer on account of amalgamation or de-merger of two or more companies by an order of a High Court, from the date of certificate of incorporation given by the ROC.

> Any person though not liable for registration, has an option for obtaining voluntarily registration as per section 25(3) of CGST Act, 2017.

Sec. 23 of CGST Act – “Persons NOT liable for registration in GST”

Sec. 23(1) – Any person engaged exclusively in the business of supplying goods or services or both that are:

(a) not liable to tax or

(b) wholly exempt from tax

(c) an agriculturist, to the extent of supply of produce out of cultivation of land.

Sec. 23(2) – The Government may, on the recommendation of the GST Council, by notification, specify the category of persons who may be exempted from obtaining registration under this Act.

Sec. 2(7) of CGST Act – “Agriculturist”: means

An individual or a Hindu Undivided Family who undertakes cultivation of land—

(a) by own labour, or

(b) by the labour of family, or

(c) by servants on wages payable in cash or kind or by hired labour under persona supervision or the personal supervision of any member of the family.

Points of Attention

♦ So Cooperative societies doing agriculture activates are liable to be registered now.

♦ Activities like Dairy farming, Poultry farming and sericulture are not covered as agricultural activities.

Sec. 24 of CGST Act – Compulsory Registration in GST

Following persons are required to obtain registration irrespective of threshold limit u/s 22:

| 1 | Persons making any inter-state taxable supply |

| 2 | 2. Casual taxable persons

As per section 2(20) of CGST Act, “ Casual taxable person” means a person who occasionally undertakes transactions involving supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory where he has no fixed place of business. e.g. A person registered in Delhi participates in Trade Fair at Bangalore. So he will be considered as casual taxable person in Bangalore, Karnataka |

| 3 | Persons who are required to pay tax under reverse charge a) Sec 9(3) – Specified categories of goods/services as notified by b) Sec 9(4)– Supply of goods/services by an unregistered person to registered person. |

| 4 | Specified categories of services provided through e-commerce operator on which tax shall be paid by such e-commerce operator ( Like services on Urban Clap) |

| 5 | Non-resident taxable persons

As per section 2(77) of CGST Act, “ Non resident taxable person” means any person who occasionally undertakes transactions involving supply of goods or services or both, whether as principal or agent or in any other capacity, but who has no fixed place of business or residence in India; e.g. A person registered in USA participates in Trade Fair at Bangalore. So he will be considered as non resident taxable person in Bangalore, Karnataka |

| 6 | Persons who are required to deduct tax u/s 51 |

| 7 | Persons who are required to deduct tax u/s 52 |

| 8 | Input service distributor |

| 9 | Persons who supply goods and / or services on behalf of other registered taxable persons whether as an agent or otherwise ( Like Commission agent) |

| 10 | E Commerce operator |

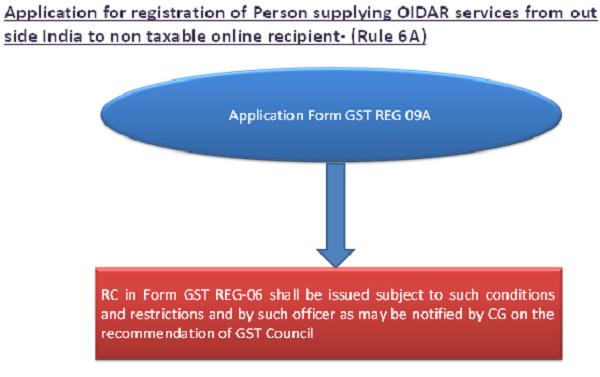

| 11 | Person providing OIDAR services from a place outside India to unregistered persons in India ( Like Online gaming portals, E Books, Netflix, foreign journals) |

| 12 | Such other persons as may be notified by the Government on recommendation of GST Council. |

Sec. 26 of CGST Act – Deemed Registration

Sec. 26(1) The grant for registration under SGST Act or UTGST Act shall be deemed to be grant of registration under CGST Act.

Sec. 26(2) Any rejection of application for registration or the Unique Identity Number under the CGST Act / SGST Act shall be deemed to be rejection in other.

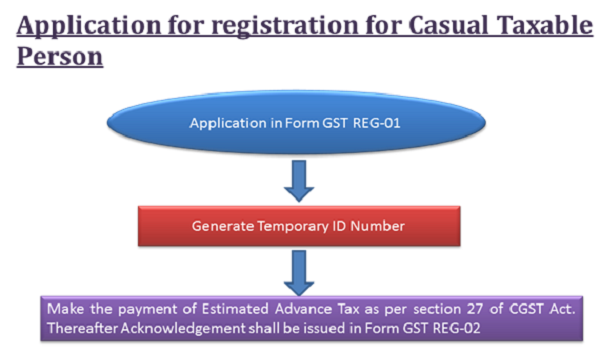

Application for Registration-Normal Cases (Rule 1)

1. PAN / Mobile number / Email address / State or UT is mandatory for registration – Part A of Form GST REG-01.

2. Validate of PAN online / Validation of mobile and email id through OTP passwords sent to respective accounts.

3. Thereafter, temporary reference number will be generated based on which application can be done electronically along with information / documents in Part B of Form GST REG-01.

4. On receipt of application, an acknowledgement shall be issued Form GST REG-02.

5. SEZ Unit / Developer shall make separate application for registration as a business vertical distinct for its other units located outside SEZ.

Verification of the application and approval-(Rule 2)

1. Registration is to be issued within 3 common working days from the date of submission of application after examination of the same by PO.

2. Any query / clarification needs to be called for within 3 days of submission of application in Form GST REG-03.

3. The applicant shall reply to such query / clarification in Form GST REG-04 within 7 working days from the date of receipt of such intimation.

4. If PO satisfied with reply, he may approve the of registration within seven days from the date of receipt of such clarification.

5. If PO is not satisfied with reply or there is no reply, application shall be rejected by order in Form GST REG-05.

6. If no action is taken by PO within 3 days or 7 days, the registration shall be deemed to have been approved.

Issuance of registration certificate-(Rule 3)

1. RC shall be issued in Form GST REG-06 showing principal place of business and additional place(s) of business & GSTIN.

2. Registration shall be effective from the date on which the person becomes liable to registration where the application for registration has been submitted within 30 days.

3. Where the application for registration has been submitted after 30 days from such date, the date of registration shall be date of grant of

Voluntary Registration:

As per section 25(3) of CGST Act, 2017, any person, though not liable, may get himself registered voluntarily, and all provisions of this Act, as are applicable to a registered person shall apply to such person.

This is beneficial in B2B transaction for passing the ITC benefit.

Sec. 25(2) of CGST Act – Single Registration or Multiple registration in a State/UT

A person shall be granted a single registration in a state or UT , provided that;

Where a person is having multiple business verticals in a state or UT may be granted a separate registration for each business verticals, subject to such condition as may be prescribed. ( Refer Rule 4)

Sec. 2(18) of CGST Act – “Business Verticals”: means

A distinguishable component of an enterprise that is engaged in the supply of individual goods or services or a group of related goods or services which is subject to risks and returns that are different from those of the other business verticals.

Explanation.––For the purposes of this clause, factors that should be considered in determining whether goods or services are related include––

(a) the nature of the goods or services;

(b) the nature of the production processes;

(c) the type or class of customers for the goods or services;

(d) the methods used to distribute the goods or supply of services; and

(e) the nature of regulatory environment (wherever applicable), including banking, insurance, or public utilities;

Rule 4 : Separate Registration for Multiple Business Verticals within a State or UT

Separate Registration for Multiple Business Verticals within a State or UT Shall be granted subject to following conditions:-

1. No business vertical of a taxable person shall be granted registration to pay tax under composition levy (u/s 10) if any one of the other business verticals of the same person is paying tax under normal levy (u/s 9).

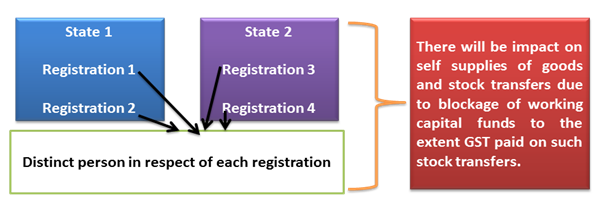

2. All separately registered business verticals shall pay tax on supply of goods and / or services made to another registered business vertical of such person and issue a tax invoice for such supply.

3. Procedure of verification and grant of registration shall be in line with other registrations.

4. Any registered person eligible to obtain separate registration for business verticals may submit a separate application in FORM GST REG-01 in respect of each such vertical.

Distinct Persons under GST:

Section 25(4) , A person who has obtained or is required to obtain more than one registration, whether in one State or Union territory or more than one State or Union territory shall, in respect of each such registration, be treated as distinct persons for the purposes of this Act.

> Person with more than one registration whether in a state/UT or in more than one State/UT to be treated as distinct persons.

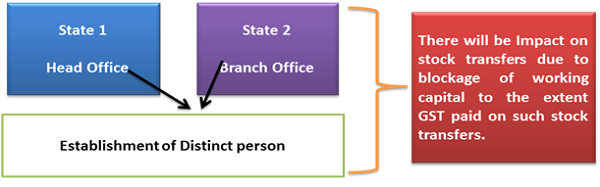

Section 25(5) , Where a person who has obtained or is required to obtain registration in a State or Union territory in respect of an establishment, has an establishment in another State or Union territory, then such establishments shall be treated as establishments of distinct persons for the purposes of this Act.

> Establishment of same person indifferent States, to be treated as distinct persons.

establishment

Other Provision of Section 25 of CGST Act

> PAN / TAN required for registration – however other document may be sufficient for non-resident taxable person

> If person fails to register, proper officer may proceed to register such person.

> Registration or an Unique Identity Number shall be deemed to have been granted if no deficiency is communicated.

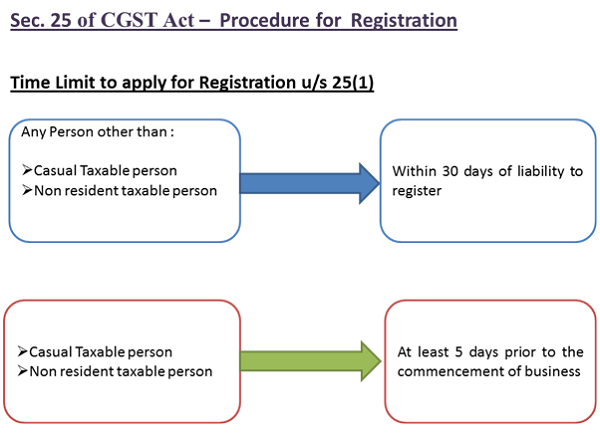

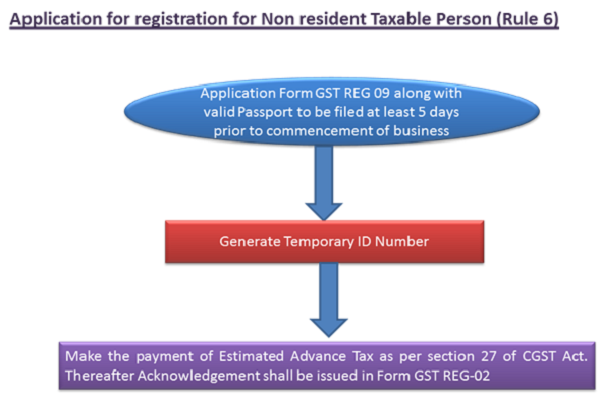

Section 27 of CGST Act: Special provision in relation to casual taxable person and non resident taxable person

1. A CTP or a NRTP shall apply for registration at least 5 days prior to the commencement of business.

2. CTP or NRTP can make taxable supplies only after issuance of registration certificate.

3. Registration certificate to CTP or NRTP shall be valid for a period specified in application for registration or 90 days from effective date of registration, whichever is earlier.

4. The period of 90 days can be extended by a further period not exceeding 90 days through application in Form GST REG-10.

5. CTP or NRTP along with registration application requires to make an advance deposit of tax in an amount equivalent to estimated tax liability.

6. The said advance shall be credited to electronic cash ledger and can be utilized in a prescribed manner as per sec 49.

7. Refund of any amount shall be granted as per sec. 54(13)

Rule 16 – GST Migration of person registered under existing law

1. Every person registered under existing law (other than ISD, TDS deductor) having PAN shall enrol on the common portal by validation his e mail id & mobile no.

2. Upon enrolment, he shall be granted registration on provisional basis and RC shall be granted in Form GST REG-25, mentioning therein GSTIN and shall be made available on the common portal.

3. On one PAN, only one provisional registration shall be granted only in the state of registration under existing law.

4. On issuances on provisional registration in Form GST REG-25, an application shall be filed in Form GST REG-24 within a period of 3 months or such extended period for issuance on of PRC in Form GST REG-06.

5. If information found correct and complete by PO, PRC in Form GST REG-06 shall be made available on common portal.

6. Where Form GST REG-24 is not filed or information submitted found to be incomplete or incorrect, the PO shall cancel the provision registration by issuing order in Form GST REG-26.

7. An opportunity of being heard shall be given in by issuance of SCN in Form GST REG-27.

8. SCN in Form GST REG-27 can be vacated by issuance of order in Form GST REG-19 if it is found that no such cause exist for SCN was issued.

9. Every person registered under the existing law, not liable to be registered under the existing law, may at his option, shall submit an application in Form GST REG-28 with in 30 days for cancellation of the registration granted to him and the PO shall, after conduction such enquiry as deemed fit, cancel the sais registration.

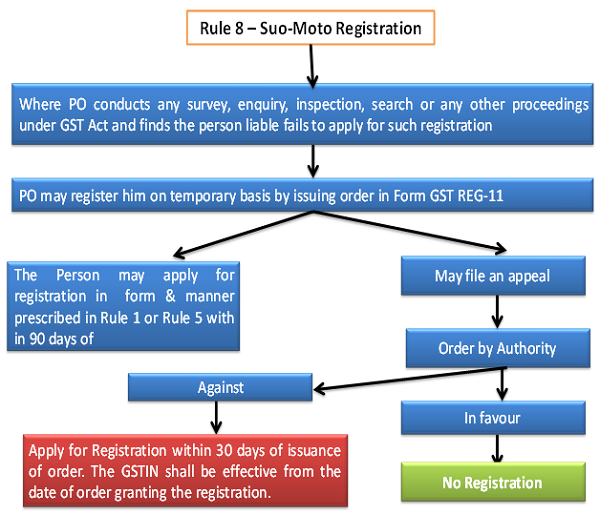

Rules 8

Rule 9 – Unique Identity Number for Specified entities

1. As per sec 25(9), Specialized agency of the United Nations Organization or any Multilateral Financial Institution and Organization notified under the United Nations (Privileges and Immunities) Act, 1947 (46 of 1947), Consulate or Embassy of foreign countries / other person or class of persons, as may be notified by the Commissioner shall be granted a Unique Identity Number.

2. The Application shall be in Form GST REG-12 and application shall be submitted electronically.

3. Unique Identity Number will be allotted with 3 working days in Form GST REG—06.

Rule 10 – Display of RC & GSTIN on the name board

1. RC shall be displayed in a prominent location at the principal place of business and every additional place or places of business.

2. GSTIN shall be displayed on the name board exhibited at the entry of his principal place of business and every additional place or places of business.

Amendment of Registration-Section 28 & Rule (11)

1. Application in Form GST REG-13 to be made electronically within 15 days of the change along with documents

2. Where the change relates to:

i. Legal Name of Business,

ii. Address of Principal Place of Business or any additional place of business, or

iii. In details of partners or directors, Karta, Managing Committee, Board of Trustees, Chief Executive Officer or equivalent, responsible for day to day affairs of the business

which does not warrant cancellation of registration under section 29, the PO shall approve the amendment within 15 days by order in Form GST REG-14

3. Where change relates to any particulars other than those specified above, RC shall stand amended and any approval will not be required.

4. Any change in the mobile number or the e-mail address will be only after online verification.

5. If PO is not satisfied, then any query / clarification needs to be called for within 15 days of submission of application by issuing notice in Form GST REG-03.

6. The applicant shall reply to such query / clarification in Form GST REG-04 within 7 working days from the date of receipt of such intimation.

7. If PO satisfied with reply, he may approve the of registration within seven days from the date of receipt of such clarification.

8. If PO is not satisfied with reply or there is no reply, application shall be rejected by order in Form GST REG-05.

9. If no action is taken by PO within 15 days or 7 days, the registration shall be deemed to have been approved.

Cancellation of registration-Section 29

1. Cancellation of registration by registered person

a) Discontinuation of business

b) Change in constitution of business

c) Where person is no longer liable for registration.

2. Cancellation of registration by proper officer

a) contravened the provisions of the Act or the rules made thereunder

b) Non filing of return for continuous period of 6 months

c) Non filing of return for 3 consecutive tax periods in case of persons opting for compounding levy

d) Voluntary registration and business not commence with in 6 months.

e) Any registration has been obtained by means of fraud, willful misstatement or suppression of facts

Registration to be cancelled in certain cases- Rule 13

The registration granted to a person is liable to be cancelled if the said person

1. does not conduct any business from the declared place of business; or

2. issues invoices or bill without supply of goods or services in violation of the provisions of this Act / Rules

Application for cancellation of registration- Rule 12

1. Application for cancellation of registration by registered person shall be filed in Form GST REG-15 within 30 days.

2. Include details of closing stock and liability thereon

3. Pay an amount equivalent to the credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date of such cancellation or the output tax payable on such goods, whichever is higher.

4. For capital goods, pay an amount equal to the input tax credit taken on the said capital goods reduced by the percentage points as may be prescribed in this behalf or the tax on the transaction value of such capital goods, whichever is higher

5. Submit relevant documents in support thereof

6. No cancellation of registration for one year in case of voluntary registration

7. Final Return needs to be furnished

Cancellation of registration by proper officer – Rule 14

1. SCN shall be issued in Form GST REG-16 to the taxable person to show cause within seven days as to why his registration should not be cancelled

2. Reply to SCN shall be filed in Form GST REG-17

3. If reply found unsatisfactory, registration cancellation order in Form GST REG-18 shall be issued within 30 days from the date of application / the date of reply to the show cause issued

4. Notify the taxable person arrears, tax, interest or penalty, if any

5. If reply found satisfactory, cancellation proceedings shall be dropped by passing an order in Form GST REG-19

Revocation of Cancellation of registration by proper officer – Sec 30 & Rule 15

1. Submit an application in Form GST REG-20 for revocation of cancellation of registration within 30 days from the date of service of the order of cancellation of registration

2. Application for revocation cannot be filed if cancellation is on account of failure to furnish returns or failure to pay liability unless such return is filed / liabilities are discharged.

3. For justified reasons, PO shall revoke cancellation of registration within 30 days of application or receipt of clarification by passing an order in Form GST REG-21.

4. For unjustified reasons, PO shall issue SCN in Form GST REG-22.

5. Reply shall be filed in within 7 days in Form GST REG-23.

6. For justified reasons, PO shall revoke cancellation of registration within 30 days of application or receipt of clarification by passing an order in Form GST REG-21.

7. For unjustified reasons, PO shall reject the application by passing an order in Form GST REG-05.

Physical verification of business premises in certain cases- Rule 17

1. Where the PO is satisfied that physical verification of POB is required after grant of RC, he may get such verification done.

2. Such verification report including photographs shall be uploaded in Form GST REG-29 on the common portal within 15 days following the date of such verification.

List of Forms for GST Registration

| GST FORM | PARTICULARS |

| FORM GST REG-01 | Application for New Registration |

| FORM GST REG-02 | Acknowledgement for submission of registration application |

| FORM GST REG-03 | Requisition for Clarification w.r.t. application |

| FORM GST REG-04 | Clarification w.r.t. above |

| FORM GST REG-05 | Rejection of application |

| FORM GST REG-06 | Certificate of Registration |

| FORM GST REG-07 | Application for Registration for TDS / TCS |

| FORM GST REG-08 | Cancellation of registration w.r.t. TDS / TCS |

| FORM GST REG-09 | Application for registration to non-resident taxable person |

| FORM GST REG-9A | Application for registration OIDAR Services |

| FORM GST REG-10 | Application for extension in period of operation by casual person & non-resident taxable person |

| FORM GST REG-11 | Issue of order for suo moto registration |

| FORM GST REG-12 | Application for grant of unique identity number |

| FORM GST REG-13 | Application for Amendment in Registration Certificate |

| FORM GST REG-14 | Approval for Amendment in Registration Certificate |

| FORM GST REG-15 | Application for cancellation of Registration Certificate |

| FORM GST REG-16 | Show Cause Notice for cancellation |

| FORM GST REG-17 | Reply to Show Cause Notice for cancellation |

| FORM GST REG-18 | Order for cancellation of Registration Certificate |

| FORM GST REG-19 | Order for dropping cancellation proceedings |

| FORM GST REG-20 | Application for revocation of cancellation of registration |

| FORM GST REG-21 | Order for revocation of cancellation of registration order |

| FORM GST REG-22 | SCN for rejection of application for revocation of cancellation of registration |

| FORM GST REG-23 | Reply to SCN in FORM GST REG-22 |

| FORM GST REG-24 | Application by existing registrants for provisional registration |

| FORM GST REG-25 | Provisional registration certificate to existing registrants |

| FORM GST REG-26 | Order form cancellation of Provisional registration certificate to existing registrants |

| Form GST REG-27 | SCN for cancellation of Provisional registration certificate to existing registrants |

| Form GST REG-28 | Application for cancellation of Provisional registration certificate granted to existing registrants |

| Form GST REG-29 | Report of Physical verification by PO |

The author is a practising CA and is registered Insolvency Professional. He can be reached at cavinodchaurasia@gmail.com , Mob. +91 9953587496.

i dony know the meaning for SCN what should i do sir and which document should be applied and how to reply for that

youtube url https://youtu.be/_wNw3Zkanc4

thank you sir. very well explained in detailed. Request you provide us ppt presentation. My email id is mainbhineha@gmail.com.